The star ratings assigned to Covered California health plans have only nominal value to the prospective consumer. The star ratings are weighted heavily toward the quality of health care delivered. Health plans do not administer health care. It is somewhat unfair to affix a low star rating to a health plan when the poor care was delivered by people beyond their control.

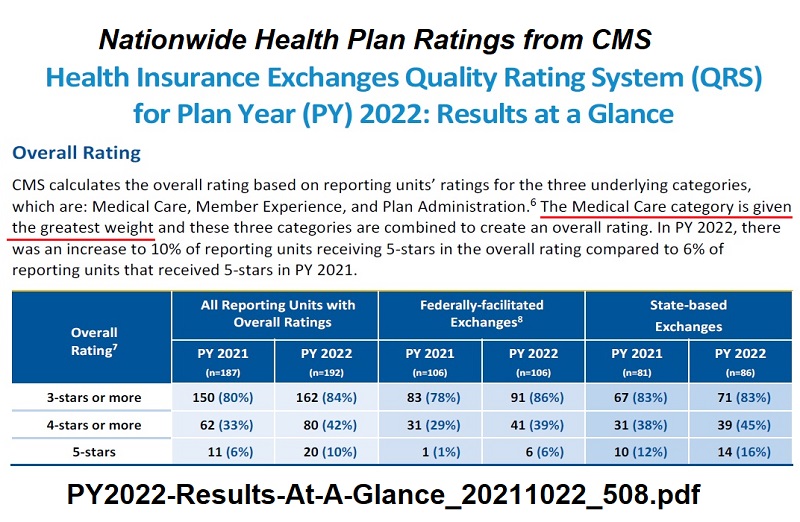

The overall star ratings are based on the three categories of medical care, member experience, and plan administration. The data used for the measurements are collected from voluminous amounts of patient health care services and member surveys. The methodology is above criticism. However, the attribution of delivery of health care services, where the health plan has little input, is misleading to consumers. Plus, there seems to be little analysis of the measurements in relation to the type of health plan responsible for the services.

Covered California Star Ratings EPO, HMO, PPO Plans

When a consumer reviews the Covered California star ratings, the perspective is of the consumer interacting with the health plan. Consumers intuitively know that their health is delivered by doctors, hospitals and other health care providers and facilities. The assumption is that the star rating is about the health plan for things like customer service, filling prescriptions, making premium payments, finding doctors, and prior authorization for elective procedures.

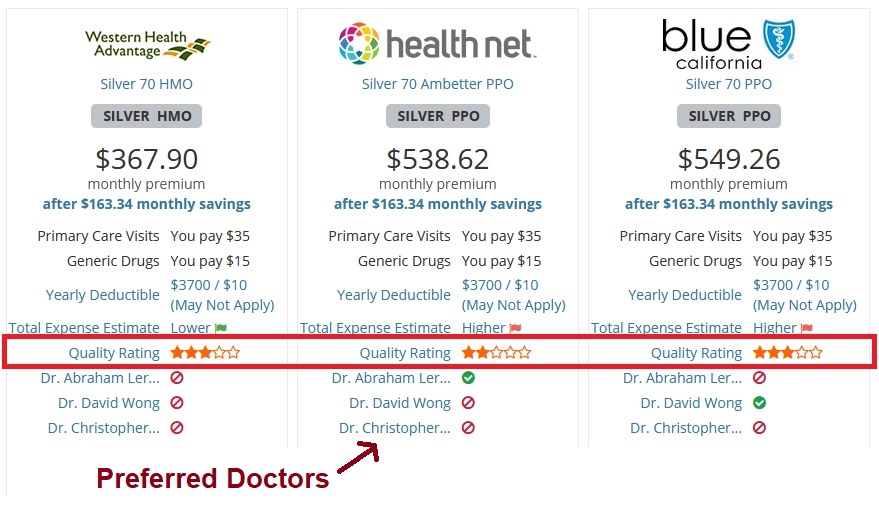

One of the most important strides for increasing consumer satisfaction with their health insurance are the standard metal tier benefit design plans. Regardless of the carrier or plan type (EPO, HMO, PPO) the plans are structure exactly the same and cover the same health care services. A Silver 70 plan from an HMO in Northern California will exactly the same member cost-sharing as a PPO plan in Southern California.

The significant difference between the different carriers is the array of providers they have in the plan for in-network health care. Obviously, Kaiser Permanente health insurance will only have Kaiser doctors and hospitals in their network. Other HMO plans will contract with different medical groups and hospitals to build their provider networks. PPO plans may have many of the same providers as some HMO plans, but without the condition of having a Primary Care Physician direct the health care.

Most consumers would be surprised to learn that their health plans are being rated on how well their doctors treat them. Consumers don’t want their health plan involved in their health care decisions or interactions with their doctors. Consequently, some health plans are paying for the sins of some providers by being labeled with a low star rating.

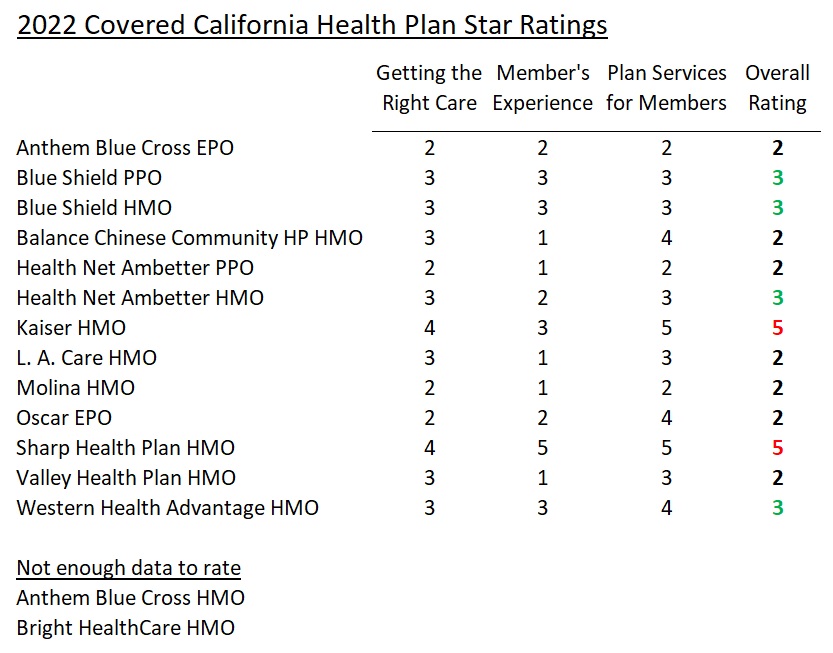

For 2022, Covered California has nine HMO plans and four EPO/PPO plans. The administration of health care services is very different between Primary Care Physician ‘gate-keeper’ HMO model and the self-referral EPO/PPO model. Two HMO models, Kaiser and Sharp, each earned 5 stars. The Blue Shield and Health Net HMO plans received 3 stars. In general, HMO plans are better at tracking and coordinating care than EPO/PPO models.

The problem with the EPO/PPO health plan model is that if a member has health care challenge, they may see their primary care physician and multiple specialists. If all of the doctors are in different medical groups, there may be little to no communication between the doctors. It is up to the patient to coordinate results, findings, and analysis around to the different providers. The lack of sharing of information can result in prolonged illness and pain.

The HMO model more closely coordinates care from initial diagnosis, tests, imaging, therapy, and prescription medications. The lack of coordination of care in the EPO/PPO models may be one reason why we see higher rates of dissatisfaction of with medical care in these models resulting in lower star ratings. Consumer’s trade-off a higher level of coordination of the HMO model for freedom of choice of the EPO/PPO model.

Another influence in the ratings not accounted for is consumer bias. Kaiser consistently gets high ratings for their health care. Of course, individuals who do not like the Kaiser model of health care try not to be Kaiser members. Most people in Kaiser, have a favorable impression of Kaiser, and their expectations are managed by their understanding of the system. Therefore, individuals most likely to complain about Kaiser health care are not members of Kaiser.

This does not mean that non-Kaiser members love their health plans. There are many people who have a negative perception of their EPO or PPO plan, but keep the plan because it includes the doctors they want to see. Another boost for some HMO plans is sharing a name with a hospital. Both Kaiser and Sharp hospitals have generated favorable perceptions for their care delivery. Unfortunately, the consumer may not understand that Kaiser and Sharp health plans are distinctly separate from the hospital and the respective medical group of doctors.

Health Plan Customer Service, Provider Search

The biggest complaint of HMOs on the part of members is usually the inability to see a certain specialist or get more advanced imaging and tests. The health plan has little to do with the referrals of the Primary Care Physician. However, there can be equal frustration with finding a specialist in the EPO/PPO model. Occasionally, an EPO/PPO member gets hit with on out-of-network bill because the doctor they saw or the test provided was performed by an out-of-network provider.

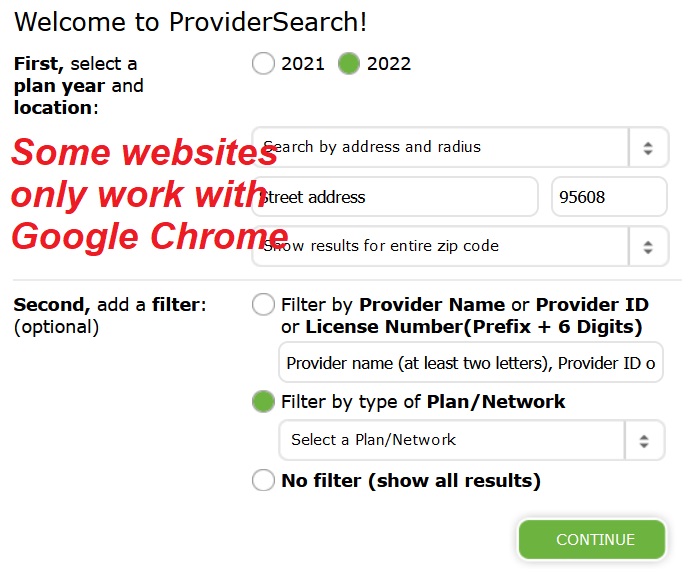

There should be a specific star rating on how easy it is to perform an accurate provider search through the health plan’s website. The provider search tool for most health plans is difficult to navigate. Some of the online doctor search tools are completely worthless and too easily yield incorrect results. A health plan is only as good as the provider network it offers to the members.

You can visit the California Office of the Patient Advocate to see the star ratings for plan not offered through Covered California. Some of the health plans on the OPA Health Plan Report Card have better ratings than through Covered California. The better member experience ratings is partially accounted for by understanding that employer group plans have a larger network of doctors and hospitals than the individual and family plans offered through Covered California.

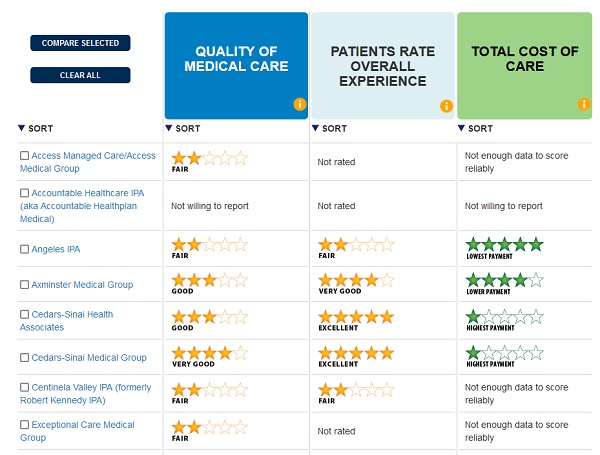

An even more important health rating is for the medical groups, who in many instances, are providing the health care that the insurance is paying for. The Office Patient Advocate reports on the star ratings for the different medical groups on a county basis. The downsides to the medical group ratings is that independent physician data is not captured and it can be difficult to search for a medical group on a health plan’s provider online search tool.