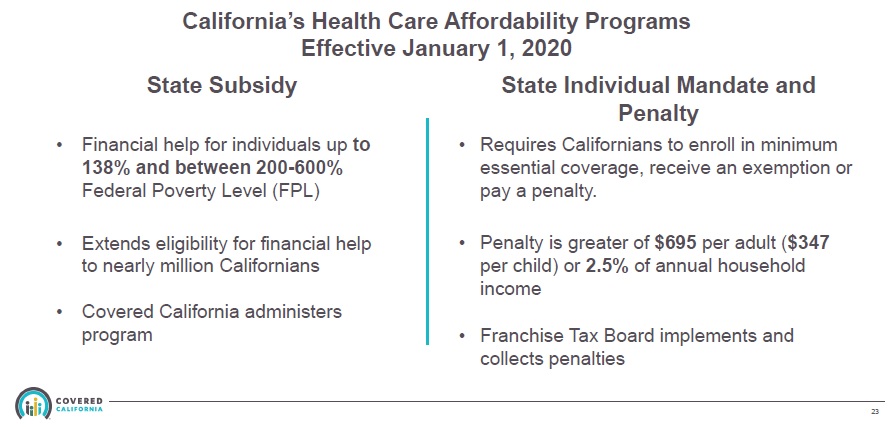

Beginning in 2020, California will provide a subsidy to reduce the cost of a household’s health insurance premiums for higher income individuals and families. The income limits for the subsidy are higher than the federal ACA premium tax credit subsidy. In some instances, the household will receive both the state and federal subsidy to reduce the health insurance premium.

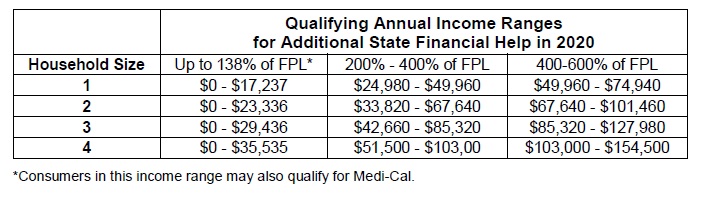

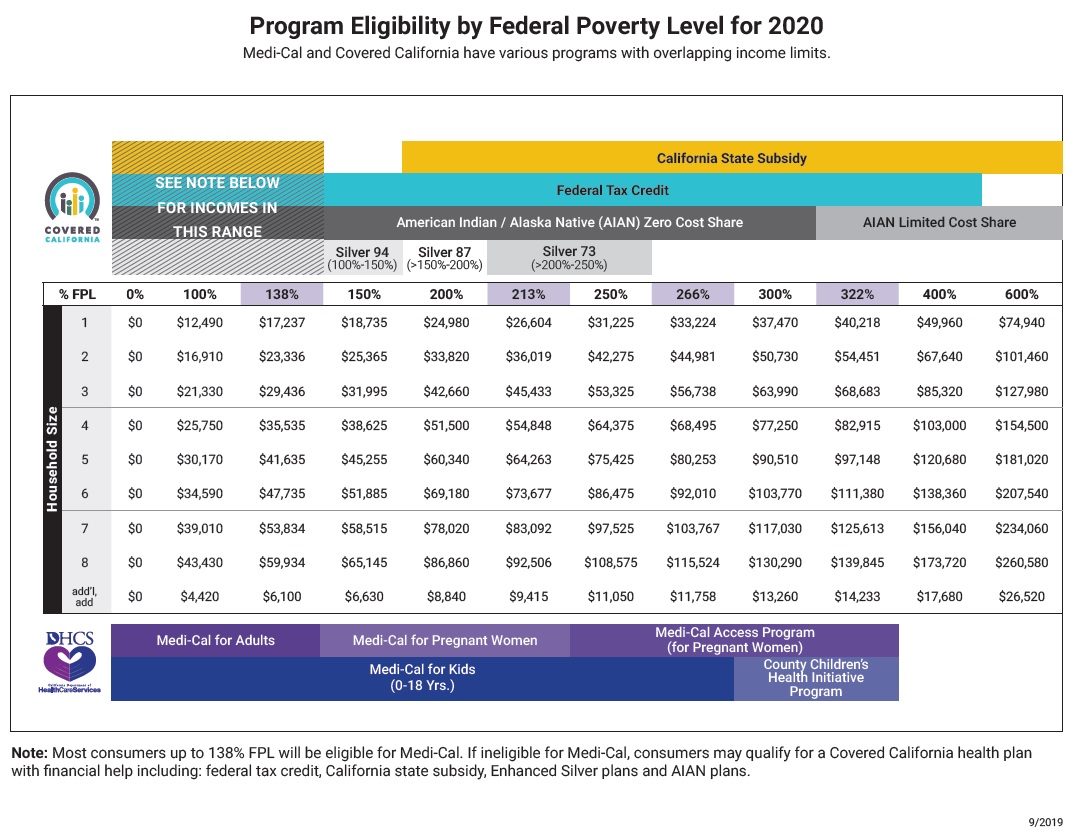

There are several conditions to be eligible for the California Premium Subsidy Program. The first condition is that you can only get the subsidy if you purchase health insurance through Covered California. Households can be eligible for the subsidy with incomes between 400% and 600% of the federal poverty level, an income range where no federal ACA Premium Tax Credits are offered.

To be qualified to receive the California Premium Subsidy you must:

- Apply for health insurance coverage through Covered California.

- Meet and accept all the conditions for entering into the Covered California exchange as outlined by the Affordable Care Act (ACA).

- Have the income level necessary to receive both the federal and state subsidy (200% – 400% of the federal poverty level) or income between 400% and 600% of the federal poverty level for only the California Premium Subsidy.

Note: I understand that many people just want to see if they qualify for the California subsidy. This post is dedicated to the details of how the subsidy is determine and how the program works. As of this post in late September, Covered California is still working on the final regulations and implementation.

Covered California Premium Subsidy Calculator Link

California vs. Federal ACA Subsidies

For the most part, the California Premium Subsidy Program will be structured similar to the federal ACA Premium Tax Credits. The significant difference from the federal program is that it targets household incomes from 200% up to 600% of the federal poverty level (FPL) and below 138% of the FPL for people who are not eligible for Medi-Cal.

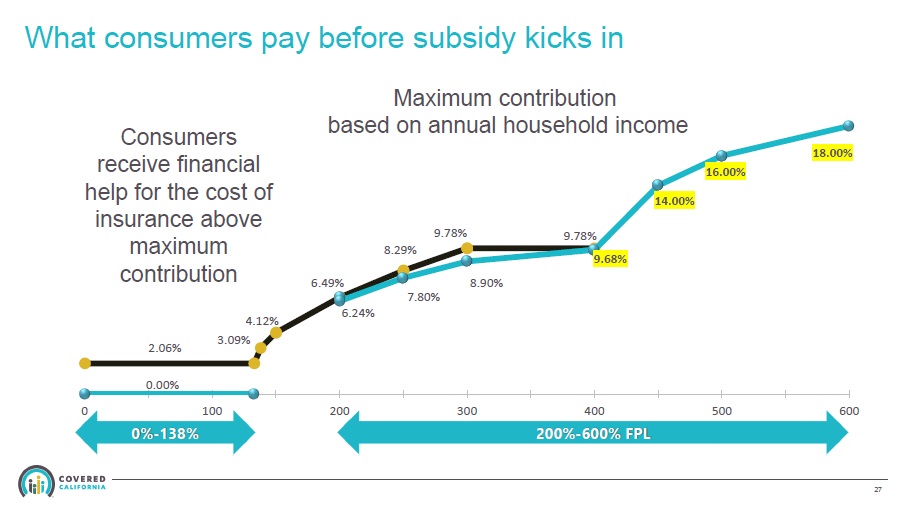

The federal ACA Premium Tax Credit program seeks to make the second lowest cost Silver plan in an individual’s or family’s region affordable. It applies an affordability percentage to the household income and then makes up any difference with a subsidy to make the health insurance affordable. This affordability or applicable figure percentage ranges from 2% for very low incomes and as high as 9.56% for incomes over 300% FPL, but under 400% FPL. (2018 IRS Instructions for form 8962, Premium Tax Credit Reconciliation. The IRS refers to the affordability percentage as the applicable figure. I have chosen to call it the affordability percentage).

The affordability percentage is the amount the ACA has established as being a household’s responsibility for health insurance costs at a particular income level relative to the FPL. If, through the formula for affordability, it determines your household should spend no more than $400 per month on health insurance, but the premium for the second lowest cost Silver plan is $1,000, then you are eligible for a $600 monthly federal ACA Advance Premium Tax Credit subsidy.

You will notice that between 200% and 400% of the FPL, the California affordability percentages are slightly lower. California believes that households in that range should spend less on health insurance than the federal ACA levels. This translates into a small subsidy from the California Premium Subsidy program, added to the federal ACA subsidy, to make the health insurance premium a little lower.

Differences Between Federal and California Subsidies

The California Premium Subsidy will work in much the same way. It will be based on an affordability percent and the second lowest cost Silver plan in the region in which you reside. However, the California subsidy version deviates from the federal program in a couple of ways as implemented in California.

First, because California has expanded Medi-Cal, meaning a household can qualify for no cost Medi-Cal if their income is under 138% of the FPL, the California Premium Subsidy will be available to individuals and families with incomes under 138% and who don’t qualify for Medi-Cal. Individuals and families in this income bracket will need to apply through Covered California to get the subsidy.

Second, households with incomes between 200% and 400% of the FPL, who may already be getting a federal subsidy, will be eligible for an additional California Premium Subsidy to further reduce their health insurance premium. Consumers in this bracket, who are already in Covered California will have to do nothing. The California Premium Subsidy will be automatically applied.

Third, the California Premium Subsidy targets households with incomes over 400% and up to 600% of the FPL, who today, are ineligible for a federal ACA Premium Tax Credit. Households in this income bracket, will have to apply through Covered California to get the subsidy if they aren’t already purchasing health insurance through Covered California.

Second Lowest Cost Silver Plan

The benchmark for eligibility to receive any subsidy is the affordability of the second lowest cost Silver plan. There are individuals, usually in Southern California where the rates are lower, who, even though their income is under 400% of the FPL, receive no federal ACA Premium Tax Credit. This is because at their estimated income, the second lowest cost Silver is already considered affordable when compared to the affordability percentage set forth in the ACA. In other words, the full rate of the second lowest cost Silver plan is a smaller percentage of the household’s income than the affordability percent under the federal ACA Premium Tax Credit program.

There may be some cases where the second lowest cost plan is affordable by federal affordability percentages, but not affordable under the California affordability percentages. This would result in a very modest California Premium Subsidy to bring the monthly health insurance premium down to the California affordability percentage, for incomes between 200% and 400% FPL.

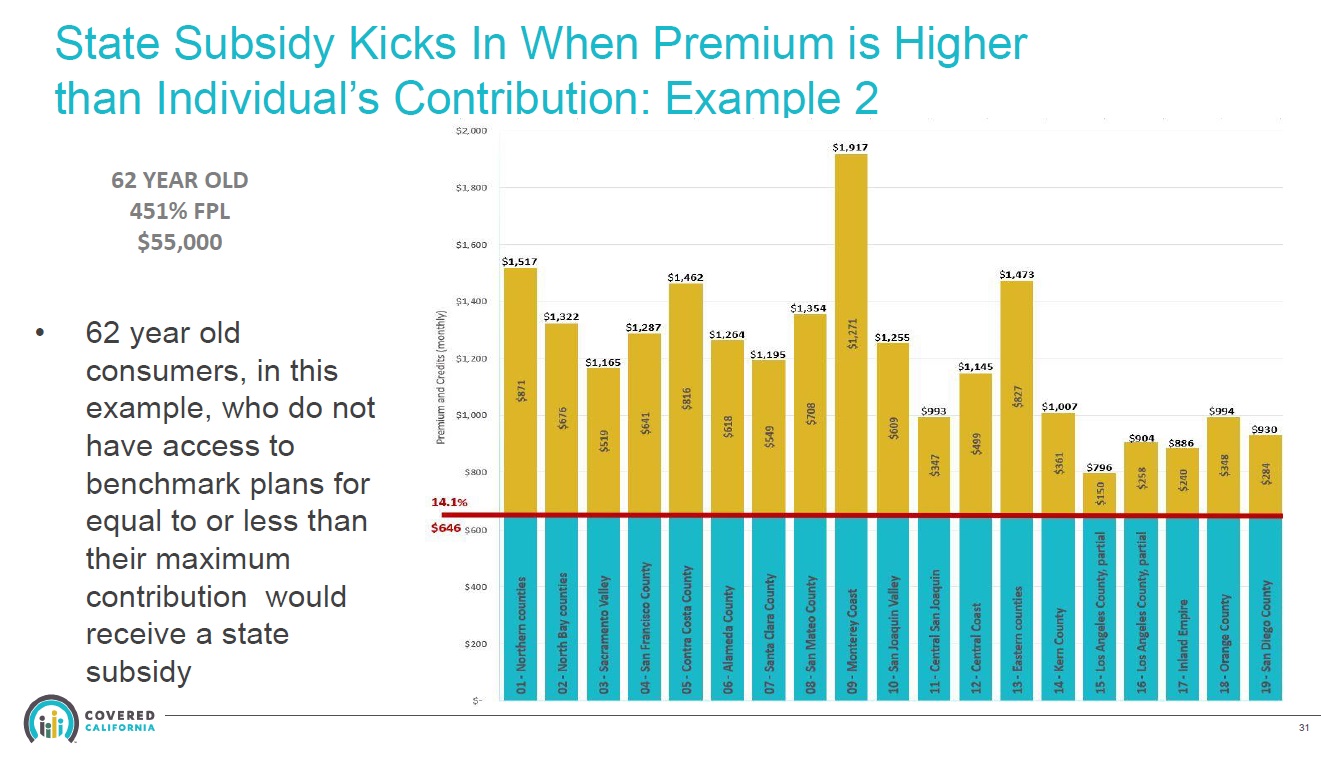

Because of the fixed rate structure of health insurance premiums mandated by the ACA, health insurance premiums are disproportionately higher for older adults. The rates are set so that the highest rate at age 64 can be no more than 3 times the rate for a 21-year-old. But a graph of the rate increase changes between 21 and 64 years of age is not a straight line. Individuals who are older will see a greater change in their year-over-year premiums than younger individuals. While younger individuals may see a 2% increase based on their age, older individuals can realize a 4% or 5% increase by getting one year older.

Because of this skewed rating curve, older adults with incomes between 400% and 600% will be the prime beneficiaries of the California Premium Subsidy.

Conditions for California Premium Subsidy

Eligibility for California Premium Subsidy will have many of the same conditions as the federal ACA Premium Tax Credit. Some of those conditions are: Consumers will need to have the appropriate citizenship or immigration status, you can’t be claimed as a dependent on another person’s tax return, you must plan to file taxes, you are not eligible for subsidies if you have affordable employer group insurance, enrolled in Medi-Cal, and if you are married, you must file a joint tax return.

- Consumers will need to have the appropriate citizenship or immigration status

- You can’t be claimed as a dependent on another person’s tax return

- You must plan to file taxes

- You are not eligible for subsidies if you have affordable employer group insurance

- You cant be enrolled in MAGI Medi-Cal

- If you are married, you must file a joint tax return

Some of the differences between the two programs are:

- You will reconcile the California Premium Subsidy with the California Franchise Tax Board, not the IRS

- Whereas the consumer does not have to accept the federal ACA Premium Tax Credit, with the California Premium Tax Credit you must accept the full monthly subsidy and reconcile the subsidy when you file your California state income return.

- Regardless of if you are eligible for both federal and state subsidies OR only California subsidies, you must enroll through the Covered California online application.

What is Premium Tax Credit Reconciliation?

When you enter Covered California, you estimate your income for that plan year. For the purposes of the federal and state subsidy, your income will be based on your Modified Adjusted Income (MAGI). Covered California then determines the ANNUAL premium tax credit you are eligible for based on your annual income estimate. We all know that an income estimate made in December for the next year will not be your exact income for the that year. Your final MAGI will usually be higher or lower.

The federal ACA Premium Tax Credits are reconciled on form 8962 Premium Tax Credit reconciliation. If your final MAGI is below your estimated income, you will be eligible for an additional tax credit, assuming your household income is over 100% of the FPL. This is because you were entitled to more premium tax credit subsidy than you received during the year. As of late September 2019, Covered California is still working with the Franchise Tax Board to develop the forms necessary to reconcile the California Premium Subsidy for 2020 state income tax returns.

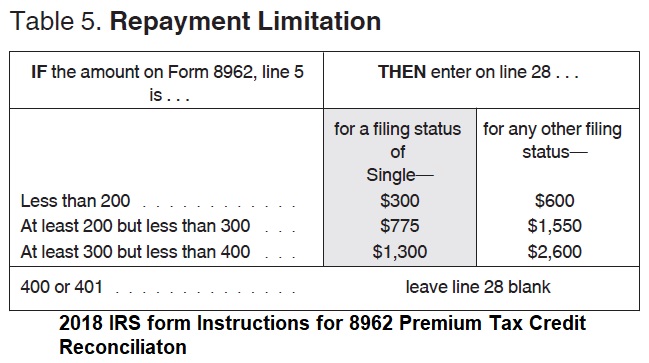

If your income is higher than your estimated MAGI, but below 400% of the FPL, you will have to repay part of the Advance Premium Tax Credit subsidy, subject to an IRS repayment limitation. If your MAGI is OVER 400% of the FPL, you have to repay the entire ACA Premium Tax Credit you received.

For the California Premium Subsidy, you will reconcile that subsidy amount with the Franchise Tax Board when you file your state income tax return. And this is where it gets complicated and a potential headache for tax prepares. If your income is between 200% and 400% of the FPL you potentially could be receiving 2 subsidies, one from the feds and one from the state. If you earn over 400% of the FPL you will only get a subsidy from California.

Covered California has identified at least six different reconciliation scenarios. Some of these situations involve reconciling the subsidies on both the federal and state income tax returns. Some of the scarier scenarios require a large repayment to either the federal government or state Franchise Tax Board (FTB) when the taxpayer files their income tax return.

Note: There are NO federal subsidies for incomes over 400% of the FPL.

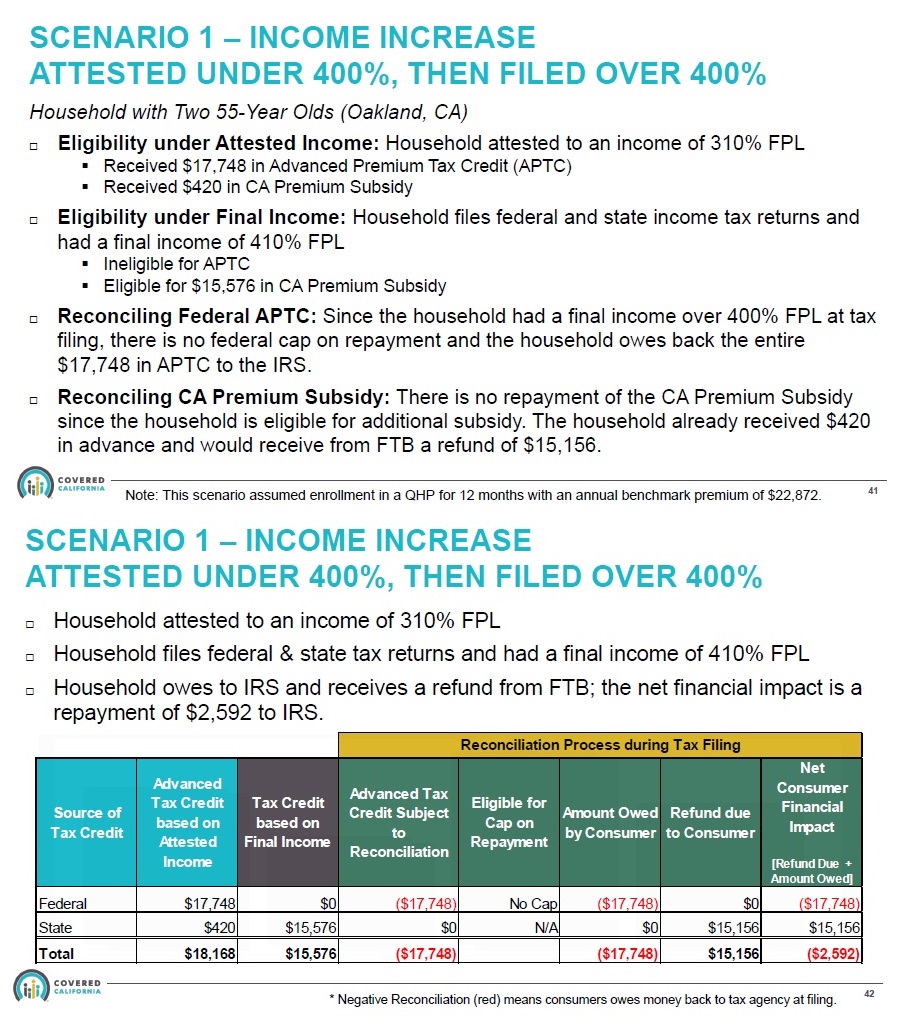

Scenario 1: The household estimates their Modified Adjusted Gross Income (MAGI) UNDER 400% FPL, but then files with a MAGI OVER 400% FPL. They must repay ALL of the federal subsidy, but become eligible for a large California subsidy. In the Covered California illustration, the consumer has a net loss as the federal subsidy repayment is larger than the California Premium Subsidy they received from the FTB.

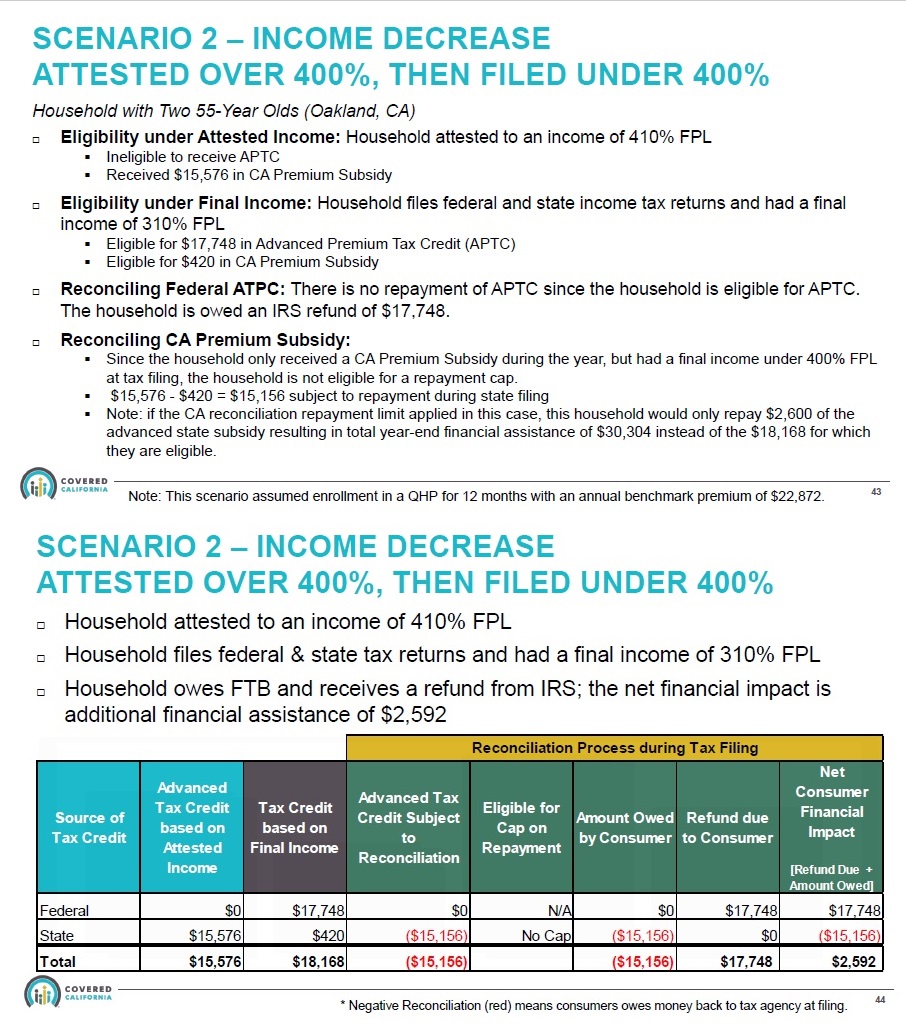

Scenario 2: The household estimated their MAGI over 400% FPL, but then had a MAGI of under 400% FPL. They are now entitled to federal ACA premium tax credit subsidy. Because the federal subsidies can be more generous, the household has a net gain in premium subsidies. They must repay almost all of the California subsidy, less a small amount if the income is over 200% FPL, but they receive a larger federal subsidy. In this illustration the taxpayer will have a net subsidy credit gain of $2,592.

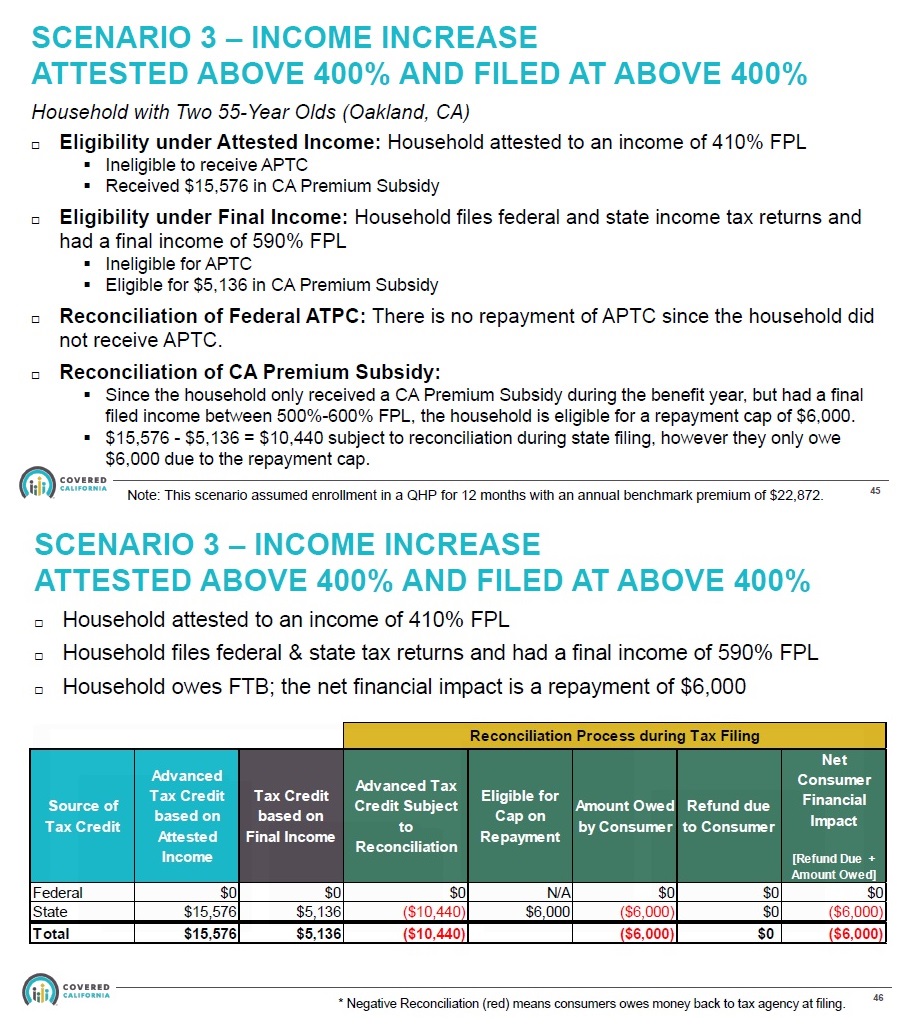

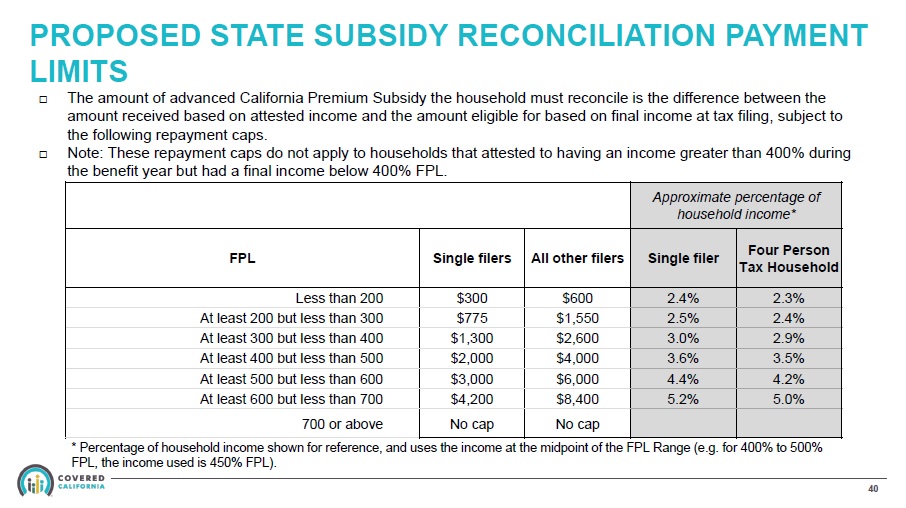

Scenario 3: The household estimated their MAGI OVER 400% FPL, but then filed a MAGI higher than their original estimate, but still UNDER 600% FPL. This means they received a California subsidy amount based on the lower income estimate. They were not entitled to as much subsidy under the higher income. This means they have to repay part of the subsidy amount back to California, subject to a repayment limitation.

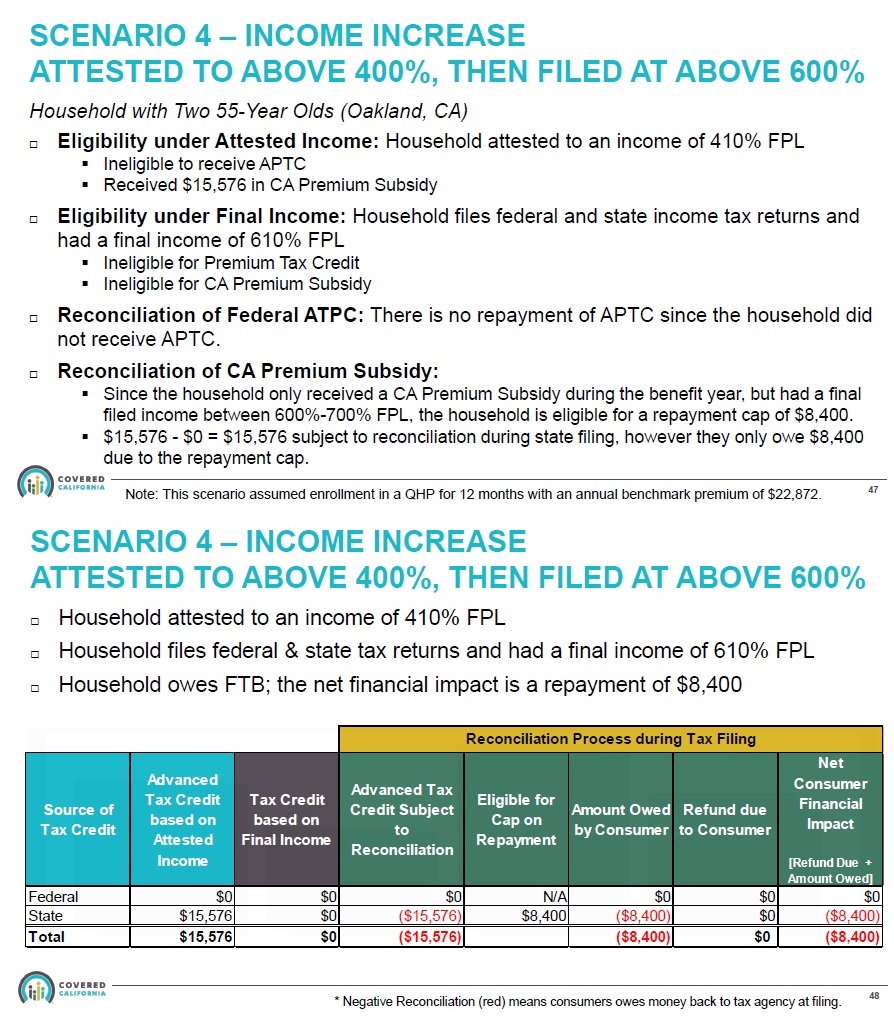

Scenario 4: The household estimated their MAGI OVER 400% FPL, but their final MAGI was OVER 600% FPL. With an income over 600% of the FPL, the family was not entitled to any California Premium Subsidy. However, because the final MAGI was UNDER 700% FPL, they are in the range of the California subsidy repayment limitation. They don’t have to repay ALL of the subsidy, only a portion of the amount. If the final MAGI is over 700% FPL, the consumer must repay all of the California Premium Subsidy back to California.

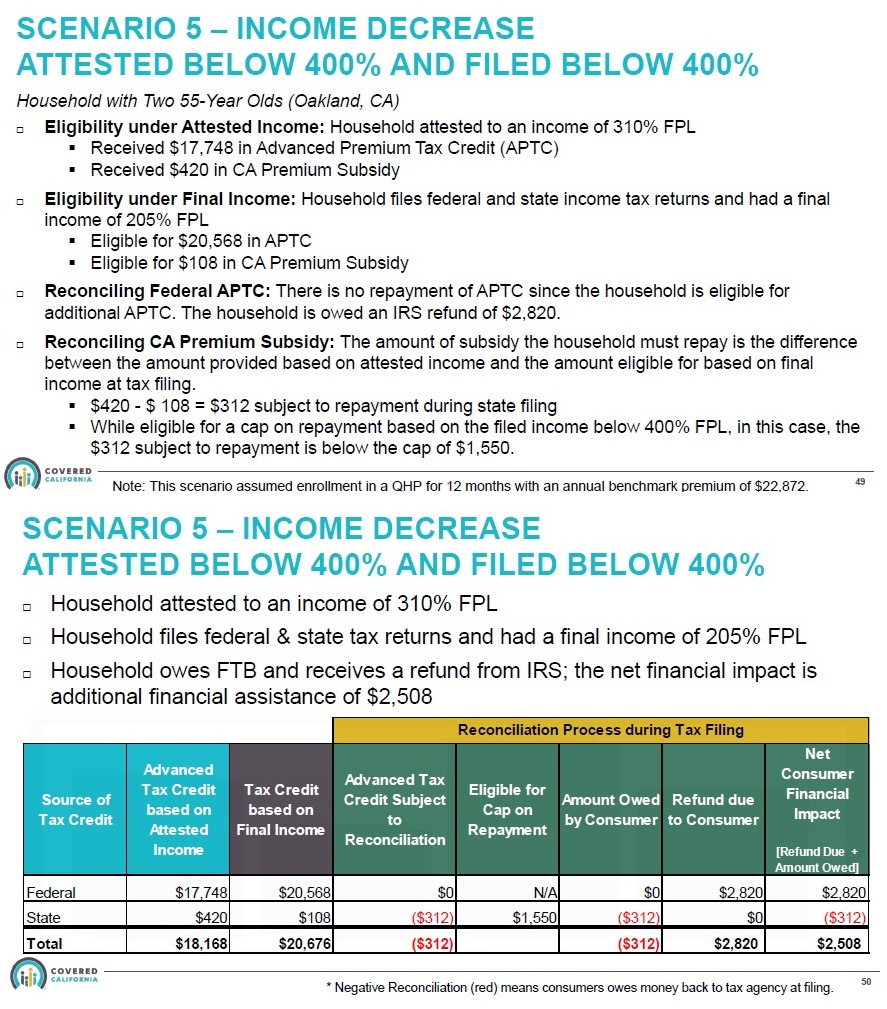

Scenario 5: The household estimated their MAGI UNDER 400% FPL and filed an even lower MAGI on their tax return. The federal Premium Tax Credit is larger because their income was lower than estimated. Conversely, the lower MAGI meant they were entitled to less California subsidy. This occurs because of the different affordability percentages the federal government and California use.

In this illustration, the federal and state affordability percentages are closer together at the lower income, so California doesn’t have to advance as much subsidy to help the household meet their slightly lower affordability percentage. The household has to repay some of the state subsidy, but it is offset by a larger federal subsidy. The net premium subsidy is $2,508: an additional tax credit on the federal return of $2,820 and an additional tax liability (-$312) on the state return.

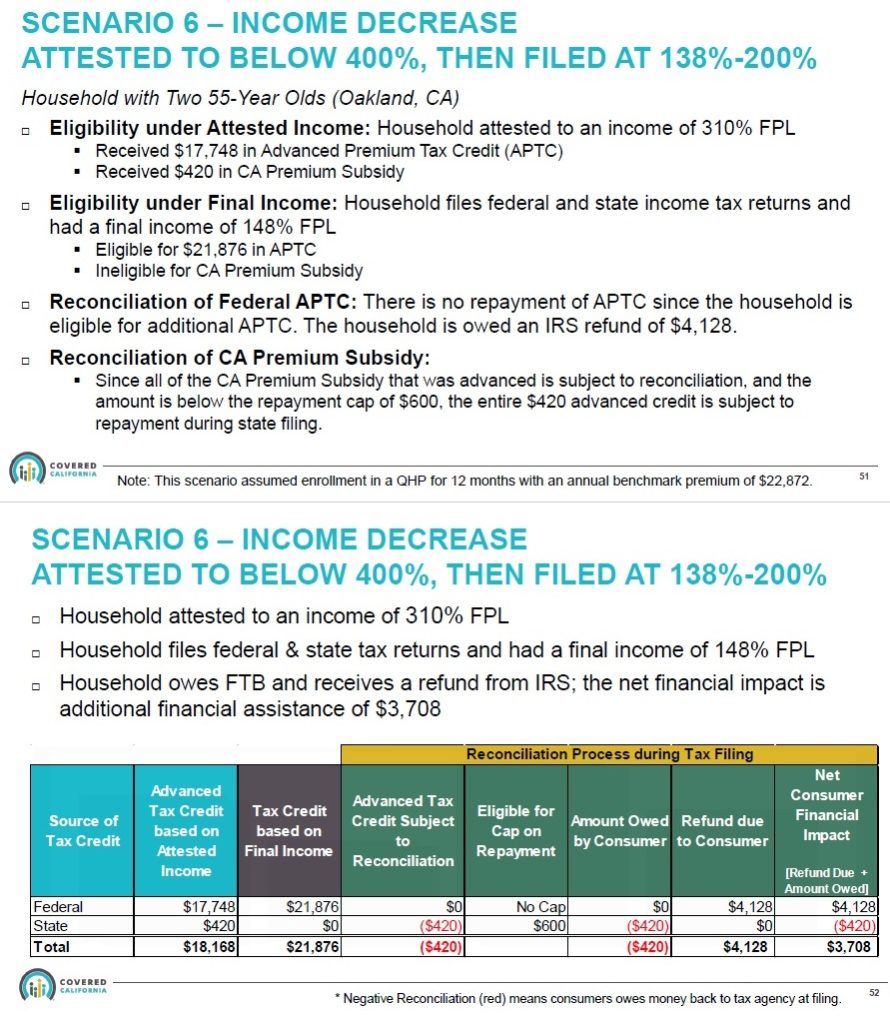

Scenario 6: The household estimated their MAGI UNDER 400% FPL, but when they filed their taxes, their MAGI was UNDER 200% FPL. There is no state subsidy for incomes between 138% and 199% of the FPL. The federal subsidy increases to $4,128, but they have to repay the state subsidy the received of $420. The net result is an increase in the overall subsidy of $3,708 ($4,128 – $420).

There are potentially more scenarios, especially as it relates to households with a MAGI under 138% FPL and ineligible for Medi-Cal, but file with a higher MAGI. I’m still waiting from answers from Covered California for some of these unique income situations.

Consumers who earn less than 138 percent FPL will see their premiums for the benchmark plan lowered to $1 per member, per month. To receive the California subsidy under 138% of FPL, you cannot be eligible for Medi-Cal.

No Doubling-Up on Subsidies

For households between 200% and 400% FPL you won’t get both the federal and state subsidy. The affordability percentage for the California Premium Subsidy is a little lower than the federal ACA Premium Tax Credit. The federal subsidy will be applied first to reducing the health insurance premium. Then, the California subsidy will add a small amount to reduce the premium to the state affordability percentage.

For a household of two, with an income of $40,000, they are at 237% of the FPL. The federal affordability percentage for this household is paying no more than 7.81% of the household income and California affordability percentage is 7.38%.

Covered California will look at the second lowest cost silver plan in the region and then determine how much federal ACA is applicable and how much California Premium Subsidy can be applied. The system might determine that for this household size, income, and region, they are eligible for $1,782 per month from the ACA Premium Tax Credit. Then, because California has determined that that household should only spend 7.38% on health insurance, Covered California determines the household is eligible for a larger subsidy of $1,796.

The household will not receive both the full federal and state subsidy. Covered California will apply the full federal subsidy of $1,782, and then, an additional $14 from the state subsidy to equal a total subsidy of $1,796.

Repayment of California Premium Subsidies

There is no repayment limitation of the California Premium Subsidy IF the estimated income is over 400% FPL, but then the final income on the California state income tax return is UNDER 400% FPL. The expectation is that if the household income is under 400% the federal ACA subsidies kick-in. Under Scenario 2 above, the household had to repay all the state subsidy, less the difference between the federal and state affordability percentages, but the larger federal subsidy off-set the repayment. What is unclear is if the final household income is between 0% and 138% FPL. Covered California shows an affordability percentage of 0% for this range.

There is a repayment limitation of the California Premium Subsidy IF your estimated income is OVER 400% AND your final MAGI is higher than the estimate but under 700% FPL. Under the California Premium Subsidy repayment limitations, if the MAGI is under 700% FPL, then the individual will be limited to a maximum repayment amount of $4,200 and $8,400 for a family.

Note: Covered California is fairly confident that the IRS will not consider the California Premium Subsidy as unearned income. I do not know if those who forego health insurance, and have to pay the new California penalty for not having health insurance, will be able to deduct that penalty on either their federal or state income tax return.

Health Plan Downsides

Not all individual and family plans offered in California are available through Covered California. Sutter Health Plus is not in Covered California. There is no way to get a California Premium Subsidy for your Sutter Health Plus plan in 2020. You would have to give up your Sutter plan, enroll in Covered California, and select a different carrier. Similarly, Blue Shield and Kaiser offer off-exchange plans (health plans offered only directly from the carrier) that will not be available in Covered California. If you have a Blue Shield Silver 1850 PPO plan, for example, you will have to drop that plan when you enroll in Covered California.

For consumers who have elected and off-exchange Silver 70 plan because they are priced lower, they will have to compare the plan rates. (Covered California includes a surcharge on all Silver 70 plans to fund the cost-sharing reductions for Silver plans 73, 87, and 94). The California Premium Subsidy may not reduce the health insurance premium to below the 2020 rate of your off-exchange Silver 70 plan.

Note: if you do enroll in Covered California to receive the premium subsidy, YOU MUST terminate your current off-exchange health plan, Covered California will not do it for you.

Podcast

Cal Premium Subsidy