Young adults should not buy health insurance just to derail Obamcare.

The new strategy of the GOP and Tea Party unveiled this summer to derail Obamacare is to encourage young adults not to purchase health insurance. The premise for their campaign is that if not enough young people, who pay premiums and infrequently generate claims through using healthcare services, fail to enroll, their lack of participation will undermine health insurance companies and force them to close plans or withdraw from the state based exchanges altogether. The weakness of this strategy is that no one can say with certainty that a membership pool with an absence of young adults will necessarily tilt a plan out of profitability.

How many young adults do we need to enroll?

It was estimated by David Simas, Deputy Senior Advisor at The White House, on the PBS Newshour that several million of the young adults currently without health insurance need to enroll for a successful insurance market place.

We know that in order for us to be successful, to really make sure the marketplaces are effective, there’s a smaller subset that needs to really be at the center of our focus for outreach. And that’s about two million to two-and-a-half-million young and healthy 18-to-35-year-olds. – David Simas

While all successful insurance plans require more premiums to be collected than are paid out in claims, I have yet to find a definitive study that shows a lack of young adult enrollment in health insurance will crush the health plans into insolvency.

A model for profitable guarantee issue health insurance

On the flip side, we actually have a working model of health insurance that offers guarantee issue health insurance in California to anyone regardless of age and pre-existing medical conditions, it’s called the small employer group health plan. With a minimum of two employees participating, up to a maximum of fifty, any small business can start a small group health plan in California. Many of these small group plans are started by business owners who have either been denied health insurance because of a medical condition or have a family member or employee that have been refused an individual and family plan (IFP).

Small group plans might mirror state exchanges

Small employer group plans, because they are guarantee issue, are more expensive than IFPs. While this is an anecdotal observation, most of the small groups I am familiar with are disproportionately comprised of older individuals as the younger employees choose not to participate for a variety of reasons. In addition, most of the plans discount the premium of young dependents. This occurs as the premium columns for the plans are set up as Employee Only, Employee + Spouse, Employee + Dependents or Employee + Family.

Small group plans discount dependents

While the Employee + Family is the highest premium, it doesn’t matter if the the employee has one child or 10 dependents, it’s all the same premium. (Although there is speculation that more plans might start including premium columns based on household size.) What we see are small groups that tend to have a higher utilization of health care services and fewer young adults participating. This scenario may mirror what will happen in the state exchanges.

Small group plans are working for thousands of small businesses

Because small group plans tend to have a higher ratio of individuals who need healthcare services the carriers do have challenges maintaining reasonable premium increases in the face of escalating health care costs. Even with the challenges of rising health care expenses, all the major insurance companies in California promote and actively solicit new small group business. If the lack of young adults, or young invincibles as they are known, participating in these plans was a significant factor to their viability the carriers would have fought to have the 1993 law (AB 1632),authorizing small group plans, amended or repealed years ago.

3:1 premium ratio

Part of the forecast for needing significant numbers of young adults to enroll derives from the new mandate that rates in the state exchanges can have no more than a three to one ratio. In other words, the most expensive premium for an adult of 64 years of age can only be three times that of a 21 year old. This regulation lowers the rates for older members, encouraging participation, and elevates the rates for young people. However, there are a number of market influences that make predicting actual enrollment very difficult.

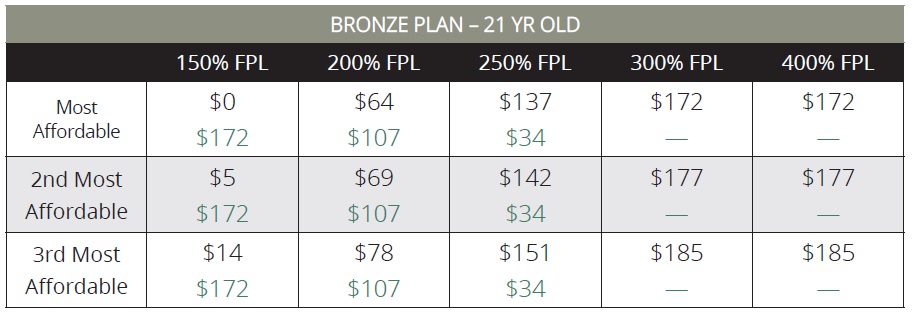

Younger more likely eligible for subsidy

Younger adults making less money will more likely be eligible for the Advance Tax Payment Credit, subsidy, to substantially reduce or eliminate their premium depending on the plan they select. A young adult, perhaps going to school and living at home, may qualify for a zero premium Bronze health plan in California if his or her income is 150% or less of the federal poverty line. In California that translates into approximately $16,755 per year and the individual will pay no monthly premium.

Some young adults may qualify for zero premium health insurance.

How will Medicaid effect enrollment of young adults?

Many young adults may actually qualify for expanded coverage under Medicaid because of their income. We won’t know how many will be eligible to enroll in Medicaid until they begin the application process. For every person enrolled in Medicaid, young, middle aged or near retirement, there is one less individual in a private health insurance plan representing the risk of a claim.

Fractured national market may help enrollment

I have often written that one of the issues creating enormous inequities in our country are “state rights”. Specifically, each state regulates its own insurance industry. Consequently, we have 50 different insurance markets, laws and regulations in the UNITED States. This division of markets may actually work to help the ACA succeed because the population of each state is unique and the health insurance companies understand the demographics and can price plans accordingly.

From a report by the Milliman Group for Covered California

The Milliman / Society of Actuaries (SOA) report suggests that the utilization and health status of members in the individual market varies widely between states prior to the implementation of the Affordable Care Act.3 These differences are largely due to the variation in regulatory environment between states. Individual market average health status cost relativities range from 0.806 for “Least Restrictive” states to 1.231 for “Most Restrictive” states. This wide variation demonstrates that under the guaranteed issue provision of the Affordable Care Act, there is a significant potential for demographic adjustments to affect utilization and premiums. – Milliman: Factors Affecting Individual Premium Rates in 2014 For California

Health insurance companies are smarter than any government regulation

This leads to another weakness of the strategy to encourage young adults not to participate: health insurance companies are smarter than the government. Remember, the state exchanges are facilitating the purchase of health insurance from private “for profit” and “non profit” health plans. The insurance companies offering these plans either have their own actuarial department or contract with a firm to develop detailed forecasts of expected healthcare utilization and subsequent claims they may have to pay for a specific population in a specific region.

Insurance carriers are conservative and take few risks

There is no way Anthem Blue Cross, Blue Shield of California, Health Net and Kaiser and a number of smaller regional health insurance plans are going to market with premiums that could force them into insolvency. It is beyond my comprehension that they would rely on the government, either through the promise of the individual mandate or persuasive marketing, to deliver a certain percentage of young adults for enrollment. If anything, they have factored in the worst case scenario of very few young adults enrolling for health insurance through the exchanges.

ACA back stop for the wild pitch

The folks who wrote the ACA weren’t dumb either. They understood that the new guarantee issue feature of the individual market would allow people without insurance to get coverage and have their medical conditions addressed. The ACA anticipates the pent-up demand for health care services and works to shield the insurance carriers from unexpectedly high medical claims with a re-insurance provision.

The Reinsurance Program enacted in the Affordable Care Act will reimburse carriers for 80% of claim costs in excess of $60,000, up to a reinsurance cap of $250,000. This program is financed through a fee on all insurance policies, including large group employer policies, with the resources only used for reinsurance for the non-grandfathered individual market, both on and off Covered California. While the fees are likely to be passed through as increased premiums, the presence of reinsurance is likely to reduce Covered California premiums, as carriers will not be responsible for the full costs of claims for these individuals. – Milliman: Factors Affecting Individual Premium Rates in 2014 For California

But the “back stop” for health insurance companies facing expensive claims from the new market doesn’t stop with the re-insurance program. The ACA also sets up a Risk Corridor mechanism to mitigate some of the risks involved to the carrier’s bottom line.

Risk Corridors to protect profits

In addition to the reinsurance and risk adjustment programs, the federal government will also mitigate the risks to Qualified Health Plans participating in the individual and small group markets on Covered California by applying retrospective charges and credits to carriers. These charges and credits depend on the difference between a carrier’s allowable costs and its target amount for these costs. Allowable costs include incurred claims and expenditures on activities to improve health care quality. Because the risk corridor program could potentially provide an influx of federal funds to a carrier that exceeds its target for allowable costs (medical claims and quality improvement expenditures), and to Covered California as a whole, it is possible that this program could potentially encourage carriers to participate in Covered California at competitive rates despite concerns over whether the carrier will receive sufficient earned premiums to meet medical expenditures. – Milliman: Factors Affecting Individual Premium Rates in 2014 For California

Who cares if the young adults don’t show up for the party?

Between the re-insurance program, risk corridors, individual mandate and numerous taxes and fees, the Affordable Care Act has sought to create a profitable market place for insurance companies participating in the state exchanges. We have seen that small employer group plans that have higher health care utilization and fewer young healthy members continue to be offered and promoted in California and other states.

Strategy based on false assumptions

The strategy to derail health care reform by unethically encouraging young adults not to enroll in a health insurance plan, risking their health and finances, will not work. Those young adults who heed the devil’s advice not to enroll may be reasonably angered when they receive a reduced federal tax refund because the penalty for not having coverage was withheld. Those collected penalties, whether they like it or not, will help offset the costs for others who responsibly enroll in the health insurance plans. It may be somewhat of a roller coaster ride to get the ACA fully implemented, but that train won’t be derailed.

Strategy to derail ACA in action

If you want to see a glimpse of the talking points and arguments conservatives against the Affordable Care Act are deploying watch the PBS Newshour segment “Is Health Care Reform a Good Bargain or Burden for Young American?” In it you will see Evan Feinberg, President of Generation Opportunity, parrot disingenuous lines of reason as to why young adults should not purchase health insurance through the exchanges.

“Look, young people are going to be used under Obamacare. Our generation is being asked — that’s the only way it works — to subsidize an older, wealthier generation’s health care. It’s simply not a good deal for us at all.

But insurance doesn’t work by having prepaid health care for everyone and having young people pay a greater portion than they would otherwise use, so that older people who are necessarily going to use it.

That’s not insurance. That’s just a wealth redistribution scheme, where young people pay for older, sicker people. So, no, that’s not at all what young Americans should be interested in.” – Evan Feinberg

Preserve your wealth and kill Medicare

Under Evan’s tortured logic we should dump Medicare and Social Security taxes that help support and insure our older retired American citizens. He is exhibiting a callous disregard not only for his fellow citizens denied health insurance but toward the covenant we have made with older Americans to provide them a modicum amount of financial security from catastrophic health care bills.

[wpdm_file id=54 title=”true” desc=”true” ]

August 21, 2013 Commonwealth Fund Report

A new report by the Commonwealth Fund, Covering Young Adults Under the Affordable Care Act: The Importance of Outreach and Medicaid Expansion, reveals just how much young adults do want health insurance. Millions of young adults up to the age of 26 were to be placed on their parents health insurance plans. In many situations, the parents will be able to save the cost of the dependent on the health insurance if their son or daughter participates in the new health insurance exchanges. Many of these young adults, as shown above, may pay nothing for their health insurance.

Blog post on the importance of community – Love Your Neighbor As Yourself: Support Health Care Reform

October 9, 2013

The tea party caucus of the House Republicans have forced Speaker Boehner to not offer a continuing budget resolution unless it strips out the funding mechanism for Obamacare. We have been eight days with out the federal government having any spending authority, essentially shutting down the government. The House GOP tea party Republicans have now convinced themselves that in order to save the country from Obamacare they must not only shut down the government but they will not increase the debt ceiling which will force the federal government to pick and choose which bills it can pay. This will put the U.S. into technical default on our obligations.

Greater than encouraging young adults not to purchase health insurance is the reckless nature the Republicans are holding our country hostage over a program they just don’t like. The Republicans were correct when they predicted the ACA would be a train wreck. I just had not clue it would be them conducting the train of the U.S. into default.