The most difficult part of applying for health insurance with the Affordable Care Act subsidies can be the income section. If you estimate too low, you get put into Medicaid or Medi-Cal. If you estimate too high, you receive no help paying for health insurance. However, the key to receiving the Premium Tax Credit subsidies is properly estimating your Modified Adjusted Gross Income.

Finding Your Adjusted Gross Income

The income used for estimating the health insurance subsidy is known as the Modified Adjusted Gross Income (MAGI). This is a real friendly IRS term. Regardless, it is your Adjusted Gross Income that you report on your federal income tax return Modified by some other income that is not normally taxed. This is for your tax filing household, you, your spouse, and the individuals you claim as dependents and are listed on the primary tax filers tax return. It doesn’t include your roommates.

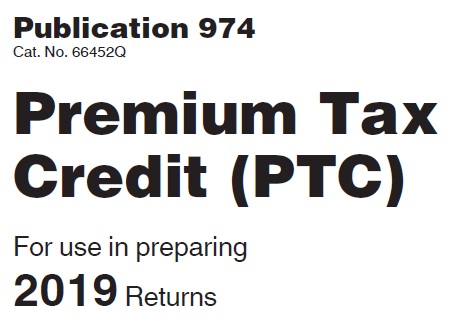

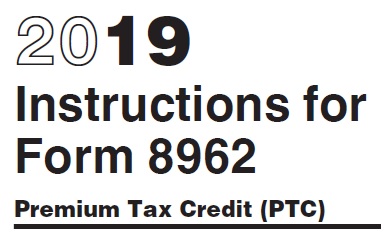

Stop: The information I am presenting comes from IRS documents such as

Publication 974

Instructions for Form 8962

and Covered California documents on the topic of income. Always consult your tax preparer or CPA if you have any questions about your own situation.

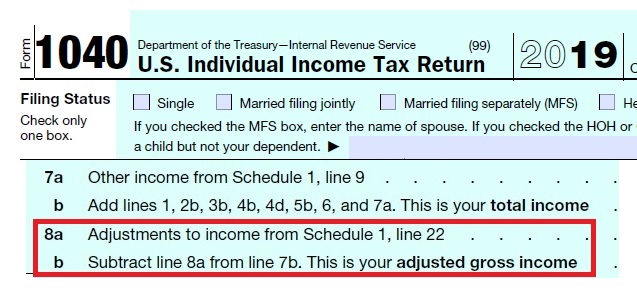

Let’s start with your AGI or Adjusted Gross Income

This can be found on line 8b of the 2019 1040 income tax return. It clearly states, “This is your adjusted gross income.” The AGI is the sum of all your

- Wages, salaries, tips, etc. reported to you on W-2 sent to you by your employer.

- Schedule 1 of the 1040 list Additional Income

- Business income or loss Schedule C

- Other gains or losses property transactions Form 4797

- Rental Real Estate, royalties, partnerships, trusts Schedule E

- Farm income Schedule F

- Unemployment compensation

Self-Employed Small Business

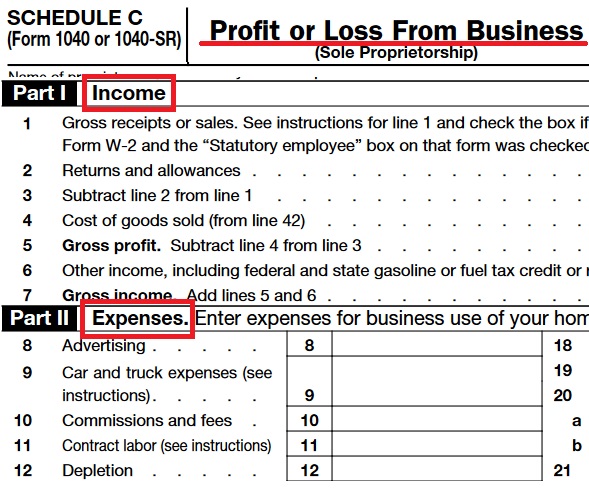

If you run your own business and sell a service or product, maybe you receive a 1099 for your work, you most likely complete a Schedule C Profit or Loss from a Business. The key point is that your reportable income from Schedule C is your gross revenues minus your expenses.

For example, I had $60,000 in revenue from my different business activities in 2019. There were insurance commissions, revenue from by website, the sales of my history books. But I also had significant and legitimate business expenses such as business travel, office supplies, utilities, insurance, etc.

My gross revenue minus my expenses, all listed on Schedule C is the taxable income that gets fed into Schedule 1, and then into my adjusted gross income.

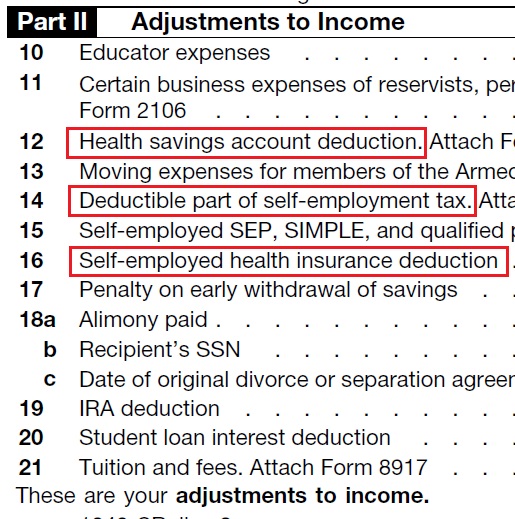

Your adjusted gross income is also reduced by certain deductions for things like contributions to a Health Savings Account, part of your self-employment tax, IRA deduction, and student loan interest. But a real big deduction, that is unknown until you do your taxes, and AFTER you have received subsidies for your health insurance, is the self-employed health insurance deduction. This is complicated topic, but just realize that when you are estimating your income, and you meet all the IRS conditions, you get to deduct the part of the health insurance premiums you pay after any subsidy has been subtracted from the full rate.

Back to the 1040

If you think your adjusted gross income from your last tax return is a fair and accurate estimate of the current year’s situation, you have part of the equation completed.

Modified Adjusted Gross Income

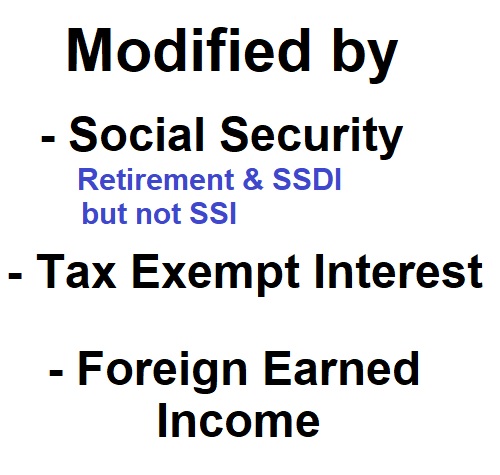

Your adjusted gross income is modified by the additions of Social Security retirement benefits, Social Security Disability Insurance payments, but not Supplemental Security Income,

Along with tax exempt interest, like muni-bonds, and foreign earned income.

The Social Security retirement income is really important. Your spouse may be on Medicare, and not seeking health insurance, but if they are receiving Social Security retirement benefits, that income, even though it may not be fully taxed, it must be included in the Modified Adjusted Gross Income. Many families have failed to include the Social Security retirement benefits in their income estimated and then found they earned too much money to qualify for the Premium Tax Credit subsidy and they had to pay it all back.

Another element that modifies your household income is if your children earn money. According to the IRS documents, you only include your dependents income if they are required to file a federal income tax return because they meet the income tax return filing threshold.

A lot of this tax stuff is just confusing. So here is another way of looking at the modified adjusted gross income. First, money you receive that you have to report as taxable income is included.

In most cases this means you are reporting money that is given to you as a gift unless you have to report the money on your income tax return.

Distributions from some IRAs are taxable. Prizes, awards, and rewards money are taxable.

Cancellation of debts, gambling winnings, lottery, and raffles are usually taxable events

Insurance benefits are usually not counted as income unless someone else paid the premiums for the insurance.

Child support is not income.

In-Home Support Services income in most circumstances is not considered federally taxed income.

In addition to money you earn and must report on your taxes, you must include those Social Security retirement benefits and tax-exempt interest, that’s the modified part of Modified Adjusted Gross Income.

Is that crazy enough for you? With luck your most recent tax return’s adjusted gross income is sufficient for estimating your income for the health insurance subsidies. But it is only an estimate. If your life changes in the middle of the year, and that change involves your income or one of your tax dependents income, you need to carefully consider how to report the change.

YouTube Video on Estimating Your MAGI

IRS Forms and Publications

2019