California individual and family plans have several confusing elements such as coinsurance, copayments, and plan maximum out-of-pocket amounts. It gets even more complicated when you add the family deductible and maximum into the accounting mix. However, all the different plans have a similar way of accumulating or accounting for member cost sharing and how it adds up to meet deductibles and maximum out-of-pocket amounts.

Health Plan Deductibles

Health plan deductibles are member cost sharing elements that, once met, trigger lower cost sharing on the part of the plan member. With the medical deductible, once the plan member has a health care service subject to the deductible, and has a patient responsibility for those services that equals the deductible amount, the next dollar of costs is shared with the health plan.

For example, you have a Silver 70 plan and need in-patient surgery in a hospital. That surgery cost is subject to a $4,000 deductible. Once the hospital bills you for $4,000, you have met your medical deductible and that triggers coinsurance. The next dollar over the deductible is subject to a coinsurance percentage. For the Silver 70 plan, the coinsurance is 20 percent. This means you pay $0.20 of the next dollar billed and the health plan pays $0.80.

Only certain health care services under the Silver plans are subject to a medical deductible in order to trigger lower cost-sharing. *

- In-patient hospital stays and services

- In-patient mental health treatment

- Skilled nursing facility services

- Certain outpatient procedures, imaging, and prosthetics

All other services will have a set copayment for the service or a set coinsurance percentage.

*All health plans can have slightly different rules regarding what is applicable for accumulating toward the deductible and maximum out-of-pocket amounts. Always consult your member agreement or Evidence of Coverage for specific details.

Most Silver plans have a separate medical and pharmacy deductible. Gold and Platinum plans usually have no deductibles. With these plans the member goes straight into coinsurance for certain services or drugs. High Deductible Health Plans, which are Health Savings Account compatible, usually have a combined medical and pharmacy deductible. If the plan has a pharmacy deductible, the plan member must spend a specific dollar amount on prescription medications from a retail pharmacy before they get the lower copayment or coinsurance rates for those drugs.

For example, you are prescribed a medication where a 30-day supply from your local pharmacy retails for $100. Your pharmacy deductible is $300. The drug is considered a Tier 2 on the health plan’s drug formulary. Tier 2 drugs have a $60 copay for a 30-day supply. After three months of paying for the drug ($100 x 3 = $300), you have met your drug deductible. The next month the drug price will drop to the Tier 2 copayment level of $60.

What all the deductibles, coinsurance, and copayments have in common is that they all accumulate toward meeting the plan maximum out-of-pocket amount (MOOP). When you reach your MOOP, then all the services and prescription drugs are covered 100% by the health plan. But it can seem like forever to reach your MOOP when you are going through lots of tests, procedures, and swallowing drugs like candy on Halloween.

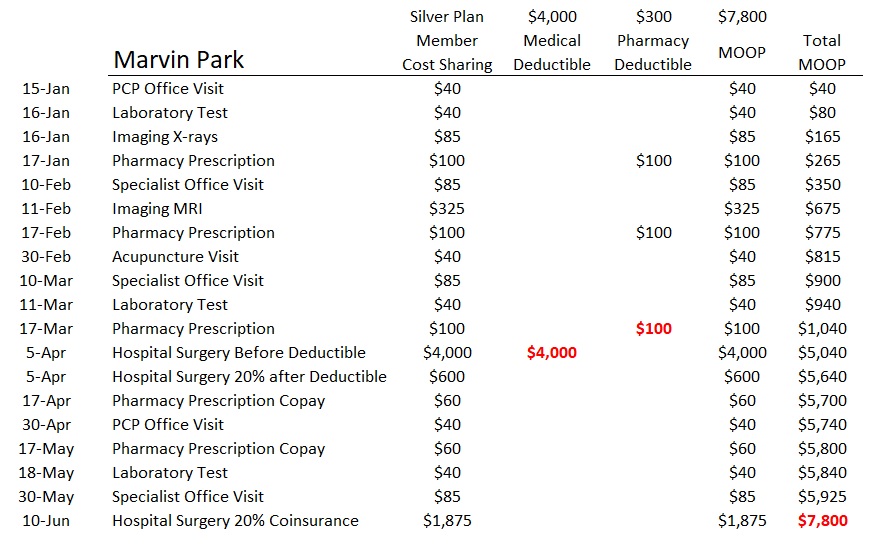

Below is the timeline for Marvin Park who has an unfortunate year of having to use many different health care services and prescription medications. The accumulation of costs table illustrates how each health care service and prescription medication adds to the deductibles and MOOP. The first column is the cost or member responsibility for the health care service or prescription drug. The second and third column detail if the cost sharing applies to either the medical or pharmacy deductible. Finally, the fourth column accumulates all the costs toward the MOOP.

Marvin first visits his Primary Care Physician (PCP) on January 15 for an ache in his abdomen that he has had for some time. The doctor orders some lab tests and a x-ray. After reviewing the diagnostic information from the lab and x-ray, the doctor prescribes a drug to hopefully treat the condition. Marvin purchases the medication from his local pharmacy and pays the full retail price for the medication.

For January, all of Marvin’s copayments for health care services and the retail cost of the prescription accumulate toward his plan MOOP. The pharmacy prescription also goes toward meeting his pharmacy deductible of $300 for the Silver 70 plan.

In February, Marvin is referred to a specialist who orders and MRI. The visit and the MRI copayments go toward meeting the MOOP. Marvin refills the prescription at the full retail price which accumulates toward meeting his pharmacy deductible. Also, in February, Marvin receives an acupuncture treatment to help with the pain. This copayment goes to the MOOP.

Marvin visits the specialist again in March who orders another lab test and also determines that surgery is necessary. Before the surgery, Marvin refills his prescription medication at $100. He has now met the pharmacy deductible of $300 for the plan. Marvin’s surgery, which requires an overnight stay in the hospital is scheduled for early April.

The in-patient surgery Marvin has is subject to the medical deductible of the plan. The first $4,000 of the hospital charges are Marvin’s responsibility. But because he has just met the medical deductible, additional hospital costs are billed at 20% coinsurance. Marvin is responsible for an additional $600 of hospital medical services which represent 20% of the remainder of the total costs for the hospital admission for the surgery. All of the medical deductible and coinsurance for the hospital costs accumulate toward meeting the MOOP.

In April, after the surgery, Marvin refills his prescription, but instead of paying the full retail cost, because he has met his pharmacy deductible, he only pays a $60 copayment for the Tier 2 drug according to his plan’s drug formulary. Marvin continues to receive treatment for his condition visiting his PCP and specialist.

It is determined Marvin needs another surgery in June. Because he has already met his medical deductible, he is only responsible for 20% of the hospital charges for the next surgery. With that next surgery and the subsequent coinsurance, Marvin has met his MOOP of $7,800. For the rest of the year, the health plan will cover 100% of his treatment costs and pharmacy medications.

Family Deductible and Maximum Out of Pocket Amount

Marvin is the head of a large household. His spouse and four dependents also had a difficult year with lots of demand for health care services. It is a certainty that when two household members meet their medical deductible, the rest of the family does not have to meet it and they go directly into coinsurance for health care services subject to the deductible. Similarly, when Marvin and one of his family members meets their MOOP, everyone in the family is no longer subject health care costs.

The question that arose from Marvin was if other family member’s cost sharing can accumulate to deductibles and MOOP. Below is language from the Evidence of Coverage documents for Kaiser and Blue Shield. First, it is clear that neither the family medical deductible nor the family MOOP must be met before one family member, who has met either the individual deductible or MOOP, can receive the benefits of 100% coverage from meeting those dollar amounts.

It also seems to be the case that a family can collectively incur cost sharing that accrues to the family deductible, thereby triggering it, without any one family member meeting the individual deductible. This also applies with the family MOOP. However, customer service representatives for different carriers have given slightly different answers when queried about how the family deductible and MOOP are met.

The varying answers may be a function of the variety of health plans and some confusion while explaining the details. For instance, the Bronze 60 HDHP plans for 2020 have a combined medical and pharmacy deductible and MOOP. For 2020, the Bronze 60 HDHP plans have a deductible (which includes medical and pharmacy costs) that equals the MOOP. When a family member reaches the deductible of $6,900, they have also met their MOOP. The family deductible and MOOP is $13,800.

From the Blue Shield Bronze 60 HDHP Summary of Benefits

Family coverage has an individual OOPM (Out of Pocket Maximum) within the Family OOPM. This means that the OOPM will be met for an individual with Family coverage who meets the individual OOPM prior to the Family meeting the Family OOPM within a Calendar Year.

It is bad enough when one family member meets their medical and pharmacy deductible along with their MOOP. I can’t imagine the illness and accidents that would need to happen to a family for them to meet the family deductible and MOOP. Because the language of the Evidence of Coverage seems a little vague in places, coupled with conflicting answers from the carriers, if your family is having a bad year and everyone seems to be going to the doctor or hospital, carefully track how your medical expenses are accumulating toward meeting the deductibles and MOOP.

If you have a PPO plan with coverage for out-of-network providers, there is a separate out-of-network deductible and MOOP.

Kaiser Silver 70 Off Exchange Member Agreement

If you are a Member in a Family of two or more Members, you reach the Plan Deductible either when you reach the amount for any one Member, or when your entire Family reaches the Family amount. For example, suppose you have reached the deductible amount for any one Member. For Services subject to the Plan Deductible, you will not pay Charges* during the remainder of the Accumulation Period, but every other Member in your family must continue to pay Charges during the remainder of the Accumulation Period until either he or she reaches the deductible amount for any one Member, or the entire Family reaches the Family Amount.

*Charges refers to the full invoiced amount for the service. Coinsurance may still apply.

The only payments that count toward the Plan Deductible are those you make for covered Services that are subject to this Plan Deductible under this EOC.

In other words, copayments and coinsurance for health care services don’t accrue to meeting the medical deductible.

Maximum Out of Pocket

If you are a Member in a Family of two or more Members, you reach the Plan Out-of-Pocket Maximum either when you reach the maximum for any one Member, or when your Family reaches the Family Maximum. For example, suppose you have reached the Plan Out-of-Pocket Maximum for any one Member. For Services subject to the Plan Out-of-Pocket Maximum, you will not pay any more Cost Share during the remainder of the Accumulation Period, but every other Member in your family must continue to pay Cost Share during the remainder of the Accumulation Period until either he or she reaches the maximum for any one Member or your Family reaches the Family Maximum.

Payments that count toward the Plan Out-of-Pocket Maximum. Any payments you make toward the Plan Deductible or Drug Deductible, if applicable, apply toward the maximum.

Most Copayments and coinsurance you pay for covered Services apply to the maximum, however some may not.

If your plan includes pediatric dental Services described in a Pediatric Dental Services Amendment to this EOC, those Services will apply toward the maximum.

Blue Shield PPO Silver 70, 2019

Calendar Year Medical Deductible

The Calendar Year Medical Deductible is the amount an individual or a Family must pay for Covered Services each year before Blue Shield begins payment in accordance with this Evidence of Coverage and Health Service Agreement. The Calendar Year Medical Deductible does not apply to all plans. When applied, this Deductible accrues to the Calendar Year Out-of-Pocket Maximum. Information specific to the Member’s plan is provided in the Summary of Benefits.

There is also an individual Medical Deductible within the Family Medical Deductible. This means Blue Shield will pay Benefits for any Family member who meets the individual Medical Deductible amount before the Family Medical Deductible is met.

Once the respective Deductible is reached, Covered Services are paid at the Allowable Amount, less any applicable Copayment or Coinsurance, for the remainder of the Calendar Year.

Maximum Out of Pocket

Calendar Year Out-of-Pocket Maximum

The Calendar Year Out-of-Pocket Maximum is the highest Deductible, Copayment and Coinsurance amount an individual or Family is required to pay for designated Covered Services each year.

There is also an individual Out-of-Pocket Maximum within the Family Calendar Year Out of- Pocket Maximum. This means that any Family member who meets the individual Out-of-Pocket Maximum will receive 100% Benefits for Covered Services, before the Family Out-of-Pocket Maximum is met.