The fundamentals ACA health insurance subsidies, technically known as the Advance Premium Tax Credits, are relatively straight forward. The calculation itself is simple math. What makes grasping the concept of the subsidy difficult are all the conditions and data necessary for an individual to crunch the numbers. But let’s focus on the basics.

There are three inputs for the subsidy calculation

- Household Income

- Consumer Fair Share Percentage

- Second Lowest Cost Silver Plan

The household income amount, which is estimated for the current year subsidies, is a complicated endeavor in itself. It is known as the Modified Adjusted Gross Income, which is the federal adjusted gross income plus Social Security, foreign earned income, and tax-exempt interest.

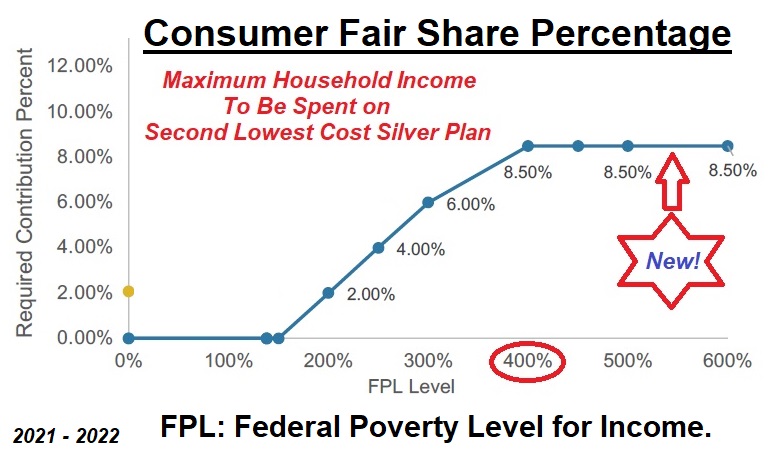

The Consumer Fair Share Percentage, recently updated for 2021 and 2022, is a percentage of the household income to be spent on health insurance premiums. It is the fair share that the individual or family should be reasonably expected to pay toward health insurance premiums.

For households who are eligible for the subsidies, the Consumer Fair Share Percentage ranges from 2 to 8.5 percent. The percentage increases as the household increases and tops out at 8.5 percent, regardless of income, at least through 2022. The graph is confusing because it is based on the federal poverty level income.

The federal poverty level accounts for the number of people in the household. For example, an individual earning $50,000 is at 400% of the federal poverty level for 2020 in California. A family of 3 with $50,000 income is at 234% of the federal poverty level. That FPL percentage correlates to a Consumer Fair Share Percentage.

The Second Lowest Cost Silver Plan (SLCSP) is the designated benchmark plan in the ACA. The subsidies are meant to make the SLCSP premiums the household pays the exact percentage of the Consumer Fair Share Percentage. The annual premium of the SLCSP is used in the calculation. The subsidy can be spent on any metal tier plan offered.

Simple Calculation of ACA Health Insurance Subsidy

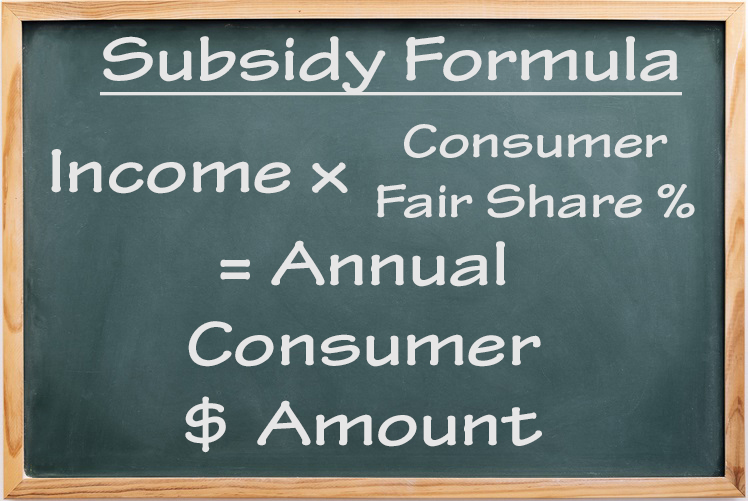

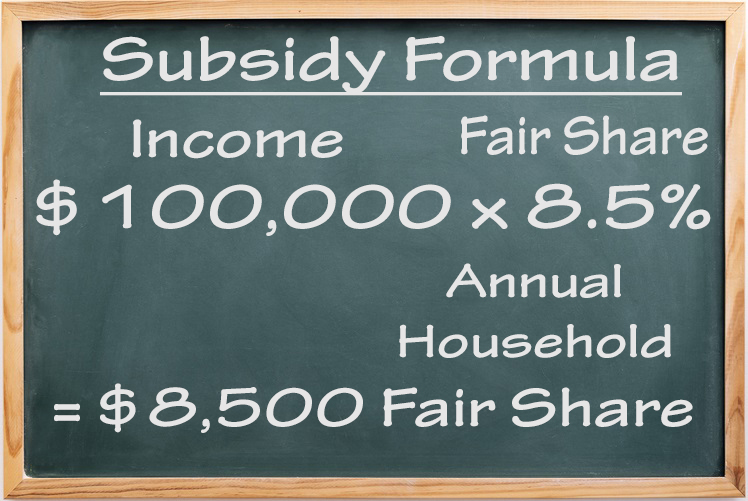

The first step is to determined the annual amount the consumer should pay based on the estimated income and Consumer Fair Share Percentage.

The household income is simply multiplied by the fair share percentage to yield an annual dollar amount.

In this example, the household income is $100,000 and the Consumer’s Fair Share Percentage is 8.5 percent. The result is that under the ACA this household should pay no more than $8,500 per year on health insurance.

The next step is to determine the annual amount of the Second Lowest Cost Silver Plan. This is where the online exchanges such as Healthcare.gov and CoveredCa.com simplify the process. They have all the rates entered into the system. The exchanges will automatically display the SLCSP when comparing your Silver plans offered in your specific zip code.

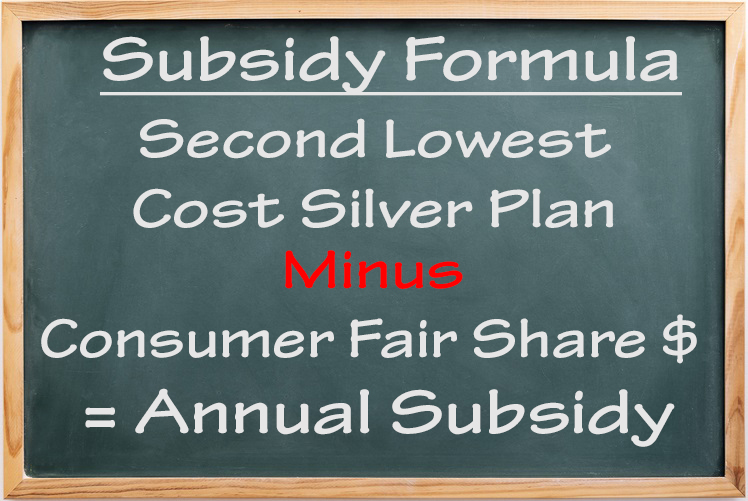

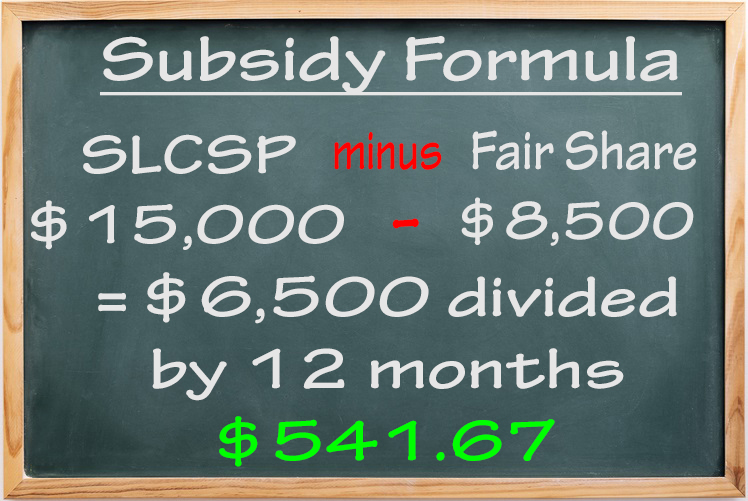

For the calculation, the consumer fair share dollar amount is subtracted from the annual amount of the SLCSP.

In this example, the annual amount of the SLCSP is $15,000. The consumer fair share dollar amount of $8,500 is subtracted from the $15,000 to yield a Premium Tax Credit amount of $6,500. The difference of $6,500 is divided by 12 to get a monthly Advance Premium Tax Credit subsidy of $541.67 per month.

As long as the SLCSP annual amount is larger than the consumer fair share dollar amount, there will always be a subsidy amount available to the consumer. Of course, a change in the household income, up or down, will change the consumer fair share dollar amount during the year. The current Consumer Fair Share Percentage, where it is applied to all incomes over 400 percent of the federal poverty level, will hold through 2022.