Health insurance plans have wheels or gears that turn slowly like an old clock. Over time, when you meet a deductible, pay coinsurance and copayments, the clock strikes announcing you have met your maximum out-of-pocket amount (MOOP.) Unfortunately, not all health plans have the same gears, making comparisons complicated.

All health, dental, and vision insurance plans will have mechanisms that have the plan member pay a certain portion of the provided services. When you know how the different parts of the member cost-sharing work overtime, it is easier to predict future costs.

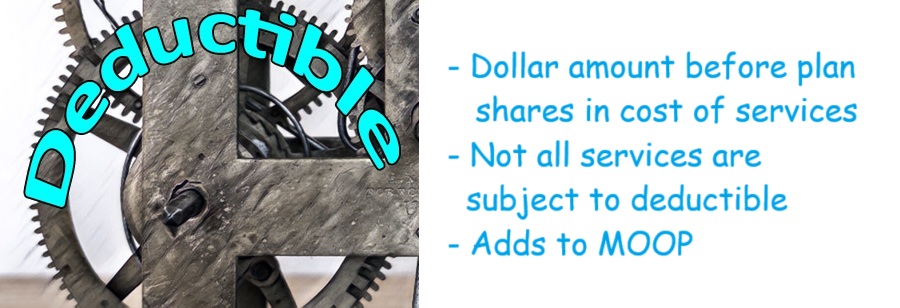

What is the Deductible?

A deductible is a dollar amount the plan member must satisfy before the plan shares in the cost of the service. The deductible may apply to all the services covered or only a select few. Some plans will have no deductible to meet. You go straight into coinsurance or copayments for services. The deductible amount accrues to meeting the maximum out-of-pocket amount.

Example. A health plan has a $5,000 deductible that applies to all services. You must accumulate $5,000 in health care services – all at once or over time – before you go into 40 percent coinsurance. In other words, once you are responsible for $5,000 in services, the next dollar of costs, the health plan pays 60% and you pay 40%.

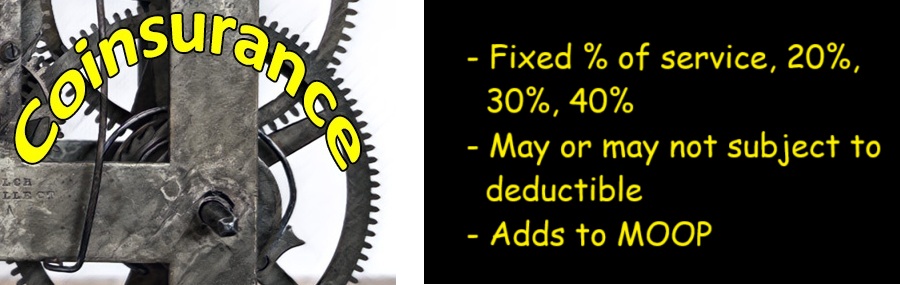

How does Coinsurance work?

Coinsurance is a percentage of the health care service that the plan member is responsible for. A deductible may or may not need to be met before coinsurance is triggered. The coinsurance you pay accumulates towards meeting the maximum out-of-pocket amount.

Example. A health plan has 30 percent coinsurance for x-rays. You get an x-ray and the negotiated rate for the service through the health plan is $500. You would be responsible for 30% of the cost or $150 ($500 x .3 = $150.)

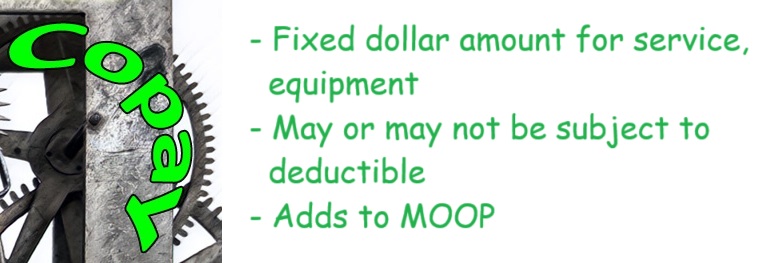

What is a Copayment?

Copayments are a set dollar amount for a service. Generally, no deductible needs to be met before the copayment applies. Copayments you make for health care services are added to meeting the maximum out-of-pocket amount.

Example. A health plan includes primary care office visits at a set copayment of $50, not subject to the health plans deductible. When you visit your doctor you pay $50 even though you have not met your deductible.

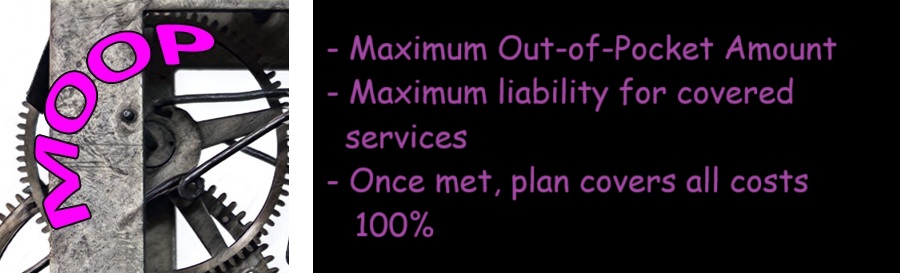

Your Maximum Out-of-Pocket Amount (MOOP)

The plans maximum out-of-pocket amount (MOOP) is the backstop to further health care expenses. All your out-of-pocket health care expenses accrue toward meeting the MOOP. Once the MOOP is met, the health plan pays 100 percent for all covered services.

Example. Jane had an outpatient procedure. The procedure cost $7,000. The health plan had a $5,000 deductible. After the deductible, Jane was responsible for 40 percent coinsurance. For the outpatient procedure, Jane was responsible for the deductible of $5,000. That left a $2,000 balance that was subject to the health plans coinsurance of 40 percent or $800 ($2,000 x .4 = $800.)

Jane has accumulated $5,800 toward meeting the maximum out-of-pocket amount of $7,000. After the procedure, there were additional services for office visits, physical therapy, prescription medication, and durable medical equipment to help with mobility that cost another $2,000.

However, once Jane spent another $1,200 she met her maximum out-of-pocket amount of $7,000 ($5,800 plus $1,200 = $7,000.) The health plan covered the $800 of services and equipment at no additional cost to Jane.

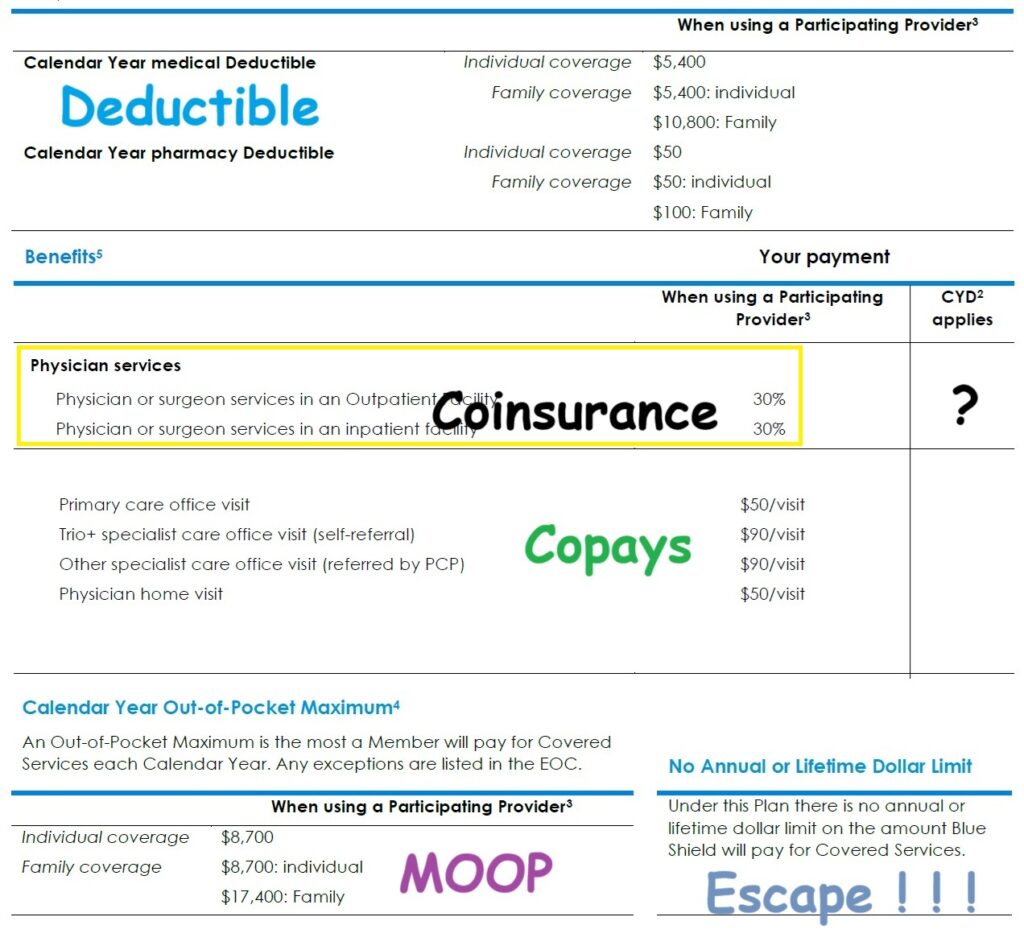

Summary of Benefits

A health plan’s summary of benefits is like opening up a clock case and viewing all of the wheels, gears, and levers of the movement. The summary of benefits or evidence of coverage will indicate when you are responsible for any deductible, coinsurance, and copayments. Most importantly it will let you know the escape of health care expenses with the dollar amount of the maximum out-of-pocket amount.

In this example I have put a question mark in the column of CYD (calendar year deductible.) The deductible and coinsurance may not apply to every service, equipment, or drug. Sometimes you go straight into coinsurance and you don’t have to meet any deductible.

My YouTube video explaining deductibles, coinsurance, copayments, and MOOP.