When something changes with your Covered California health plan or subsidies, Covered California usually sends out a notice. These notices, sometimes lacking crucial details, are the red flag of an impending health plan breakdown. However, when individuals and families select to receive the notices by email, they may not study the information until it is too late. It is better to opt for paper notices delivered by the United States Postal Service.

My general preference for my clients and myself is to receive notices by email. Over the course of several years, working with clients who suddenly found themselves without either a subsidy or health insurance through of Covered California, I have changed my opinion. I now encourage Covered California members to receive paper notices that they can hold in their hands and digest the information.

Select Notices Delivered to Your Residential Mailbox

Covered California is a very security and privacy conscious organization. Text messages you receive will never include personally identifiable information or personal health information. When you are alerted that you have a new Covered California email, you need to log into your account and access your secure mailbox. This is where you will find your annual tax documents from Covered California along with any important notices about changes to your health plan, the subsidies, or verification documents that need to be submitted for review.

It appears that many people are like me. We get an email about a notice and then it gradually fades from our minds that we need to log into the account and pull the letter. If I receive a paper notice, I hold it in my hand and read it. Then I can put it in a place to remind me to follow up. Part of the problem is that Covered California notices lack critical details as why something is happening.

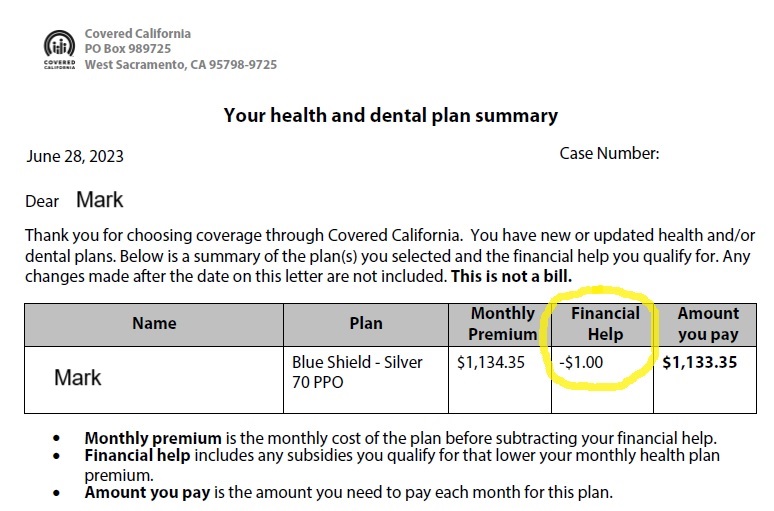

In this example, Mark received an alert that he had Covered California notice. The notice stated that his financial help was only $1. Mark had been receiving over $800 per month is the Advance Premium Tax Credit subsidy. Mark only got concerned when he received an invoice for his health plan for the full amount of $1,133.35.

Paper Letters May Alert You Early About Covered California Breakdowns

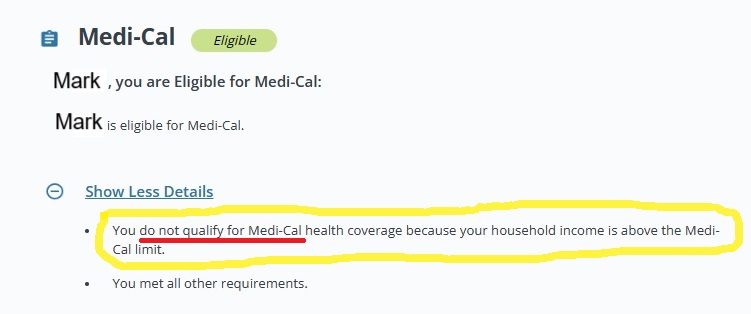

The Covered California letter gave no details as to why he lost his subsidy. When he accessed his Covered California account, he was confronted with contradictory eligibility statements. Mark was eligible for Medi-Cal. But when he clicked ‘Show More Details,’ he was informed that he did not qualify for Medi-Cal because his income was too high.

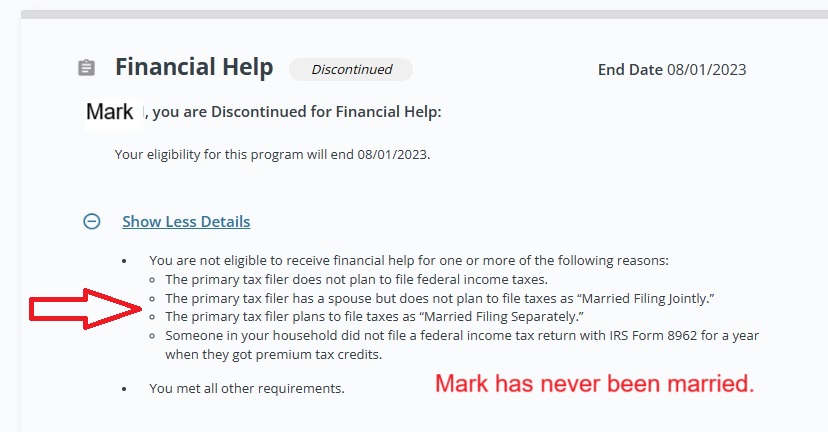

Mark’s Covered California account enumerated specific conditions that were not met in order to qualify for the subsidy. It noted he had a spouse, but he did not indicate that he his tax filing status would be “Married Filing Jointly.” That he planned to file his taxes as “Married Filing Separately.” Mark has never been married.

The condition that terminated his subsidy was that Covered California could not determine if he had filed his 2022 federal tax return, a condition of receiving the subsidies in 2023. Mark assumed that because he was granted an extension to file his federal tax return because of a weather related event in his area, that information would be transferred to Covered California. The extended tax filing date is not considered within Covered California.

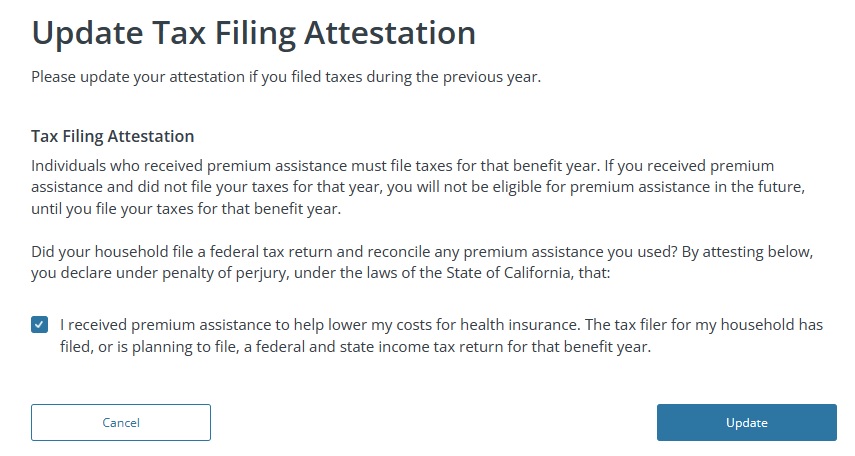

However, Covered California does provide a means to tell them that the household has or will file their federal income return for the previous year. This is known as the tax filing attestation. By attesting that he will file his taxes, Mark was able to have the monthly subsidies returned to his account. The problem is that the subsidy is not retroactive, it will only apply to the next month. Consequently, Mark must make the full premium payment for his health insurance in August, then in September the premium will drop after the subsidy has been reinstituted.

Multiple Covered California Letters Indicating a Problem

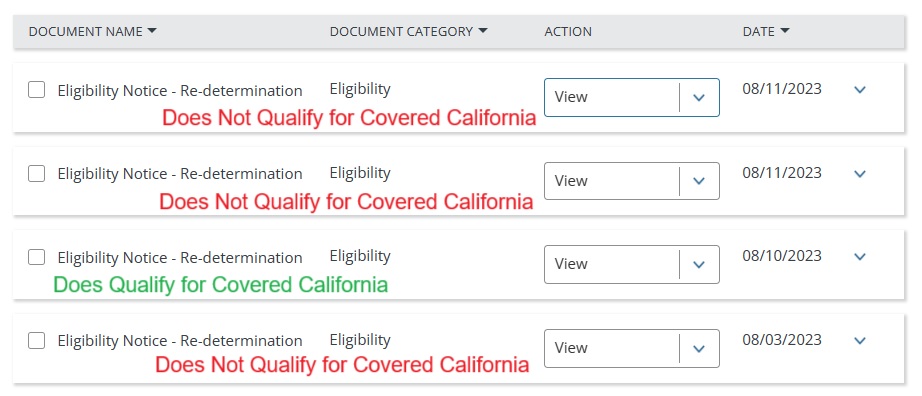

Sometimes Covered California does not generate one notice, they may issue multiple contradictory letters to the member. June had a similar situation to Mark, her Covered California enrollment went sideways after she updated her address. Covered California generated 4 different letters between August 3 and August 11. The first letter stated she was ineligible for the subsidies. The next letter dated August 10 stated she was eligible for subsidies. Finally on August 11, the Covered California system generate two more letters denying her the subsidies.

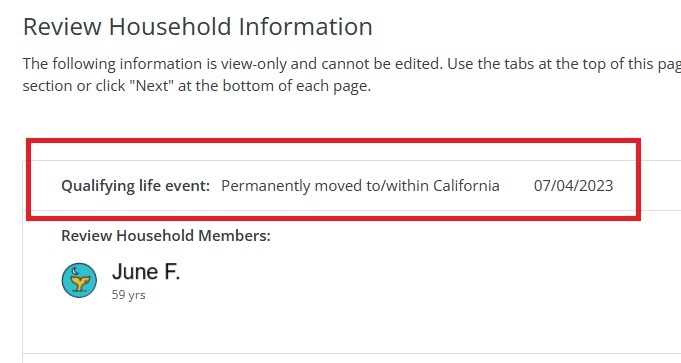

If June would have had been receiving all these letters, it would have been very apparent that something was wrong with her account. In speaking with Covered California, everything looked good. In July she moved down the street and updated her address. The qualifying life event (QLE) of Permanently moved to/within California was selected. That possibility triggered a review as permanently moving to California requires proof of the new residence.

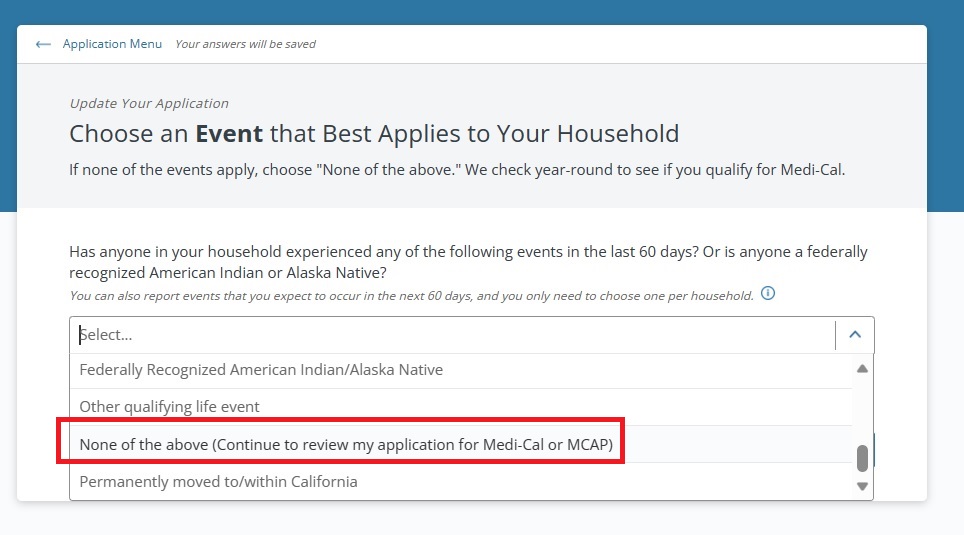

All June was trying to do was update her residential address. She was not seeking health insurance as she was already enrolled and receiving the subsidies. In situations like this, including reporting a change to the income, Covered California has instructed agents to select the QLE of “None of the above (Continue to review my application for Medi-Cal or MCAP.) Even though most people want to stay away from the Medi-Cal maze, that QLE really does work and does not trigger any account melt-downs unless the monthly income is in the Medi-Cal zone.

With Covered California, you want to jump on potential problems as soon as possible. If you wait too long the issues become intractable and you can lose important subsidies or be sentenced to working with your county Medi-Cal office. Receiving paper notices, as opposed to emails, elevates the priority of scrutinizing the enrollment issues.