The Affordable Care Act health insurance subsidy reported on the 1095A statement flows across several different federal IRS tax return forms. Most online tax preparation software handles all of the data to calculate the final Premium Tax Credit in the background. However, it can be helpful to know what forms and schedules are involved in case you want to double check the numbers or something does not look right.

Estimated reading time: 11 minutes

The following examples use forms and schedules published by the IRS. Every household’s situation is unique and different and you should always consult with a tax professional when you have questions.

1095A Information for form 8962

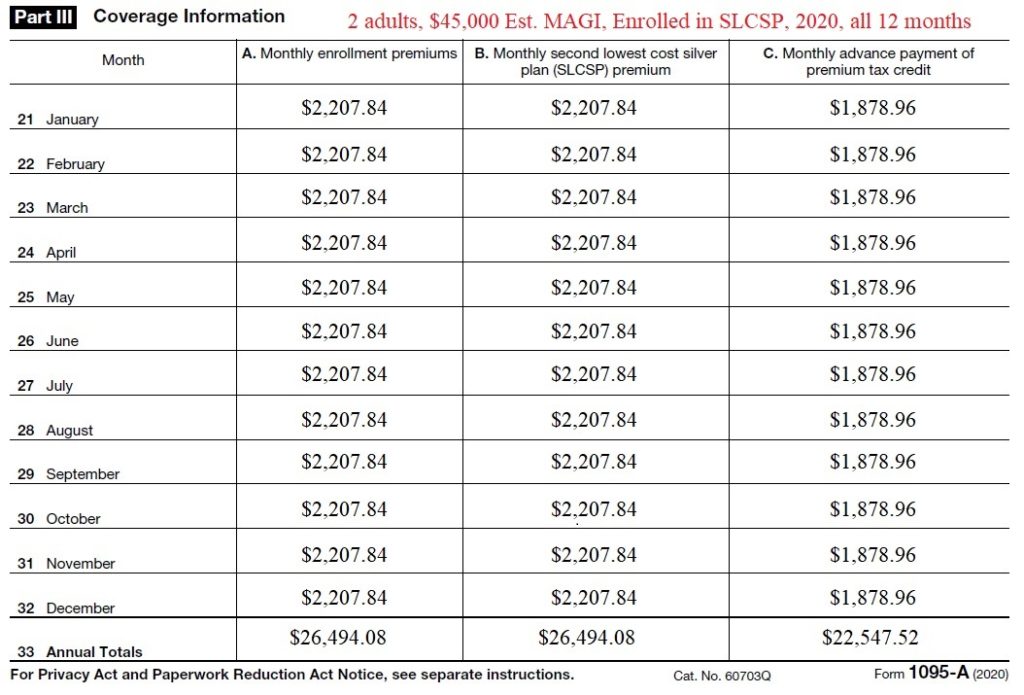

The 1095A statement has three columns of information:

- A. the full rate of your monthly health insurance premiums

- B. the full rate of the Second Lowest Cost Silver Plan.

- C. the monthly Advance Premium Tax Credit forwarded to your health insurance carrier every month to lower your health insurance costs

You may receive multiple 1095As if you were enrolled in different states through out the year, changed plans, or family members were on different plans.

The Second Lowest Cost Silver Plan (SLCSP) rate is important because it is the benchmark plan for determining the final subsidy. The ACA is formulated to make the SLCSP affordable, regardless of what metal tier plan you ultimately selected. In the following example, I use the 1095A for Don and Mel Purmt who were enrolled in the same plan for all 12 months of the year. Don and Mel estimated their Modified Adjusted Gross Income at $45,000 for 2020. They have no children and they also selected the SLCSP that is why column A and B are the same.

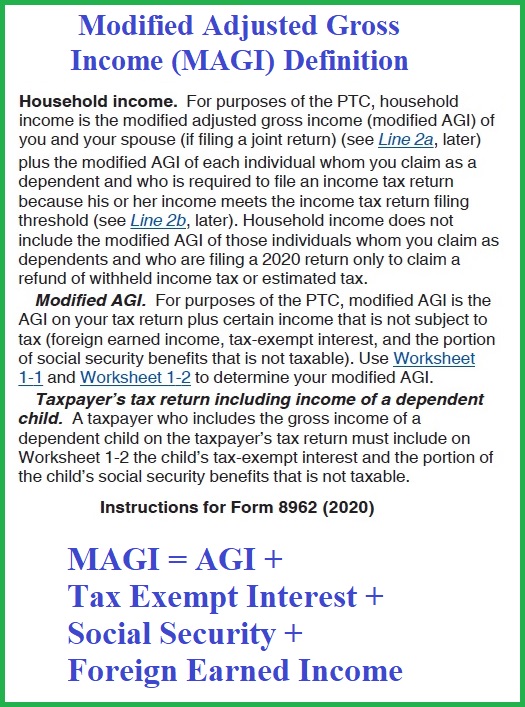

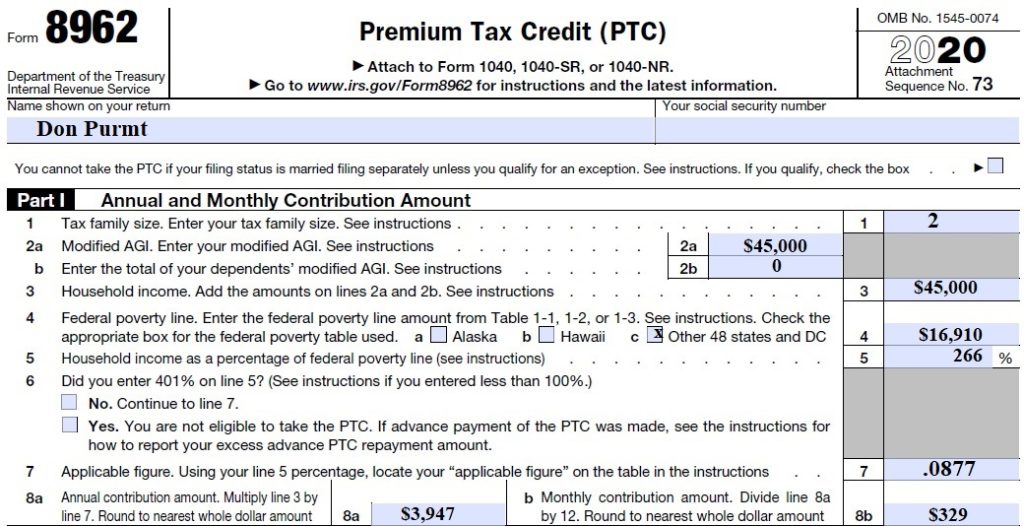

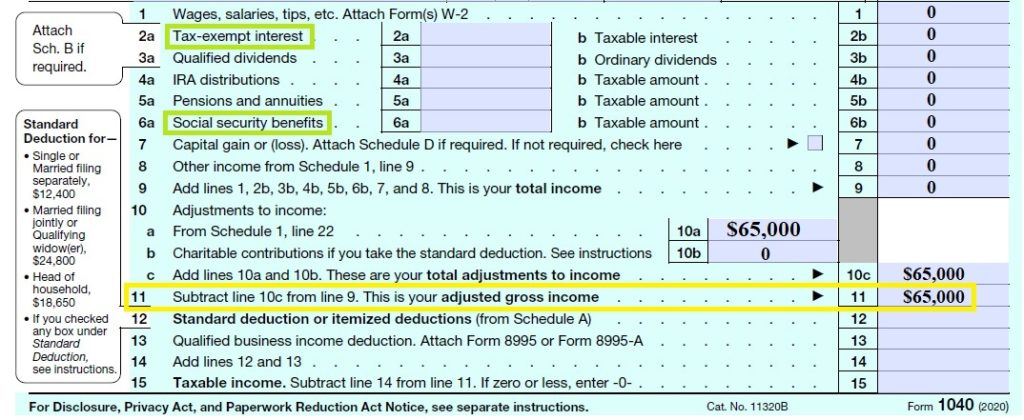

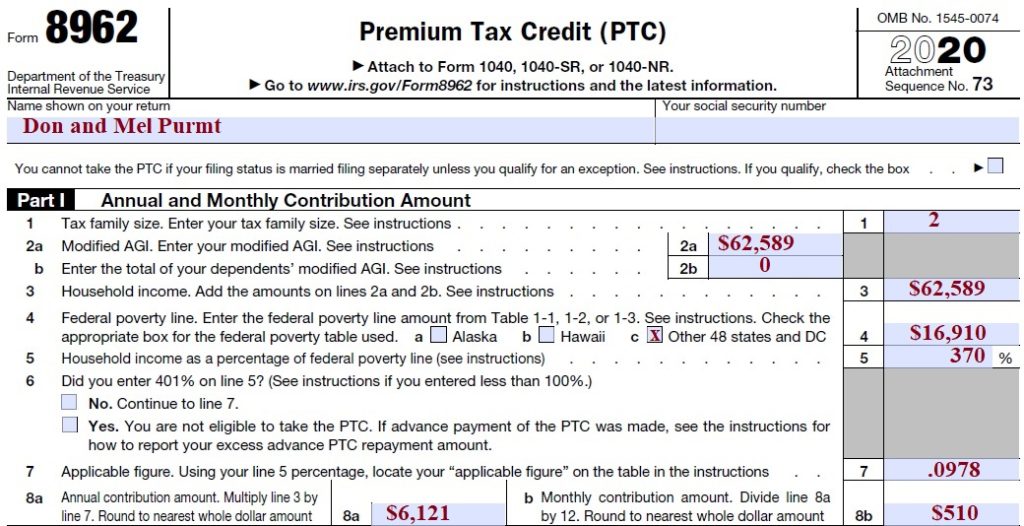

The reconciliation of the Advance Premium Tax Credits Don and Mel received through the year happens on form 8962. The final Modified Adjusted Gross Income (MAGI) for the Purmt’s was exactly as they originally forecasted. The MAGI is the Adjusted Gross Income from line 11 of form 1040 for 2020, plus tax exempt interest, Social Security, and foreign earned income. Many of the definitions and tables are found in the instructions for 8962 and IRS publication 974.

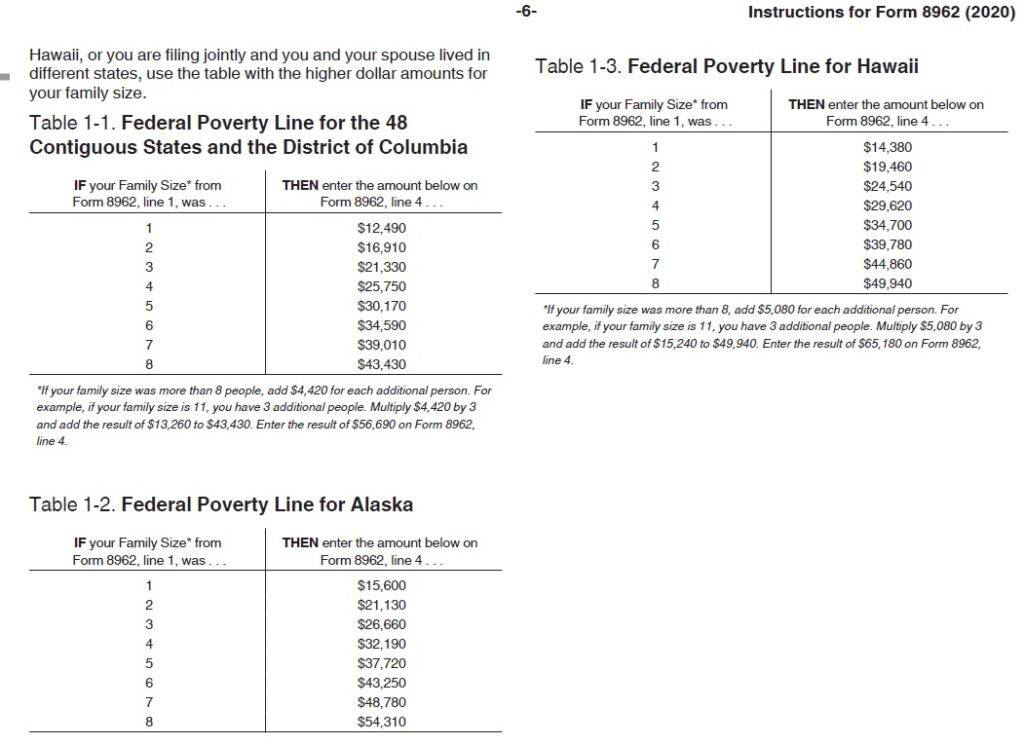

Next, the household income needs to be converted into a percentage of the federal poverty level. For a household of 2, the 2020 FPL is $16,910. This makes the Purmt’s income of $45,000 to be 266 percent of the FPL.

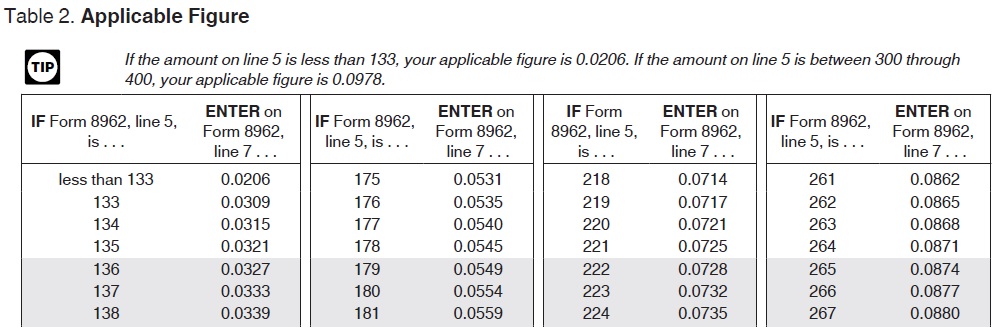

The next part of the calculation is finding what the IRS calls the Applicable Figure. This is essentially the consumer responsibility or fair share of the health insurance costs for the individual or family.

The Applicable Figure table at 266 percent FPL is .0877. The Applicable Figure is multiplied by the MAGI. The results on Line 8a (45,000 x .0877) is $3,947, rounded up. Under the ACA, the Purmt’s should pay no more than $3,947 or $329 per month for the second lowest cost Silver plan for health insurance. The subsidy advanced by the market place exchange (Covered California, Healthcare.gov) is the difference between the cost of the SLCSP and the family’s consumer responsibility.

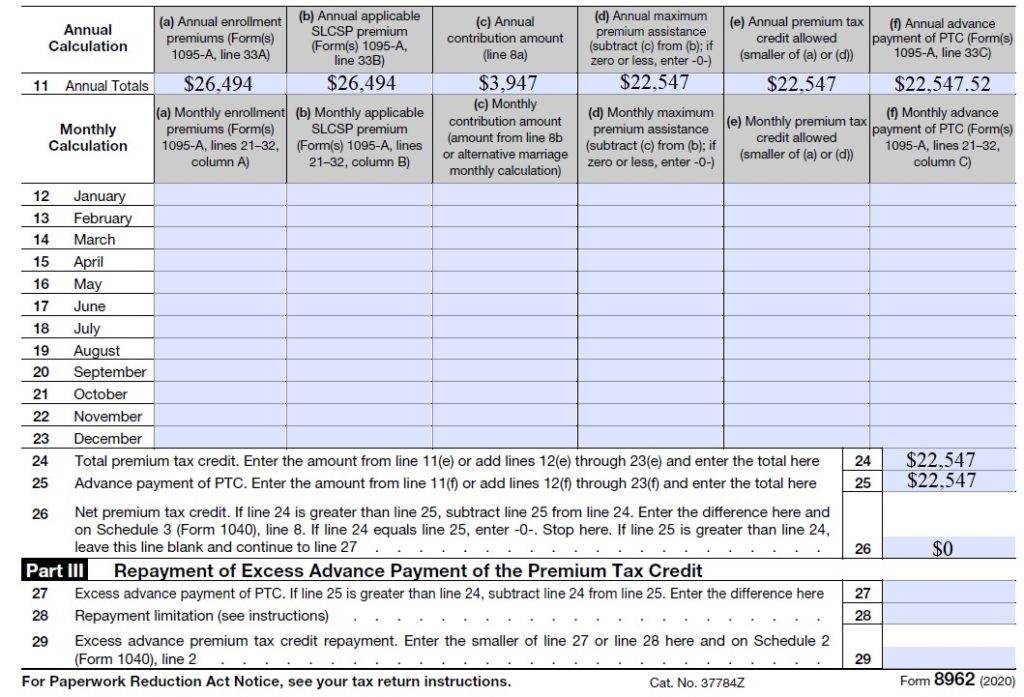

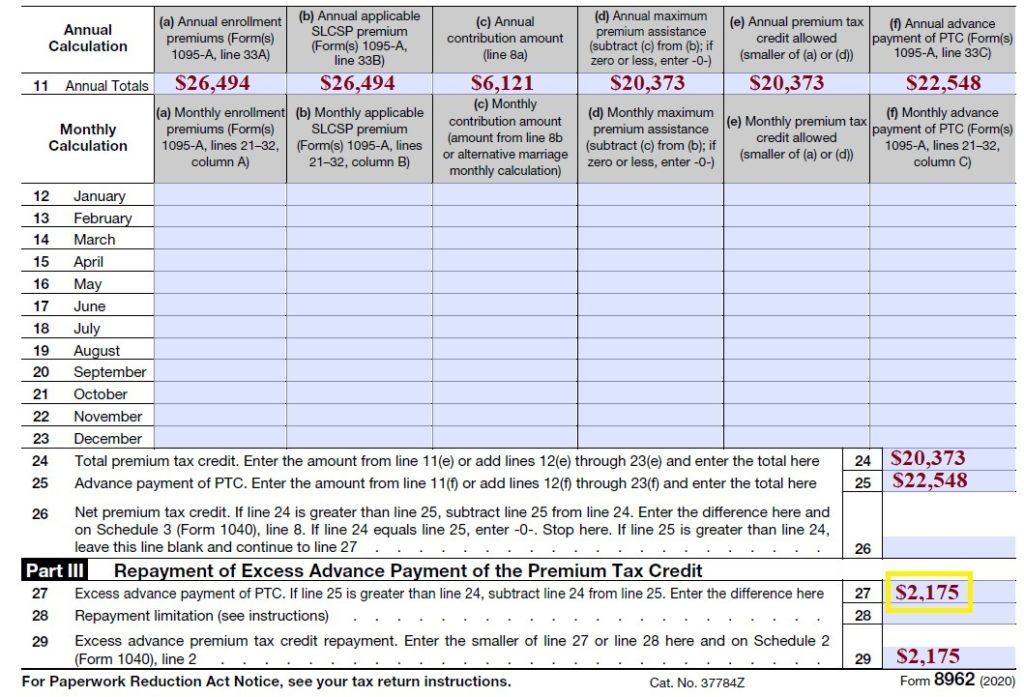

The next part of form 8962 reconciles what the family received in advance subsidy versus what they are entitled to with their final MAGI.

Columns 11 a, b, c, and f, reflect the information from the 1095A and the calculated fair share or consumer responsibility. Column d is what the family is entitled to; the cost of the second lowest cost Silver plan minus the family’s responsibility. The consumer is not entitled to a Premium Tax Credit subsidy greater than the cost of the health insurance. Hence, column e compares the enrollment premiums versus the calculated allowed subsidy credit.

The Premium Tax Credit subsidy would be limited if, for example, the family had chosen a Bronze plan where the subsidy was greater than the premiums. (Many consumers may only pay $1 for a Bronze plan under this scenario.) The Premium Tax Credit subsidy would be limited to the total cost of the Bronze plan.

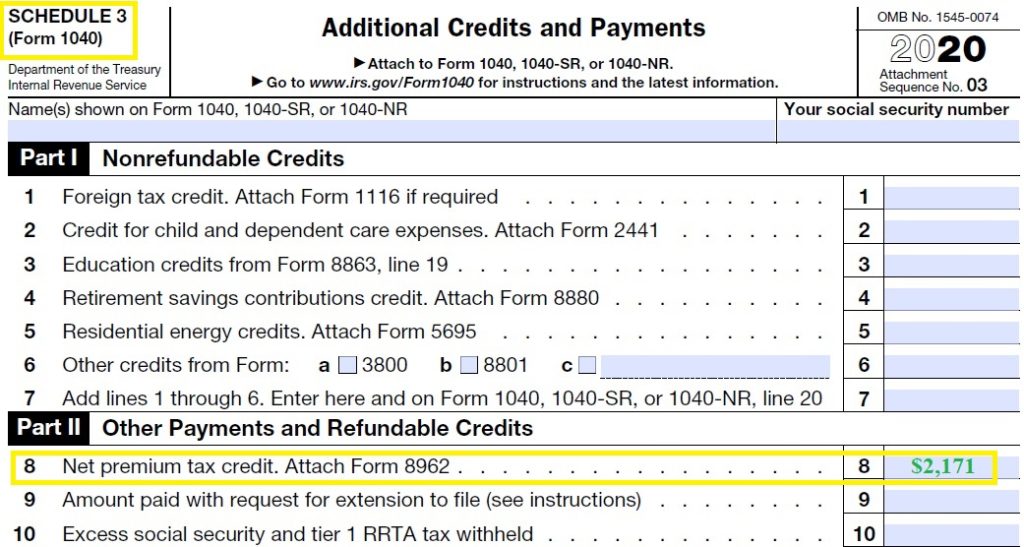

Because the Purmt’s Advance Premium Tax Credit subsidy equaled what they were entitled to, lines 24 minus 25, they neither have to repay any excess subsidy, nor will they get any additional Premium Tax Credit. If the family’s MAGI was lower than estimated, they may have received an additional Premium Tax Credit subsidy. The addition tax credit is entered on Schedule 3.

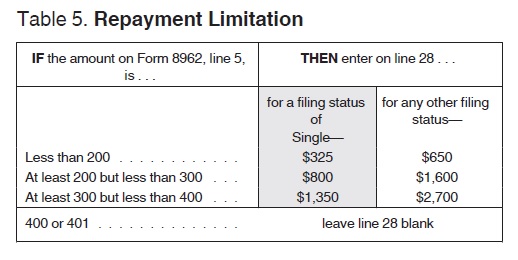

If the MAGI is higher than originally estimated, the Purmt’s may have to repay all of the subsidy or portion of it subject to a repayment limitation.

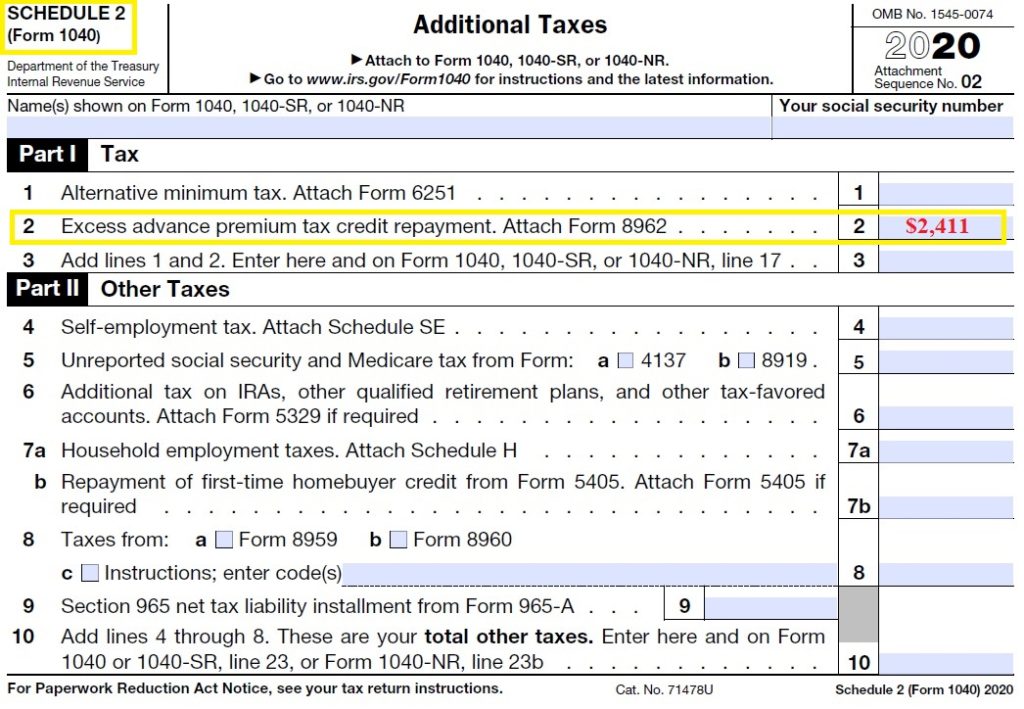

The repayment of the excess Premium Tax Credit is logged on Schedule 2.

Repayment of Excess PTC Subsidy

The information from all the different schedules is captured and fed onto the 1040 tax return. The flow of the data, especially for self-employed individuals, can be problematic. In an alternate scenario, the Purmt family, who run a small business and are self-employed, earn more income than they originally estimated.

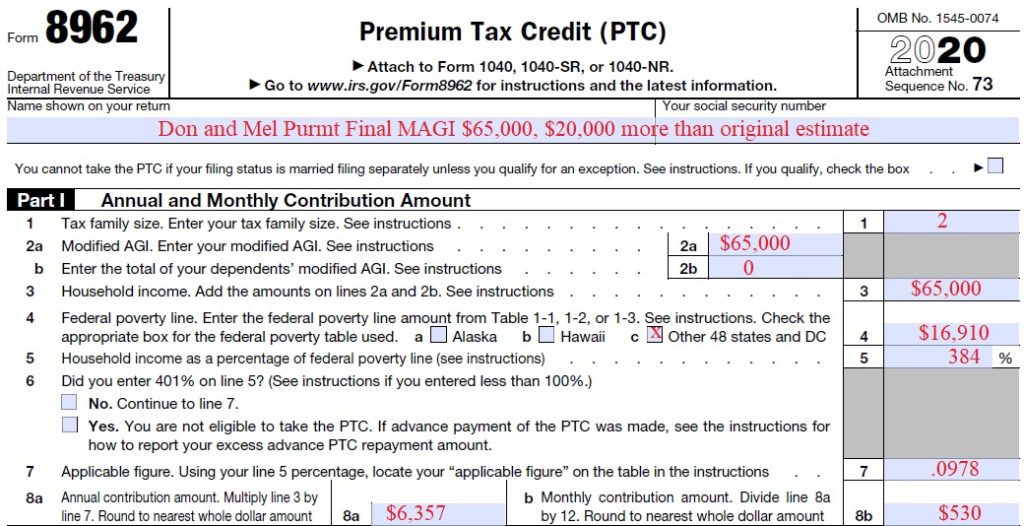

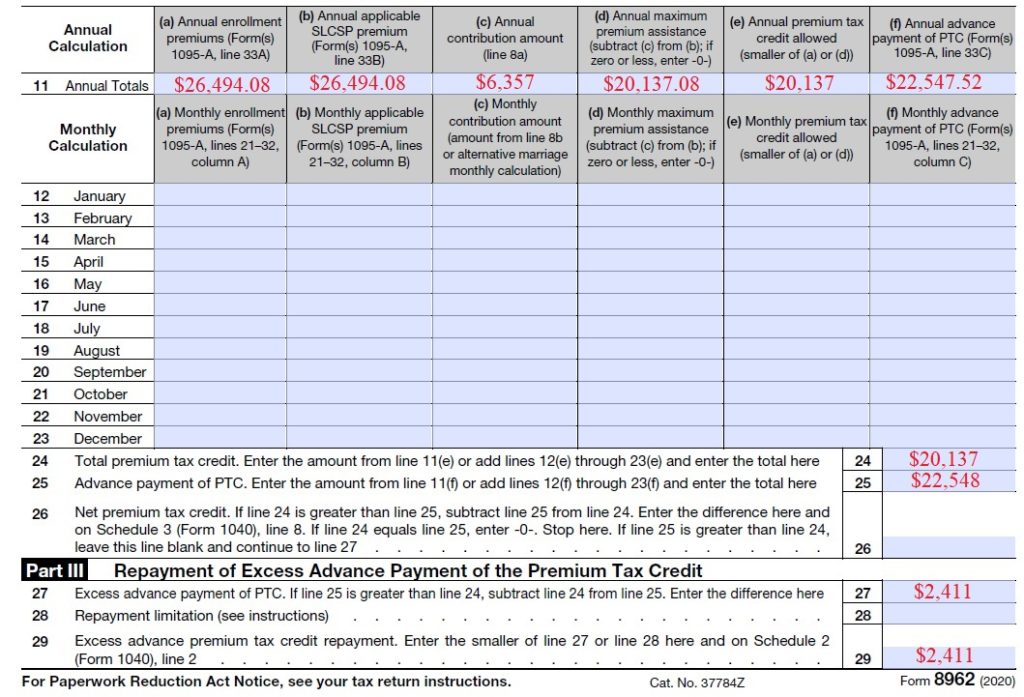

Don and Mel’s adjusted gross income for 2020 is $65,000. It is $20,000 more than originally estimated. Their AGI is their MAGI since they did not have any tax-exempt interest, Social Security, or foreign earned income. Note, line 11 of form 1040 tax return is the adjusted gross income (AGI.)

When form 8962 is calculated, their MAGI is 384 percent of the FPL and the applicable figure is larger resulting in a higher consumer responsibility of $6,357 for health insurance.

The Purmt’s received a subsidy based on $45,000, reflected in column f of 8962. But they are only entitled to $20,137 (column e) when they subtract their consumer responsibility (c) from the SLCSP (b). When they subtract the Premium Tax Credit they are entitled to at the higher income from what they received, they owe $2,411. Their repayment is not subject to the repayment limitation because it is below $2,700.

Self-Employed Health Insurance Deduction

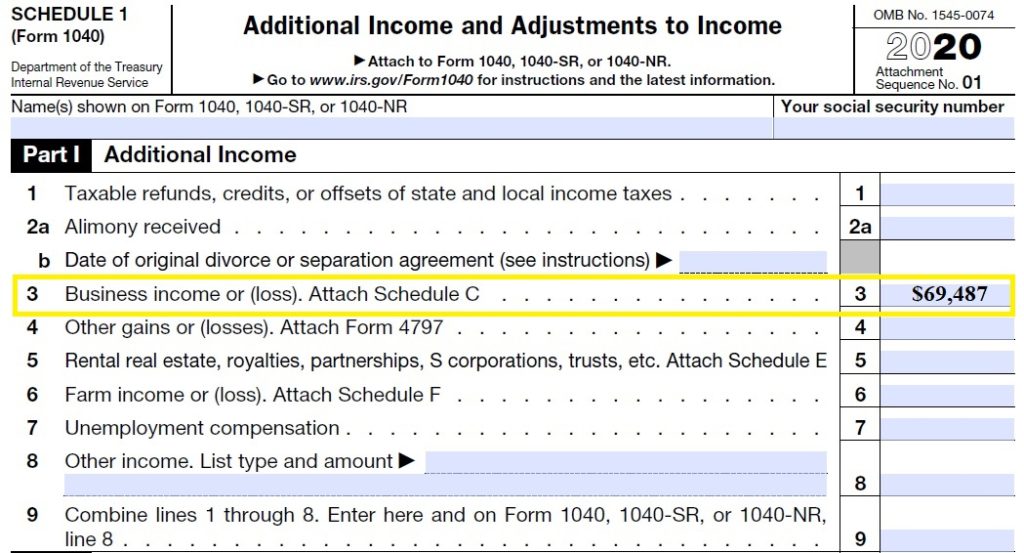

Unfortunately, there is another wrinkle for the Purmt’s, they are self-employed and entitled to deduct their health insurance premiums to lower their AGI. Originally, they had calculated their 2020 business income at $69,487.

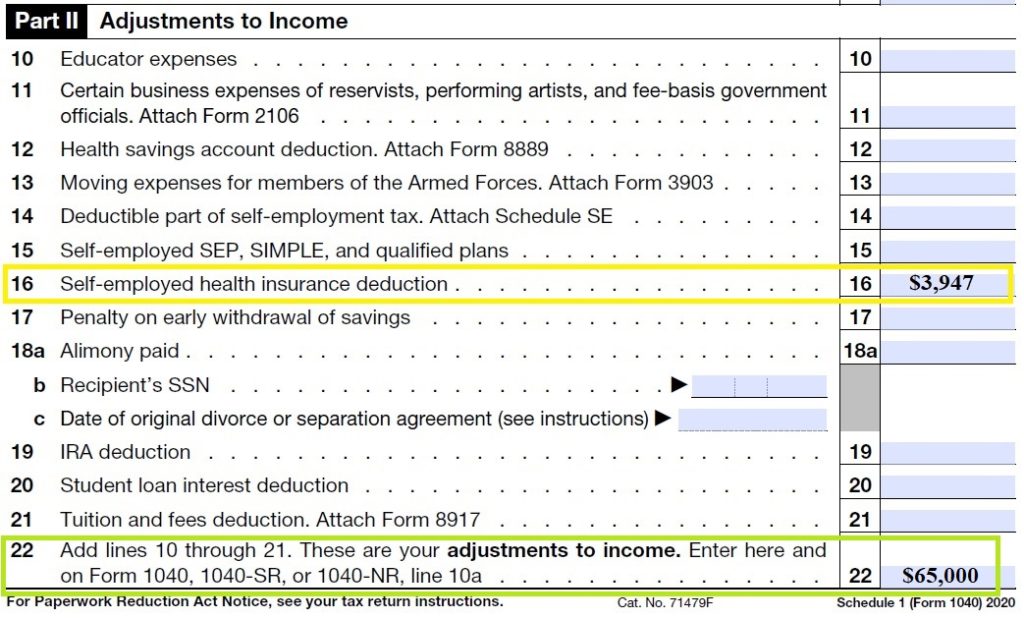

They then deducted the health insurance premiums of $3,947 they paid after the Advance Premium Tax Credit.

This made their MAGI $65,000. After the form 8962 calculations, and having to repay $2,411 excess Premium Tax Credits, they now get deduct $6,358 ($3,947 + $2,411) from their AGI.

Because their MAGI is now lower, on account of the larger health insurance deduction, they have to run the new MAGI of $62,589 ($65,000 – $2,411 repayment) through form 8962 again.

This will yet again change the excess Premium Tax Credit as it will be calculated on a lower MAGI.

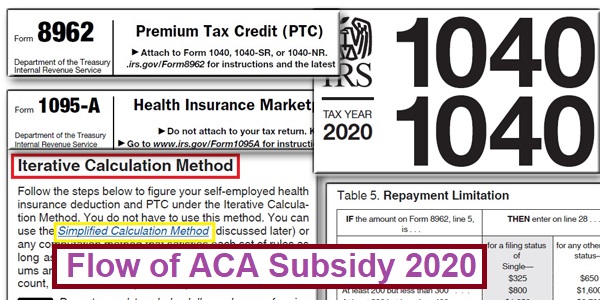

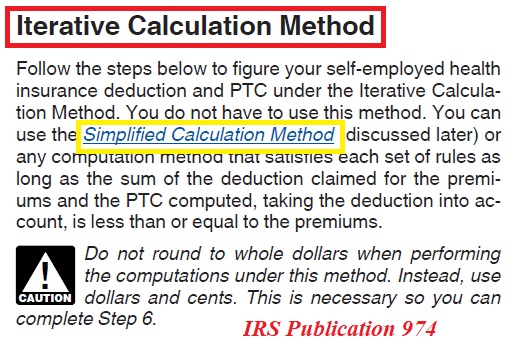

This is a circular reference that the IRS is aware. They have provided guidance in Publication 974 on how to address the problem. Tax payers can use an either iterative or a simplified method of calculation.

If this wasn’t bad enough, if the Purmt’s live in California, it may be worse. California has additional premium subsidy. The California income tax returns are based on the federal AGI. Then the California premium assistance subsidy is reconciled. Changing the federal AGI must change the California calculations. Plus, some California tax payers whose income increased and never received an Advance California Premium Assistance subsidy, may be eligible for it when they do their taxes. The increased subsidy will reduce what the tax payer can deduct on their federal return, sparking another round of calculations.

I’ll review and address the California Premium Assistance subsidy in another blog post.