Covered California health insurance market loves agents. But is the feeling mutual?

All 2,000 webinar connections were filled with insurance agents listening to Michael Lujan Director of Sales and Marketing for Covered California explain their role and opportunities in California’s new health insurance market place. From training to compensation, insurance agents have been anxious to hear if there is any room for them in the government arranged health insurance market. [wpdm_file id=72 title=”true” ]

Not all health insurance agents love health care reform

Ironically, many of the agents listening and asking questions have undoubtedly been ardent opponents of health care reform and many have actively called for the repeal of Obamacare. But here they were, listening to hear if they could make a dime off the tax-payer subsidized, guarantee issue health insurance plans that many have called the end of America and the beginning of socialism.

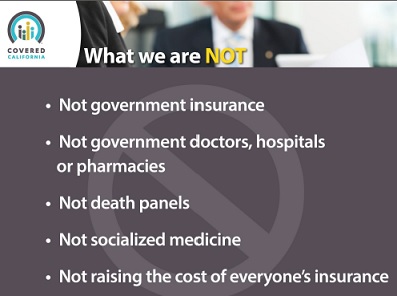

Covered California doesn’t have death panels

Mr. Lujan was cognizant of the antipathy of many in the insurance industry towards health care reform and tried to dispel myths that Covered California was a government take over of health care insurance with ominous death panels.

What Covered California isn’t for insurance agents.

Agents get a big welcome hug

Covered California is welcoming the participation of licensed health insurance agents to help them enroll as many Californians in plans as possible. Some of the topics that were touched on and clarified are:

- Agents will have to take at least 8 hours of training and pass a test before they will be eligible to sell either individual or small group plans through Covered California.

- Commissions for individual sales will be paid by the insurance carrier while small group plans (SHOP) will be paid through Covered California, competitive with today’s market rate.

- Commissions will be paid on the retail premiums, not the subsidized amount.

- An individual or business working with a commissioned broker will realize the same premium as if they purchased direct through Covered California or Assister.

- Outside of Covered California itself, only insurance agents will be allowed to enroll small businesses into the small group Small Business Health Options Program (SHOP)

- Agents will still be able to represent plans offered outside Covered California

- Once an agent has been certified to sell Covered California plans, they can then market themselves as having this designation.

Prospecting with Covered California

After the issue of marketing was broached, the predictable questions from agents on how they might be able to leverage Covered California to their advantage started to roll in.

- Will Covered California provide us with leads?

- Can agents work with Assisters, Navigators and the organizations conducting outreach and education?

- Can they get referrals from Assisters?

- Can an agent hire an Assister?

- Can agents get a list of uninsured Californians for marketing purposes?

Filling the sales pipeline

It was like the vultures circling around road kill. You could tell some of the agents could already smell the easy money of guarantee issue insurance. Another guarantee issue insurance product is Medicare Advantage plans. A hurdle to limiting the number of agents representing and selling these plans is the yearly re-certification from Medicare and strict marketing practices surrounding the government subsidized plans. All of the regulations placed upon agents and carriers were in response to unethical practices that duped many seniors into enrolling in a plan that was not in their best interest. (You can’t cold call a Medicare beneficiary about a Medicare Advantage plan). I doubt that Covered California will place as many restrictions on the certification of their agents as Medicare, but I hope there will be prudent restrictions.

Should cross selling be allowed?

Because of the way Covered California and the plans are structured, it will be hard for an individual, family or small business to enroll in a plan that is better for the agent than the client. However, my fear is not the selling of an inappropriate health insurance policy but the hard sell some people might get from an agent for life, auto, home, hospital indemnity, accident, and cancer plans. This is where I hope Covered California, like Medicare, will require the agent to discuss only health, dental or vision insurance when meeting with a client about Covered California plans. The agent should be required to set up a separate appointment to review any other products not expressly offered by Covered California.

Agents can recommend a plan

A small but significant difference between Assisters and agents is that Assisters can’t recommend a plan but agents can. While the health plans selected for the individual market are all very solid, there are a few that only have experience in the Medi-Cal and Medicare market and none in the commercial market. Some of the plans have documented issues with customer service. While I don’t think I would necessarily advise against enrolling with some of the health plans, I would be remiss if I didn’t alert the consumer to any deficiencies I’d heard about.

Are we on board?

Regardless of how insurance agents may have felt about health care reform, it is here and we need to work with it. Instead of hoping for the failure of Covered California or working against it, which some insurance agent and plan associations continue to do, insurance agents should put their efforts toward making Covered California a success. The one thing every agent is reminded of during the regular ethics training is to put the client’s interests first. If a Covered California plan is a better value for the client than one outside the exchange and without subsidies, that is the road you have to walk down.