The cost of health insurance is very high and it hurts to pay the premium every month for most families. If you never go to the doctor, it is always like sandpaper rubbing your backside that you must pay for coverage you never use. One way to look at health insurance is that it is asset protection.

Health Insurance Protects Your Assets Like Your House

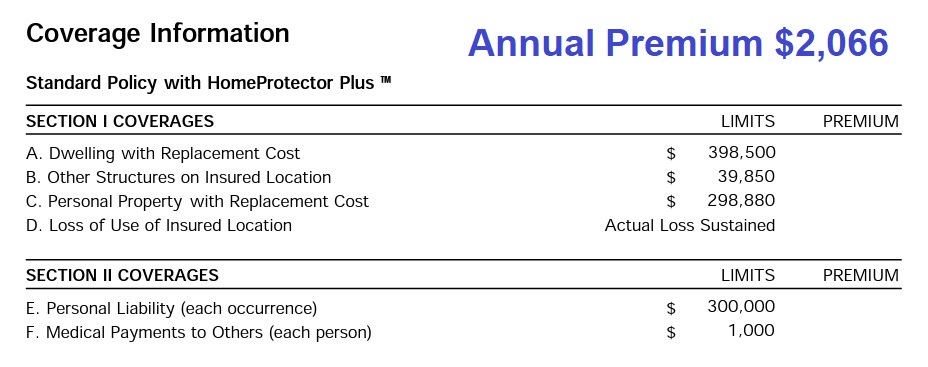

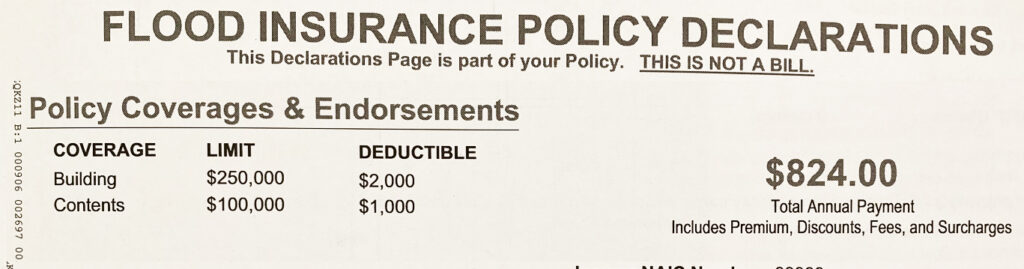

We all pay for insurance that we never use. Currently, insurance on my 1,750 square foot home is $2,066 annually. It will cover a replacement cost for the dwelling up to $400,000. I must also have flood insurance that cost $824 per year. The flood insurance only covers up to $250,000 to replace the home.

My total homeowner insurance costs are $2,890.00, and I have never filed a claim in the 20 years that I have owned the home. The average cost of this homeowner’s insurance combination has been approximately $2,000 per year, which means I have spent $40,000 on insurance that I have never used…thank goodness. While homeowner’s insurance will cover some minor damage, most of us view the insurance as replacing the house in the event of a catastrophic loss.

Maximum Liability, No Dollar Cap Coverage

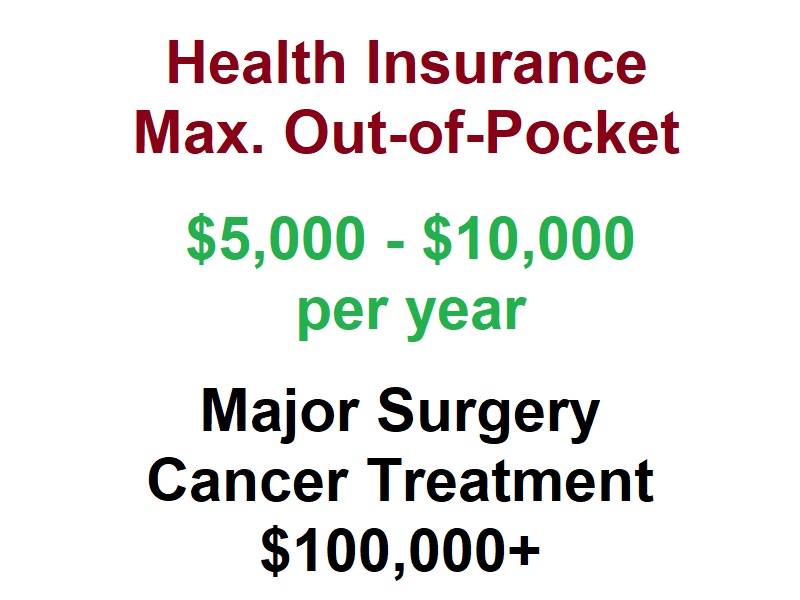

Health insurance, like homeowner’s insurance, is asset protection. Most creditable health plans will have a maximum out-of-pocket amount of between $5,000 to $10,000. In other words, once you have spent the maximum out-of-pocket amount of the health plan, it covers all costs of health care for the remainder of the year.

While $10,000 out of your wallet sounds like a lot, it can be a fraction of the total cost of the health care services. The cost of major surgeries or cancer treatment can easily top out at $100,000 or more. The health insurance with a maximum out-of-pocket amount limits your liability so you do not have to liquidate your assets to pay the doctor and hospital bills. Health insurance protects your assets.

The biggest difference between health insurance and policies for home and auto is,

Health insurance has NO dollar cap for coverage of your medical expenses.

If your cancer treatment costs $500,000 in one year, after you have met your maximum out-of-pocket amount, the health plan fully covers the in-network health care costs.

Health Insurance Help with Routine Services

In addition, many health plans are designed to help reduce the cost of routine health care services. Most of the health plans have set copayments or coinsurance for routine health care services like doctor office visits, labs, tests, x-rays, imaging, urgent care, emergency room care, outpatient procedures, and prescription drugs. Your car insurance does not give you set copayments for oil changes, brake jobs, or new tires.

When I review our family’s use of health care services I remember the health insurance coverage for:

- Maternity costs

- Surgery for the broken leg

- Tests, procedures, and imaging during the cancer scares

- All the tests and imaging to find out why I was experiencing paralysis in my shoulders

- All the routine physicals, labs, and doctor visits to review lab results.

If we consider our life to be an asset in the household, how much should the insurance cost to protect us? Our health care system is good at fixing people and keeping us alive. There are times when I have difficulty justifying life insurance!

Health insurance is expensive. However, like other insurance products we must purchase such as home and auto policies, health insurance is similar in that it serves the purpose of asset protection. Your homeowner’s insurance will cover the cost of rebuilding your home if it burns down. My flood insurance is meant to replace the house if the big wave of water inundates the structure. Health insurance is meant to keep us healthy or return us to health so we can continue to be productive and sustainable.