Will this family be excluded from affordable health insurance?

Health care reform, which was suppose to make health insurance affordable, may force employees in group plans to make unaffordable choices.

Expanding business health insurance

A laudable goal of the ACA was to encourage businesses to maintain and expand health insurance coverage to their employees. The rational, as I understood it, was that small and large group plans are usually more efficient, already in place and the employers must make a contribution to the employee’s health insurance premium. The employer contribution increases the affordability of the health insurance. Unfortunately, employers do not have to make any contribution on behalf of the employee’s dependents, spouse or domestic partner.

Group versus individual market affordability

Because the employer is making a contribution towards the employee’s health insurance premium, thereby increasing the affordability, that would reduce federal expense of extending a tax credit if the employee purchases health insurance through the state exchange. For individuals and families that are not offered group health insurance, with income between 138% and 400% of the federal poverty line, tax credits will be applied to reduce their monthly health insurance premium when purchased through a state exchange.

The paradox of group coverage for families

The wrinkle in the employer group rules is that if an employee is offered “affordable”B health insurance, he or she is no longer eligible for the tax credit subsidy through the state exchange for his or her dependents. While the health insurance for the employee may be affordable because of the employer contribution, coverage for the rest of the family may be unaffordable. For low and modest income employees offered group insurance the extra cost of insuring dependents may force them to forego extending coverage to their families.

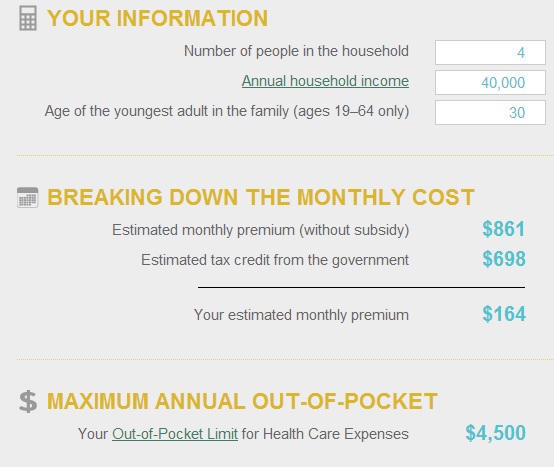

From the Covered California health insurance premium calculator: a family of 4 with annual income of $40,000 and the youngest adult is 30 years old can expect a monthly health insurance premium of $164. ($861 family premium – $698 tax credit)

Covered California cost estimator, family of 4.

Employer group coverage

A similar group plan (Employee + Family) can run approximately $1,050.29A for the full premium. If the employer contributes 50% of the employee’s premium or $144 (Employee Only @ $288), the employee would be responsible for $906.29. That is an additional $744.29 that the employee must shoulder because he or she is not eligible for the state exchange tax credit.

Family size is important

Insurance through a state exchange also factors in how many dependents in a family. As the number of dependents increases the tax credit also increases. For group plans in California the premium is not determined by the size of the family. Consequently, a family of eight (two adults and six children) receive a better deal per person than a family of three (two adults and one child).

Comparing apples and oranges

We still don’t know all the different small and large group plans that may be offered starting in 2014. There is the possibility that the disparity between the cost of family coverage under a group plan and the state exchange plans will be substantially narrowed. I have also read that the Department of Health and Human Services is still considering rules governing this particular paradoxical situation.

Solution for affordability

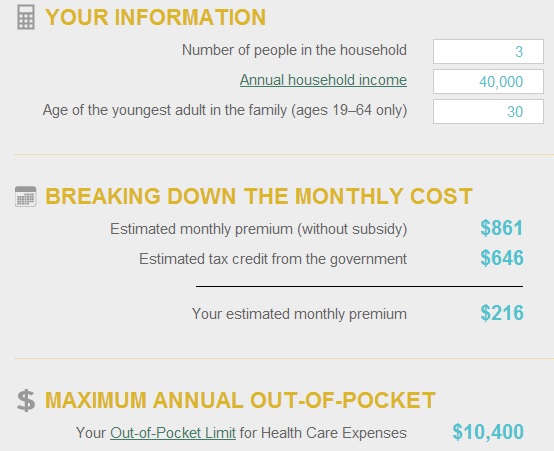

The solution is to allow dependents of an employee offered “affordable” group insurance to be insured under Covered California and receive the tax credit. If we change the household size from four to three to reflect one adult receiving health insurance through work, at the same income level, the monthly rate jumps to $216 with the tax credit under Covered California calculator. The new split health insurance premium of $216 plus $144 would be $360 or $546.29 less than the straight employer group coverage.

Covered California cost estimator, family of 3

Undocumented workers get little help

You can only receive a tax credit through Covered California if you are a Legal Resident as defined by federal law. However, group plans base eligibility on the employers California quarterly wage report DE-9C. In general, if an employee works 30 hours per week he or she can participate in the group plan. This might be one solution, albeit expensive, for some individuals and families to get health insurance if the don’t meet all the qualifications for the state exchange.

A. Western Health Advantage Jan. 2013, W 4025, Region 2, RAF 1.0

B. Affordable is not exceeding 9.5% of the employee’s income.

Download Kaiser Family Foundation flowchart of coverage with additional definitions.->[download id=”58″]