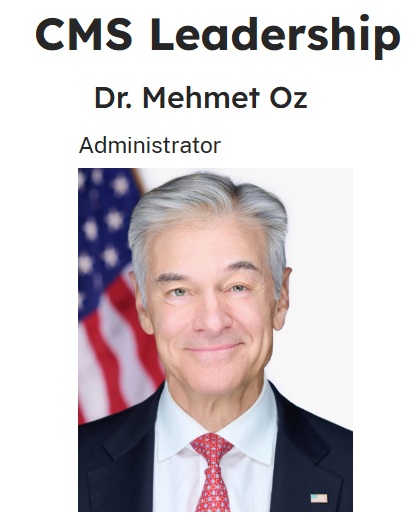

Covered California has written to Dr. Mehmet Oz, Administrator of CMS, regarding proposed rule changes to the Affordable Care Act health insurance program. In the letter, Covered California politely pushes back on the proposed rules that will hurt health insurance consumers in California.

Dr. Mehmet Oz became the administrator of the Centers for Medicare and Medicaid Services (CMS) in April, 2025. CMS regulates the Patient Protection and Affordable Care Act that provides subsidies for health insurance consumers. Covered California is the marketplace exchange for the ACA subsidies in California.

Covered California writes to Dr. Oz

In March, CMS issued proposed rules for eligibility and enrollment into ACA health plans for individuals and families. The new rules would affect the open enrollment period, verification of eligibility, passive renewals of health plans, among other items. The rational for the rule changes was to curtail fraud and align the individual and family plans closer to employer group plans.

Unlike the CMS rational for the new rules – which were primarily anecdotal – Covered California’s response was based on facts and data. Jessica Altman, Executive Director of Covered California, introduces Dr. Oz to the fact that Covered California has brought the uninsured percentage of residents from 17.2 percent in 2014 down to 6.4 percent in 2023. Altman points out that California has had the largest drop in the uninsured rate of any state since the ACA launched in 2014.

Central to Altman’s response, and threads through eleven-page letter, is that Covered California’s success is a function of the flexibility the state had to implement innovative strategies to help consumers enroll in health insurance. The new CMS rules are based on a one-size-fits-all concept when each state’s population is different.

Combating Enrollment Fraud

A theme of the Trump administration push to radically change the federal government is a pre-text of rooting out fraud. CMS states fraud is widespread on the part of insurance agents who surreptitiously enroll consumers into health insurance with a $0 premium. While this might be the case in other states who do not run their own marketplace exchanges like Covered California, Altman points out that they have experienced an “incredibly low instance of fraud.”

As an agent, I can attest that it is very difficult to enroll an unsuspecting consumer into health insurance through Covered California. There are too many points in the application process that require a consumer’s participation from identity verification, contact information, and subsequent letters Covered California sends out. It is also difficult for an agent to hijack a consumer’s account for nefarious purposes.

Altman informs Dr. Oz that Covered California’s fraud prevention is so successful that CMS copied some of the practices.

“These practices have been so successful in California that CMS adopted several of them in 2024 when it sought to address growing complaints of improper enrollments on the federally-facilitated marketplace.”

Shorter OEP

CMS has proposed shortening the Open Enrollment Period across the nation so that the last day to enroll would be December 15th. California’s Open Enrollment Period (OEP) has run through the end of January. The CMS argument for a shorter OEP is that consumers jump into health insurance at the last minute, get a health condition addressed, then drop the coverage. This is known as adverse selection.

California’s experience has been that over 35 percent of new enrollments after December 15. Additionally, later enrollees tend to be younger and healthier.

“Covered California’s traditional OEP [November 1 – January 31] has proven effective and straightforward for our consumers, allowing them sufficient time to choose a plan that is right for them. Further, it has worked for our market, supporting both additional and healthier individuals to enroll, and has helped enhance the stability of our marketplace.”

I want to highlight the statement “…it has worked for our market,…” Covered California focuses on marketing. Any successful enterprise must know and understand their market, their potential consumers. November through December is a crazy time for people with all the changes in school schedules, vacations, and holidays. Many people don’t focus on stuff like health insurance until the chaotic holidays are over. Consequently, an OEP through January 31st helps many individuals and families enroll into or change their health insurance plans.

Special Enrollment Period Verification

CMS has proposed tighter rules surrounding acquiring health insurance during a Special Enrollment Period, outside of OEP. Like the shorter OEP rule, CMS assumes that most people use the Special Enrollment Period (SEP)to game the system when they need health care and fail to enroll during the OEP. The experience of Covered California shows that special enrollments are not comprised primarily sick people.

“Specifically, in California, the prospective risk scores for consumers enrolling during SEPs have been consistently equal to or lower than those during the OEP, even during years of flexible SEP policies and the implementation of enhanced federal premium tax credits (PTC). For example, in 2024, the prospective risk scores for both OEP and SEP enrollment were the same, at 0.96. In previous years, the trend of SEP enrollees presenting a lower or equal risk compared to their OEP counterparts has been consistent.”

As an agent, my experience has been that I primarily work with two groups of people for SEPs. A qualifying life event for the SEP is loss of coverage. First, a family has lost employer group coverage, or their COBRA is ending. The second group are young adults who are turning 26 and can no longer remain on the parent’s employer group coverage. Consistent within these groups is that health insurance is important to them for maintaining their current health and preventing future illnesses.

The CMS proposed rule would have the marketplace exchanges perform audits on the validity of the loss of coverage qualifying life event. Unfortunately, the paperwork documenting the loss of coverage is not easily tracked down. The young adult leaving the family plan does not have letter specifically stating they will lose coverage. The individual getting divorced only knows the date they will lose their ex-spouses coverage. No formal letter has been issued.

Altman spells out the reality of the situation.

“With CMS data showing that 27 percent of people are unable to meet the SEP documentation deadline, it is clear that these verification hurdles are significant. They [proposed verification rule] particularly discourage younger, healthier people from enrolling, who are less likely to navigate complex paperwork during life changes. This could lead to fewer healthy individuals in the insurance pool, undermining its stability and driving up costs for everyone.”

The letter asks for flexibility.

“We urge CMS to preserve the autonomy of states to tailor SEP enrollment strategies that best suit their needs, ensuring the sustainability of healthy risk pools and minimizing coverage obstacles, rather than creating new ones.”

Automatic Enrollment Plan Change

CMS has proposed discontinuing the practice of the marketplace exchange automatically enrolling consumers in better health plans if there is no difference in the monthly premium. In particular, CMS referenced marketplace exchanges like Covered California upgrading consumers from Bronze to Silver plans with lower cost-sharing. CMS correctly states that more subsidy (Advance Premium Tax Credit) is used when the upgrade is made.

Covered California addresses the issue by stating that they give the enrolled member notice of the change and the opportunity to decline the upgrade. Another practice, not mentioned by CMS, is change from a Platinum or Gold plan over to a enhanced Silver 87 or 94. These plans are actuarily better than a Gold 80 or Platinum 90. In addition, with the lower premium to subsidize, the member has a lower monthly premium and lower health care costs.

Covered California summarized their approach to the automatic enrollment changes.

“Building on this success, Covered California expanded the policy to include transitions from Gold and Platinum to Silver 87 and 94 plans, respectively, as well as from Bronze plans to $0 Silver 73 and Silver 87 plans. This strategic expansion resulted in more than 34,000 consumers receiving a higher-value plan at a lower cost for the 2024 plan year. Notably, over 60 percent of these consumers were moved from either Gold or Platinum plans, saving them money each month on their premium and fewer out-of-pocket expenses given that they were crosswalked to richer benefits while likely improving their long-term health. We also note that the Platinum and Gold Crosswalks can lead to federal savings on the premium tax credit when the crosswalked plan happens to be the lowest cost Silver plan.

“The 2024 Covered California Member Survey5 reflects strong approval for the Affordability Crosswalk initiative, with 90 percent of members who were notified about their plan change finding the Crosswalk useful. This indicates broad endorsement of the policy and, crucially, has not led to consumer confusion or grievances.”

$5 Premiums

CMS wants to impose a $5 minimum monthly premium on consumers who fail to review or update their $0 premium health plans for the next plan year. CMS states that the $5 premium would be refunded to the consumer when they filed their tax return. The objective of CMS is unclear as the $5 premium would lead to just having their health insurance terminated for nonpayment.

The Covered California letter states, “Imposing a $5 charge on those seeking to continue their fully subsidized coverage, even temporarily, unfairly impacts the most economically vulnerable groups.” Altman reminds Dr. Oz that no employer-sponsored health plan, Medicare, or Medicaid have punitive fees associated with automatic enrollment.

“Imposing a more cumbersome reenrollment process exclusively on marketplace consumers is both unjustified and illogical. Ironically, implementing a $5 charge that may later be eliminated is more likely to lead to consumer confusion, and ultimately, loss of coverage.”

DACA Loss

CMS wants to prevent DACA recipients from enrolling in subsidized health insurance plans. Altman argues for allowing DACA recipients to continue to participate in the marketplace exchange in what could be construed as a mission statement.

“Covered California is deeply committed to ensuring that all individuals and communities have access to comprehensive, equitable healthcare, reflecting our state’s core values of equity and accessibility. By embracing the diversity of our state and recognizing healthcare as a fundamental right, we work towards a healthier California. Including DACA recipients in marketplace coverage reduces uninsured rates, brings younger enrollees into the market, and connects Californians to coverage they need and deserve. We strongly oppose removing DACA recipients from the definition of lawfully present.”

Gender Affirming Care

Another contentious issue CMS tackled was gender affirming care referred to as sex-trait modification within the proposed CMS rule. In short, CMS wants to eliminate gender affirming care because employer sponsored health plans don’t include such covered health care services. While other states may not require group plans to include gender affirming care in employer group plans, California does.

“In California, longstanding nondiscrimination requirements prohibit coverage exclusions based on an enrollee’s sex, including gender identity. Such requirements apply to all state-regulated employer-sponsored coverage in California, and apply to California’s selected EHB benchmark plan at the time of adoption. CMS’s proposal to prohibit “sex-trait modification” within EHBs [Essential Health Benefits] would be nonrepresentative of a typical employer plan within California. Additionally, available evidence suggests gender-affirming care is widely covered by employer-sponsored coverage across the country, especially among large employers.”

Altman argues for continued flexibility for states who want to include gender affirming health care services as essential health benefits within the Covered California plans.

“Rather than implementing a blanket prohibition on coverage of “sex-trait modification” as an EHB, CMS should honor state flexibility in defining EHBs, ensuring packages are comprehensive, evidence-based, and match employer coverage standards, in line with the ACA’s purpose.”

Not Enough Time to Implement Changes

Aside from the negative impacts of the proposed CMS rules regarding eligibility and enrollment, Altman addresses the operational side. Basically, the enrollment and eligibility software would need to be changed on compressed project timeline. Some rules would require manual validation. The health plans must also change their operations and software. On top the rule changes, the enhanced Premium Tax Credits are set to expire at the end of 2025 and congress has not addressed if they will continue or be terminated.

Altman summarizes the problems that are easily seen.

“This proposed rule contains many provisions that, if finalized, would exacerbate these same challenges by giving less time, increasing consumer confusion and barriers to coverage, and imposing unnecessary uncertainties and last-minute operational burdens on marketplaces and our partners. In particular, the proposed rule would require several significant changes to our eligibility system within a very rapid period, some of which are not even possible to complete by the proposed implementation date. Operationalizing others in such a short window would disrupt additional system changes planned well in advance and strain pre-established budgets. Moreover, these changes would heavily impact our communication and outreach efforts, as well as service center staffing, potentially necessitating an expansion of our resources. To provide marketplaces with the necessary time to adapt, stabilize, and minimize impact to consumers, we recommend postponing implementation of any finalized proposals.”

At a time when many people are in shock over the rapid and irrational changes Trump is making to our federal government, it is nice to read a composed and thoughtful response to unambiguously politically inspired rule changes to the Affordable Care Act.

YouTube video of my review of the Covered California response to Dr. Oz.