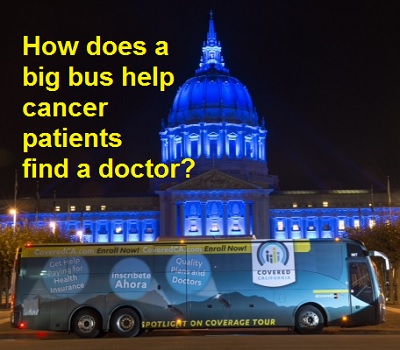

Covered California has a big bus to promote open enrollment but can they help a cancer patient determine if her oncologist will be in-network?

In the last week as I’ve been bombarded with feel-good press releases from Covered California about their grand and glorious bus tour across the state promoting themselves and open enrollment, I’ve also been working with several cancer patients trying to find a health plan. From a person who is in the trenches working to enroll consumers in the best fit health insurance, the Covered California road show displays how their bus has taken a wrong turn down Marketing Lane. Californian’s need help finding health plans that include their doctors, hospitals, and cancer drugs. They could care less about a bunch of people riding around on a bus promoting their selves.

Covered California can’t help cancer patients

Several individuals undergoing cancer treatment have contact me about their health insurance. Some are having their current health plans changed or cancelled. For example, Assurant health plans are leaving the market at the end of 2015 and Blue Shield is dropping Stanford hospital and providers in 2016. While this seems trivial to most people, other folks facing serious illnesses have a thick layer of stress when it comes time to investigating and evaluating health plans.

Consumers need answers about health insurance

Contrary to what Covered California markets to the general public, you just don’t enroll in health insurance. You need to find a plan that includes your doctors, hospital, and other providers and covers your prescription medication. Most of my time working with clients is spent tracking down this information. I would like to see a consumer try and get that level of detail out of anyone at Covered California. All they do is refer people to their inadequate summary of benefits. People fighting cancer needs answers. They don’t need to be told to go it alone which is what Covered California does.

How does the EOC describe PKU?

There are other consumers that face challenging and complicated family health care situations. One family has several children with Phenylketonuria (PKU) and all must receive special dietary formula and foods. The only way to learn how the health plan treats PKU foods and formula is by researching their Evidence of Coverage documents and calling the health plan. I would like to see either Covered California or any of their Navigators go into such depth to assist someone. Most of the time they avoid helping people and claim it’s a liability issue for them to do so. Since when is it a liability to help a neighbor with cancer find a health plan that includes their doctors?

Out of state coverage?

Which plan will be the most beneficial when a consumer has to travel out of state? For Covered California they only care about California and looking up the information is of no interest to them. But we live in a modern society where people actually travel. We don’t dwell year round in California. One gentleman spends a substantial part of his year in another state on business. He wanted to know which health plan would cover his out-of-state health care expenses. Similar to the PKU situation, you have to comb through the EOCs and Member Agreements to see how each health plans handles such out-of-state situations. I doubt few at Covered California even know what an Evidence of Coverage is or have even read one.

Covered California confusing nutrition label

The overwhelming majority of California’s just want affordable health insurance and never plan on using it. For them, Covered California is the Costco of warehouse markets – lots of products to choose from with little assistance. Then there are those California’s that actually need to know what they are buying and the ingredients in the health insurance container. I guess that is what health agents are for. Perhaps one day when Covered California is done building their brand they’ll focus on delivering what consumers need which is real information about the health plans.

Alternative use for the big Covered California bus

The primary mission of Covered California is to determine eligibility for the premium assistance tax credits. Next is generating revenue to keep their operation in the black. Covered California wants consumers to enroll in health plan through them because they earn $13.95 for each individual per month, paid the health plan to them. At $13.95 per person per month they are making more than most agents. But I guess the fancy paint job on that bus and the cost of diesel fuel costs Covered California a lot of money. Maybe outside of open enrollment they can use the big blue bus to take cancer patients to their doctor appointments.