When you fail, you walk alone.

I screwed up big time on behalf of a man with a serious illness. The end result is that he will be without health insurance for the month of December. Even though there are other people who failed in this situation, I have to take the ultimate responsibility that he might have to shoulder thousands of dollars in health care expenses that would have been covered by health insurance. I broke the business rule of never following your heart, and always trust your gut.

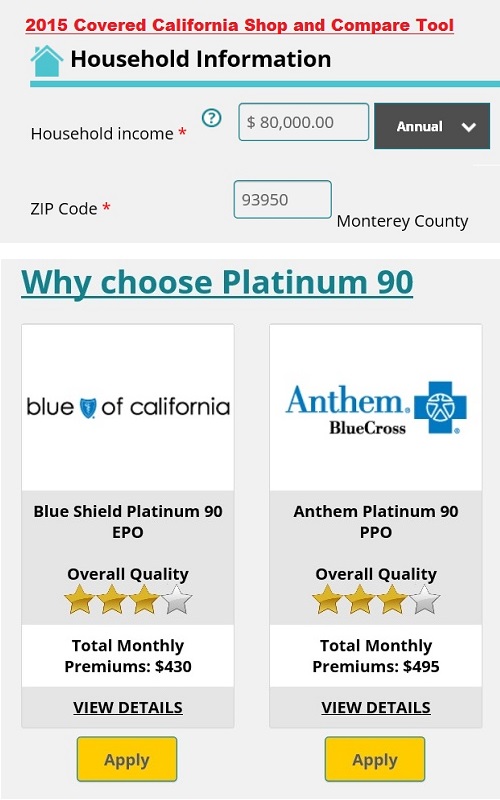

In early November I was contacted by a man who was having his Medi-Cal eligibility terminated at the end of the month because of an increase in his income. His concern was that he would be undergoing some heavy duty medical treatment for cancer at Bay Area hospital and wanted health insurance that would keep those providers into December with any new private health insurance. Blue Shield included the providers and the Covered California Shop and Compare Tool listed Blue Shield as being available in his county for 2015. That was mistake number one – trusting anything from Covered California.

On November 12th I told the gentleman in an email that it would be best for his current agent to handle the Special Enrollment Period (SEP) for December since he had access to his Covered California account. In previous communications he indicated that only his agent had access to his Covered California account with which he was determined eligible for Medi-Cal. He had no way of delegating me as his agent short of calling Covered California. In subsequent communications it was intimated to me that his current agent didn’t want to hassle with the paperwork for the SEP.

My second mistake came in offering help to enroll him in a health plan without being his delegated Covered California agent. By November Blue Shield had stopped accepting online enrollments for SEP. They could only be submitted by paper application. The gentleman decided he wanted to apply for a Blue Shield plan with the paper application. On Sunday November 15th I was able to fax a paper application over to Blue Shield with the letter indicating the man’s Medi-Cal coverage was being terminated November 30th.

The next series of events was so infuriating that I just wanted to strangle someone at Blue Shield. A couple days after I faxed the enrollment to Blue Shield I was told they had not received part of the transmission. I faxed the paperwork again. Again they said only some of the pages were received. They also used the excuse that their fax machine had not been working properly on November 15th. A week after the original fax (wonderful 20th century technology tantamount to the telegraph in the telephone age) I was instructed by Blue Shield to scan an email the application.

The scanned version of the application was a 15MB file that the email server bounced back to me. The reason for the refusal was that the Blue Shield email box could not accept files that large. At this point I am literally screaming at the Blue Shield representatives demanding they find a way for me to deliver the application. I knew that because they acknowledged a partial receipt on November 15th, they would honor the complete application for a December 1st effective date. But there seemed no reliable way to get the paper application to Blue Shield and none of their customer service representatives gave a rat’s behind about this issue.

Around this time the gentleman informed me he received a letter from Blue Shield saying they could not process his incomplete application they received by fax. (Note! What is crucial here is that they received the first page of the application by fax that has both his address AND the plan he wanted to enroll into.) I called Blue Shield again and was told to scan each page and the then email it to them. I was also assured that Blue Shield would make the effective date of the enrollment December 1st even if they could not complete the application until later in December. Mistake number three was trusting anything a health insurance company says.

On Tuesday December 1st, I scanned, individually, all 18 pages of the enrollment application and emailed each page, individually to [email protected]. On December 3rd the gentleman and I received an email that his application had been declined because Blue Shield did not offer health plans in his zip code.

Thank you for the application for health coverage with Blue Shield. We are returning the application for the following reason (s):· You resides[sic] in an EPO excluded region which is outside of Blue Shield of California’s network

Why in hell didn’t they tell us that earlier? That had the first page of the application that indicated the plan selection. They had his zip code because they sent him a bloody letter.

I double checked the Covered California Shop and Compare Tool and it showed Blue Shield being offered. When I frantically dug through all the Blue Shield literature, they were correct, Blue Shield didn’t offer a plan in his zip code for 2015. Not only was this man screwed for Blue Shield coverage because we didn’t receive notification of the denial until after December 1st, he couldn’t get coverage through Covered California because it was after December 1st.

The 2015 Covered California Shop and Compare Tool showed a Blue Shield EPO being offered in a Monterey County zip code. But the plan wasn’t really offered and a consumer was denied health insurance for SEP December 2015 enrollment.

Had I just been informed by someone at Blue Shield early enough, I could have pursued other health insurance options for this man. I don’t believe there is a conspiracy to prevent SEPs at Blue Shield. I do believe they foster a culture of incompetence and lack of responsibility. Although, I’ve yet to work with any other health plan that was any better. People are numbers and cost inputs to health plans. The proof of my assertion is that health plans are quick to follow the rules that trigger denial even when the person is dying of cancer.

My efforts to enroll this man into a nonexistent health plan has resulted him in having no coverage for December. I want to climb into a hole and die. Nothing I do or say can rectify the situation. I have forwarded the man a copy of my errors and omission insurance in case he wants to make a claim against my services. I have sent him a link to the California Department of Insurance on how to place a formal complaint against a health insurance agent.

Of course, I don’t think too many agents would or do go to the lengths I have to help people enroll. I usually spend an hour just verifying that a family’s providers are in-network. But all of my good intentions are of little value to a man facing a serious illness and who trusted me to secure his health insurance for the last month of the year.

I let my empathy cloud my business judgment. I never should have gotten involved until I was appointed his agent. The best way to handle SEPs is through Covered California, especially when Medi-Cal is involved. Just submitting the application through Covered California gives you some protection against the unscrupulous business practices of the health insurance companies where delay turns into their friend of denial. My gut said “stick to the protocol of agent delegation”, my heart said “just help someone in need and worry about the details later.”

When I was eight years old my cat got mange, a condition where the animal loses its fur. With both parents out of work and the car recently repossessed, a simple trip to the veterinarian for medication was out of the question. My brother, who was five years older, volunteered to take my cat to a vacant field and put him out of his misery with a single shot from his pellet gun. I feel as bad now as I did then – helpless. I wish someone could take me out and put me out of my misery.

I feel like I’m no better these health insurance companies and Covered California who promise all sorts of wonderful things and then don’t deliver. However, I am different from those weasels in one respect – I admit my mistakes and I tell the truth. That, of course, is of no value to the man without health insurance. All I can hope is that by recounting these events other people will learn from my mistakes and folks will not be left without health insurance for even a single month.