While the California Premium Assistance Subsidy through Covered California closely resembles the federal Premium Tax Credit for health insurance, the subsidy determination is not straight forward. The California subsidy can be conditional on the federal subsidy and the income tables. In addition, the consumer responsibility percentages are different than the federal Premium Tax Credit. Consequently, the final reconciliation for any California Premium Assistance Subsidy can be substantially different than the original enrollment credits.

Estimated reading time: 7 minutes

Like the federal Advance Premium Tax Credit, the California Premium Assistance Subsidy determines any monthly health insurance credit based on the household’s estimated income. The estimated Modified Adjusted Gross Income, along with household size or coverage family, is run through a formula to determine if any of the household members qualify for the California subsidy. However, a subsidy may not have been granted based on certain conditions such as the premium of the health plan and how much federal subsidy the individual is eligible for.

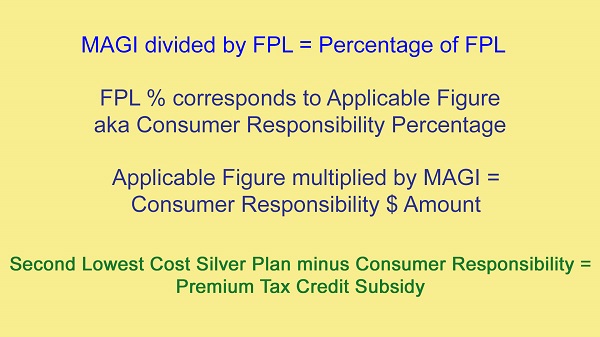

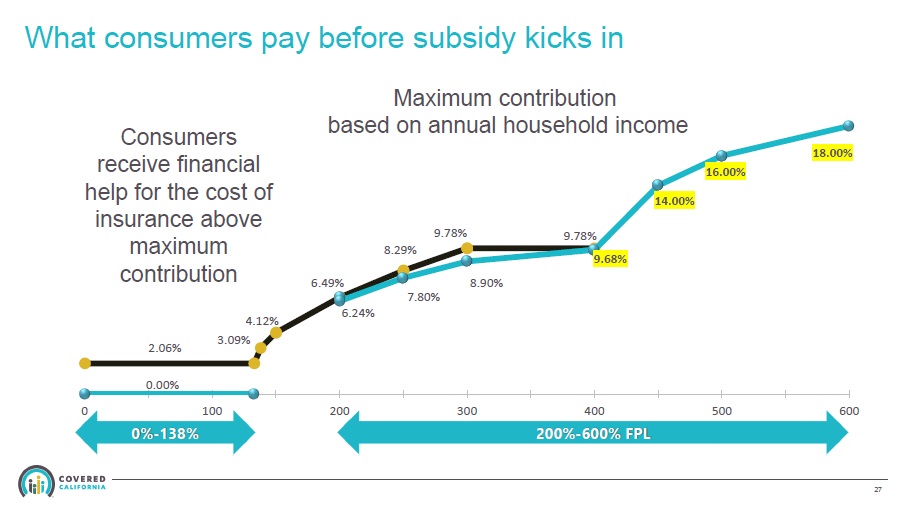

The starting point for the subsidy calculation is also the end point for reconciling the subsidy on the California 540 income tax return. First, your Modified Adjusted Gross Income (MAGI) is converted into a percentage of the federal poverty level (FPL), which varies by household size. That FPL percentage is then matched to the Applicable Figure. The Applicable Figure is itself a percentage, the percentage of the household’s fair share or consumer responsibility for health insurance. It is a sliding scale with income closer to the FPL being responsible for less of the health insurance premium.

The MAGI is then multiplied to get the consumer fair share or responsibility dollar amount. The federal and California subsidy system is designed to make the Second Lowest Cost Silver Plan (SLCSP) affordable. If the rate for the SLCSP is $1,000, and your monthly consumer responsibility – as determined by the Applicable Figure – is determined to be $100, then the subsidy is $900. In some cases, the $900 monthly subsidy is a combination of both federal and California subsidy amounts. It can also be just the federal amount or the California subsidy.

The California affordability curve is lower than the federal subsidy curve. In other words, California wants to make health insurance more affordable – the consumer pays less – than the federal percentage. Then when the federal subsidy ends at 400 percent of the FPL, California provides a subsidy up to 600 percent of the FPL. However, there is no California subsidy for incomes between 138 and 200 percent of the federal poverty level.

When determining any California Premium Assistance Subsidy, the federal Premium Tax Credit is first subtracted from the premium. If the California Premium Assistance Subsidy for the consumer fair share percentage is lower than the federal figure, an additional subsidy may be added to reduce the monthly premiums further. Of course, this is all based on the initial household income, the final taxable Modified Adjusted Gross Income is often times different from the original estimate. Hence, tax payers need to reconcile the California Premium Assistance Subsidy they received, with what they are eligible for based on the final income amount.

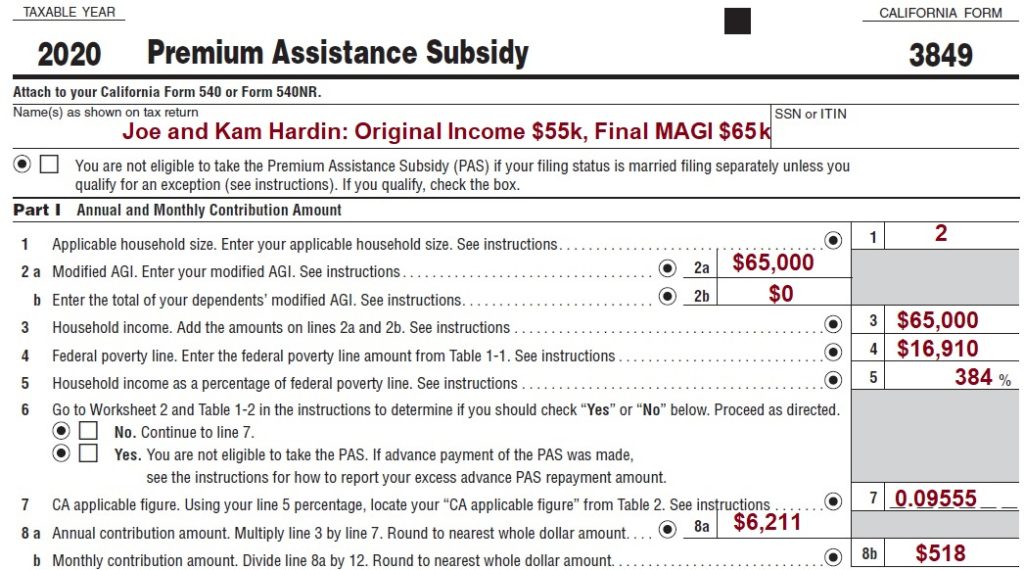

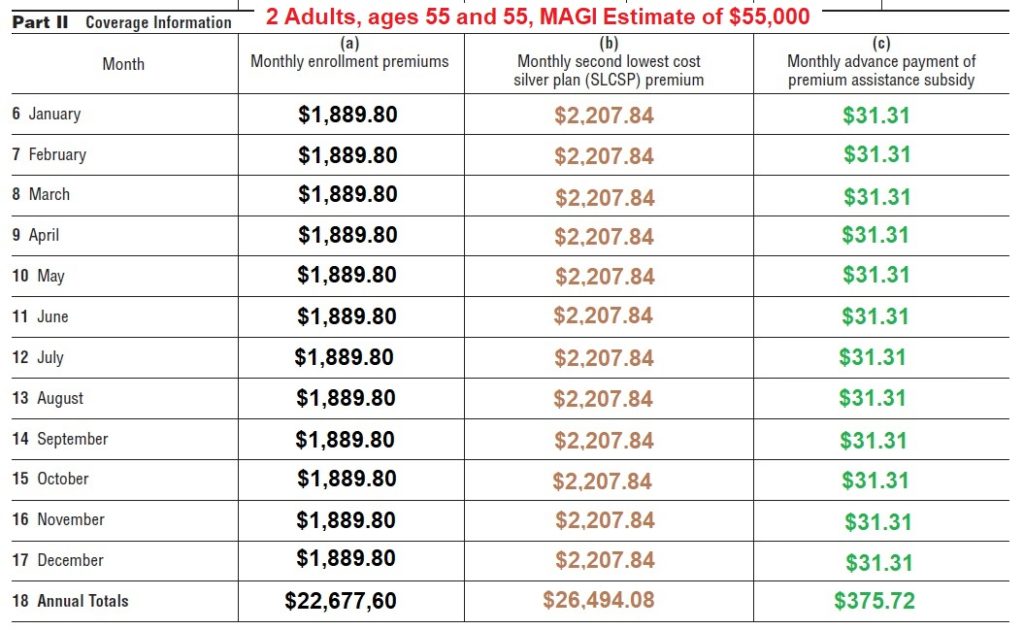

In this example, we have a married couple, both 55 years old, who entered Covered California at the beginning of 2020. They estimated their Modified Adjusted Gross Income at $55,000. They received a Franchise Tax Board (FTB) 3895 that showed the total premiums for their Silver plan enrollment (a), the rate of the Second Lowest Cost Silver Plan (b), and the amount of California Premium Assistance Subsidy (c.) This was in addition to their federal Premium Tax Credit subsidy reported on their 1095A and reconciled on IRS form 8962.

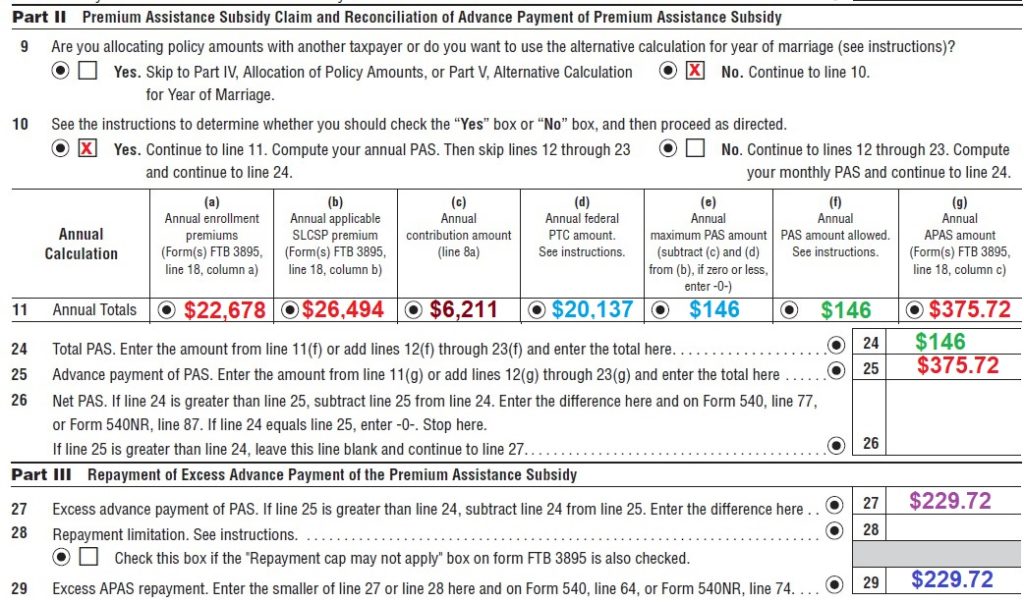

Initially, when the couple applied through Covered California, their information was run through the calculations presented on FTB form 3849 to determine the California Premium Assistance Subsidy. However, when they did their federal tax return, the couple’s MAGI was higher than originally projected. The final MAGI was $65,000. The final California subsidy is calculated with the higher MAGI.

The $65,000 MAGI is divided by the federal poverty level (FPL) for their household size and region of the United States. That yields a percentage of the FPL. The 384 percentage is then matched to an Applicable Figure on a published table located in the instructions for FTB form 3849. The Applicable Figure is essentially a percentage of the consumer’s income that is expected to be spent on health insurance to make the Second Lowest Cost Silver Plan affordable. This couples Applicable Figure is 0.0955 multiplied by their MAGI for a consumer responsibility of $6,211 annually or $518 per month.

Part II of FTB 3849 reconciles the California subsidy the couple received with their final MAGI, which in this case was higher than originally estimated. Information from the couple’s FTB 3895 and Part I of the FTB 3849 are pulled into the calculations. Column 11a reflects the total premium amount for their Silver plan. 11b is the SLCSP (the couple enrolled in the lowest cost Silver plan that is why the numbers are different.) 11c is the dollar amount they are responsible for as calculated in Part I. 11d is the federal Premium Tax Credit calculation. It is computed on a separate worksheet, but should mirror the amount from the federal form 8962.

For incomes between 200 and 400 percent of the federal poverty, the California fair share percentage is slightly smaller than the federal number. The federal Premium Tax Credit is subsidizing the bulk of the Second Lowest Cost Silver Plan and California is just adding a little extra dollar amount. For this couple, they received $376, 11(g) in California Premium Assistance Subsidy, but at the higher income, were only entitled to $146 11(f). Consequently, they must repay the difference, $230, on their California income tax return.

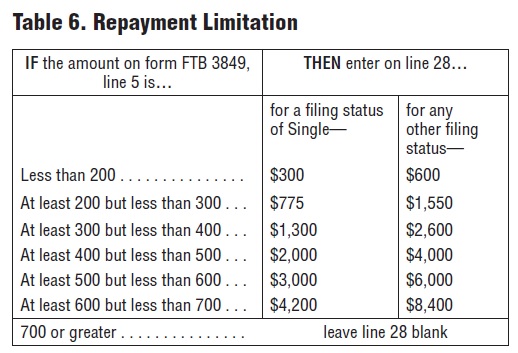

There is a California repayment limitation for excess subsidy amounts like there is at the federal level. This couple’s excess subsidy is below the limitation so they must repay all of it on their California income tax return for 2020.

This is a very basic primer for how the California subsidy is calculated. I will present a more in depth review in a YouTube video.

See Also California and federal subsidy credit and repayment scenarios.

1095A_FTB3895

- 540 Form 2020

- 1095A Notice

- 1095x Form Definition

- 3849 California Subsidy Reconciliation form 2020

- 3849-instructions 2020

- 3895 FTB CA Notice

- 3895 FTB CA Quick_Guide

- 3895 FTB Form 2020

- 3895 FTB Statement instructions-covered-ca 2020

- 3895 FTB Statement instructions-recipient 2020

- 3895b-MEC Penalty Reporting 1095B_pub 2020

- 3895c-MEC Penalty Reporting 1095C_pub 2020