It can be a mystery as to how the Affordable Care Act – also known as Obamacare – subsidy to reduce the monthly cost of health insurance for individuals and families is calculated. First of all, it is not a subsidy in the technical sense of the term, it is a federal tax credit, that may have to be repaid under certain circumstances.

The Obamacare health insurance subsidy is known as the health insurance Premium Tax Credit. Your estimated Premium Tax Credit is Advanced or paid to your selected health plan every month to lower the portion you have to pay for health insurance. You then reconcile how much Premium Tax Credit you received during the year with the amount that you should have received based on your final Modified Adjusted Gross Income.

But let’s go back to this tax credit thing. One analogy I use is the Child Tax Credit that the federal government gives you when you have a baby or adopted a child. If you have a child in 2020, the federal government will give you a $2,000 Child Tax Credit when you file your taxes in 2021. That tax credit can reduce your tax liability, and if you owe nothing to the federal government when you do your taxes, they will send you some of the amount in a refund check.

Unfortunately, a $2,000 tax credit does not help you buy diapers, car seats, clothes, or pay grandma to watch the toddler when you are at work. What would help is if they sliced the tax credit up into 12 equal amounts and sent you a check every month.

Well, that’s what they do with the Premium Tax Credit. When you fill out an application through Healthcare.gov or one of the state marketplace exchanges like Covered California, they take that information, estimate a Premium Tax Credit for the year, slice it up into 12 parts, and send a portion to your chosen health insurance plan.

How The Premium Tax Credit Is Calculated

So now the question is, “How does the exchange calculate the estimated annual premium tax credit subsidy to cut up?”

This all revolves around the IRS because it is a federal tax credit. The first step is to determine the household size. The household size is the number of people on the primary tax filers income tax return, spouse and dependents. Your roommates and other family members who live with you are not part of your tax filing household.

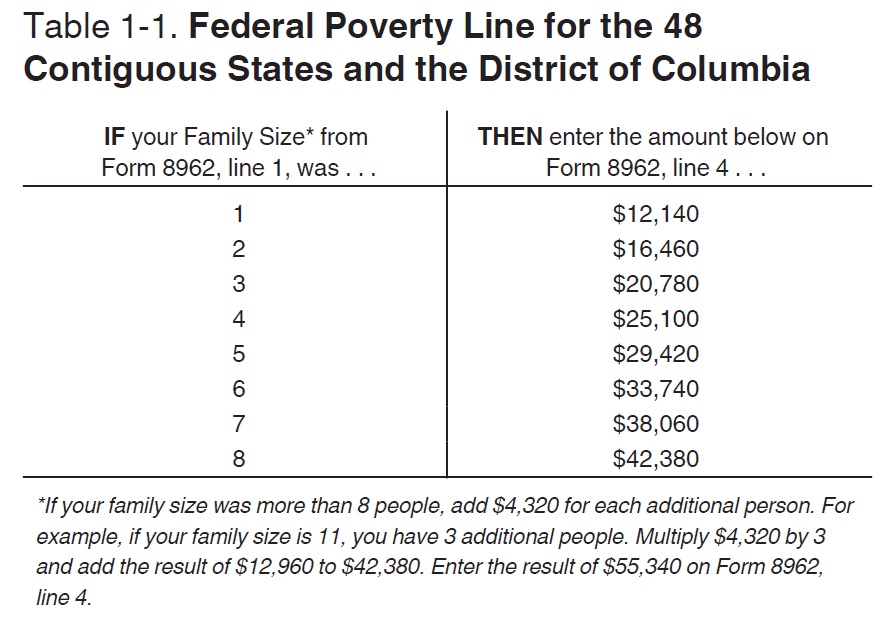

The household size is important because it is compared to the federal poverty level. Premium Tax Credits are awarded to households whose Modified Adjusted Gross Income is between 100% and 400% of the federal poverty level. The larger the family, the larger the income the household can have and qualify for the Advance Premium Tax Credit.

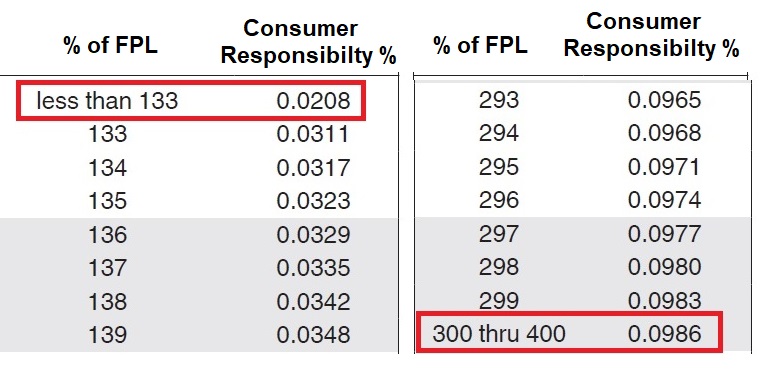

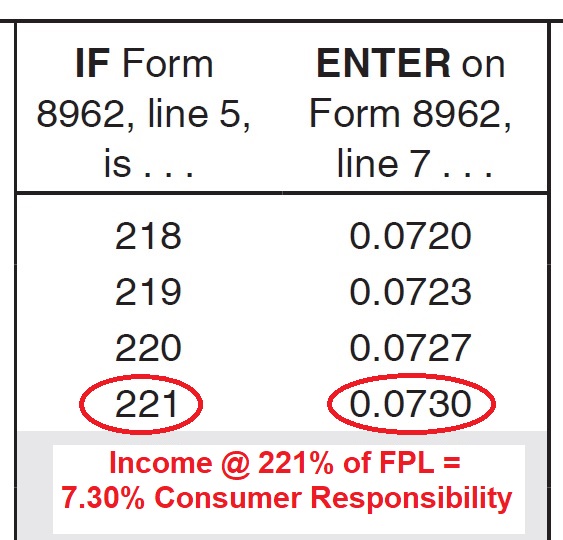

Where the household income falls between 100% and 400% of the federal poverty level will determine the consumer responsibility for their health insurance premium. This is called the Applicable Figure by the IRS. The Affordable Care Act says that individuals or families should have to pay no more than 2.08% if their income is less than 133% of the federal poverty level and no more than 9.86% if their income is up to 400% of the federal poverty level for the second lowest cost silver plan, also known as the benchmark plan.

The Second Lowest Cost Silver plan is important. The ACA is geared to make the Second Lowest Cost Silver Plan affordable. It directly influences changes to the premium tax credit every year. If the Second lowest cost silver plan increases a lot between years, the subsidy also increases. If the cost stays the same between years, the subsidy will not change very much.

Let’s put the Obamacare Subsidy into action

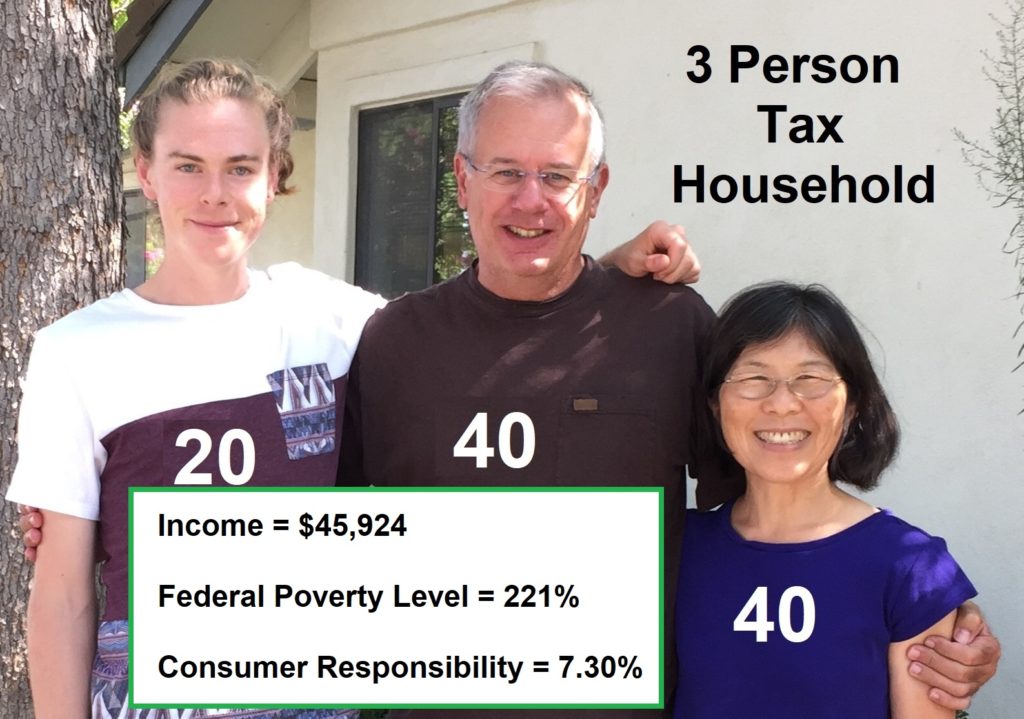

Let’s consider the tax household of the Byrd Family with 3 people ages 20, 40, and 40 years old. The Byrd’s estimate their income in 2019 to be $45,924. That puts the Byrd’s income at 221% of the federal poverty level. Under Obamacare, at 221 percent of the federal poverty level, based on the Applicable Figure chart in IRS instructions for form 8962, the Byrd’s consumer responsibility for health insurance is 7.30 percent of their estimated income.

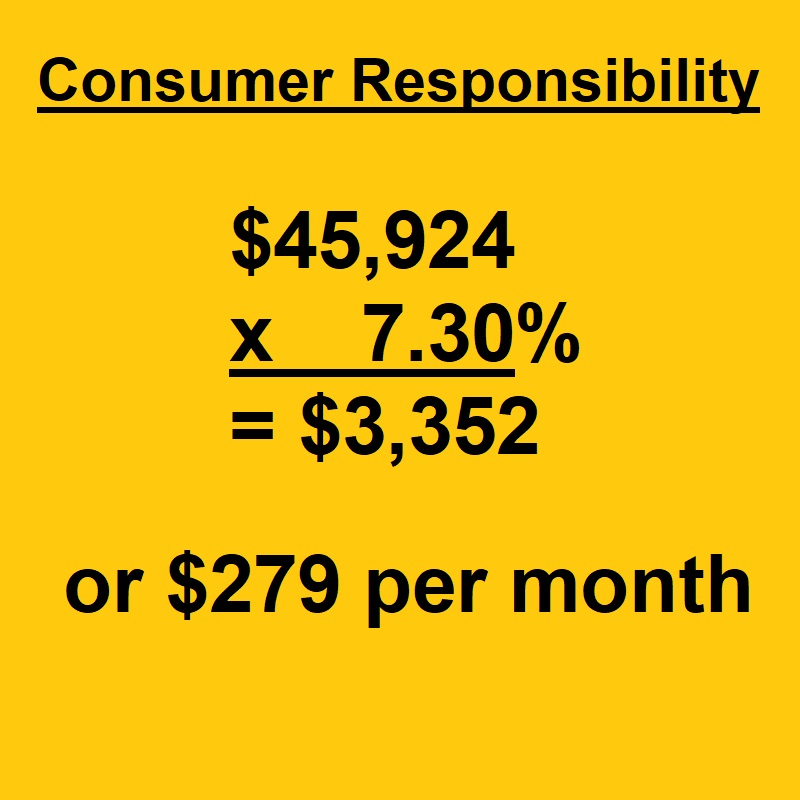

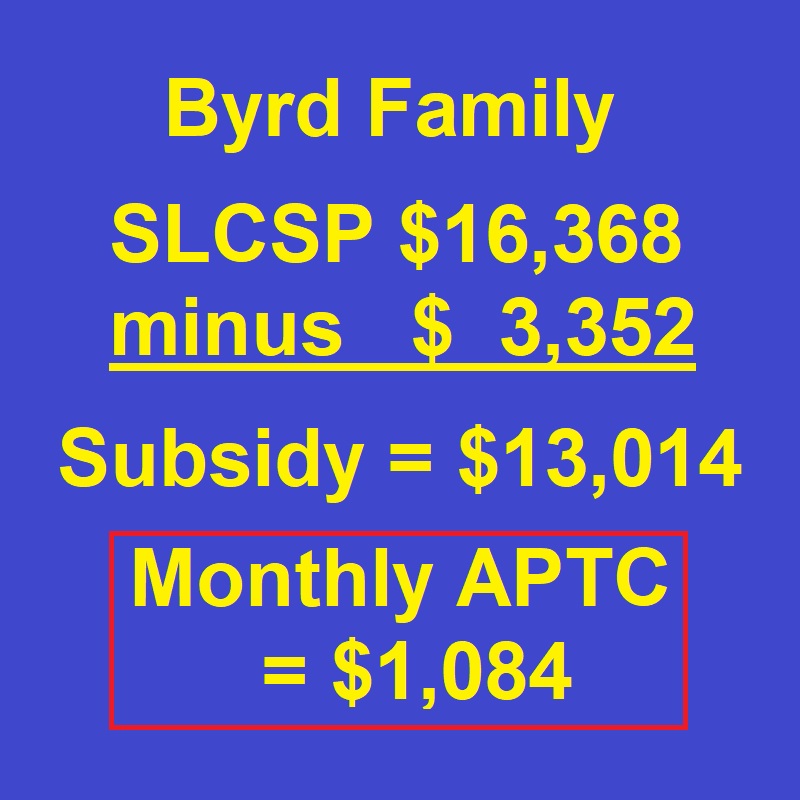

7.30% of $45,924 is $3,352 per year, a monthly amount of $279.

That means the Byrd family is expected to pay no more than $3,352 annually for health insurance, if they selected the Second Lowest Cost Silver Plan. On a monthly basis, the consumer responsibility for the Byrd’s is $279.

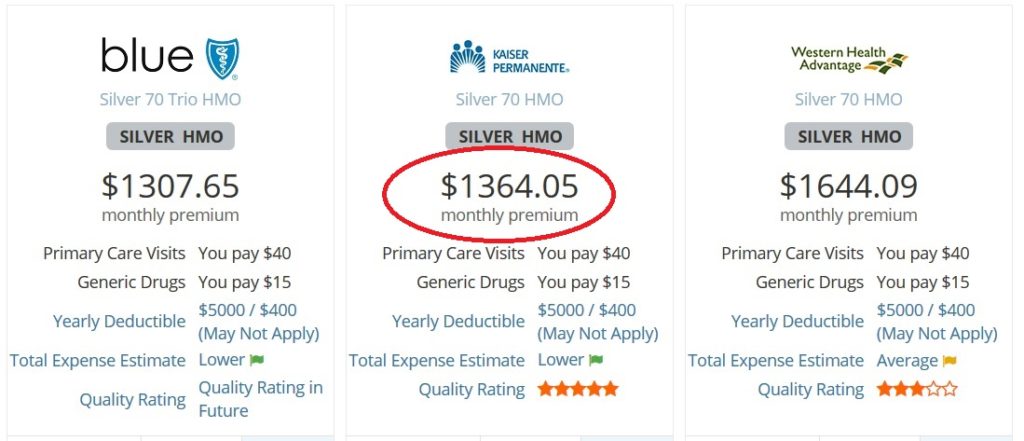

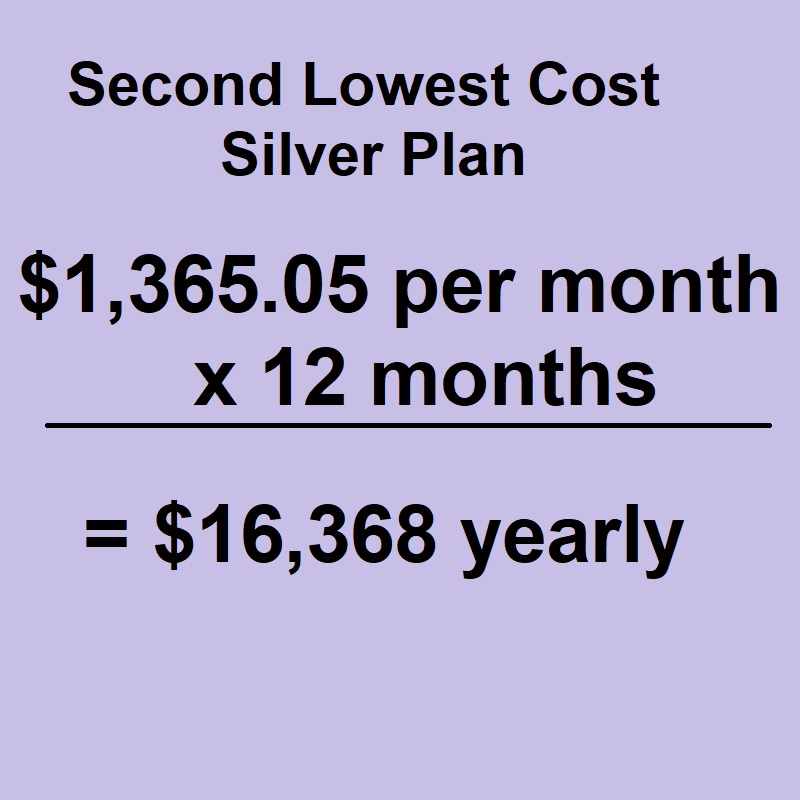

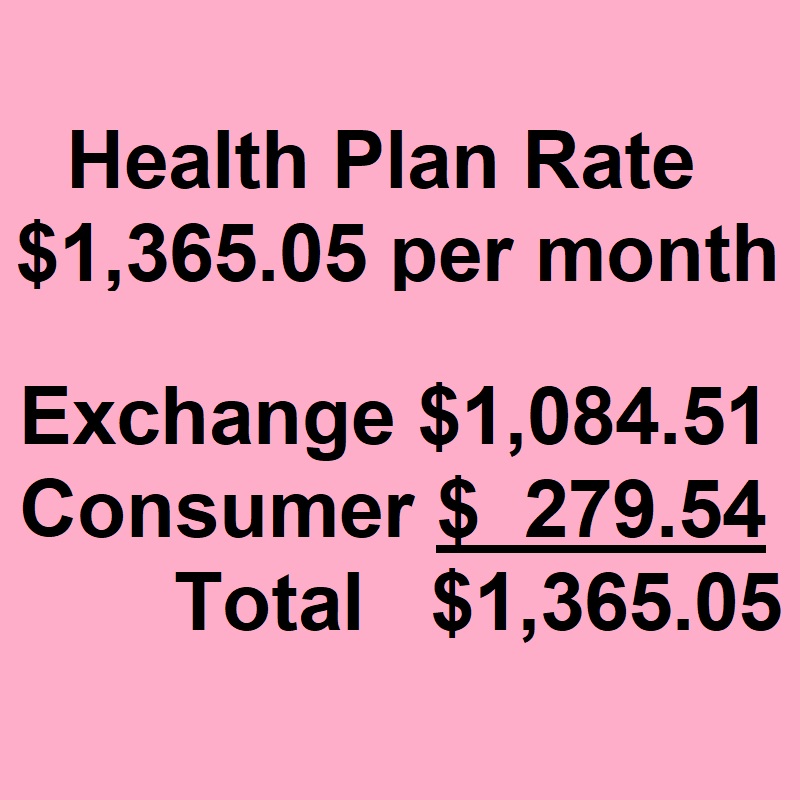

The Byrd’s go shopping for health insurance on the marketplace exchange. In the Byrd’s rating region, the Second Lowest Cost Silver Plan is a Kaiser Silver plan. The full monthly premium of this Second Lowest Cost Silver Plan is $1,364 per month or $16,369 annually.

The Premium Tax Credit subsidy is difference between the rate of the Second Lowest Cost Silver Plan and the Consumer Responsibility for the household size and income.

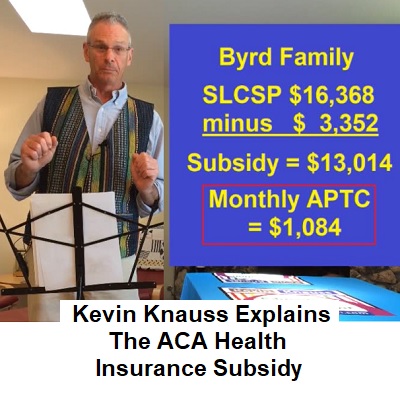

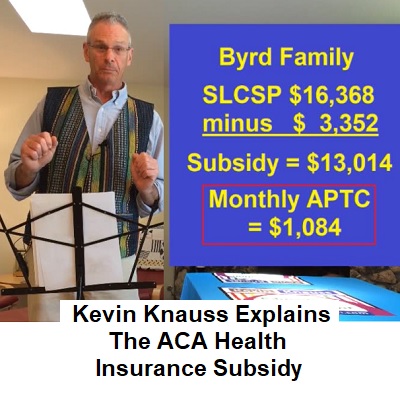

When the Byrd’s put all their information into the application, it calculates that they should pay no more than 7.30% of their income toward health insurance ($3,352 per year), and subtracts that from the annual cost of the Second Lowest Cost Silver Plan ($16,368 – $3,352 = $13,014.12) The exchange then divides the annual $13,014 of the subsidy by 12 months to get a monthly subsidy of $1,084.50.

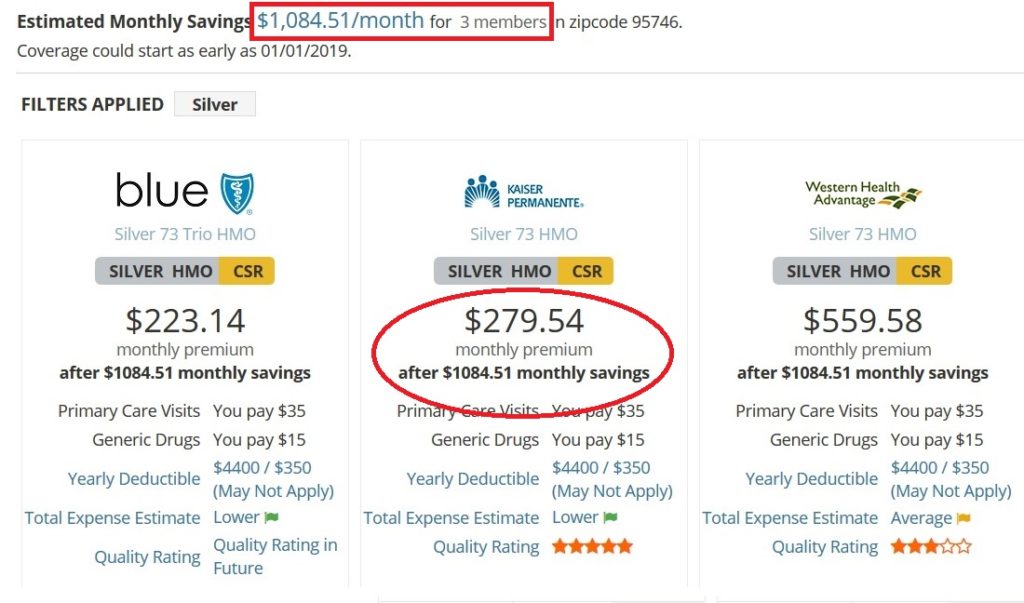

To see if the calculations work, I put the Byrd family information into the Covered California Shop and Compare Tool. Bingo! It calculated the Byrd family would receive $1,084 monthly Advance Premium Tax Credit which made the Second Lowest Cost Silver Plan $280 per month.

The $1,084.50 is sent to the health plan the Byrd’s select. If they select the second lowest cost silver Kaiser plan, their monthly health insurance premium payment would be $279.54. They could select the lowest cost Silver Blue Shield HMO plan and the full $1,084 subsidy would be applied to that plan. But they could also enroll in a higher price Silver, Gold, or Platinum. In addition, they could elect to apply the monthly subsidy to a lower cost Bronze plan.

The subsidy amount will always remain the same regardless of what plan they select. However, if they move to a different rating region, the Second lowest cost Silver plan may be different and that will change their monthly subsidy.

YouTube video of How The Obamacare ACA Health Insurance Subsidy is calculated