The commissions paid to health insurance agents support fabulous estates, corner offices, and palatial work suites….NOT!

Health insurance carriers do not pay great commissions to agents, not like home, auto, and business insurance can. Complicating any discussion about agent commissions for health insurance enrollments is that each carrier has a different compensation schedule. Sometimes there are different levels of compensation for different product types. For instance, HMO plans may have better compensation than PPO plans. This discussion pertains to California. Other states may have different agent compensation models.

Health Insurance Agent Compensation

First, let’s identify the different commercial markets that a carrier may participate in:

- Individual and Family, including Covered California

- Employer Group

- Medicare

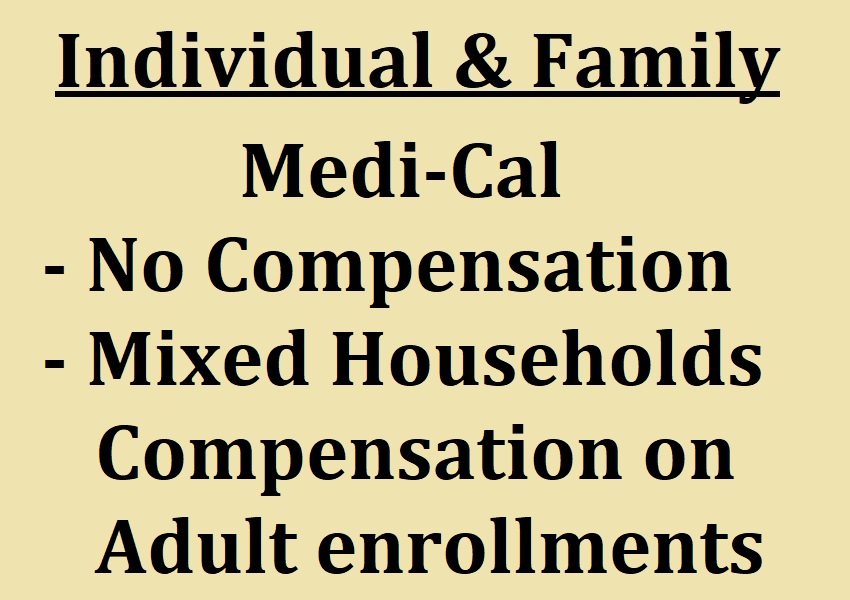

Individual and Family

In general, the compensation paid to agents is the same whether the household enrolls through Covered California or direct with the carrier, also known as off-exchange. The compensation can be a flat one-time fee, a monthly per member per month amount, or a commission based on the total monthly premium amount.

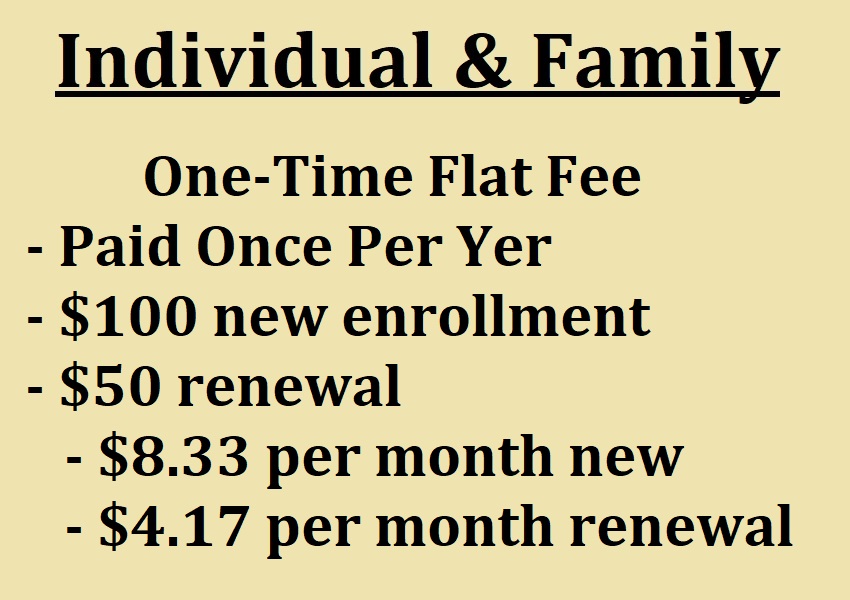

One carrier uses a flat fee of $100 per person for new enrollments. Renewals are $50 per person. This translates into $8.33 per member per month in the first year and $4.17 per member per month for renewal years.

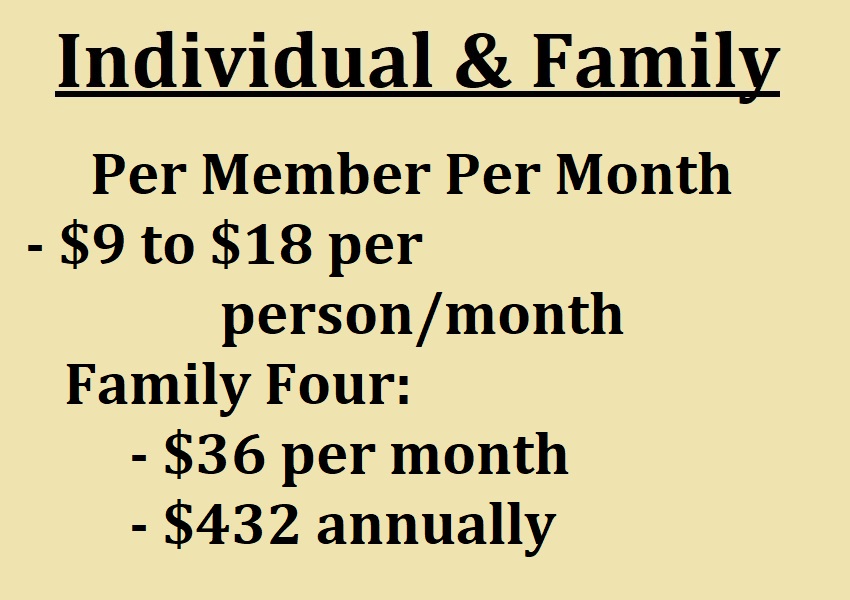

Most carriers have switch to a monthly per member flat rate. The monthly per member per month fee can range from $9 to $18. If I enroll a family of four into a plan that pays $9 per member per month, that’s $36 per month or $432 annually, if they stay enrolled for the full 12 months.

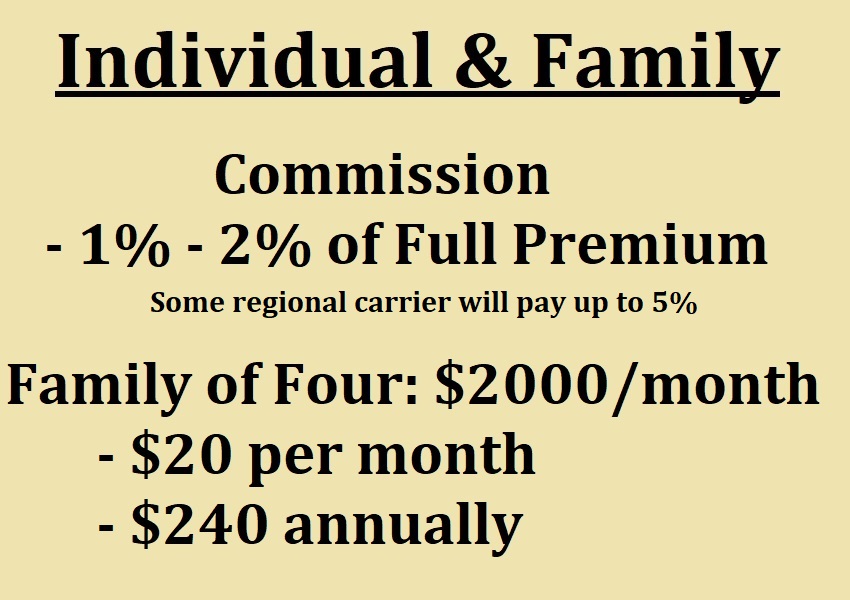

The other compensation structure is a commission on the full monthly premium. Commissions range from 1% to 2%. If the full monthly premium is $2,000 for a family of four, the monthly commission at 1% would be $20 or $240 annually.

With Covered California, agents, like myself, also assist with Medi-Cal eligibility. Agents are not compensated at all for helping individuals and families qualify for Medi-Cal. If a household of four, two adults and two children, where the children qualify for Medi-Cal, and the adults qualify for the subsidy for a private plan, the agent will be paid a commission for the adult enrollments.

Covered California does not pay agents to assist consumers with enrollments into individual and family plans. The insurance plan or carrier compensates the agent. Agents are not paid anything for answering questions about Covered California. They are only paid a commission if the person enrolls into a health plan the agent represents and is appointed with.

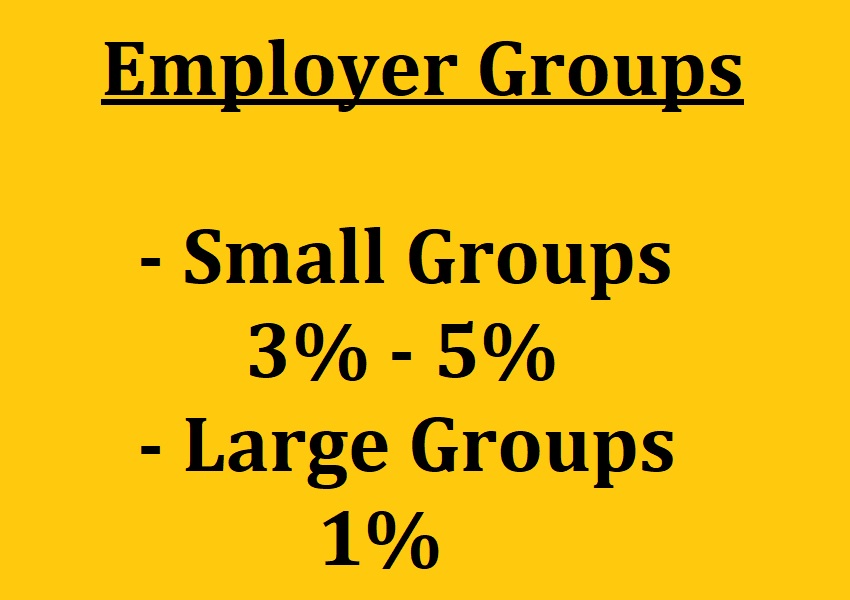

Group Plans

There is more uniformity in the commission structure between carriers for small group enrollments. They average between 3% and 5% of the total monthly premium of the group. Large group compensation can be down around 1% or less, but you are talking monthly premiums that exceed $100,000 monthly.

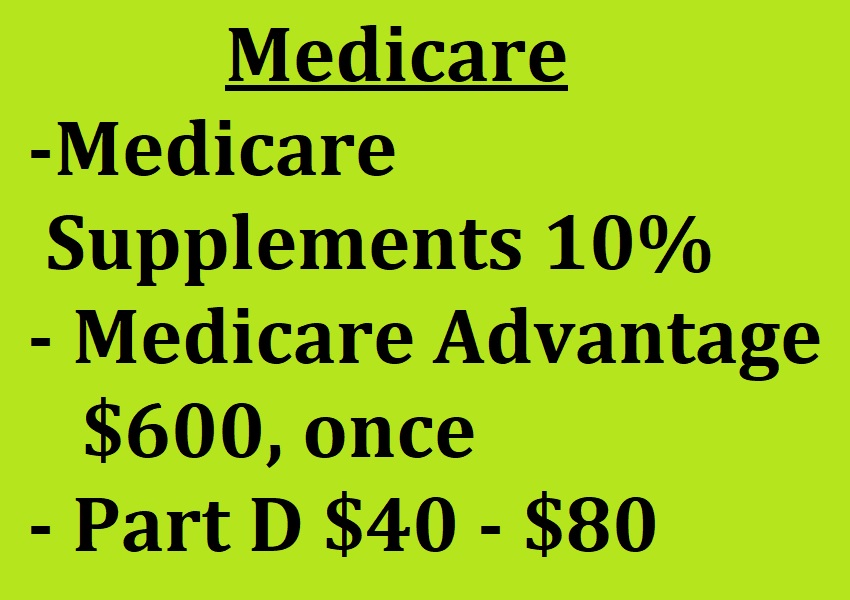

Medicare

The three types of enrollments agents earn a commission from for Medicare are Medicare Supplements, Medicare Advantage Plans and Prescription Drug Plans. Medicare Supplement Plans average 10% commissions. If a Plan G has a monthly premium of $150, the agent will earn $15 per month.

Medicare Advantage and Part D Prescription plans have the compensation structure regulated by the Center for Medicare and Medicaid Services. Medicare Advantage plans have an average of a $600 one-time flat fee per enrollment. The Part D Plans average between $40 and $80 one-time fee. The flat one-time fee can be prorated if the member enrolls later in the year or leaves without participating for the full 12 months.

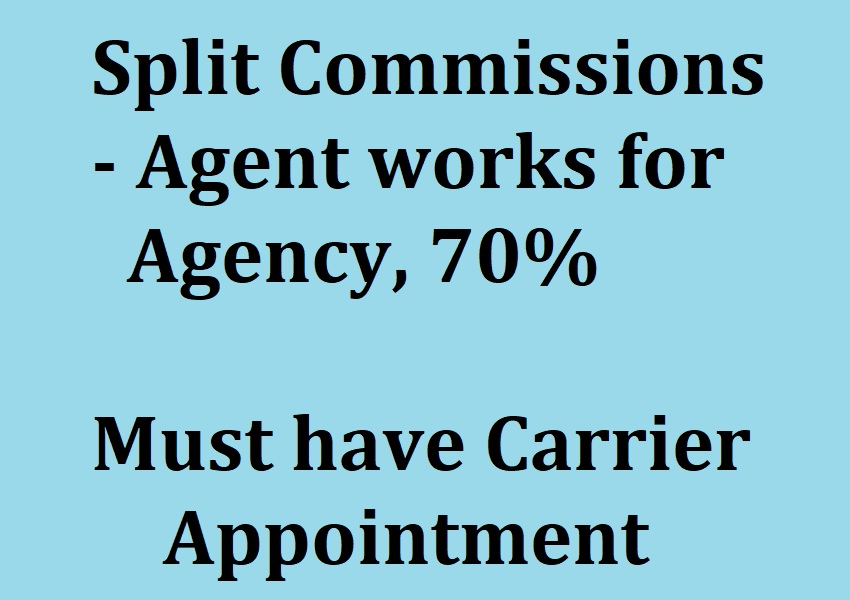

Split Commissions Paid To Agents

An agent may not realize the full commission amount if they work for an agency and have to split the commission. Usually the commission split is 70% for the writing agent and 30% for the agency.

Most health insurance agents will work with all the different consumer products from individual and family to Medicare. This helps diversify the income, but one-time fees for enrollments such as Medicare are paid by March. This loads the commissions payments earlier in the year.

Would I recommend becoming a health insurance agent? No, not unless you had another income stream such as a monthly pension.