The Affordable Care Act (ACA) allows for Special Enrollment Periods for individuals and families to purchase a health plan through the federal or a state exchange when there is a loss of coverage from a qualifying such as a change in employment. There has been confusion over how to characterize the previous month’s employment wages for the determination of premium assistance especially when the qualifying event is triggered by the loss of job. There are also issues with reporting a new job for part of the year.

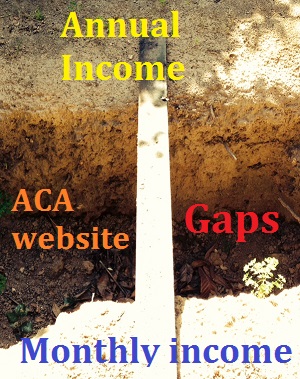

ACA tax credits based on annual, not monthly income

The ACA Advance Premium Tax Credit (APTC) or premium assistance is calculated based on the household’s annual modified adjusted gross income. Even though a family may have experienced a job loss which propels them to seek health insurance through the exchange, the immediate family income of near zero may not necessarily make them eligible either premium assistance or expanded Medicaid. Eligibility will be based on the wages or income in the prior months plus future earnings. All of the IRS regulations and guidance I have researched points to the APTC being determined on the annual income as reported on federal income tax returns and not monthly reported income.

From the Final IRS regulation on the ACA Tax Credits (Download entire document at end of post)

(2) Modified adjusted gross income.

Modified adjusted gross income means adjusted gross income (within the meaning of section 62) increased by—

(i) Amounts excluded from gross income under section 911;

(ii) Tax-exempt interest the taxpayer receives or accrues during the taxable year; and

(iii) Social security benefits (within the meaning of section 86(d)) not included in gross income under section 86.

(d) Premium assistance amount. The premium assistance amount for a coverage month is the lesser of—

(1) The premiums for the month for one or more qualified health plans in which a taxpayer or a member of the taxpayer’s family enrolls; or

(2) The excess of the adjusted monthly premium for the applicable benchmark plan over 1/12 of the product of a taxpayer’s household income and the applicable percentage for the taxable year.

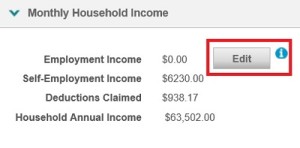

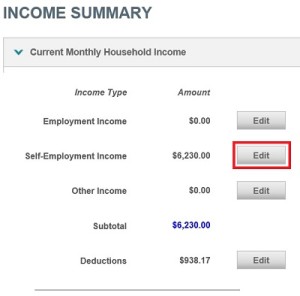

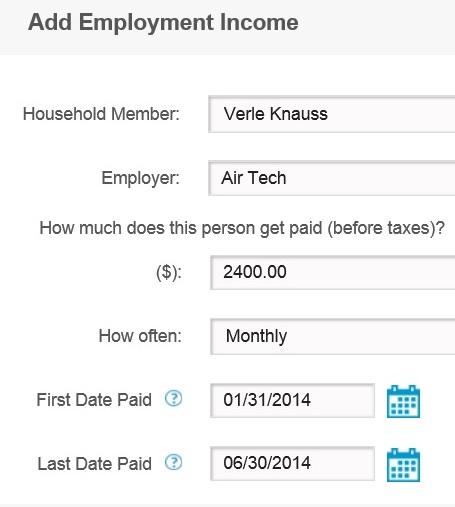

Covered California updates income reporting section

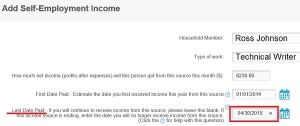

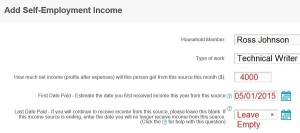

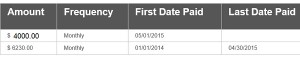

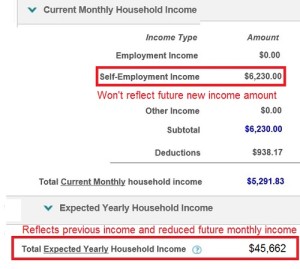

In August, Covered California finally updated the income reporting section to reflect the real world. In other words, they have made it easier to report the wages from a job held only for a few months or a short term contract payments under Self Employment. They have done this by adding a First and Last payment date to the application. This is a big improvement over having to annualized wages that were for less than 12 months. However, income that is added with a First and Last date will not show up under current income. But it will show up in the total for the projected annual income.

Covered California finally added First and Last pay dates for reporting past income.

How are the tax credits determined?

For the purposes of determining the APTC, I’m not sure if Covered California is using the Total Annual Income divided by twelve or the Current Monthly Income figure. From what the IRS has published so far, they will be looking at the total income and not the monthly income. If a household APTC is based on a monthly income after the loss of a high wage job, the household may received too much in tax credits and have to pay the excess back to the IRS. In this regard, annualizing partial year income is better because it spreads it out over the twelve month period.

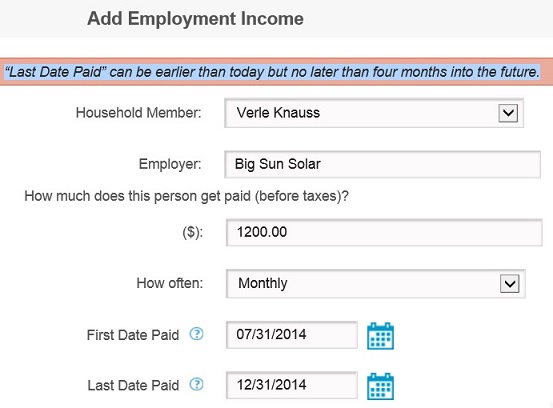

Current income can only be forecast four months into the future with Covered California.

Add Income

The income section will not let you put in a Last Date Paid later than four months into the future. So if you know the job or contract will end after 5 months, you’ll have to go back into the system and put a Last pay date. But entering a First date allows the system to calculate the wages not for the full twelve months, which was the previous flaw in the system, but only from the month started until either a specified end date or the end of the year.

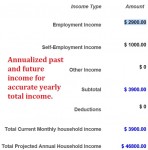

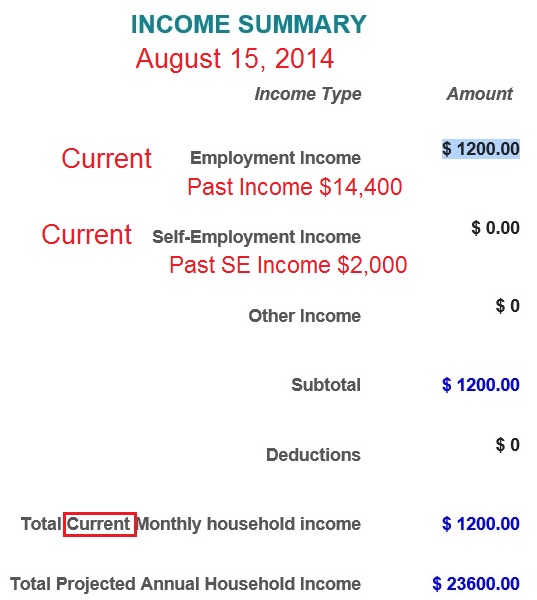

Projected Income Summary

Covered California income summary only show current income, but reflects past income in Total Projected Annual.

In this example, Mr. Knauss worked for six months at $2,400 per month or $14,400 for the year. Then he picked up a new job at $1,200 per month. His wife had a part-time job in the spring that paid her $2,000. Neither of the wages from the last employer or the part-time job show up in the Current Income calculations. They are reflected in Projected Annual Household Income.

$14,400 + $2,000 + ($1,200 x 6 months) = $23,600

What would be of assistance when either the client or the agent is reviewing the information is the date of the change and a separate column indicating the partial year wages.

—————————————————————————-

The following paragraphs were part of the initial post and may not be relevant since the changes to the income section

No entry for previously earned wages on ACA enrollment

Confusion on the part of people applying after open enrollment, during a Special Enrollment Period, centers on the applications request for current monthly income. At least in the case of Covered California, the CalHEERS application takes the monthly amounts and computes an annual income. Within the formula for determining the monthly premium assistance or APTC is an affordability percentage based on the estimated annual income. If a household starts an application part way through the year, there is no obvious place to enter the previous month’s wages. If the applicant lost his or her job, when asked for the current monthly income they enter zero.

Covered California fails to explain income reporting

There needs to be a better explanation on the website that prior wages and income must be divided by 12 so the program can properly determine the estimated modified gross income that will most closely resemble the tax payer’s income for 2014 federal taxes. If the applicant enters the current income without regard to the previous earnings he or she will be awarded an artificially high level of premium assistance. This extra tax credit may have to be repaid in the following year to the IRS creating a huge tax liability or wiping out any refund.

Twelve month calculation only

The flaw of Covered California enrollment system with respect to the income section is that it assumes that all the applicants are applying at the beginning of the calendar year for a full twelve months. The Change Reports were designed for households that are adjusting their monthly income stated at the beginning of the year. There is no documentation to help consumers convert their previous income into monthly sums to generate an accurate APTC based on an annual income basis.

Converting partial year wages into annual amount

If you have wages or income from another source that has ceased at the time of your mid-year application for health insurance, you need to determine the total amount of that income and divide it by twelve. Then list that amount as a separate source of income in the wages, self-employment or other section of the Covered California website. Alternatively, you can enter the total amount of previous wages and select the frequency of Annual from the “How often?” drop down menu. This will convert the amount into 12 monthly amounts on your application.

Add partial months employment wages

In this example, Mr. Knauss worked for six months at Air Tech and earned $24,000. If he puts in the wages in a mid-year ACA application, the Covered California system will calculate he will make $48,000. He puts in the earned wages as one total amount and selects Annual from the “How Often?” drop down menu. The $24,000 is then converted into $2,000 regular monthly income amounts for twelve months. (Click to enlarge thumbnails)

Projecting partial year future income

Unfortunately, the Covered California online application has no functionality that I could find for handling partial year future income either. If a household member acquires a job in July, for the last six months of the year, and it is entered as a monthly income, the system calculates a full 12 months of wages to the total projected annual household income. This causes the system to erroneously over-estimate the annual income. Similar to income in previous months, the work-around-solution is to project the income for the remaining months of the year and either divide by 12 or select Annual from the frequency menu.

Add partial year future wages

In this example, Mr. Knauss must estimate his earnings from a new job for the last six months of the year. Again, he simply can’t enter the monthly wages and select a frequency of “Monthly” because that will erroneously inflate the annual income by adding twelve months of the monthly wage to the total. Similar to reporting income from a job he left, he must forecast the remainder of the year’s wages in total and either divide by 12 or select annual. The two jobs will have two separate income entries.

——————————————————————————

Focus on the Projected Annual Household Income figure

Whether you’re declaring previous income or forecasting future wages, the target number should be what you reasonably expect your total annual income to be on your federal taxes. If you under report your income and receive too much premium assistance you’ll have to pay it back. (See: IRS limits APTC repayment) If you over estimate the income you may not receive any premium assistance until you file your taxes the following year and the IRS figures out the error.

Annual income review step is needed

Covered California needs to copy and steal the build of the Healthcare.gov website. On the federal exchange you enter your monthly income, but then it prompts you to confirm the calculated annual income. For a person that enrolls mid-year with a new job, having made no income in the previous months, Healthcare.gov allows the applicant to enter an amount for their estimated annual income. Instead of calculating a $2,000 per month wage into 24,000, the federal system lets the user override the calculated annual amount. It is far simpler, and probably just as effective, income estimator than the Covered California cumbersome three income section with no place to intuitively adjust income for less than 12 months.

Healthcare.gov annual income adjustment

Past income my preclude future tax credits

The real shocker will be for people who lose a job in the middle of the year but because their previous wages were greater than 400% of the federal poverty line, even if it was for the first six months of the year, they will be ineligible for premium assistance when they need it most. For example, an individual earned $50,000 in January through June. When they annualized that income on their Covered California application ($50,000 divided by 12 = $4,166 per month) the system will show they are not eligible for premium assistance. Neither will they be eligible for expanded Medi-Cal.

Affordability gap under current rules

A double whammy would be if the individual lost his or her position because of a medical issue and both the COBRA and ACA exchange health plan premiums are more than they can afford because of the loss of income. The exchanges have little wiggle room for helping people in these situations because the way the law was written around annual income and the IRS. However, Covered California could at least provide some additional guidance on their website so people don’t inadvertently over or under estimate their income because the system wasn’t built around real-world experiences where people lose and gain employment during the year.

See also:

Covered California COBRA SEP Cautions

What is considered income for Covered California

Monthly Medi-Cal income issues

[wpdm_package id=171]