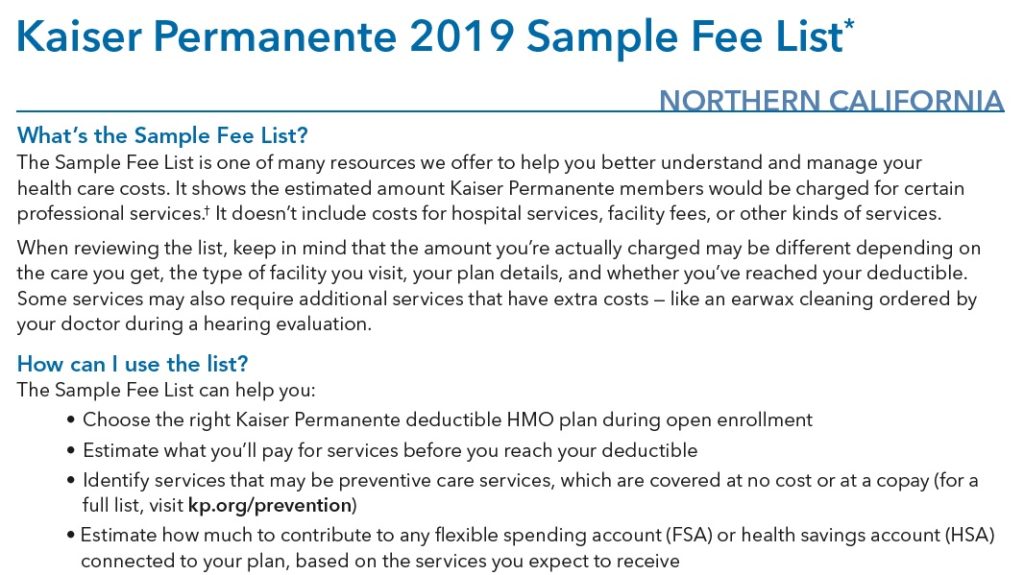

I’ve received many calls from consumers confused as to how the California health plans actually work. The Covered California summary of benefits for the different metal tier plans is lacking in crucial details. In this post I will attempt to dive into the details to provide some clarity.

First – All California health plans sold through Covered California, known as on-exchange, cover all the same health care services as plans sold directly by the health insurance companies, referred to as off-exchange. For example, urgent care, emergency room, mental health services, acupuncture, labs, office visits, imaging, plus many more, are all covered services regardless of if you purchase a plan through Covered California or off-exchange direct with a carrier.

If all the covered services are the same, why are the rates different between the health plans? Part of the reason the rates are different is because the cost of providing those services varies within different parts of California. The overall cost of health care services is lower in Southern California. Consequently, the rates are 10% to 20% lower in Southern California versus Northern California for same person at the same age.

But an even larger factor in the rate differential between health plans is the network of providers. Health plans with large networks of doctors, specialists, and hospitals translates into higher rates. For example, one of the reasons the Blue Shield PPO plans are more expensive in Northern California for 2020 is that they include Sutter doctors and hospitals in the network. An even more expensive plan is the Health Net Full PPO network that is the only health plan to include Stanford doctors and hospitals.

Second – All plans include the mandated preventive health care services at no cost. For example, the well-woman visit will be no cost regardless of the type of health plan you have, a Bronze High Deductible Health Plan or a Platinum plan.

Finally, all individual and family plans include pediatric dental and vision benefits for dependents 18 years old and younger.

California Health Plans for 2020

Let’s look at the Standard metal tier plans using in-network providers. I’ll cover the High Deductible Health Plans, Health Savings Account compliant, at the end. The following discussion focuses on member cost-sharing for an individual. Family plans can accumulate dollars in a slightly different way that is more favorable toward meeting deductibles and maximum out-of-pocket costs for households of two or more.

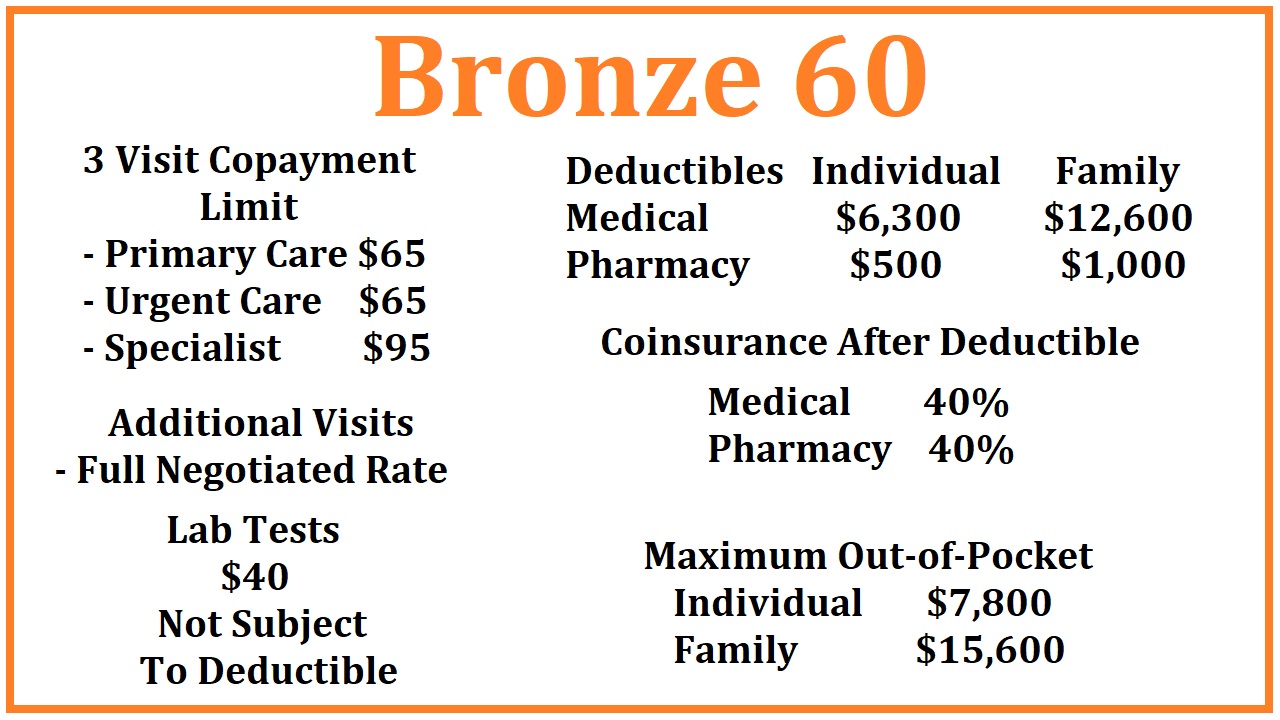

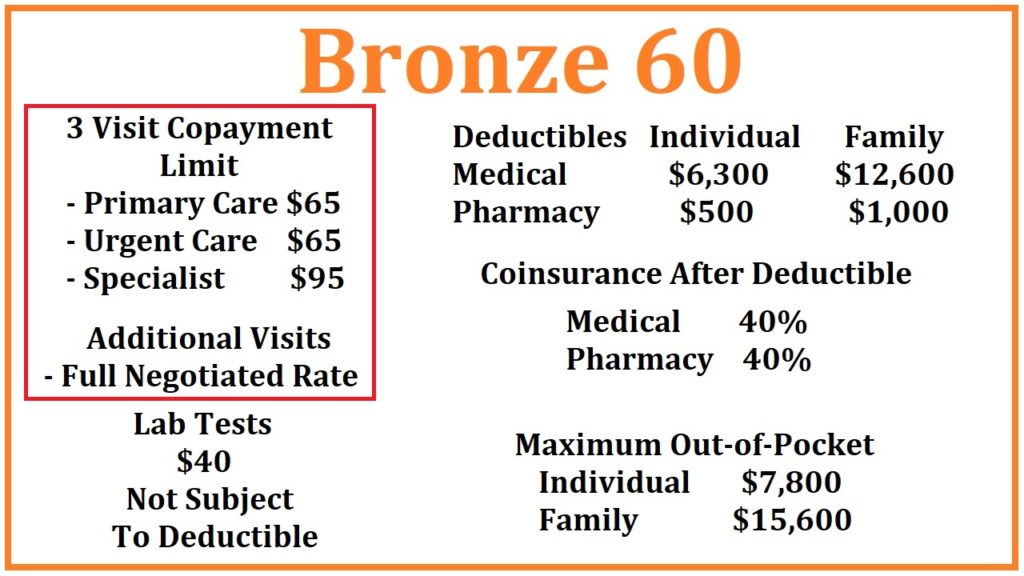

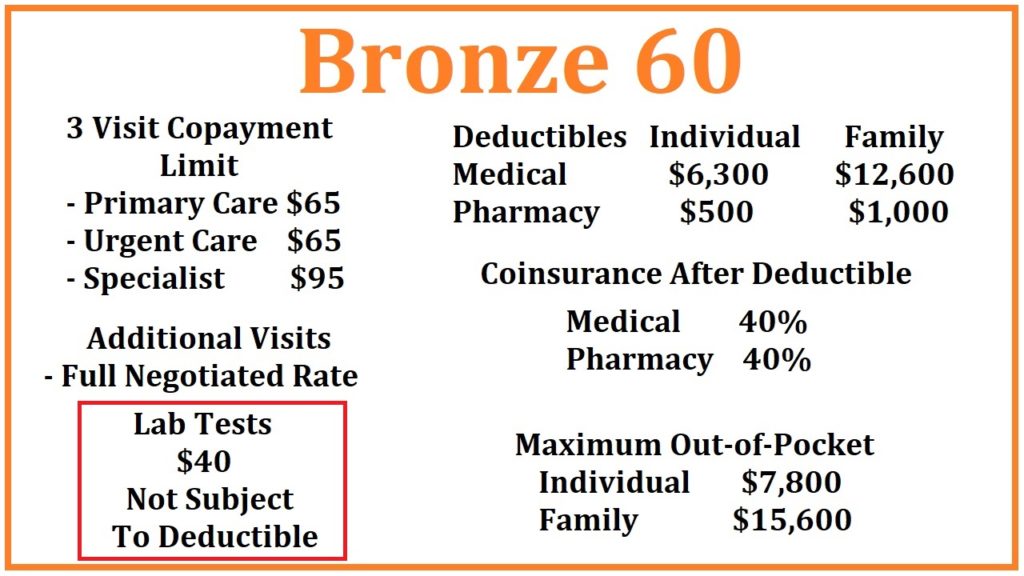

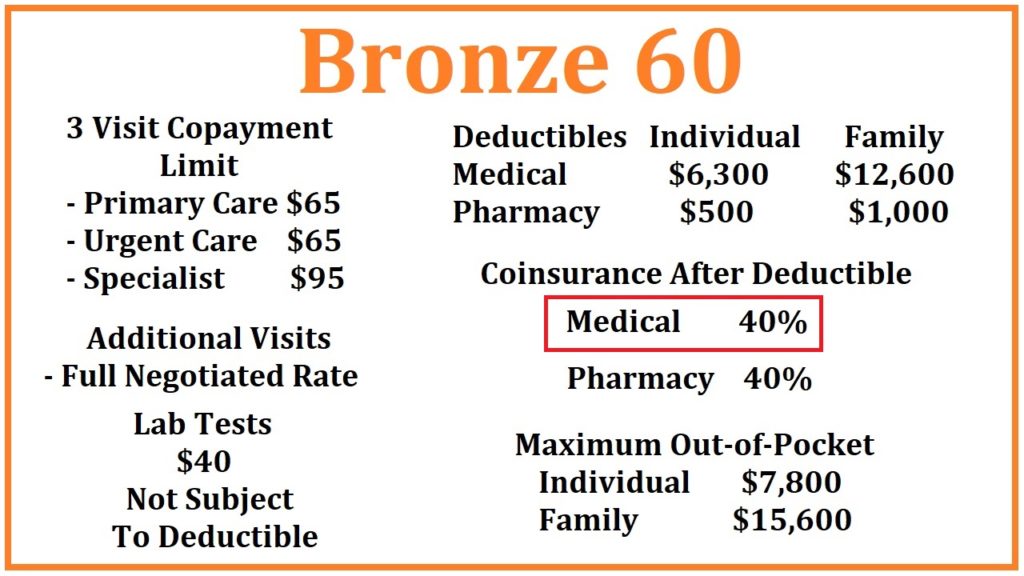

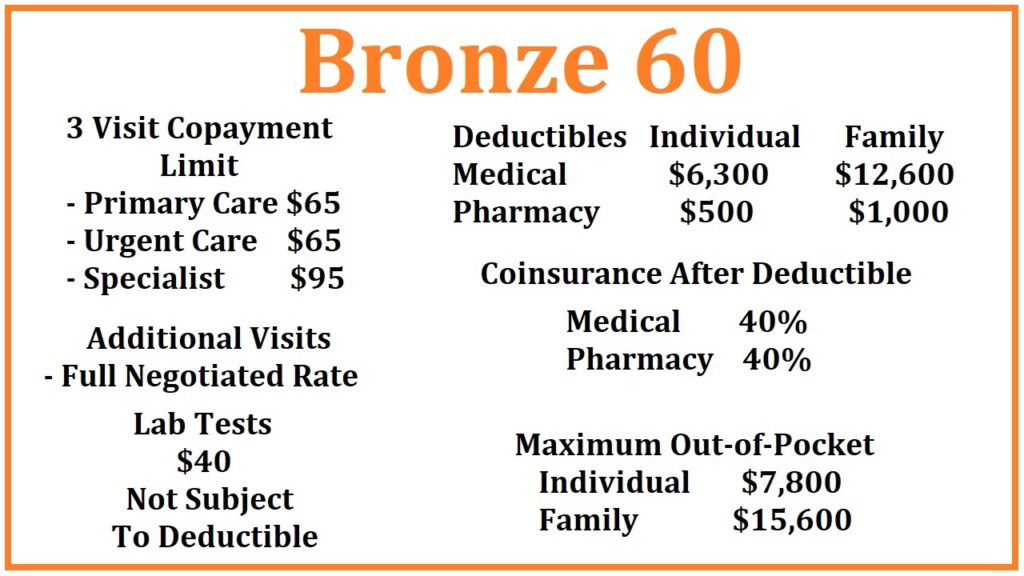

Bronze 60 for 2020

Office Visits

There are 3 health care visits at a set copayment amount in the Bronze 60 plan: Primary Care Visits at $65, Urgent Care at $65, and a Specialist visit at $95. Once you have had 3 of these health care visits, in any combination, you then pay the full negotiated rate for the next and additional visits. For example, you go to Urgent Care for a rash (1st visit), then see your Primary Care Physician for a follow up (2nd visit), who then refers you to a Specialist (3rd visit), you have used your 3-visit allowance. The next office visit will be at the full negotiated rate for that provider as established between the health plan and the physician.

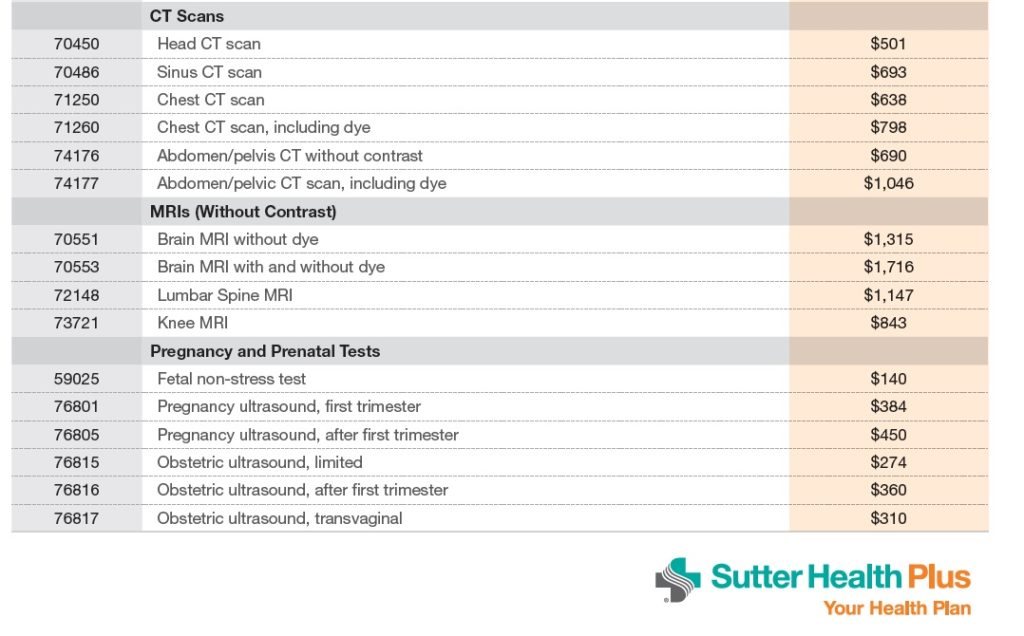

Some of the health plans have published fee schedules for the cost of some of their services. If you had to see your Kaiser doctor for a 4th visit, under their 2019 fee schedule, a level 2 visit would cost $85 in Northern California, $75 in Southern California. If the doctor performs a therapeutic service such as cleaning wax out of your ears or removing a pre-cancerous skin deformity, that service may entail an extra charge beyond the diagnostic office visit.

Labs

Under the Bronze 60 plan, laboratory tests are $40 not subject to any deductible. This means you will only pay $40 for most lab tests. Some tests fall outside the normal and routine testing and may cost more. Otherwise, you can get as many lab tests as you need under the Bronze 60 plan at the $40 copayment.

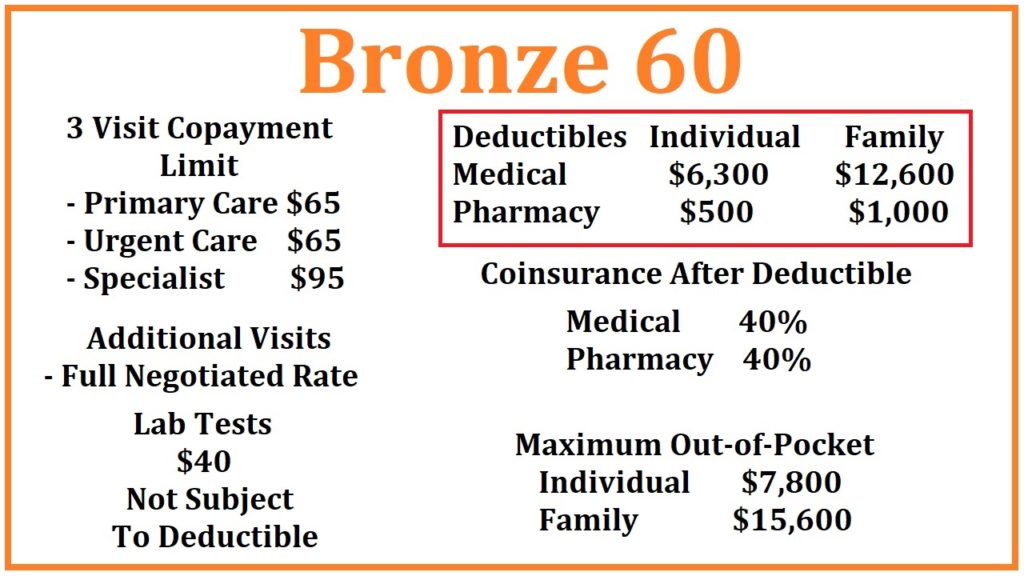

Deductibles

The Bronze 60 has two categories of deductible: medical and pharmacy.

Medical Deductible

Aside from the 3 health care visits and labs outlined above, all other health care services are subject to a $6,300 medical deductible. This means you pay the full negotiated rate for the health care services until you have met a plan member responsibility for an individual of $6,300. Health care services subject to a medical deductible were obtained from the Kaiser Permanente and Blue Shield of California Summary of Benefits

Some of the services subject to the deductible include:

- Ambulance rides

- Dialysis

- Diabetic equipment and supplies

- Diagnostic imaging: x-rays, MRIs, CT scans, etc.

- Doctor, Specialist, Urgent Care, visits after the first three visit combination

- Durable medical equipment

- Emergency room services

- Home health care and Skilled Nursing Facilities

- In-patient hospitalization

- Mental health out-patient and in-patient services

- Outpatient surgery and treatment

- PKU product formulas and special foods

- Rehabilitative therapy

Once the medical deductible of $6,300 has been met, you go into 40% coinsurance. This means that the next dollar of health care services is shared; you pay $0.40 and the health plan pays $0.60 up to the maximum out-of-pocket amount of $7,800. After you have met your maximum out-of-pocket amount, the health plan pays 100% for all covered services, drugs, and equipment.

Emergency Room visits for a life-threatening medical condition will be treated as in-network by all California health plans regardless of what hospital you are taken to anywhere in the United States.

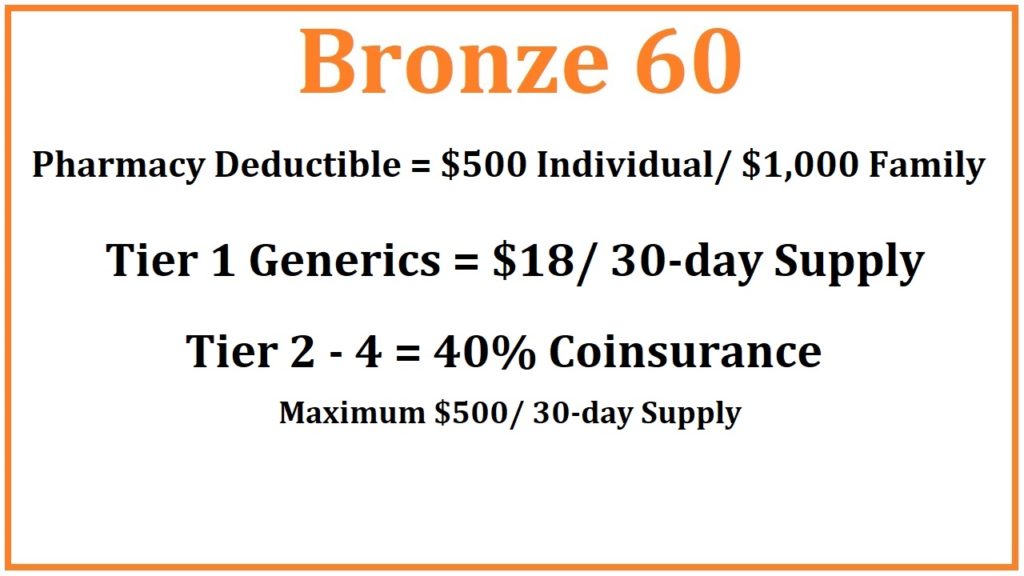

Pharmacy Deductible

The Bronze 60 plan also includes a pharmacy deductible. You must spend $500 at a retail pharmacy before the benefits are triggered. Once you spend $500 on prescribed medications, Tier 1 generic drugs are $18 for a 30-day supply. All other drugs in the health plan’s drug formulary are 40% coinsurance capped at $500 for a 30-day supply.

For example, let’s assume you are prescribed a drug that costs $600 per month. In the first month you have met your pharmacy deductible. The next month you will pay 40% of the drug cost or $240. If the drug has an over the counter retail cost of $1,500, you would only be responsible for $500 per month, even though the 40% coinsurance equals $600.

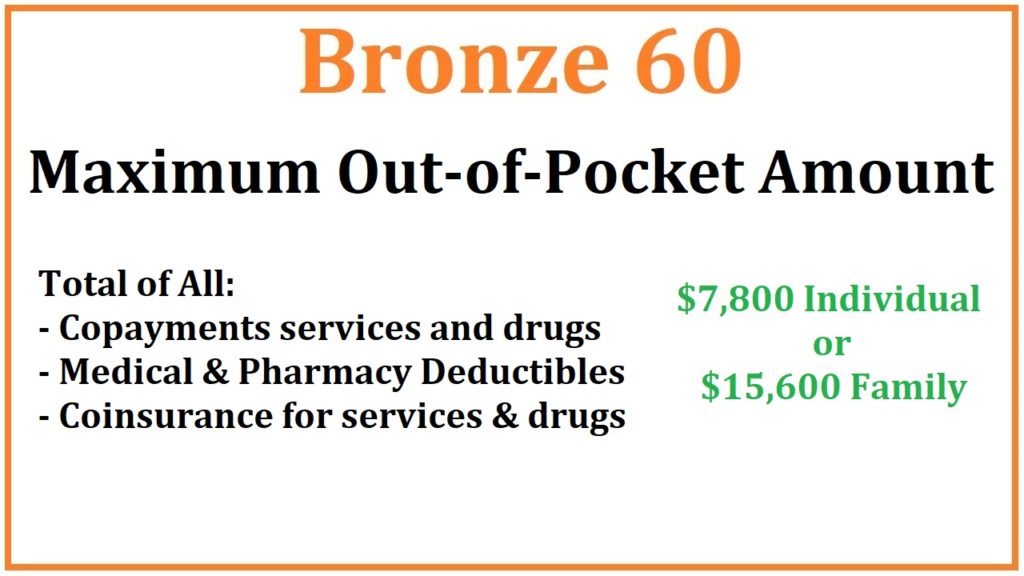

Maximum Out of Pocket Amount, all of the

- copayments for the office visits, labs,

- medical deductible,

- 40% coinsurance for medical services,

- pharmacy deductible,

- drug copayments and

- coinsurance

accrue toward meeting your maximum out-of-pocket amount. When all of your medical and pharmacy costs equal $7,800, the maximum out-of-pocket has been met and the health plans covers the rest of the in-network expenses 100%.

Bronze plans are your basic catastrophic medical insurance plan. If you want a health plan that covers routine health care and prescription drug benefits, with predictable copayment amounts, you need to consider a Silver, Gold or Platinum plan.

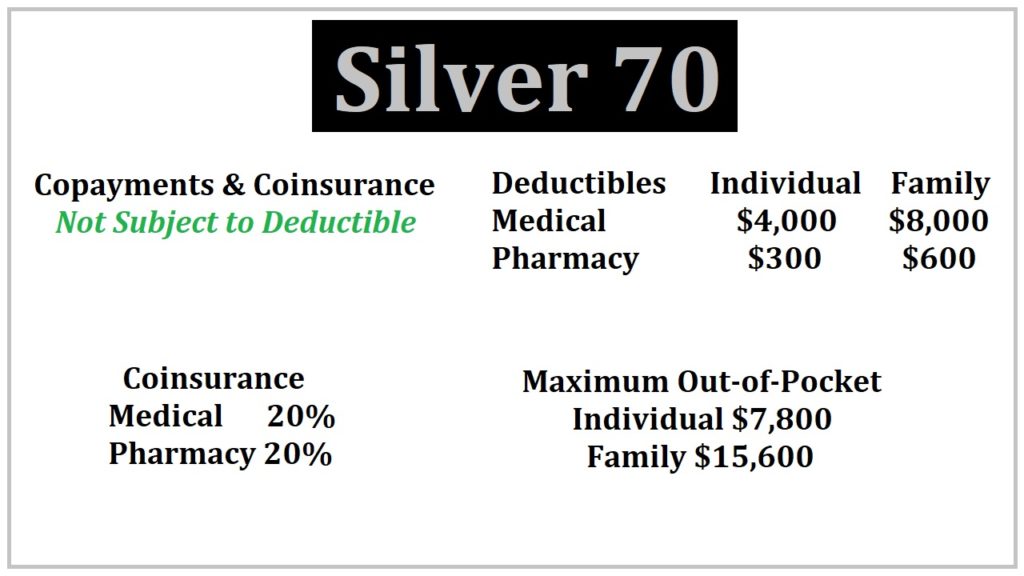

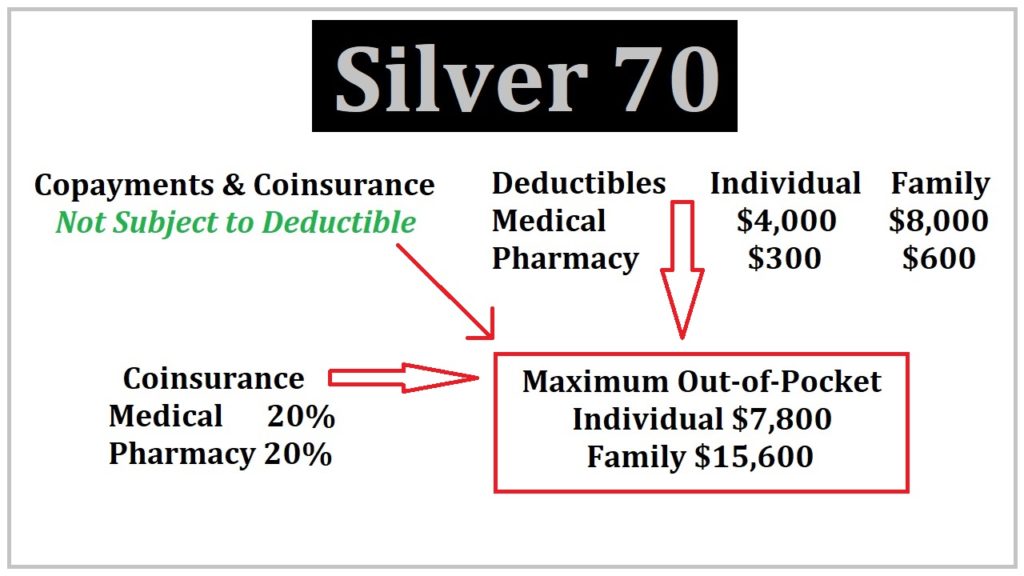

Silver 70 for 2020

As opposed to the Bronze 60 plans that had a limited number of office visits at a set copayment amount, there are generally no limits on services that have a specified member copayment for Silver plans. First, Silver copayments for health care services are not subject to any medical deductible. As soon as the health plan is effective, your cost for a variety of services is a set copayment.

- Ambulance rides $250, $5 higher for off-exchange plans

- Emergency Room $400, waived if admitted to the hospital, in which case, those in-patient costs are subject to the medical deductible

- Imaging: MRI $325

- Laboratory Test $40

- Office Visits for your Primary Care Physician $40

- Specialist Visit $80

- Urgent Care $40

- X-rays, Diagnostics tests like an ultra sound $85

Office visits- Let’s say you are having trouble hearing. If you visit your primary care physician, the office visit will be $40. If the Primary Care Physician refers you to an Ear, Nose, and Throat Specialist, that copayment will be $80. If the Primary Care Physician or the specialist refers you to an audiologist for a hearing test, that visit could have a $40 copayment. However, some diagnostic tests, such as those involving heart monitoring, could fall under the $85 copayment for diagnostic tests.

The important part to understand is that all those visits and tests are not subject to the medical deductible. The costs do accumulate toward meeting your maximum out-of-pocket amount.

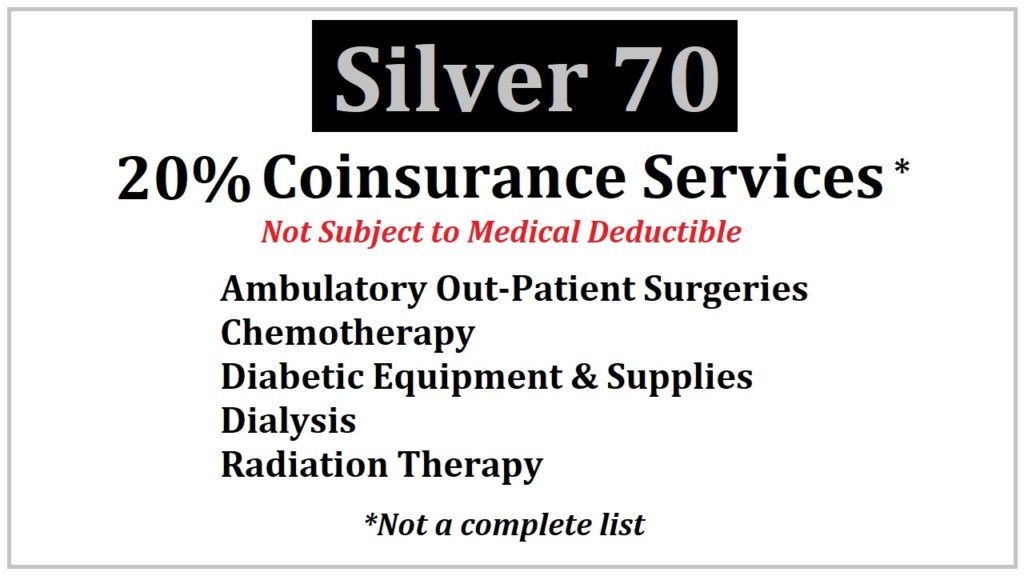

There are many services that have no set copayment, but are subject to a coinsurance member responsibility. The coinsurance percentage for the Silver 70 plan is 20 percent. For instance, male sterilization and the termination of a pregnancy have 20 percent coinsurance, not subject to the medical deductible. Other services subject to 20 percent coinsurance are:

- Ambulatory outpatient surgeries,

- Diabetic equipment and supplies

- Dialysis,

- Durable medical equipment

- Radiation therapy and Chemotherapy

are subject to 20 percent coinsurance, but not the medical deductible.

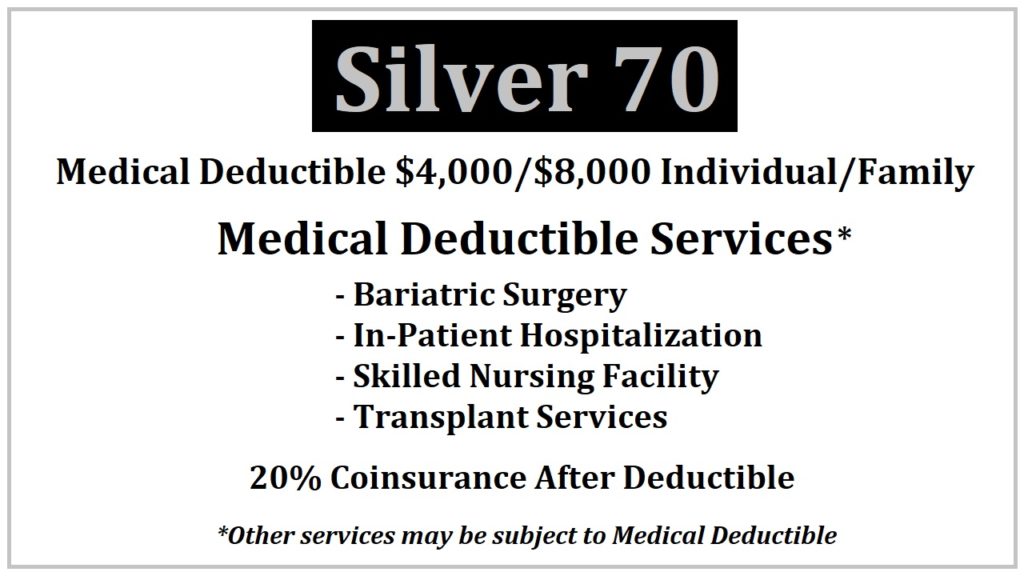

Medical Deductible

Health care services subject to the $4,000 medical deductible of the Silver 70 plan include:

- Bariatric surgery

- In-patient hospitalization

- Skilled nursing facility and

- Transplant services

Once you have accumulated $4,000 in costs, you go into coinsurance of 20% for the next dollar over $4,000 for these services.

When all of the copayments, deductible, and coinsurance equals the maximum out-of-pocket amount of $7,800 (the same as the Bronze 60 plan) the health plan covers all in-network services and prescription medications at 100%.

But as you can see, there are far more services with a specified copayment or coinsurance percentage, not subject to the deductible, than health care services subject to the medical deductible. It’s possible to meet your maximum out-of-pocket amount without ever meeting the medical deductible.

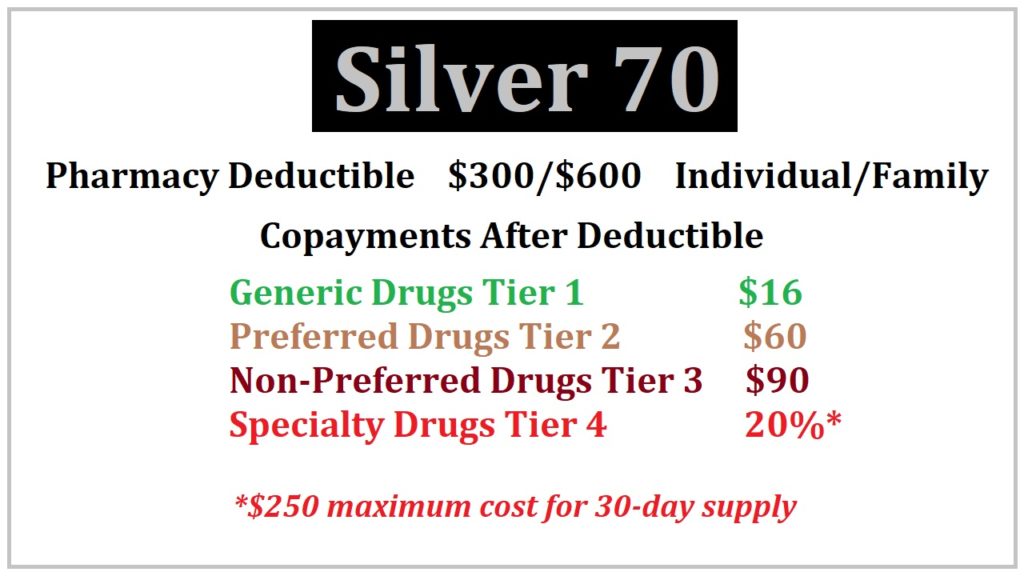

Pharmacy Deductible

The Silver 70 plan also includes a pharmacy deductible of $300. The pharmacy deductible is the over the counter retail cost of your prescription medications before the tiered copayment structure is triggered. For some people who only have generic medications, they may never meet the pharmacy deductible. For other individuals with high cost brand name drugs, they may meet the pharmacy deductible in the first month.

For example, let’s say you are prescribed a drug that has an over the counter cost of $150 for a 30-day supply. After two months of purchasing the drug at a retail pharmacy, you have met your pharmacy deductible for the year ($150 x 2 = $300). If the medication is a tier 2 preferred drug, the monthly cost will drop to the $60 copayment for a 30-day supply. If you are prescribed a really expensive drug, usually in the tier 4 specialty drug category, once you have met the pharmacy deductible, the drug cost will be capped at $250 per month.

For instance, you are prescribed a drug that is $1,500 for a 30-day supply. The tier 4 coinsurance after the deductible is 20 percent of the retail cost. But 20 percent of $1,500 is $300. The most you would pay is $250 under the Silver 70 plan.

All of the copayments, deductibles, and coinsurance dollar amounts accumulate toward meeting your maximum out of pocket amount of $7,800. Once you hit $7,800, the health plan covers the rest of the in-network claims at 100%.

Enhanced Silver Plans 73, 87, & 94

Through Covered California, individuals and families can qualify for Enhanced Silver plans with cost-sharing reductions (CSR). You cannot buy one of these plans. They are awarded to the household based on the estimated Modified Adjusted Gross Income. The benefit structure is exactly like the Silver 70 plans but most or all of the member cost-sharing, from deductibles, copayments, coinsurance, and maximum out-of-pocket amounts are lower than the Silver 70.

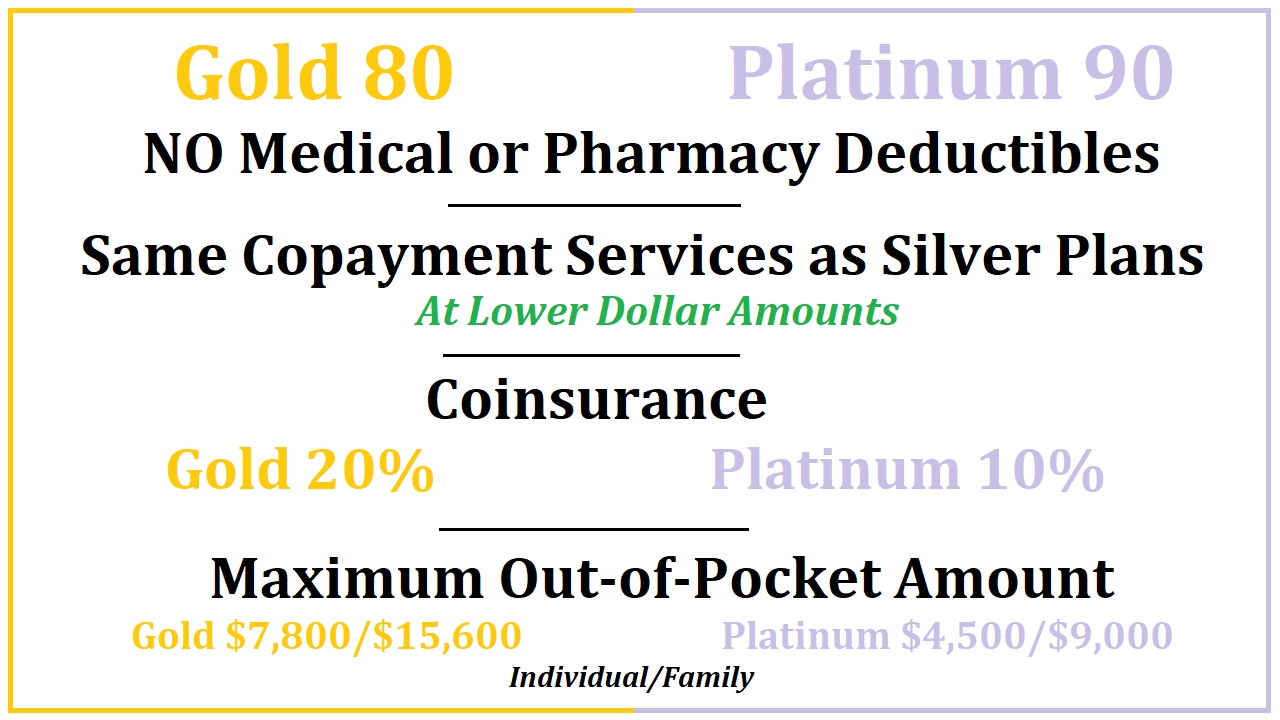

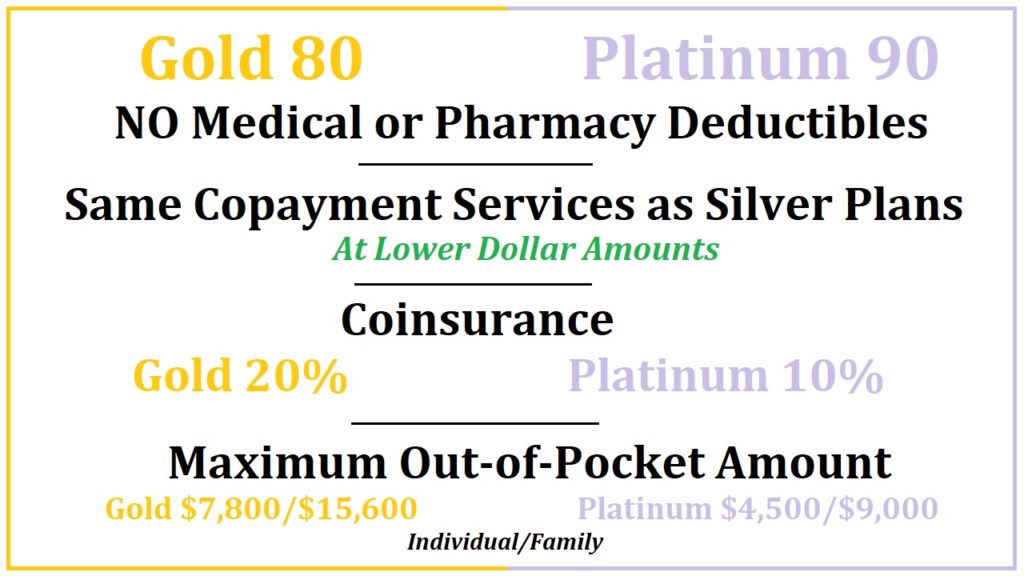

Gold 80 and Platinum 90 for 2020

The Gold and Platinum plans have a similar member cost-sharing structure as the Silver 70 plan, but without any deductibles. All of the copayments for a menu of health care services are less than the Silver 70 plan. For example, to see a Specialist with the Silver 70 plan the copayment is $80. For the Gold 80 plan the copayment is $65 and for the Platinum plan it is $30.

Because there is no medical deductible, if the health care service does not have a specific copayment amount attached to it, you pay the plans coinsurance percentage. For the Gold 80 plan the coinsurance is 20% and for the Platinum plan it is 10%.

For prescription medications, you go straight into a set copayment for drugs in tiers 1 through 3. The Gold 80 plan has 20 percent coinsurance for tier 4 specialty drugs and the Platinum 90 has 10 percent coinsurance. Like the Silver 70 plan, tier 4 specialty drugs for a 30-day supply is capped at $250.

Everything a member pays for health care services and drugs accumulates toward the maximum out-of-pocket amounts. For the Gold 80 plan the maximum out-of-pocket is $7,800 and for the Platinum 90 it is $4,500.

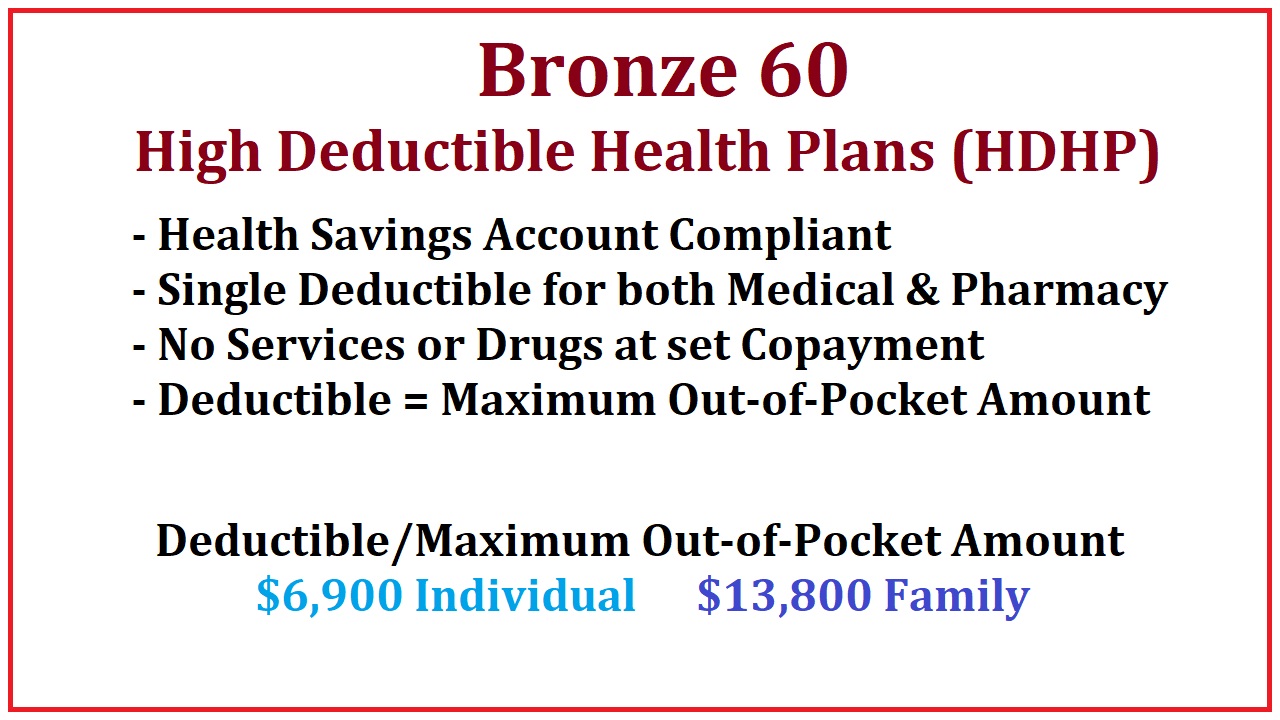

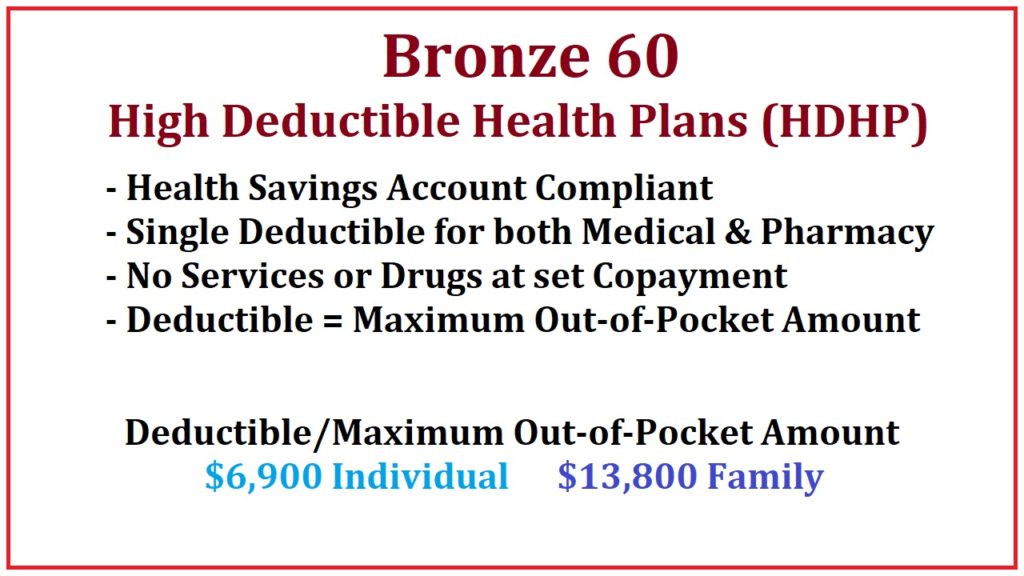

Bronze 60 High Deductible Health Plans

For 2020, Covered California devised a new member cost-sharing structure for the High Deductible Health Plans (HDHPs). These plans are Health Savings Account compliant. There is only one deductible for the Bronze 60 HDHPs that includes both medical and pharmacy benefits. There are no services subject to a set copayment amount.

The single deductible is equal to the maximum out-of-pocket amount. Therefore, once you have met the deductible, you have met the maximum out-of-pocket amount and all services are covered at 100% from that point forward. The Deductible/Maximum Out-of-Pocket is $6,900 for an individual for a calendar year.

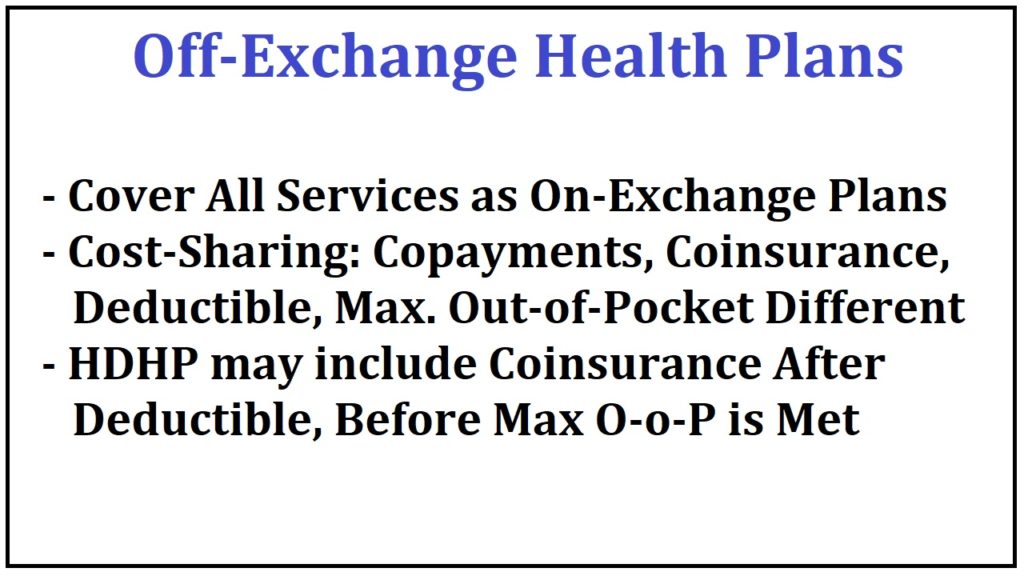

Off-Exchange Health Plans

All of the health plans offered through Covered California are also offered off-exchange, direct from the carrier with no subsidy. Several of the carriers offer additional plans that have slightly different benefit designs relative to the member cost-sharing. Most of these non-standard benefit design off-exchange plans are in the Bronze and Silver category, with a few alternatives in the Gold plan types.

All of the same services are covered in off-exchange plans as those offered through Covered California. Only the member cost-sharing designs will be different. Just like the standard Covered California plans, all of the member cost-sharing for copayments, deductibles, coinsurance, and drug costs accumulate toward meeting the maximum out-of-pocket of these plans.

The off-exchange High Deductible Health Plans also work the same way. You must meet the deductible before either the maximum out-of-pocket is met, OR, you go into a coinsurance percentage.

Even though all the plans have similar categories and member cost-sharing designs, there can be small, but significant differences between the health plans. It is just impossible to list every health care service and if it subject to a copayment amount or to a medical deductible. The best resource for narrowing down some of the expected health care costs and how they will be treated within the health plan is to read through the Evidence of Coverage document for the health plan.

But even the Evidence of Coverage cannot foresee how a health care service might be coded by the provider. For instance, earlier I talked about getting a hearing test for loss of hearing. The provider may code the hearing test as a simple diagnostic office visit subject to the regular Primary Care Office visit copayment. Other medical groups may treat the hearing test as a specialist office visit, at a higher copayment amount.

Regardless of how detailed the summary of benefits, along with the Evidence of Coverage documents may be, there is always room for unexpectedly higher costs with all health plans. But we know, that these higher costs, as long as they are received from in-network providers, will always accumulate toward meeting your maximum out-of-pocket amount.

Hopefully, this more detailed view of how the California health plans operate has answered many of your questions. If you have additional questions, please feel free to reach out to me.

Gallery of images from the video explaining the basics of the California individual and family health plans for 2020.