While the health insurance companies calculate your monthly health insurance rate based on your age and where you live, the Silver plans strongly influence your monthly health insurance premium through Covered California. Specifically, the subsidies through Covered California are based on making the second lowest cost Silver plan (SLCSP) affordable, regardless of what you plan you select. Across California, some families are winners and some are losers in the Silver plan subsidy lottery.

For 2024, it appears that most Covered California consumers will not see much increase to their monthly premiums and many will see a decrease, even with getting a year older. Covered California uses the second lowest cost Silver plan offered to you to calculate your monthly subsidy. If the second lowest cost Silver plan rate increases more than your selected plan increased its rates, you get a larger subsidy to lower your premium.

Silver Plan Rate Benchmark for Subsidy Calculation

On the flip side, if the second lowest cost Silver plan rate increases only a small amount, and your selected plan’s rate increases quite a bit, your subsidy may be less than the prior year. Of course, the largest influence to the subsidy is your estimated income. However, if we assume the income is static, the consumer is one year older, we can begin to get a picture of how the second lowest cost Silver plan influences the health insurance premiums for 2024.

California is broken up into 19 different rating regions for health insurance. I’ve chosen 9 counties to apply predefined consumer profile to review the second lowest cost Silver plan changes between 2023. In 2023, the profile of the consumer was 40 years old with an estimated income of $50,000. In 2024, the income remains the same but the consumer is one year older at 41. The rate increase between 2023 and 2024 accounts not only for the universal inflation increase that the health plans implements, but also the rate increase for getting one year older. The age related increase can be between 2 to 5 percent for most ages.

Consumer Responsibility Percentage and Federal Poverty Level

There is a modest increase to the subsidy based on the increased federal poverty level (FPL) if the income remains the same. In 2023, based the published 2022 FPL, an income of $50,000 translates into a consumer responsibility for health insurance of 8.2 percent. For 2024, with an inflation adjusted FPL published in 2023, the same income has a consumer responsibility of 7.08 percent of the household income. For this 41-year-old consumer with a $50,000 income, the higher FPL results in a $50 to $120 subsidy boost to lower the monthly health insurance premiums.

California County Comparison of Subsidies and Silver Plans

Because the age and income are static for the consumer throughout the different counties compared, the health insurance premium for the SLCSP in 2023 was $320.58. For 2024, the SLCSP premium decreases to $294.72, a direct result of the FPL increasing while the consumer income remains the same and the consumer responsibility percentage for health insurance deceased.

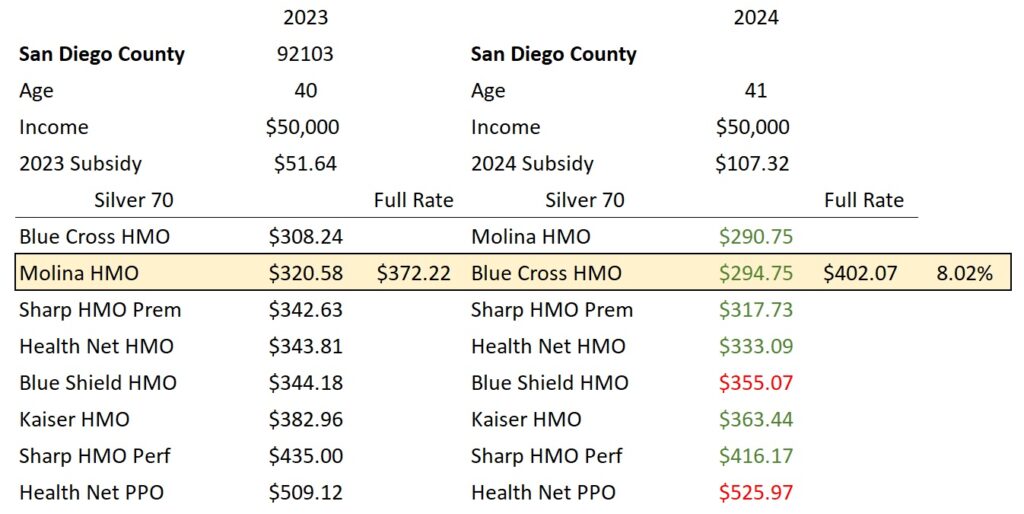

San Diego County

In San Diego County for 2024, the Blue Cross HMO displaced the Molina HMO to become the SLCSP with an 8.02 percent increase. The Blue Shield HMO, PPO, and Health Net PPO had larger rate increase making the monthly premium increase greater than the 2023. Other plans offered decreased for the 41-year-old consumer.

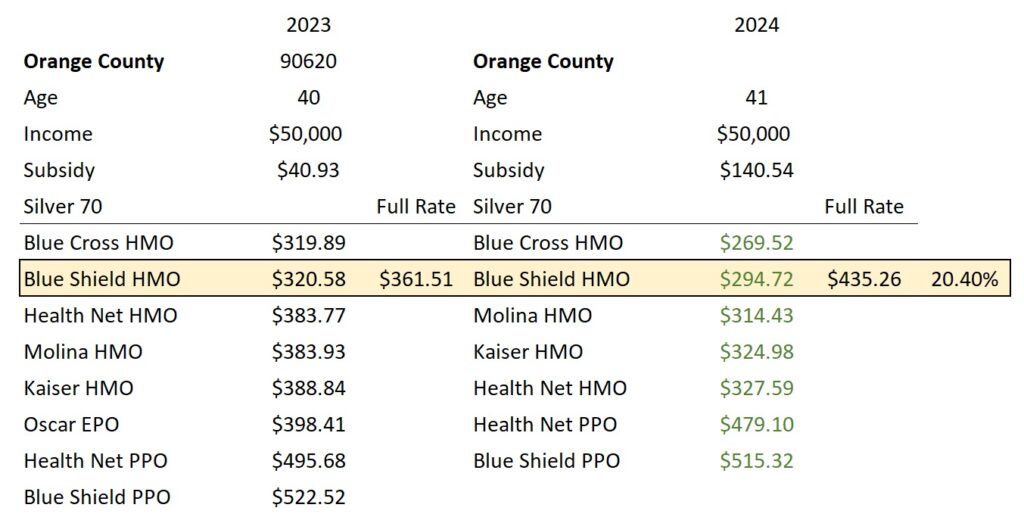

Orange County

The Blue Shield HMO, the SLCSP for both 2023 and 2024, had a healthy 20 percent for 2024 in Orange County. Because the Blue Shield HMO had such a large rate increase, while still maintaining the SLCSP position, all of the health plans offered to the 41-year-old with the $50,000 income saw the monthly premiums decrease in 2024.

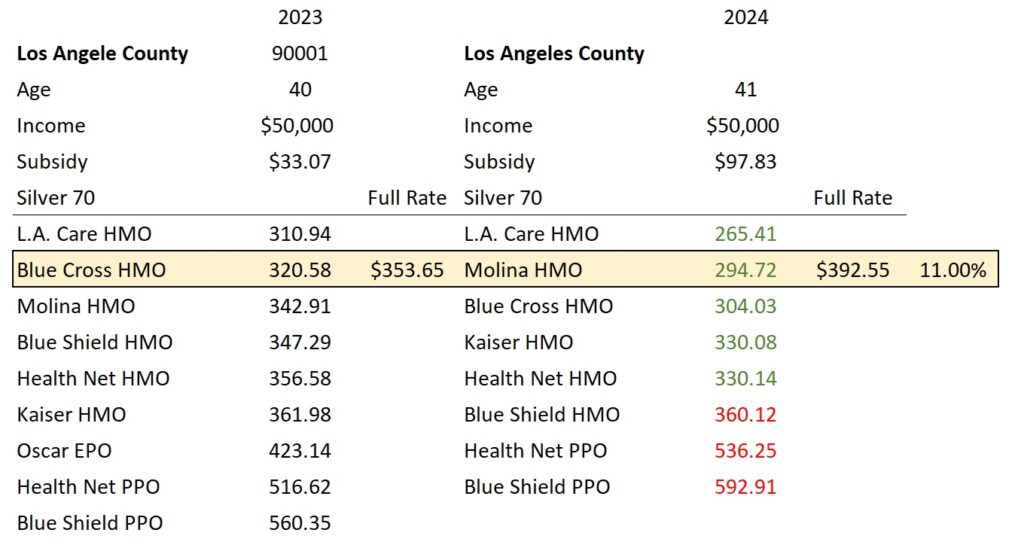

Los Angeles County

Los Angeles County consumers were not as fortunate as Orange County as the SLCSP increased 11 percent. The Blue Shield HMO, PPO, and Health Net PPO plans had larger rate increases than the 2024 SLCSP Molina HMO in 2024. Consequently, consumers in those plans did not an increase in subsidy commiserate with the increase in their plan rates, resulting in a modest monthly premium in 2024.

Northern California health insurance rates can be considerably higher than Southern California. Note that the SLCSP in Los Angeles for 2024, Molina HMO, is 45 percent lower than the SLCSP of Santa Clara County. The monthly subsidies are also larger to make the SLCSP a certain percentage of the household income.

The health insurance premiums of all of the second lowest cost Silver plans for a 41 year old with an estimated annual income of $50,000, regardless of county, is $294.72.

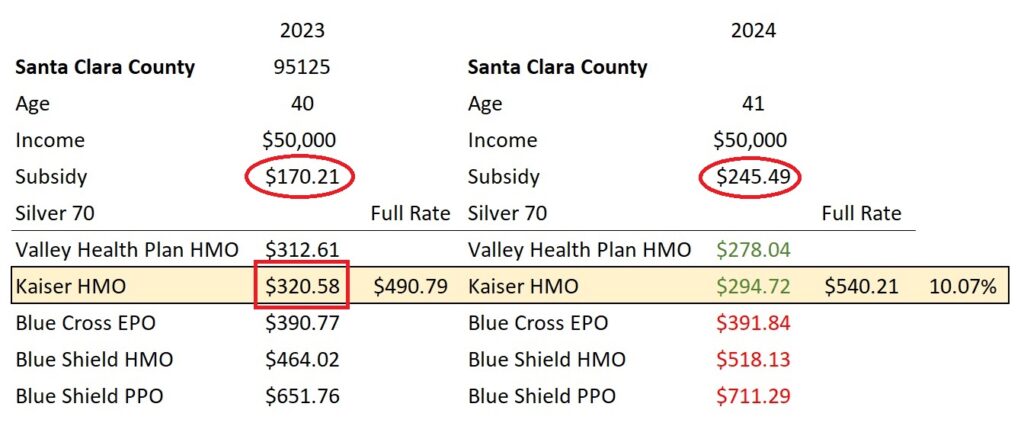

Santa Clara County

Kaiser HMO maintained the SLCSP position with a rate increase of 10 percent. Unfortunately, the Blue Cross EPO, Blue Shield HMO, and PPO plans had larger rate increases than the Kaiser plan. The subsidy in Santa Clara County did not keep pace with those higher rates. The result is consumers in plans above the SLCSP will have an increase in the monthly health insurance premium with the same estimated income between 2023 and 2024.

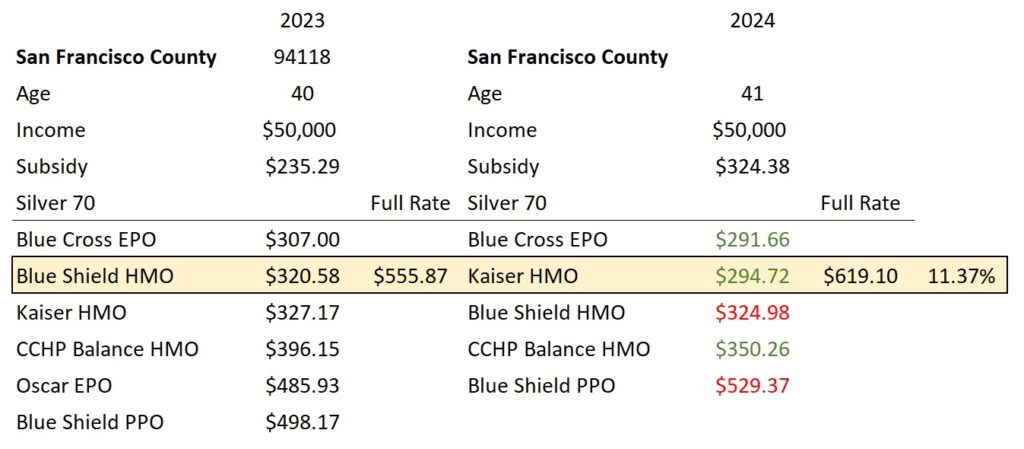

San Francisco County

The Blue Shield HMO had been the SLCSP in 2023 in San Francisco. Because the Kaiser HMO plan had rate increase less than the Blue Shield HMO, Kaiser became the SLCSP for 2024 with a 11.37 rate increase. The Blue Shield HMO and PPO plans will be higher in 2024 while the CCHP Balance plan will have slight decrease over 2023 for this consumer.

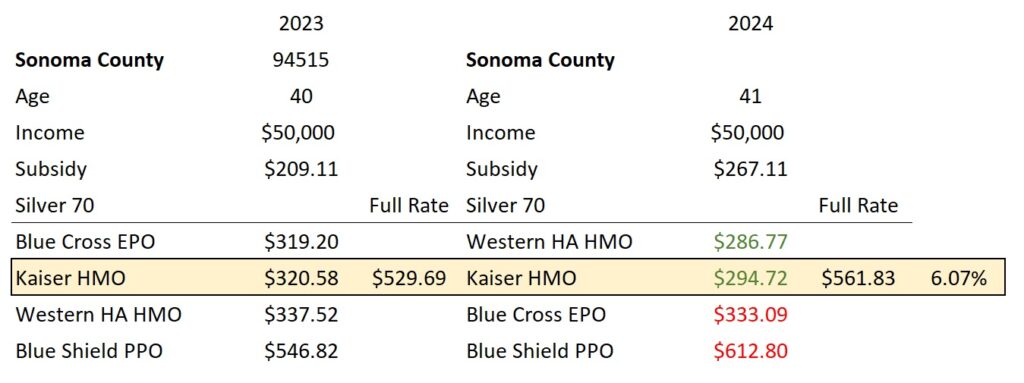

Sonoma County

Kaiser HMO, the SLSCP for 2023 and 2024 in Sonoma County, had a rate increase of 6.07 percent. The Blue Cross EPO and Blue Shield PPO plans had larger rate increases resulting in higher premiums for 2024. It is interesting that the Western Health Advantage HMO went from the third most expensive Silver plan in 2023 to the least expensive Silver in 2024 in Sonoma County. Western Health Advantage just did not have the larger rate increases associated with the other carriers.

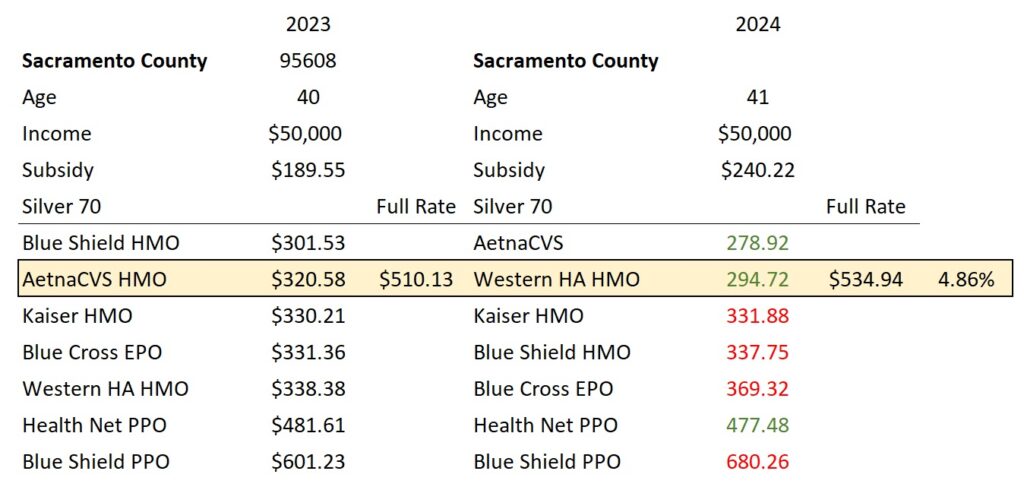

Sacramento County

Western Health Advantage’s relatively low rate increase of 4.86 percent made it the SLCSP in Sacramento County for 2024. This modest rate increase on the part of Western Health Advantage meant that the plans offered by Kaiser and Blue Shield will higher in 2024. Health Net PPO plans will realize a small premium decrease for this consumer.

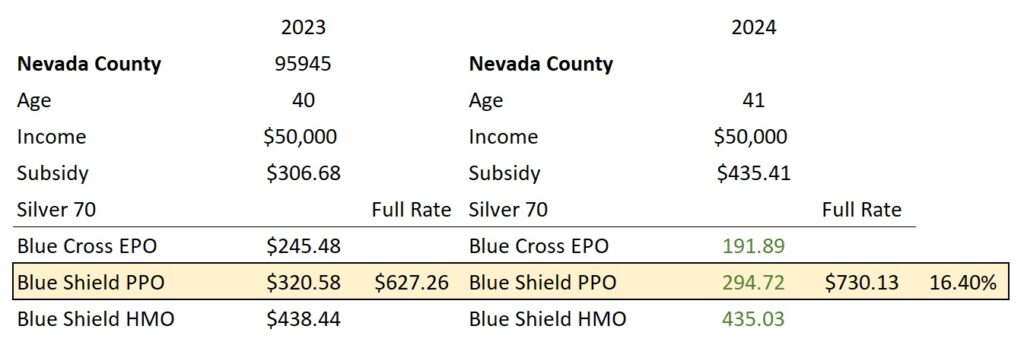

Nevada County

The relatively expensive Blue Shield PPO has been the SLCSP in Nevada County (Region 1) for several years. This means that consumers in the Blue Cross EPO and Blue Shield HMO benefit from the hefty rate increase of 16.4 percent for the Blue Shield PPO. All consumers should see their health insurance premiums remain stable or decrease in 2024 in this region.

Overall, the rate increases for 2024 have resulted in larger subsidies for consumers dampening any shocking monthly premium increases for most consumers. As the comparison review illustrates, there are some regions where the subsidy did not increase very much because the second lowest cost Silver plan did not increase much in the rate. Those consumers will experience larger than normal monthly premiums relative to individuals and families in other parts of California.