Health insurance plans are confusing. They are also more personal than other insurance products such car and home insurance. In order to narrow down your health plan options, you can use a filtering system. The plans that don’t meet your criteria or conditions are tossed so you can focus on specific plans and benefits.

Doctor and Hospital Filter

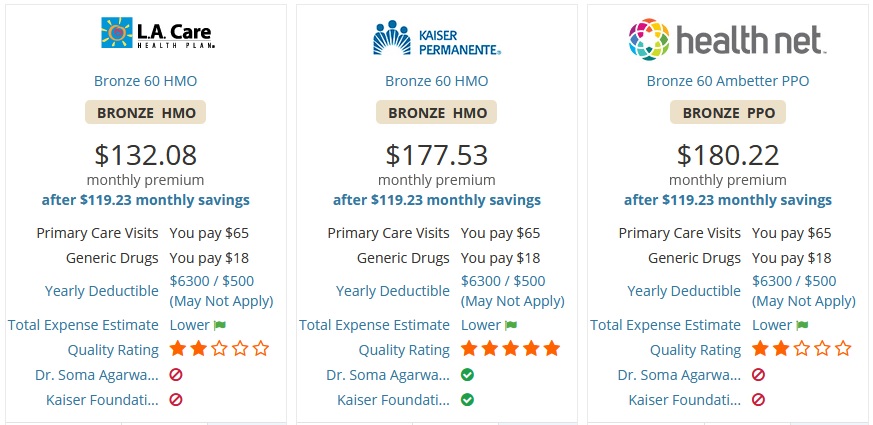

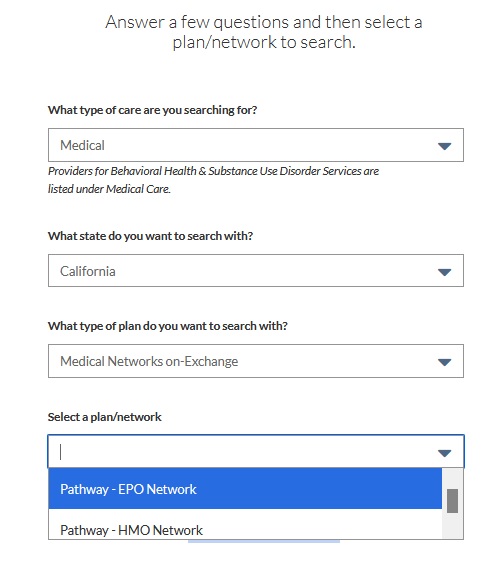

All health plans have a network of doctors and hospitals. If you want to potentially visit a specific doctor, you will want to filter out health plans who don’t have that doctor in-network. The two ways to determine if a doctor is in-network with a health plan is search for the doctor through the Covered California website and also on the health plans website. You can also call the doctor’s office to confirm network status.

When calling the doctor’s office, just be aware that there are multiple types of health plan networks (individual and family, small group, large employer group, Medicare, Medi-Cal) that the doctor may participate in. In addition, there are different plan types (EPO, HMO, PPO) and many people get confused. You may be told that the doctor accepts XYZ health plan, but it may only be for the PPO plan, not the HMO being offered to you.

Consequently, it is always best to check the health plan’s website for the contracted network status of a doctor or hospital. Similar to calling the doctor’s office, you need to be careful that you select the correct type of plan when performing the provider search. Another hurdle is that mental health providers are usually listed on a separate website for the health plan.

Prescription Filter

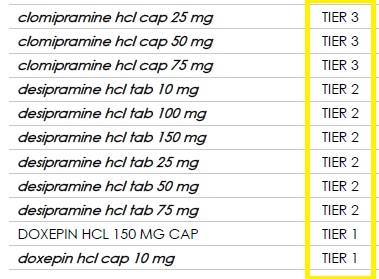

If you are taking prescription medication, you’ll want to consult the drug formulary of the health plans. While most health plans cover many generic drugs, some brand name drugs may not be covered. If the plans you are considering both include your medications, you’ll still want to learn the drug tier of your prescription. Some plans may list a brand name drug in tier 2 and another plan may have it assigned to tier 3. The difference is how much you pay for the drug every month. You may want to give more weight to a health plan that includes your drugs and the lowest member cost-sharing drug tier.

Plan Type: EPO, HMO, PPO

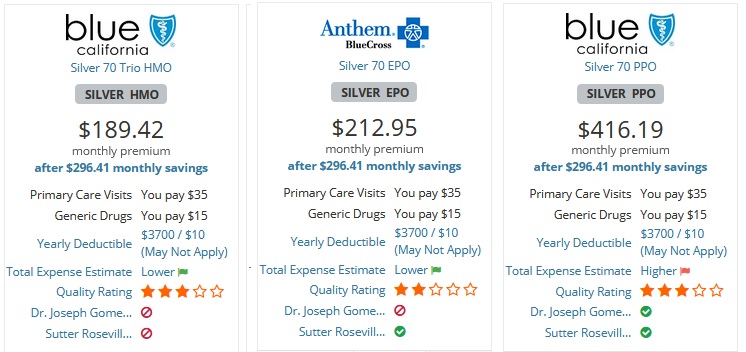

The different plan types have varying amounts of flexibility in seeking health care and the associated costs. EPO (Exclusive Provider Organization) plans allow you to visit most doctors in their network without a referral from a Primary Care Physician. With an EPO, there is no out-of-network coverage. If you see a provider who is not in their network, excluding emergencies, the plan will never cover any of the cost.

HMO (Health Maintenance Organization) plans require you to specify a Primary Care Physician (PCP.) The PCP is the gate keep for your health care and order must make referrals to any specialists you would like to visit. Like the EPO, there is no out-of-network coverage except for emergencies.

PPO (Preferred Provider Organization) plan allow you to make an appointment with most doctors in their network. You don’t necessarily need a referral from a PCP. There can be coverage for out-of-network health care costs after you meet an out-of-network deductible, which is usually several thousand dollars. After the out-of-network deductible is met, PPO plans will usually cost-share 50 percent of the allowable for the health care service. However, because the out-of-network deductible is so high and the cost-sharing so low, you really don’t want to go out-of-network if at all possible.

Sometimes you don’t have an option in regards to the specific plan type. If you have a strong preference for one plan type over another, you can filter out those plans you don’t want. If an EPO and PPO plan are offered that both include your doctors, and you prefer PPO plan, you can remove the EPO plan from your consideration.

Metal Tier Filter

Asset Protection

Health insurance, at a basic level, is asset protection similar to car, life, and home insurance. Most health plans have an annual maximum out-of-pocket amount that limits your liability to outrageous health care bills in the event of an accident or sudden illness. Once the maximum out-of-pocket amount is met, the health plan covers all in-network health care expenses for the rest of the year.

In California, most individual and family plans off-exchange or through Covered California will have maximum out-of-pocket amount of between $4,500 and $8,200. If all you want or need is just basic asset protection, you can focus on Bronze plans that have an $8,200 maximum out-of-pocket amount. Because these plans will cover you if you have a life-threatening emergency anywhere in the United States, regardless of the hospital, you are protected from astronomical emergency room care if you have an accident skiing in Vermont.

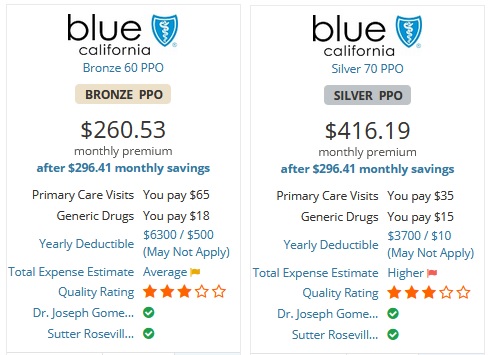

You may have narrowed down your plan choice to one or two carriers. Individuals who have no health challenges, and none are foreseen in the immediate future, will lean toward a Bronze plan. If you or a family member takes regular prescription medications, you will want to seriously consider a Silver plan. Silver, Gold, and Platinum plans have prescription drug coverage with set copays for different drug tiers. Bronze plan will cover drugs, but generally offer no significant reduced member cost-sharing.

Consequently, even though Silver plans cost more, they may actually save money in the long run with the set lower copayments for prescription medications. Similarly, if you see a doctor on a regular basis to manage a chronic condition, a Silver, or higher metal tier level, may save money because of the set copayments for office visits. There are scenarios where the Gold and Platinum plans can save money also. You will need to carefully calculate the cost savings of the higher metal tier plans compared to the increased health insurance premium of the plans over a Silver plan.

At the end of the plan selection filtering process, you should only have a couple of different health plan to focus on. You can then dive into those plans and review the specific details, the premium rates, and determine which plan is best for you and your family.