Anthem Blue Cross will be closing most of their individual and family health plans in California for 2018.

When Covered California announced the individual and family health insurance rates for 2018 they also revealed that Anthem Blue Cross will be leaving the marketplace for most of California. This means that thousands of consumers must enroll in a different health insurance plan because Anthem Blue Cross will no longer be offering health plans in Southern California and large portions of Bay Area in Northern California. But with a little bit of planning and research, most consumers should be able to find an equivalent replacement to their current Blue Cross plan.

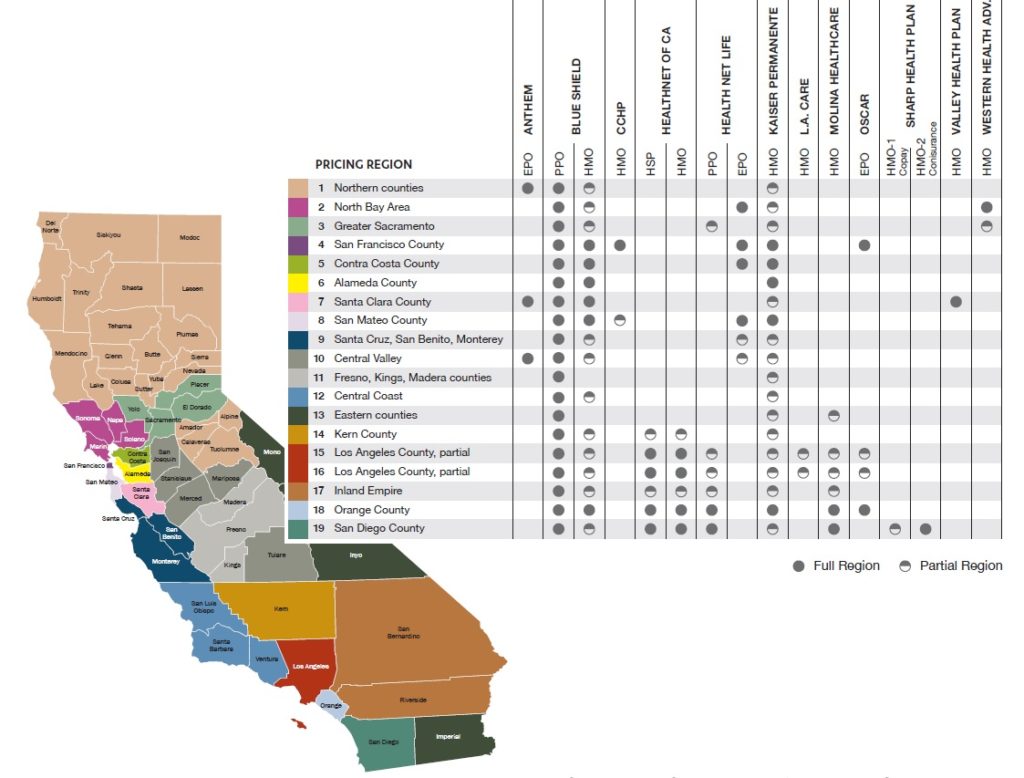

Anthem Blue Cross will continue to offer individual and family health insurance plans in the following regions and counties.

Region 1: counties: Alpine, Amador, Butte, Calaveras, Colusa, Del Norte, Glenn, Humboldt, Lake, Lassen, Mendocino, Modoc, Nevada, Plumas, Shasta, Sierra, Siskiyou, Sutter, Tehama, Trinity, Tuolomne, Yuba

Region 7: Santa Clara County

Region 10: counties: Mariposa, Merced, San Joaquin, Stanislaus

If you reside in any of the above counties you will be able to keep your EPO plan. If you reside in any other county, and you have an Anthem Blue Cross EPO or HMO plan, through Covered California or off-exchange, you will need to select a new insurance carrier for 2018. The exit of Blue Cross from the individual and family market does not affect employer group health insurance plans or their Medicare Advantage plans.

Some consumers may find their only option is Blue Shield because no other health plans are being offered in their zip code, even if the above map shows two or more plans being available.

Replacing A Closed Anthem Blue Cross Health Plan

Health insurance is only as good as the doctors, hospitals, and drugs that it covers. If a health plan doesn’t include any of the providers or prescriptions medications you need, then its only value may be the coverage for a catastrophic event such as a trip to the emergency department. Consequently, one of the first filters consumers who are losing their Blue Cross plan must consider is the network of providers for the plan offered.

Finding Providers

There are multiple ways to determine if specific doctors, hospitals, labs, and pharmacies are in-network for health plans.

- Check the health plan’s website. For HMO health plans the online provider directories are pretty accurate, but physician groups can change. For example, the UC Davis physicians group will no longer be available to Western Health Advantage (WHA) members in 2018. But WHA is adding the Canopy Health network for members in the North Bay for 2018.

- Covered California has also announced they will be providing a provider search tool through their website for 2018. They tried this in 2014 and it failed. Hopefully they have the bugs worked out of the previous version.

- Regardless of what the health plan or Covered California indicates shows as the in-network status of a provider, when in doubt, call the provider or check on the provider’s website.

Prescription Drugs

Each health plan publishes a list of prescription drugs they will cover called a drug formulary. Not all health plans cover the same brand name drugs. You will want to check each drug formulary to confirm if your drug is covered and at what tier level. One carrier may have your drug as Tier 2 and another insurance company may have it listed as Tier 3, or not cover it at all.

EPO, HMO, PPO

While most of Anthem Blue Cross’s plans in 2017 were EPO, they did offer some PPO plans in parts of California. EPO, or Exclusive Provider Organization, allows plan members to visit any doctor or provider in the health plans network, but there is no out-of-network benefits. If you visit or receive services from an out-of-network provider, and you are in an EPO, you will have to pay the full cost of the service and that amount will not accumulate toward meeting any deductible or maximum out-of-pocket amount.

Along with Blue Shield, Health Net will be offering a PPO through Covered California in certain parts of the state. Health Net will also be offering an off-exchange PPO plan that is reported to have a larger network of providers than the exchange version. But the off-exchange Health Net PPO plan is not eligible for any monthly tax credit subsidy to lower the monthly health insurance bill.

Even if you hate the idea of a HMO (Health Maintenance Organization) at least take a look at the plan and network. HMO’s can be less expensive than either an EPO or PPO health plan. Some even actually have pretty good networks of doctors and hospitals. With the money you save on premiums, you could consider visiting your favorite doctor a couple times a year as a private pay patient.

PCP Key To HMO

What you need to know about HMOs, other than Kaiser, is the Primary Care Physician (PCP) you select also determines most of the specialist you’ll be referred to. HMOs are made up of medical or physician groups. If you select a PCP with ABC medical group, that doctor will most likely refer you to an ABC specialist within that group. If the specialist you want to see is in XYZ medical group, you may not be able to see that doctor. There may only be one or two specialists within the medical group that might be located all the way across town. Even if the XYZ specialist is right down the street, you have to see the ABC specialist miles from your home because they are affiliated with your selected PCP.

It is important to know which medical group your select HMO PCP is with. You can then review the specialist in that network to determine if they have the doctors you need within a reasonable distance from your home or place of employment. Not all medical groups support all medical specialties like mental health or occupation therapy. In this case, the HMO will contract with yet another specialty medical group to supply those covered services. And like the medical group specialist that is two freeways and four surface streets away from you home, that other specialist you need may not be in your backyard.

With luck, you’ll be able to find an alternative health plan to Anthem Blue Cross that supports 100% of your doctors, hospitals and prescription medications. The greater probability is that you’ll find one health plan that includes 90% of your providers and another one that has 80% of the doctors you need. Then you will have to decide for the monthly health insurance premium which is the better bang for your money.

What Are The Alternative Health Plans?

But what if you hate all of the alternatives? I have clients who absolutely hate one or more of the carriers because of a really rotten past experience.

Blue Shield has had premium billing issues for years and every year they say they are addressing the problems – like a broken record. There are some indications that a major overhaul to the billing system will be happening in the future. Their billing problems, which only affect a small percentage of their individual and family membership, will either get better or worse.

Health Net has had some issues with customer service. Health Net was bought by Centene a major Medicaid health plan contractor. Time will tell if they add more customer service representative with more training. I noticed a big difference starting in 2016 with Health Net service. So the fingers are crossed that the improved service will continue.

Kaiser; people either love them or hate them, there seems to be no middle ground. As if the case with any HMO, it’s all about the doctor you select for your PCP. Some people report their Kaiser PCP really going to bat for them to get special care or a procedure. Other people note they only got the care they received after they switched Kaiser PCPs.

Molina had some online member portal and billing issues earlier in 2017. They seem to have corrected those issues. Initial reports from my clients who switched from Blue Cross or Blue Shield to Molina in 2017 say the Molina plans are working as advertised.

Oscar health plans have not had any major deficiencies in customer service that have been reported. So far, the few clients I have helped enroll with Oscar have not told me about any serious problems. Oscar strongly encourages people to use their mobile application, which does have some nice feature for tracking office visits, prescriptions, etc. They also have a concierge team to help with member issues. The question is if they will ramp up customer service if their membership levels surge in 2018 with the closure of the Anthem Blue Cross plans in the regions they serve.

Sutter Health Plus is an off-exchange HMO serving parts of the Bay Area and the Sacramento region. Their rates for 2017 were competitive and they have many popular medical groups like Palo Alto Medical Foundation and the Sutter Medical Group.

Western Health Advantage, which services the North Bay and Sacramento areas, seems competitively priced. But with the loss of UC Davis Health, they won’t be an alternative for Blue Cross members who want to keep their UC Davis doctors.

Cigna is closing all individual and family plans in California for 2018. I only have one client with L.A. Care and the review wasn’t good, but you can’t extrapolate performance based on one experience.

Other local HMO plans to consider are Chinese Community Health Plan in the Bay Area, Valley Health Plan in Santa Clara County, and Sharp Health Plan in San Diego County. Each of these of these local HMO plans have their pluses and minuses. But don’t sell them short until you have researched their network of doctors, hospitals, and drug formulary.

I try to post health plan documents for all the major individual and health plan carriers as they become available such the Evidence of Coverage, Summary of Benefits, Drug Formularies, Networks, etc. on my page https://insuremekevin.com/individual-and-family-navigation/

All of this research can be daunting. Find a good Certified Enrollment Counselor or Certified Insurance Agent to do some of the leg work and offer guidance. The representatives at Covered California won’t be able to provide any assistance with checking on some of the plan providers or drug formularies. If a counselor or agent can’t or won’t help you research your providers and drugs, move on and find another person who will.

Anthem Blue Cross has only given vague answers as to why they are pulling out of most of California and why the other plans are remaining. They actually address the question of working with Covered California in a Frequently Asked Question bulletin they issued about the 2018 plan closures.

Did Anthem make a deal with Covered California that ultimately led to this decision?

Anthem has a strong relationship with Covered California, and has been in an active dialogue with them to promote our shared goal of ensuring attractive, affordable plans are available across California. Ultimately, the difficult decision to offer 2018 Individual plans in three regions in Northern California was made by Anthem because of the ongoing volatility in the Individual market. There is an increasing lack of overall predictability that simply does not provide a sustainable path forward to provide affordable plan choices for all California consumers. We will continue to work closely with Covered California as we make decisions that affect consumers in California.

I found this an odd question to pose to them self for answering. At the very least, Anthem Blue Cross was sensitive to the possible appearance that they and Covered California had some sort side agreement. If Anthem were to pull out completely, Covered California may not have looked favorably on allowing them to sell in certain regions in future years. Of course, if Anthem had pulled out of Region 1, there would have been 22 counties with only one health insurance carrier – Blue Shield – being offered. Any county with just one health plan through the exchange looks like a marketplace failure when the objective was to promote competition. So it’s possible that Covered California and Anthem Blue Cross came to a wink-and-a-nod agreement for 2018. But we will never know because all negotiations are secret.

The reality is that many Californian’s will lose their Anthem Blue Cross plan in 2018. As we get closer to Open Enrollment for the 2018 plan year in November, the health plans will be posting more plan documents and updating their online provider directories. Hopefully by November 1st there will be more resources to allow consumers who must find another plan to make an intelligent selection based on quality information.

CoveredCA_2018_Plans_and_Rates_8-1-2017

Covered California rate book for plans offered in the 19 different regions of the state by age for 2018

CoveredCA_Consumer_Choice_2018_Plan_Map

Map of Covered California health plans by region for 2018.