If you purchased health insurance through Covered California brace yourself for a bevy of letters and notices arriving in your mail box this summer and fall. Covered California will be sending out marketing material, renewal notices, letters asking you to create an online account, reminders to verify your income, and requests for immigration documents.

Create an account letter

In August many people received a letter instructing them to create an online account. Within the letter NOD17 was an access code to link the consumer’s account with the application created by Covered California call center staffer, a Certified Enrollment Counselor or a Certified Insurance Agent. Apparently, this letter was also sent to people who already had an account with Covered California. But an account is necessary if you want to upload documents to verify income or residency, make a change of address or report a change to income. For changes to be reflected in your health plan such as a change of address, all updates must go through Covered California. The health insurance companies can only accept changes from Covered California to your health plan, billing or mailing address.

Consumer letters from Covered California |

||

| Notice | Time period | Content |

| NOD17 | July/August | Create an online account |

| NOD11 | August/September | Authorization to verify income, federal hub |

| September | Citizenship verification letters | |

| NOD12 | October | 2015 Renewal letter |

| October | Co-branded CC and carrier renewal letter | |

| Autumn | Families receive termination notices of stand-alone pediatric dental plans. | |

| NOD01 | November/December | Notice of Determination for APTC eligibility |

| NOD60 | December | CC letter confirming 2015 renewal or change of health plan |

Drafts of these notices along with other explanatory and supporting documents can be downloaded at the end of the post.

Income and immigration notices

Covered California link to uploaded documents.

The next batch of notices going out in September are requesting consent to check income from the federal hub and request immigration documents. Notice of consent, NOD11, allows Covered California to verify income through federal reporting sources for easier renewal of the tax credits. The citizenship and immigration verification letters are requesting documents to determine lawful residency and eligibility for the tax credits. It is important to get these document are uploaded to Covered California before September 30th or the current health insurance will be terminated.

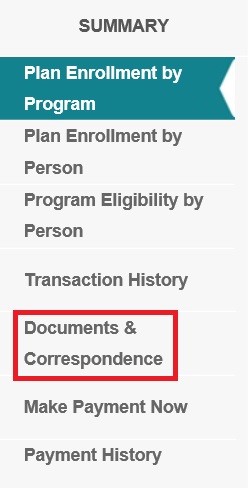

Upload immigration documents

The uploading of documents can be tricky, but there are a couple tutorials to help you through it. Usually all you need to do is take a clear picture of the immigration or naturalization documents and you can upload that to your account. If you worked with a CEC or Certified Insurance Agent they can do this for you at no cost. In the Summary section of your Covered California account is page called Documents and Correspondence. You can view all the uploaded documents to your account in this section.

Immigration Hotline September 2014

Covered California has realized they have a bigger problem with either the lack of immigration documents or incorrect information necessary. In an attempt to help people get the correct documents over to them, Covered Calif0rnia has set up an immigration document hotline to assist people in uploading the required documents – 800-909-6822. The full announcement can be read near the end of the post. Covered California has also updated the notice being sent to consumers with a lack of immigration documentation to emphasize that they will lose their health insurance if they don’t send in the correct documents by September 30th.

Renewal letters

In October Covered California will send out notice NOD12 about renewing your health plans. Current health plan members can renew or switch plans from November 15th through December 15th and the new plan will become effective January 1, 2015. Open Enrollment will be held from November 15th, 2014 through February 15th, 2015. Households will also be receiving co-branded marketing material from their current health plan and Covered California.

Children’s dental termination

Parents who purchased a stand-alone pediatric dental plan for their children will be receiving termination notices during the fall. The stand-alone children’s dental plans are being eliminated because in 2015 all health plans for children 18 and younger will include pediatric dental. Sometime in 2015 Covered California will add family dental plans to their enrollment website. Family dental plans can be in addition to the pediatric dental embedded in the health insurance.

Tax credit eligibility letter

Around November or December Covered California will send out notice NOD01 informing individuals and families of their Advance Premium Tax Credit eligibility. It was unclear from the presentation I attended whether the notice will inform the household if the APTC has been stopped because of income or merely adjusted. Also in December, for those people who renewed or changed plans before the 15th, Covered California will send another letter confirming the new health plan for 2015.

Immigration and Income file downloads

[wpfilebase tag=browser id=31 /] [wpfilebase tag=browser id=30 /] [wpfilebase tag=file id=147 /] [wpfilebase tag=file id=149 /] [wpfilebase tag=file id=150 /]

Blue Shield Immigration Verification Update

Blue Shield of California sent out an update with additional letters and dates for Covered California’s September push to get consumers to upload their immigration documents.

Covered California announcement on upload hotline

Update: Citizenship Verification Notice to Consumers

Last week Covered California sent out an email detailing information about the Citizenship Verification Notice that was mailed to consumers Tuesday. The notice has been updated since that email and is available for reference HERE.

While not all consumers will receive this notice, the consumers that do are required to submit or resubmit documentation by September 30th, 2014 or they risk having their coverage terminated.

In order to assist agents and consumers in navigating this process, Covered California has created a dedicated Upload Helpdesk Hotline. Please note: The Upload Helpdesk Hotline is specifically for consumers that submitted incorrect or invalid documents and need to resubmit required documents. The hotline is not available for assisting consumers who have not submitted any verification documents to Covered California.

The Upload Helpdesk Hotline is available Monday through Friday, 8:00 a.m. to 6:00 p.m. and Saturday 8:00 a.m. to 5:00 p.m. at 800-909-6822 or for TTY, 888-889-4500 and is available in both English and Spanish. The call is free.

As always, the Service Center is available at 877-453-9198 or via e-mail at [email protected], Monday through Friday, 8:00 a.m. to 6:00 p.m., to help answer any general questions you may have.

We thank you for your patience and cooperation at this time.

98,000 families in jeopardy of losing health insurance

COVERED CALIFORNIA REACHES OUT TO THOUSANDS OF CONSUMERS WHO HAVE LIMITED TIME TO CLARIFY THEIR LAWFUL PRESENCE IN CALIFORNIA

Agents, Counselors and Community Organizations Will Help Educate Enrollees That Citizenship and Immigration Documents Must Be Submitted, or the Consumers Risk Losing Coverage

SACRAMENTO, Calif. — Covered California is contacting about 98,000 families that must resolve eligibility inconsistencies in their 2014 enrollment documents.

The consumers will need to submit documents showing they are lawfully present in the United States as U.S. citizens, U.S. nationals or individuals with eligible immigration status, in order to continue their health insurance through Covered California. Notices are being mailed and emailed to consumers beginning this week. If proper proof is not provided by Sept. 30, 2014, these individuals risk termination of health coverage.

“We want to clear these inconsistencies so that our consumers can have a smoother renewal process without any interruption in their coverage,” said Covered California Executive Director Peter V. Lee. “We’re implementing a multi-touch, multi-channel outreach approach to notify individuals who risk losing coverage.”

Covered California has been working to clear inconsistencies. To date, more than 700,000 documents have been verified and processed.

Documents submitted by consumers will be treated confidentially and will be used only to determine the consumers’ eligibility for health insurance programs and will not be used for immigration enforcement.

Lee said some consumers may have previously provided Covered California the required documents, but the agency could not reconcile the information to verify citizenship or immigration status. For example, some documents were illegible, and in some cases two pieces of proof were needed, but only one document was sent, so the agency is requesting the documents be sent again.

The notices will provide consumers with a list of documents they can send to prove their lawful presence. The notices will be delivered in English and Spanish, and help is also available in other languages.

Consumers also will be instructed on how to upload the documents to their account, send them via U.S. mail or fax them to (888) 329-3700. Additionally, thousands of partners, including Covered California Certified Insurance Agents, Certified Enrollment Counselors, Service Center representatives and county eligibility workers, will be available to help consumers submit the necessary documentation.

Lee stressed that consumers should act quickly to submit the requested documents.

“If we do not get your documents, Covered California must cancel your health insurance, along with any federal tax credit you may be receiving that lowers your monthly premiums,” Lee said. “If you have received tax credits, and your health insurance is canceled, you may have to repay those tax credits. If your health insurance is canceled, you may also have to pay a tax penalty.”

Qualifying documents that prove lawful presence include a U.S. passport; a certificate of naturalization (N-550/N-570); a certificate of citizenship (N-560/N-561); a U.S. public birth certificate; a driver’s license issued by a U.S. state or territory; an identification card issued by the federal, state or local government; a school identification card; a foreign passport; and a green card. A complete list will be offered at CoveredCA.com.

|

|

||

|

Blue Shield Members Must Take Action to Maintain Their Coverage

|

||

|

On Tuesday, September 2, 2014, Covered California sent a letter to some of your clients with important information pertaining to their eligibility for coverage through Covered California due to an inconsistency regarding their citizenship or immigration status. Applicants for coverage through Covered California must meet certain eligibility requirements, including documentation showing acceptable citizenship and immigration status. In order for these members to maintain their coverage through Covered California and potentially avoid having to pay back their tax credits and/or a tax penalty, they must prove their eligibility for coverage by September 30, 2014. There are two categories of impacted members: Group 1: Individuals who have not provided documents that prove they are “lawfully present” in the United States as a U.S. citizen, U.S. national, or an individual with eligible immigration status. Group 2: Individuals who have provided documents intending to prove that they are “lawfully present” in the United States, but whose eligibility could not be proven because some of the information provided doesn’t match Covered California’s records. Covered California’s communication plan Covered California is reaching out to both groups of members in slightly different ways: Group 1 – documentation needed:

Group 2 – additional or new documentation needed:

Covered California’s communications will include details and instructions for submitting the required documentation. Members will have until September 30, 2014 to provide the documentation. If they do not provide the proper citizenship or immigration status documentation by this time, their health coverage will be terminated. Those who are canceled and have received tax credits could be required to repay those tax credits and might also have to pay a tax penalty. |