The most well intentioned and best designed government programs can lead to inequities among the population they are created to serve. Covered California is not immune from having to administer the Affordable Care Act health insurance subsidies regardless of the household’s net worth. The inequity is exacerbated by the no deductible health plans for low-income households set to be implemented in 2024.

Inequity and Unfairness of Covered California Subsidies

Before you brand me mean or unkind, I am all for reducing onerous health care costs, especially for low-income individuals and household. The problem is that neither the Affordable Care Act nor the new California program to cover the medical deductible for households with income under 250 percent of the federal poverty level factor in the liquid assets of the families.

The result is that some families, with less resources to cover unexpected medical expenses, get less subsidy and higher health care costs because they are still working to pay all their bills. Let us take 2 hypothetical families that are a compilation of real-world situations that I have encountered as a Covered California agent.

High Net Worth Families Still Get Large Subsidies, Extra Help

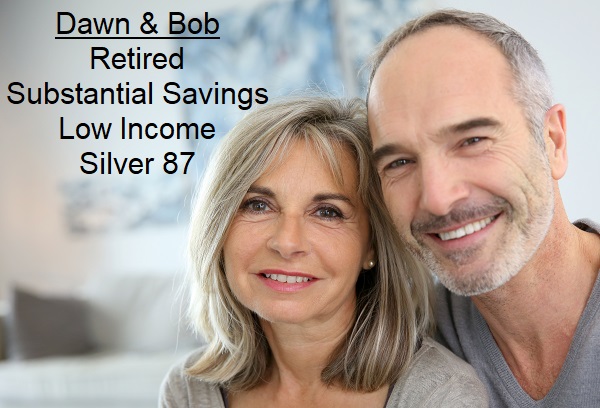

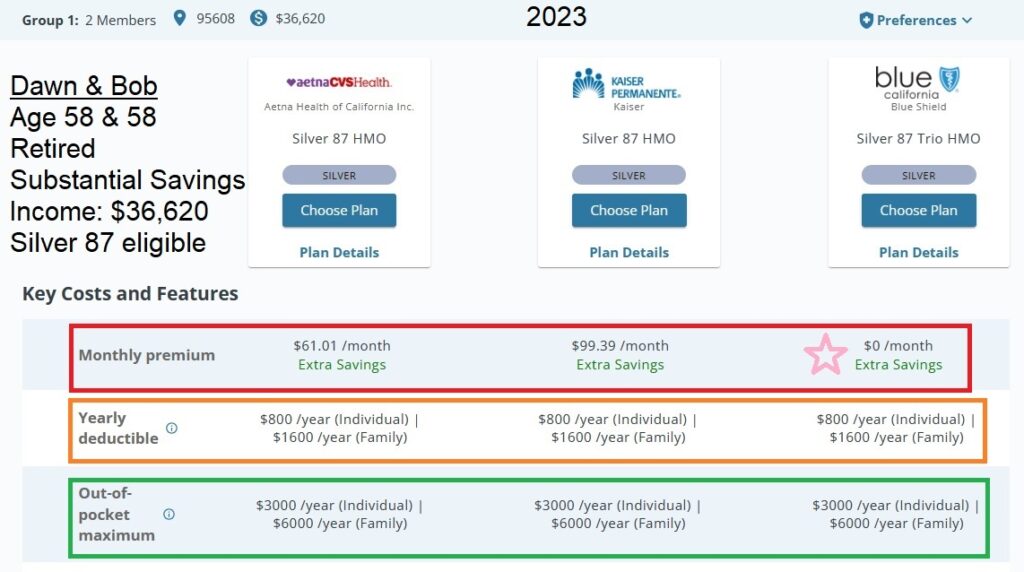

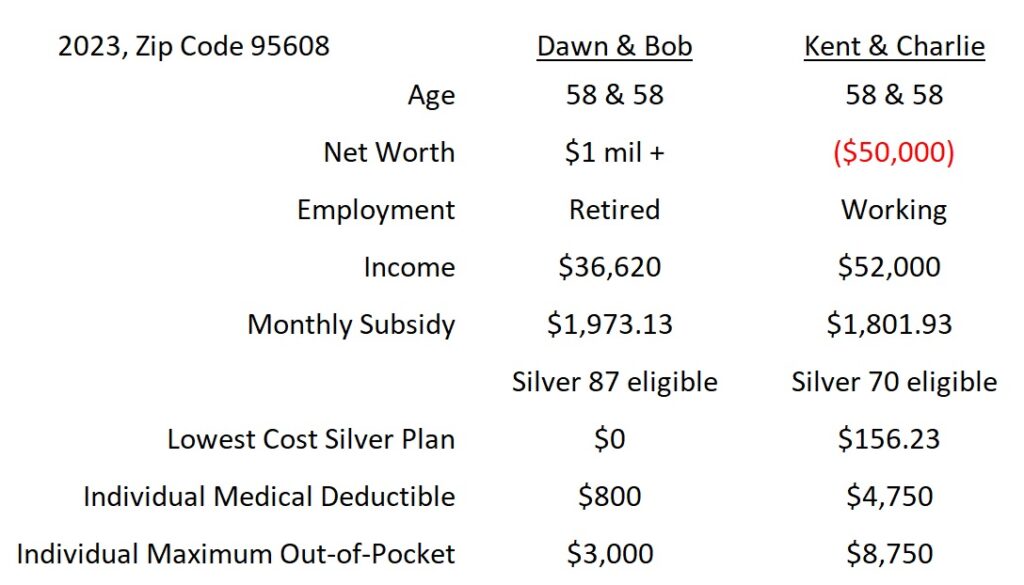

Dawn and Bob are married and they are both 58 years old. After years of working in California, they were able to pay off their house and put a substantial amount money into their retirement plans and savings account. They retired early so they could focus on their real passion for music and art. From income from their music and art, along with dividend and interest from their savings, Dawn and Bob have an annual Modified Adjusted Gross Income of $36,620.

The income for Dawn and Bob is 200 percent of the federal poverty level making them eligible for a Silver 87 health plan in 2023. They selected the Blue Shield HMO Silver 87 that is $0 per month because the subsidy they are eligible is greater than the cost of the health plan. The individual medical deductible – that only applies if they are hospitalized or in a skilled nursing facility – is $800. The maximum out-of-pocket amount for an individual is $3,000, after which the health plan covers all in-network medical expenses.

Dawn and Bob appreciate the Affordable Care Act and Covered California helping them reducing their monthly health insurance premiums and shielding their monthly income from health care expenses.

Working Families Struggle with Low Subsidies, No Extra Help

Kent and Charlie live right down the street from Dawn and Bob. They are both 58 years old and married. Both Kent and Charlie were hit hard by the Great Recession. They lost their good paying middle management jobs and could not find replacement employment at a similar income level. Because they bought a house, in addition to other expenses for their children, they leaned heavily on their savings, even withdrawing money from their retirement plans to make the mortgage payments.

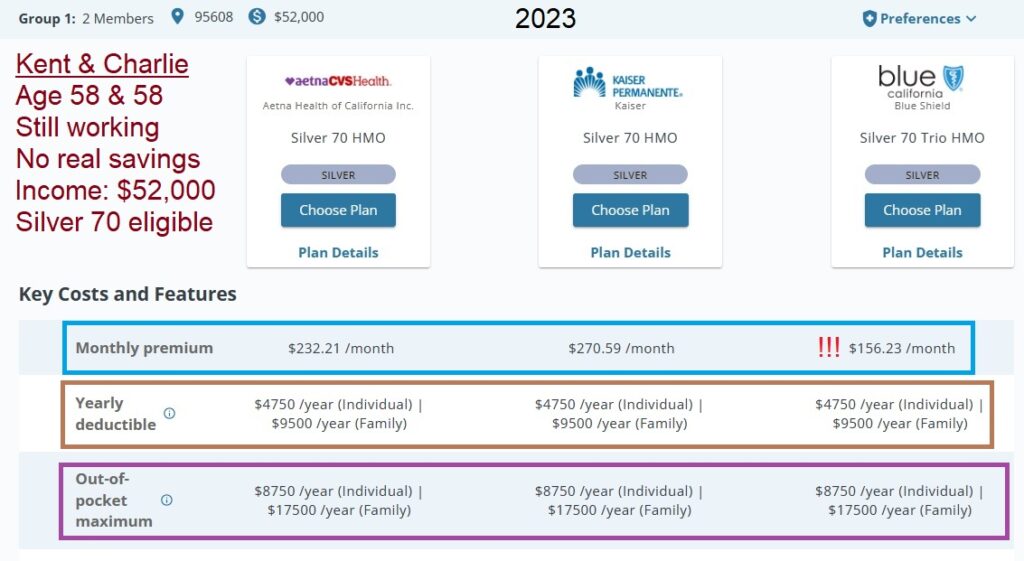

By the time they could find employment, Kent and Charlie had exhausted their savings. They were on Medi-Cal until their income rose with jobs that paid a fraction of their previous employment. Kent and Charlie are survivors and were not going to give up. Together, their Modified Adjusted Gross Income is $52,000, making them eligible for a Silver 70 health plan.

After the Covered California subsidy, the least expensive health plan offered to Kent and Charlie was the Blue Shield HMO Silver 70 at $156 per month. However, they are loyal Kaiser members and opted for the more expensive Kaiser Silver plan so they could continue to see their doctors. The individual medical deductible under the Silver 70 plan is $4,750 if one of them is hospitalized. The individual maximum out-of-pocket is $8,750 for 2023.

Like Dawn and Bob, Kent and Charlie are grateful for the health insurance subsidy to reduce their monthly premium. However, one hospitalization would significantly sap their meager savings they are working hard to rebuild before they retire, if they can retire.

Eliminating Medical Deductible Won’t Help Some Working Families

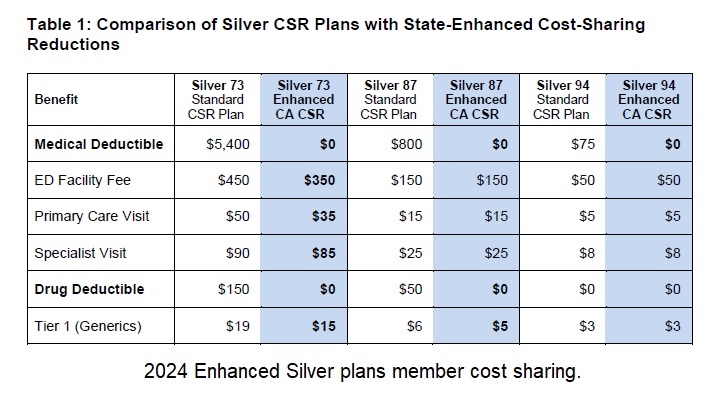

In 2024, the medical deductible for individuals and families in an enhanced Silver plan 73, 87, or 94 will be eliminated. In other words, there will be no medical deductible for those households should one of the family members be hospitalized or needed a skilled nursing facility. There is no relief for individuals with a Silver 70 health plan that is projected to have a $5,400 medical deductible.

Is it equitable that a married couple with substantial savings and high net worth receive significant health cost savings while a similar married couple with no savings but slightly higher income is subjected to higher health care costs? No, it is not equitable. It is a government program that is missing the mark on equity. Stated another way, the reduced cost sharing and no deductible health plans are not fair because the household income does not reflect the real financial state of the individual or family.

Under the 2024 Covered California program of reduced cost sharing and no deductible health plans, some financially comfortable families will be rewarded while other struggling working families will be penalized with higher health care costs.