Modified Adjusted Gross Incomes below 400% of the federal poverty level may not qualify for premium assistance based on the second lowest cost silver plan in the region.

The formula for determining how much premium assistance, also known as the Affordable Care Act premium tax credits (PTC), to lower your monthly health bill is complicated. At its core the formula uses the inputs of your

- Age

- Modified Adjusted Gross Income (MAGI)

- Special contribution percentage, and the

- Premium for the Second Lowest Cost Silver Plan* (SLCSP)

Plugged into the formula, these inputs determine if any Advance Premium Tax Credits (APTC) will be awarded to reduce your health insurance premium. Some people are surprised to learn they don’t qualify for any APTC even though their MAGI is below 400% of the federal poverty level. *Some state will increase the health insurance premium for tobacco use, but not in California.

Inputs for calculating premium assistance

What’s your Age?

The starting point is obviously your age and the age of all the members of those household. All health insurance rates are based on age and the highest premium at 64 years old can be no more than three times the rate of a twenty year old. The rate at which the health insurance premiums increase between 20 years and 64 years is not always a straight line. See Birthdays bump up premiums, not a straight line increase.

What’s your MAGI?

The Modified Adjusted Gross Income, in its simplest form, is the expected Adjusted Gross Income calculated on line 37 of the 1040 federal U.S. Individual Income Tax Return plus certain Social Security income and tax exempt interest . For some households estimating the MAGI is the most difficult part of the calculations. See What counts as MAGI income.

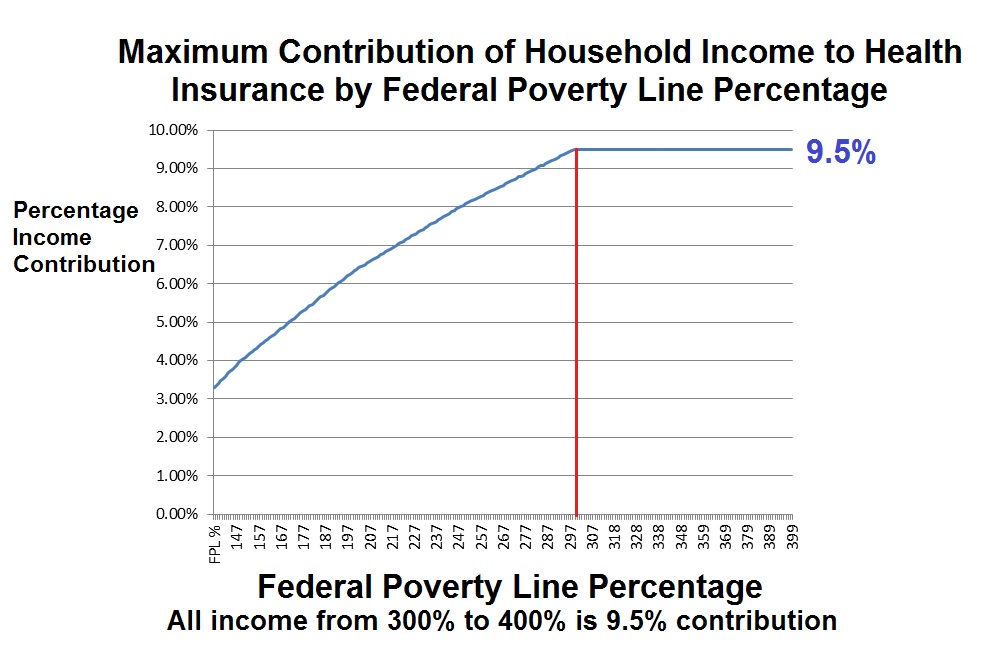

What’s your contribution percentage?

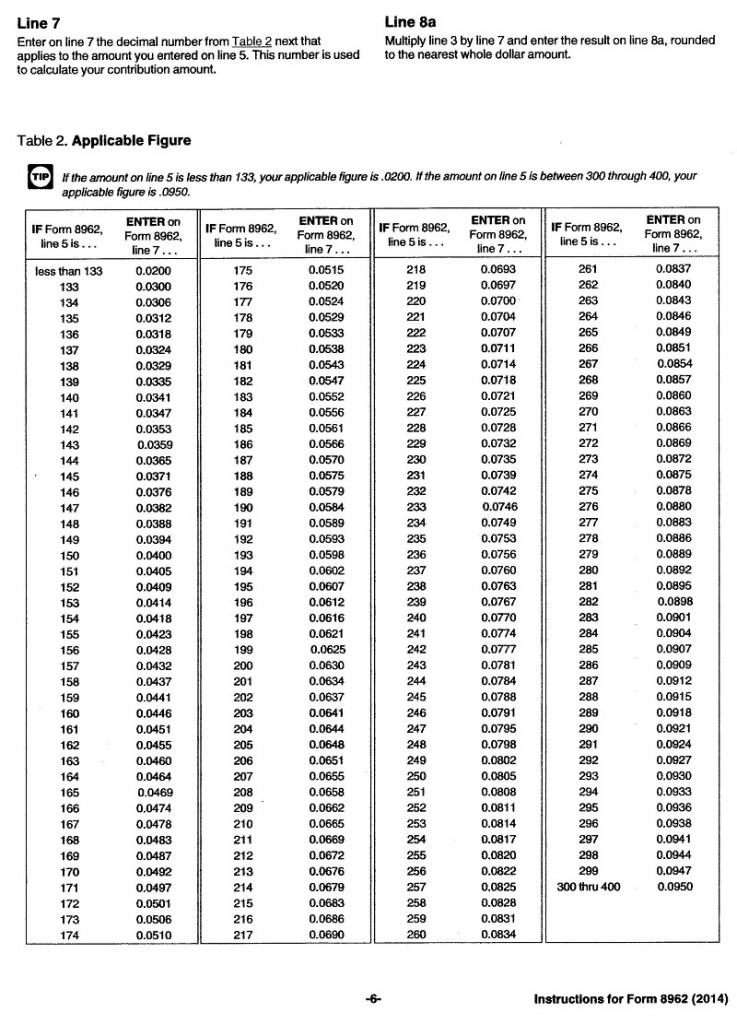

One of the biggest mysteries of PTC formula is the arbitrary contribution percentage also referred as the applicable figure on the instructions for the IRS form 8962 Premium Tax Credit reconciliation. The contribution percentage was established in the ACA and is partially tied to the federal poverty level. It is the contribution of a household’s MAGI towards health insurance premiums that is considered affordable. For example, if a household’s MAGI is 200% of the federal poverty level (FPL), then the family is expected to contribute 6.3% of their income towards their health insurance premiums. The contribution starts at 2% for incomes at 133% of the FPL and hits a maximum of 9.5% at 300% of the FPL. Households are still eligible for the PTC for MAGI up to 400% of the FPL.

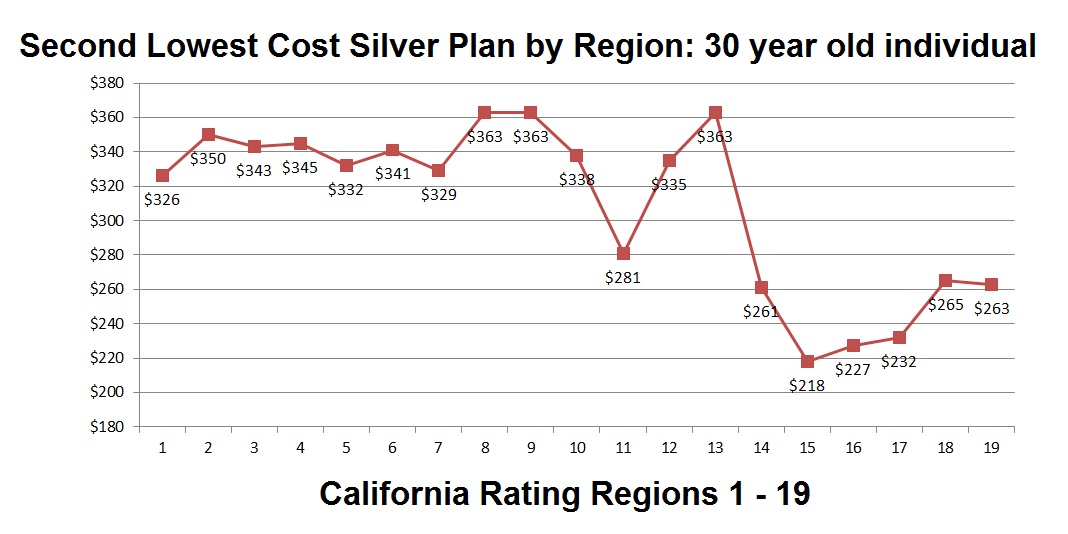

What’s the Second Lowest Cost Silver Plan?

The final input into the PTC calculation is the value of the Second Lowest Cost Silver Plan (SLCSP). This is the benchmark health insurance premium. The logic for selecting the SLCSP is that it wouldn’t be quite a high deductible plan, but it also wasn’t an overly benefit rich plan. The SLCSP was expected to be decent health insurance plan with a moderate deductible and where many regular health care services such as office visits and labs were covered by a copayment. One of the challenges for calculating or even understanding the PTC calculations is that SLCSP is region specific and may even be zip code specific.

Regions and SLCSP

In California there are nineteen different rating regions. The SLCSP rate can vary between each region and even if all the other inputs are the same (age and MAGI) the PTC could still be different. Another added wrinkle is that some health plans may not be offered throughout the entire region. For example, Kaiser limits their membership in many regions to specific zip codes. Most of Placer County in Region 3 will not include a Kaiser plan. Consequently, households with the same demographics may be eligible for different amounts of PTC if the SLCSP is a Kaiser plan for one family but it isn’t available to another family in the same region with a different zip code.

PTC = difference between what you can contribute and the SLCSP

The total amount of premium assistance or Premium Tax Credits is the difference between the cost of the Second Lowest Cost Silver Plan AND what the PTC formula determines the household should contribute to their health insurance premiums.

In other words, if the PTC formula calculates that you can contribute $3,000 toward your annual health insurance premiums, but the SLCSP for their region costs $4,000 annually, you are eligible for $1,000 in premium assistance or $83.33 per month.

400% FPL doesn’t equal PTC eligibility

Many people have referred to the published Covered California 2015 income table and have been misled to believe they qualify for monthly premium assistance because their MAGI is or below 400% of the FPL. This isn’t the case. Some households will be ineligible for the PTC before their income reaches 400% of the FPL. This can be confusing, but it all hinges on the inputs to the PTC formula. In addition, the actual income and the corresponding percentage of the FPL can vary widely between regions within California.

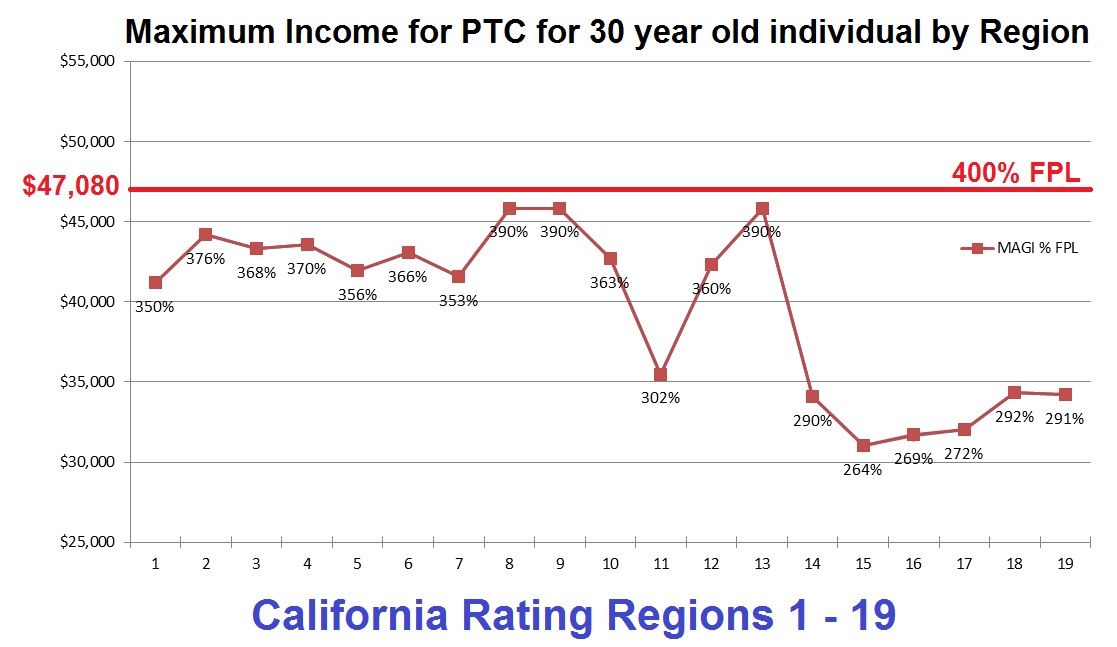

Premium assistance for a 30 year old Californian

As an example as to how eligibility for the PTC can vary by region I created test case of values to plug into the PTC formula. My goal was to see what income amount no longer qualified for the PTC. I used the SLCSP for a 30 year old individual. I adjusted the income to determine the contribution percentage to the point that the individual’s contribution amount equaled that of the premiums for the SLCSP. I ran the scenario for all nineteen regions in California. In all instances, a 30 year old individual would be ineligible for the PTC before their MAGI reached 400% of the FPL.

Can you afford 9.5% of your income for health insurance?

In thirteen of the nineteen regions, because of the rate of the SLCSP, the MAGI was between 300% and 400% of the FPL before the 30 year old lost the PTC. In these regions the maximum household contribution toward the health insurance premium was 9.5% of the MAGI. Put another way, a 30 year individual was more likely to receive PTC with a lower income to help pay for health insurance because of the cost of the SLCSP.

Moderate income may be too high for premium assistance

In regions 14 through 19 the 30 year old individual became ineligible for the PTC at incomes below 300% of the FPL. In addition, the lower MAGI was aided by a contribution percentage of less than 9.5% as determined by Applicable Figure chart, page 6 of Instruction for Form 8962 (2014), which correlates a household’s MAGI to a contribution percentage. The net result was that a 30 year old would lose eligibility for the PTC at a much lower income and percentage of the FPL because the SLCSP were less expensive in these regions. Rating regions with the least expensive SLCSP are in Southern California.

Contribution = SLSCP = No PTC

In this example we have a 30 year old individual living in Region 11 which is comprised of Fresno, Kings and Madera counties. The Second Lowest Cost Silver Plan, as determined by the Covered California Shop and Compare Tool, is United Healthcare at $291 per month or $3,372 annually.

| Region 11 | |

| Federal Poverty Line, Single Adult | $11,770 |

| MAGI | $35,490 |

| MAGI % FPL | 302% |

| Annual Contribution % | 0.095 |

| Annual Contribution $ | $3,372 |

| Annual SLCSP | $3,372 |

| Premium Tax Credit | $0 |

At a Modified Adjusted Gross Income of $35,490, this individual would no longer be eligible for any premium assistance. The individual’s expected contribution to their health insurance of 9.5% of their MAGI equals the annual premium amounts for cost of the SLCSP.

Younger people get less premium assistance

The big picture lesson is that even though the ACA allows the PTC to be claimed for MAGI’s up to 400% of the FPL, that doesn’t mean the individual or household will qualify for the Premium Tax Credit if their income is at or below 400%. You are most likely to qualify for the PTC if you live in a rating region with relatively high health insurance premiums like Northern California or you are older. Because the premiums increase with age, a 60 year old making the same amount as a 30 year old will be eligible for more premium assistance because their health insurance premium is higher.

2016 Second lowest cost Silver plans by rate, region, and carrier in California for a 30 year old individual.

| Single 30 year old | |||

| Region | Rate | SLCSP | Annual |

| 1 | $326 | Blue Shield | $3,912 |

| 2 | $350 | Kaiser | $4,200 |

| 3 | $343 | Anthem | $4,116 |

| 4 | $345 | Blue Shield | $4,140 |

| 5 | $332 | Kaiser | $3,984 |

| 6 | $341 | Kaiser | $4,092 |

| 7 | $329 | Anthem | $3,948 |

| 8 | $363 | Anthem | $4,356 |

| 9 | $363 | Blue Shield | $4,356 |

| 10 | $338 | Blue Shield | $4,056 |

| 11 | $281 | United Healthcare | $3,372 |

| 12 | $335 | Anthem | $4,020 |

| 13 | $363 | Anthem | $4,356 |

| 14 | $261 | Health Net | $3,132 |

| 15 | $218 | Blue Shield | $2,616 |

| 16 | $227 | Health Net | $2,724 |

| 17 | $232 | Health Net | $2,784 |

| 18 | $265 | Anthem | $3,180 |

| 19 | $263 | Health Net | $3,156 |

Applicable Figure chart, IRS instruction for Form 8962

[wpfilebase tag=file id=375 /]

[wpfilebase tag=file id=426 /]

Methodology: determining the maximum MAGI for PTC

There are several programs such as the Covered California Shop and Compare Tool that will determine the PTC eligibility. I certainly could have used it and played with the MAGI until the PTC equaled zero, but I wanted to see the other inputs. I started with a simple Excel spreadsheet with cells for the federal poverty level (FPL) income amount for the lower 48 states. The next cell was the estimated MAGI. Cell three was the MAGI divided by the FPL that yielded a percentage. If the MAGI % FPL was greater than 300% I entered the Applicable figure or annual contribution percentage from the IRS table of 9.5%

The Annual Contribution $ cell is just the contribution percentage multiplied by the MAGI. The next cell was the static input derived from taking the Second Lowest Cost Silver Plan monthly premium determined by the Covered California Shop and Compare Tool and multiplying by 12 to yield the annual SLCSP. The Premium Tax Credit cell is the Annual SLCSP minus the Annual Contribution amount.

If the Premium Tax Credit cell yielded a positive number (the household was eligible for the PTC because the SLCSP was more expensive than their expected contribution amount) I increased the MAGI. If the Premium Tax Credit was negative then I reduced the MAGI. If the MAGI fell below 300% of the FPL I consulted the IRS Applicable Figure Table to get the appropriate contribution percentage. For example, if when lowering the income the MAGI % FPL resulted in the MAGI being 260 of the FPL, I changed the Annual Contribution % to .0834 or 8.34%. I would then tinker with the MAGI and Annual Contribution % until Premium Tax Credit cell equaled zero. At that income, the 30 year old was no longer eligible for the PTC.

Applicable Figure chart (household contribution percentage) from IRS instructions for Form 8962 which correlates household MAGI as a percentage of the federal poverty line to an expected contribution percentage of the family’s income for health insurance.