The reconciliation of the health insurance premium subsidy you may have received from healthcare.gov or Covered California can be confusing. It is further complicated by the fact that the IRS is the final arbiter of whether you receive additional premium tax credits or you have to repay an excess amount, based on your income.

Fortunately, most people will have their taxes done on a computer software program eliminating this confusion and frustration. However, some individuals and families have financial situations that require a familiarity with the IRS reconciliation process to make sure they are maximizing the credit, or minimizing the repayment of the Advance Premium Tax Credits.

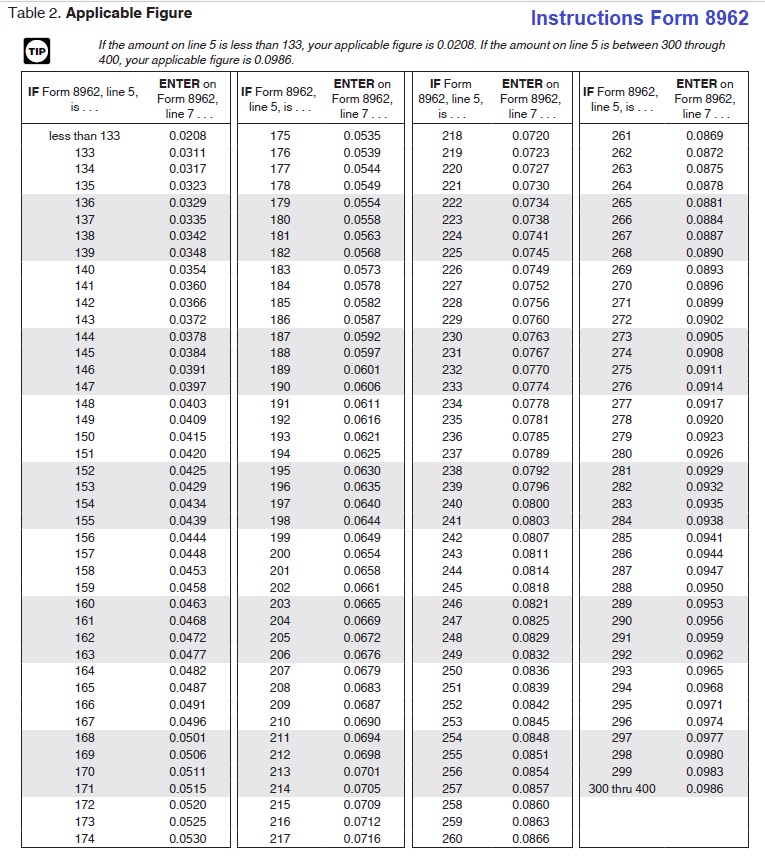

The whole point of the Premium Tax Credit under the Affordable Care Act is to limit what individuals or families must pay for health insurance by providing a monthly subsidy or Advance Premium Tax Credit. Within the instructions for IRS form 8962 is the table for the Applicable Figure also known as the percentage of consumer responsibility for health insurance premiums. At the low end, if the household income is 100% of the federal poverty level, they are only responsible for paying 2.08 percent of the cost of the Second Lowest Cost Silver Plan in their region.

Between 300 and 400 percent of the federal poverty level, a household is responsible for paying no more than 9.86 percent of Second Lowest Cost Silver Plan in their region. The difference between the consumer responsibility (Applicable Figure) and the total cost of the health insurance premium is the Premium Tax Credit. The market place exchanges such as Healthcare.gov and Covered California are the entities that forward the monthly subsidy to the health plan to lower your health insurance premium.

Reconciling Your 2019 Health Insurance Subsidy

The health insurance subsidy you received in 2019 was based on your household size and the income you estimated on your application. If your family and income are different at the end of 2019 from what you estimated at the beginning of 2019, you may be entitled to more Premium Tax Credit or you may have to repay some or all of the Premium Tax Credit subsidy back to the IRS.

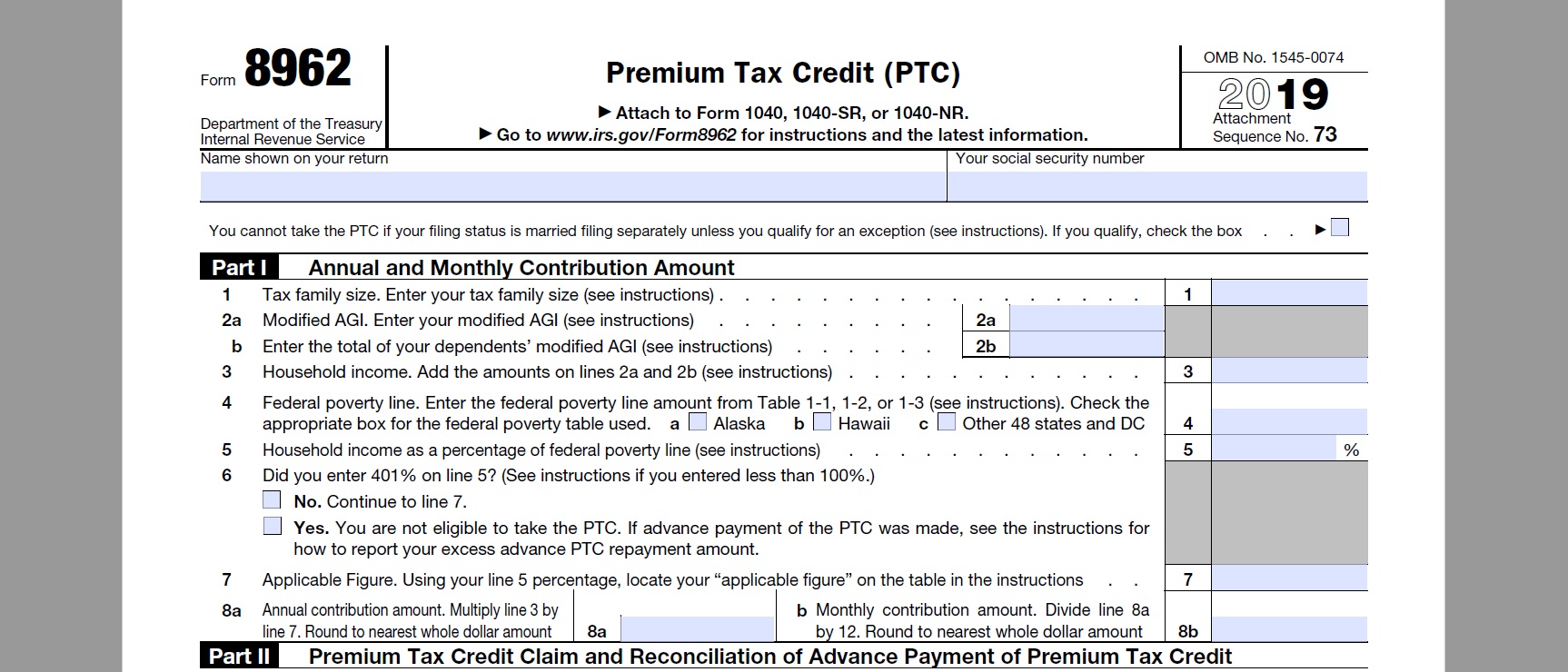

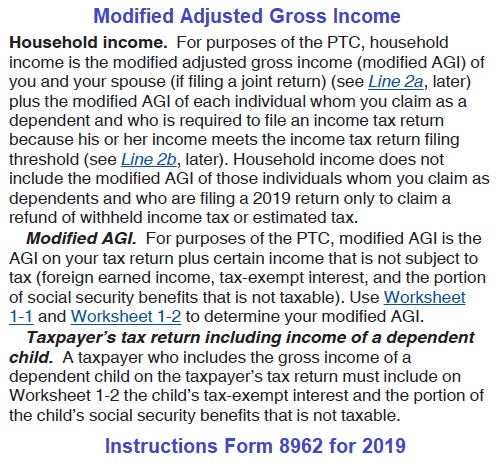

Form 8962 is where you reconcile your income and the Premium Tax Credit subsidy. It starts with your Modified Adjusted Gross Income which is the Adjusted Gross Income from your 2019 federal tax form PLUS Social Security payments and tax-exempt interest. According to the instructions for form 8962, you have to include your dependent’s taxable income if he or she is “…required to file an income tax return because his or her income meets the income tax return filing threshold…”

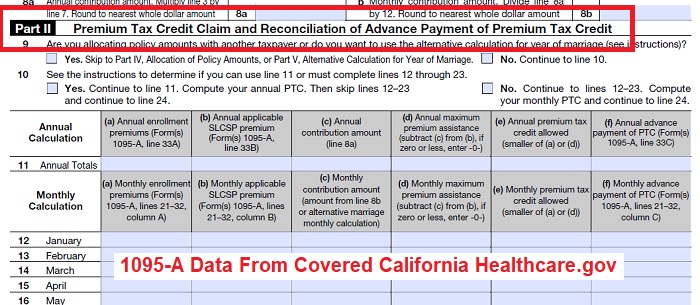

For most tax payers, the income they estimated on their application for health insurance will not be exactly the same amount as their final Modified Adjusted Gross Income (MAGI) on their 2019 federal tax return. Part II of form 8962 compares the subsidy you received (column f) to the amount of subsidy you are entitled to (column e) from data supplied by the market place exchange on form 1095-A.

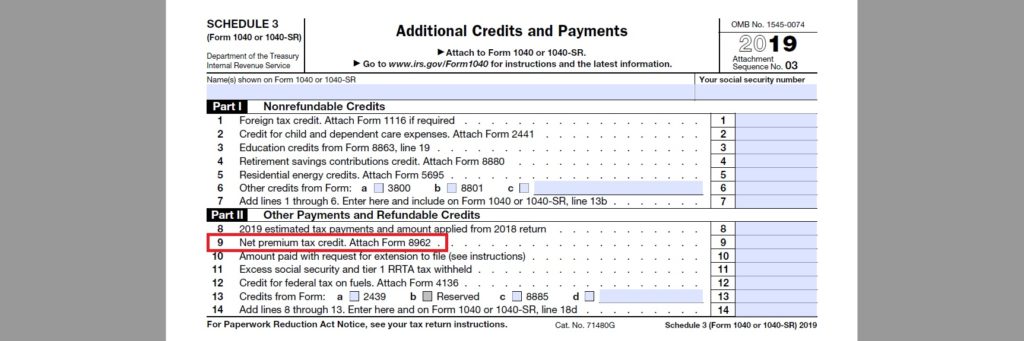

If you estimated your income higher than your final MAGI on form 8962, you will be entitled to more Premium Tax Credit. The tax credit is placed on line 9 of schedule 3, Additional Credits and Payments.

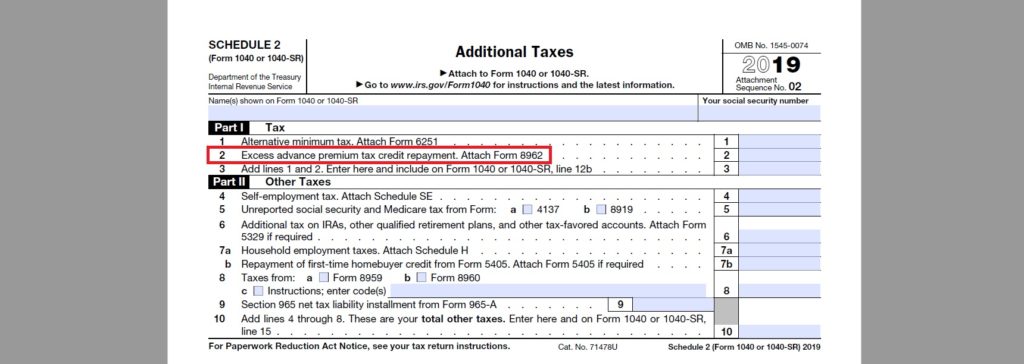

If your MAGI is higher than you originally estimated you may have to repay some or all of the subsidy back to the IRS. That is put on line 2 of schedule 2, Additional Taxes.

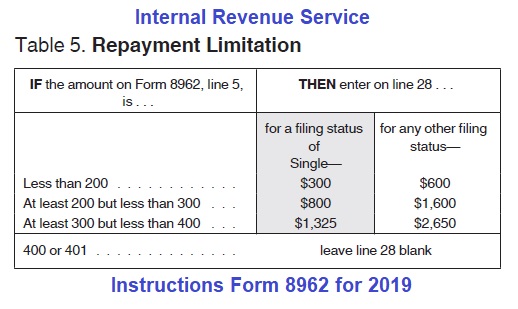

If your final MAGI is over 400 percent of the federal poverty level you must repay all of the Advance Premium Tax Credit subsidy you received during the year. If your MAGI is higher than you originally estimated, but under 400 percent of the federal poverty level, you are subject to a repayment limitation.

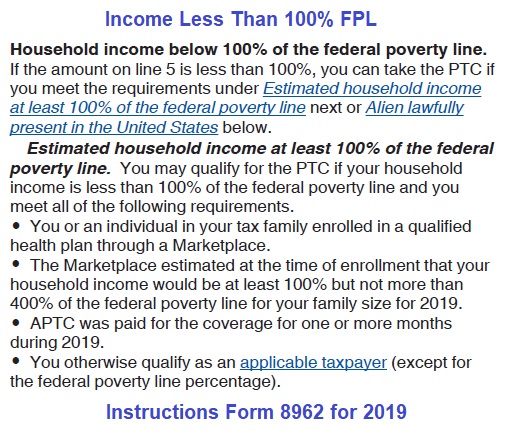

A frequent question I get is what happens if the family’s MAGI is below the threshold for receiving the Premium Tax Credit when they do their taxes. According to the IRS instructions for form 8962, you were still entitled to the Advance Premium Tax Credit if:

- You or an individual in your tax family enrolled in a qualified health plan through a Marketplace.

- The Marketplace estimated at the time of enrollment that your household income would be at least 100 percent but not more than 400 percent of the federal poverty line for your family size for 2019.

- APTC was paid for the coverage for one or more months during 2019.

- You otherwise qualify as an applicable taxpayer (except for the federal poverty line percentage).

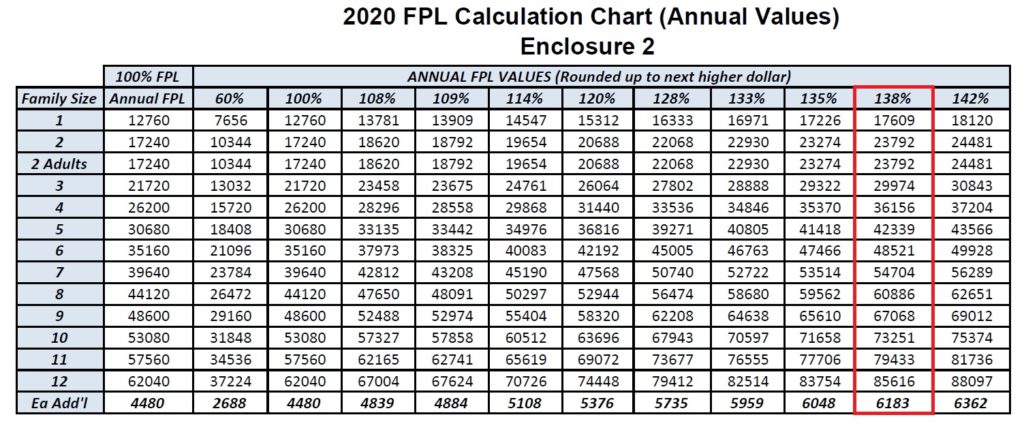

In California, an adult qualifies for the APTC subsidy if the MAGI is over 138 percent of the federal poverty level. Under 138% FPL, adults are deemed eligible for Medi-Cal. But having an income that made you eligible for Medi-Cal in 2019 does NOT mean you are eligible for Medi-Cal in 2020. You are estimating your income for 2020, which because of a variety of different circumstances, and could be much higher than your final 2019 MAGI.

Self-Employed Health Insurance Deduction Complication

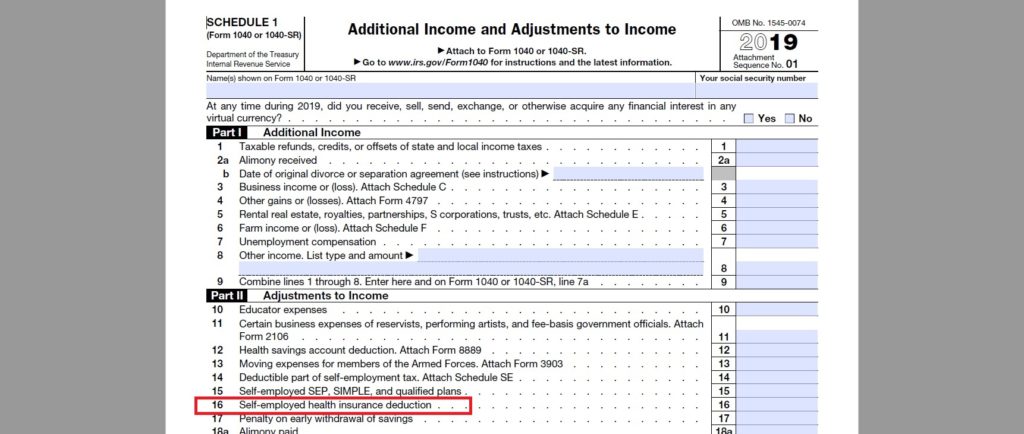

The calculation and reconciliation of the Advance Premium Tax Credit can get complicated for self-employed individuals who are allowed a deduction for the health insurance premiums they paid during the year. The self-employed health insurance deduction is taken on line 16 of schedule 1 Additional Income and Adjustments to Income.

The amount you get to deduct is the health insurance premium you are responsible for after the Premium Tax Credit subsidy. This deduction reduces the MAGI. Your final MAGI is the foundation of the subsidy. If your MAGI is different than your estimate, which is almost always the case, the subsidy will be different and that means the amount of the self-employed health insurance deduction will be different.

For example, let’s say you paid $100 per month after the Premium Tax Credit subsidy for your health insurance for a self-employed health insurance deduction of $1,200. But when you do your taxes, your MAGI is higher, which means a smaller subsidy. Further, let’s assume that the lower subsidy means that in reality you paid $200 per month for your health insurance.

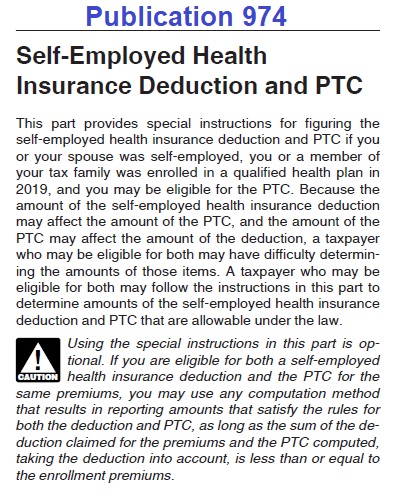

Now you get to deduct $2,400 for the self-employed health insurance deduction. BUT….that additional deduction lowers your MAGI and the Premium Tax Credit subsidy must be recalculated. This is a circular reference that goes on and on and on. The IRS has provided guidance in publication 974 on the best methods for ultimately determining MAGI and Premium Tax Credit with the self-employed health insurance deduction.

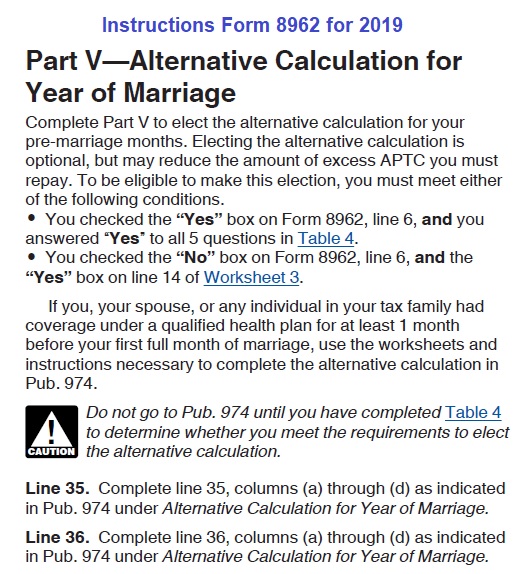

There are also a separate set of calculations for tax payers who alternately either get married or divorced during the year and how to apportion the subsidy for the various months. This stuff is complicated. If possible, always consult a competent tax preparation professional to review your situation to make sure you are not repaying too much Premium Tax Credit or that you are receiving the full amount you are due for 2019.

2019