One of the hidden dangers of the Affordable Care Act’s Advance Premium Tax Credit (APTC) provision to lower the cost of health insurance is the possibility of having too much tax credit issued for the tax payer’s final income. If the ACA applicant doesn’t report increases to the household income during the year, which triggers a corresponding decrease in premium assistance, the tax payer will be liable to pay the excess back. Fortunately, there are limits to the repayment of excess APTC based on household income.

Excess tax credit repayment limited

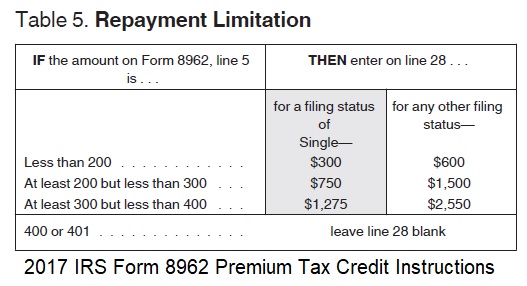

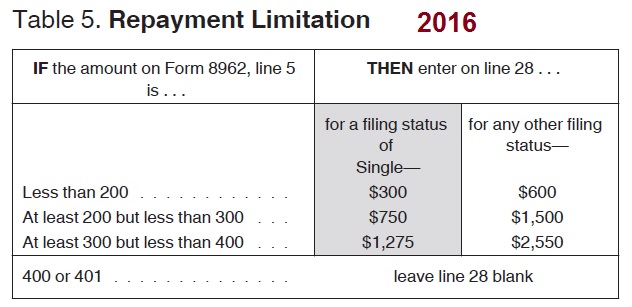

It’s almost as if the designers of the ACA knew that the APTC rules were fraught with confusion and it would surely lead to over payment. Consequently, if the household income for the tax year remains below 400% of the federal poverty level then the liability for excess premium payments will be limited. (Click on image to enlarge)

2017 Repayment Limitation

Repayment of excess Advance Premium Tax Credits is limited to less than the full amount for some tax filers with incomes under 400% of the federal poverty level.

IRS 2016 Advance Premium Tax Credit Repayment Limitations from Form 8962 Instructions.

Triggers of excess Advance Premium Tax Credits

There are a variety of situations which may trigger the federal or state health insurance exchange advancing too much tax credit to the health plan during the year. Some of the events might include –

- Increases in your household income.

- Marriage

- Divorce

- Loss of a dependent (your child get’s a job with group health insurance)

- Other changes to your household composition

- Gaining eligibility for government sponsored or employer sponsored health care coverage.

Advancing a tax credit is novel, risky

The Affordable Care Act has one very simple premise; the Internal Revenue Service will give you a credit on your federal tax return against the purchase of health insurance based on your income and local affordable health plans. This is no different than the IRS giving a family a tax credit for each child born or adopted during the tax year. But instead of waiting until the family files their tax return to apply the tax to any outstanding tax liability, the ACA through the federal and state exchanges allows the estimated tax credit to be applied directly to your monthly health insurance premiums.

Report changes in the household

Consequently, it is very important that if you are having the tax credit applied to your monthly health insurance premium that you promptly report any changes to income, household composition or availability to employer sponsored health insurance. Here are a few examples of how the IRS will treat excess APTC from the final regulations issued by the IRS on the health insurance tax credits. (Download the Final IRS Regulations at the end of the post)

Example 1. Household income increases.

(i) Taxpayer A is single and has no

dependents. The Exchange for A’s rating area

projects A’s 2014 household income to be

$27,925 (250 percent of the Federal poverty

line for a family of one, applicable percentage

8.05). A enrolls in a qualified health plan.

The annual premium for the applicable

benchmark plan is $5,200. A’s advance credit

payments are $2,952, computed as follows:

benchmark plan premium of $5,200 less

contribution amount of $2,248 (projected

household income of $27,925 × .0805) =

$2,952.

(ii) A’s household income for 2014 is

$33,622, which is 301 percent of the Federal

poverty line for a family of one (applicable

percentage 9.5). Consequently, A’s premium

tax credit for 2014 is $2,006 (benchmark plan

premium of $5,200 less contribution amount

of $3,194 (household income of $33,622 ×

.095)). Because A’s advance credit payments

for 2014 are $2,952 and A’s 2014 credit is

$2,006, A has excess advance payments of

$946. Under paragraph (a)(1) of this section,

A’s tax liability for 2014 is increased by $946.

Because A’s household income is between

300 percent and 400 percent of the Federal

poverty line, if A’s excess advance payments

exceeded $1,250, under the limitation of

paragraph (a)(3) of this section, A’s

additional tax liability would be limited to

that amount.

Example 2. Household income increases,

repayment limitation applies.

The facts are the same as in Example 1, except that A’s

household income for 2014 is $43,560 (390

percent of the Federal poverty line for a

family of one, applicable percentage 9.5).

Consequently, A’s premium tax credit for

2014 is $1,062 ($5,200 benchmark plan

premium less contribution amount of $4,138

(household income of $43,560 × .095)). A’s

advance credit payments for 2014 are $2,952;

therefore, A has excess advance payments of

$1,890. Because A’s household income is

between 300 percent and 400 percent of the

Federal poverty line, A’s additional tax

liability for the taxable year is $1,250 under

the repayment limitation of paragraph (a)(3)

of this section.

Example 4. Family size decreases.

(i)Taxpayers B and C are married and have two

children, K and L (ages 17 and 20), whom

they claim as their dependents in 2013. The

Exchange for their rating area projects their

2014 household income to be $63,388 (275

percent of the Federal poverty line for a

family of four, applicable percentage 8.78). B

and C enroll in a qualified health plan for

2014 that covers the four family members.

The annual premium for the applicable

benchmark plan is $14,100. B’s and C’s

advance credit payments for 2014 are $8,535,

computed as follows: benchmark plan

premium of $14,100 less contribution

amount of $5,565 (projected household

income of $63,388 × .0878) = $8,535.

(ii) In 2014, B and C do not claim L as their

dependent. Consequently, B’s and C’s family

size for 2014 is three, their household income

of $63,388 is 332 percent of the Federal

poverty line for a family of three (applicable

percentage 9.5), and the annual premium for

their applicable benchmark plan is $12,000.

Their premium tax credit for 2014 is $5,978

($12,000 benchmark plan premium less

$6,022 contribution amount (household

income of $63,388 × .095)). Because B’s and

C’s advance credit payments for 2014 are

$8,535 and their 2014 credit is $5,978, B and

C have excess advance payments of $2,557.

B’s and C’s additional tax liability for 2014

under paragraph (a)(1) of this section,

however, is limited to $2,500 under

paragraph (a)(3) of this section.

IRS examples income chart

| Household Income | APTC | Poverty Line | |

| Ex. 1 Income increases | |||

| 2014 Estimate | $27,925 | $2,952 | 250% |

| 2014 Actual | $33,622 | $2,006 | 301% |

| Excess APTC | $946 | ||

| 2014 Liability | $946 | ||

| Ex. 2 Income increases, Limited | |||

| 2014 Estimate | $27,925 | $2,952 | 250% |

| 2014 Actual | $43,560 | $1,062 | 390% |

| Excess APTC | $1,890 | ||

| 2014 Limited Liability | $1,250 | ||

| Ex. 4 Household decreases | |||

| 2014 Estimated | $63,388 | $8,535 | 275% |

| 2014 Actual | $63,388 | $5,978 | 332% |

| Excess APTC | $2,557 | ||

| 2014 Liability Limited | $2,500 |

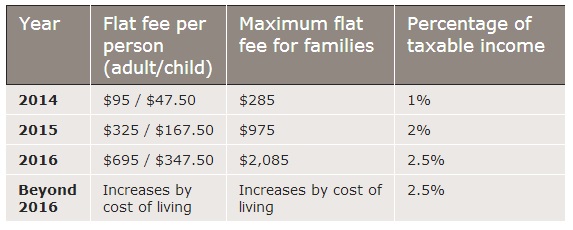

In example 2 and 4 because the household income remained within the set parameters of the APTC tax repayment limitation chart shown above, the families will not have to repay all the excess tax credit they were advanced during the year. However, even with the limited repayment amounts, having and additional unexpected tax liability of the examples above would still be a shock. For some people, the potential for inadvertent excess tax credit repayment is enough to stick with the known individual mandate penalty for not having health insurance during the year.

Individual mandate penalties, ACA

[wpdm_package id=171]