The IRS has released drafts of the tax forms that will be used to reconcile the amount of Advance Premium Tax Credit (APTC) received from an insurance exchange against how much the individual or family was entitled to based on their modified adjusted gross income. The various components used to determine the APTC (income, household size, dependents, employer sponsored insurance, etc.) not only make the initial tax credit calculation overly complicated they also contribute to making the tax credit reconciliation process difficult. While the IRS has tried to make the reporting of the health insurance tax credit straight forward there will be many families who will be flummoxed by all the statements and calculations.

New: Calculating IRS individual mandate penalty with Form 8965

IRS Guide to calculating ACA tax credits, exemptions and penalties

Draft IRS ACA tax credit forms may change

Aside from the draft forms, I couldn’t find any supporting documents that would gave any guidance or instructions on actually how to fill out the tax credit forms. Consequently, I present a review of the forms, which can be downloaded at the end of the post, with the understanding that the IRS may modify the forms or release instructions different from what I may have inferred from reading through the drafts.

Exchange Statement Form 1095a

For individuals and families that purchased health insurance through either the federal or a state exchange they will receive a statement from the exchange, f1095a–dft, with which to complete the reconciliation of the APTC using form f8962–dft. The Exchange Statement reports how much APTC the individual or family received for the year. This information is transferred to the f8962—dft. The results of f8962—dft, either the repayment of excess APTC received or an allowance for an additional tax credit, will be transferred to the new 2014 1040 federal tax return forms.

2nd least expensive Silver plan

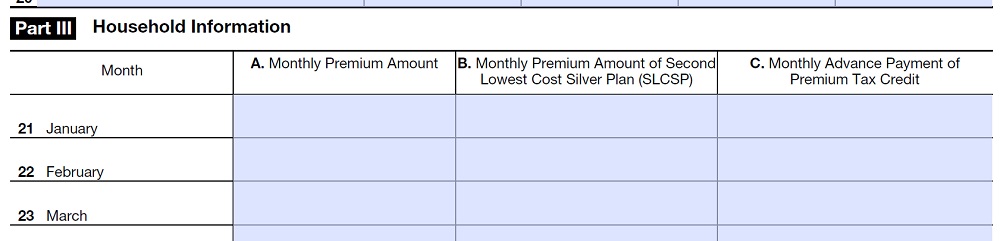

The Exchange Statement, f1095a—dft, must be sent to the tax payer by January 31, 2015, by the exchange. It will be a summary of the household members enrolled in a health plan purchased through the exchange with the corresponding start and end date of coverage. The Exchange Statement will also report the unsubsidized monthly premium amount, the cost of the 2nd least expensive Silver Plan in the region and the tax credit that was advanced to the health plan on behalf of the household.

Making health insurance affordable

Tax credits are calculated, in part, on the second lowest Silver plan in the household’s region. The goal of the ACA was to make a modest health insurance plan premium affordable to individuals and families. Consequently, a the health insurance premium for the second least expensive Silver plan was chosen on which to calculate how much tax credit must be allowed to keep a household from paying more than 9.5% of their household income on health insurance. The calculated APTC is the same whether the family enrolls in a Bronze plan with a lower premium than the Silver or a more expensive Gold or Platinum plan with a higher premium.

ACA tax credit by month

Because the APTC may change if the household size or income changes the exchange statement will report the APTC by month.

Form 1095a draft version, Exchange Statement reporting months and amounts.

Form 8962

The real fun comes when the family has to fill in Form 8962 the Premium Tax Credit reconciliation report. Not only must the primary applicant for the exchange health plan report his or her modified adjusted gross income, the taxable income of the other household members on the health plan must also be reported. (Lines 2a and b) For example, if a married couple declares their 21 year old daughter as a dependent and the daughter was on the family health plan which received tax credits, the modified adjusted gross income of the daughter must also be reported on form 8962. If the daughter had a part-time job while attending college that income goes toward determining the total household modified adjusted income for the tax credits.

Premium tax credit reconciliation

Lines 4, 5 and 6 may automatically sink some households as this is where the family determines if their total modified adjusted gross income (MAGI) exceeds 400% of the Federal Poverty Line (FPL). If the household income exceeds the Federal Poverty Line by $1, all the APTC they received during the year may have to be repaid. If the MAGI is under 400%, the family will then use the calculated percentage of the FPL to determine the “applicable figure” from a table in the instructions for the form.

Tax credits and the sliding scale of FPL

It looks like this “applicable figure” will be the maximum percentage a household is expected to contribute toward their household health insurance premium. One of the other factors in calculating the APTC is that depending on the household income the percentage the family is expected to shoulder toward the health insurance is based on a sliding scale. A family earning only 138% of the FPL is expected to contribute only 2% toward health insurance while a family making 350% of the FPL must contribute 9.5% of their MAGI toward the premium amount. The difference between what the family is expected to contribute based on the MAGI and the cost of the 2nd least expensive Silver health plan premium is the tax credit the household is entitled to.

Applicable Figure

An astute reader of this blog found additional clarification of the “applicable figure” in a presentation the IRS did for software companies developing code to handle the complicated calculations surrounding the APTC tax credit. The applicable figure is the percentage of household income that the family or individual is expected to contribute toward their health insurance premium. There will actually be a table that lists the applicable figure to be used on Form 8962 for each full percentage point of the household income between 133% and 399% of the Federal Poverty Line. In the IRS example, a household has a MAGI of $25,552. That translates into 222% of the FPL entered on Line 5 of Form 8962. From the Applicable Figure table, 222% is equivalent to .0707 or 7.07%. $25,552 x 7.07% is $1,807 annually or $151 monthly that the individual or household is expected to contribute their health insurance premium. This monthly household contribution, in combination with the premium of the second lowest Silver Plan in the region, is what will be used to determine the final tax credit. Updated 8/25/2014

MAGI and the applicable figure

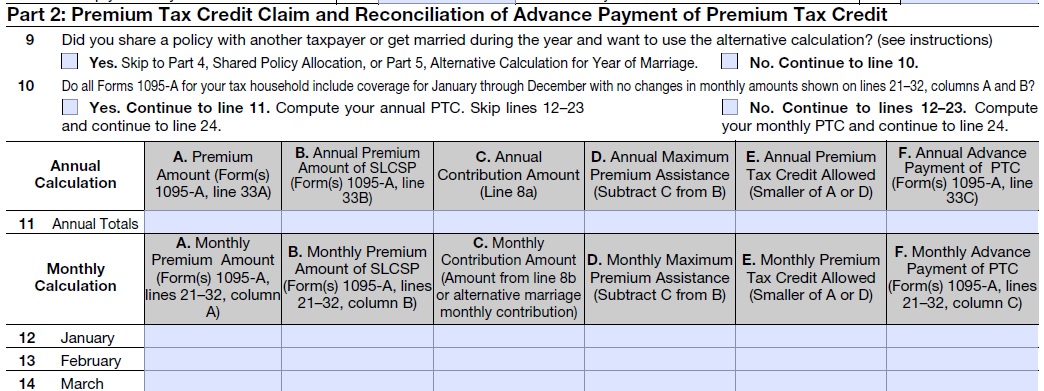

Line 8 of Form 8962 has the household multiply their MAGI by the maximum percentage amount the ACA defines they should spend on the health insurance per month. For example, a household of four with a MAGI of $60,000 is expected to spend no more than 8.1% or $4860 per year, $405 per month, on health insurance. The next step on the form is determining the premium tax credit the household is entitled to under the ACA rules. If there have been no changes to the household during the year the calculation for the APTC is fairly simple on Form 8962 – Line 11.

Draft Form 8962, Part 2, reconciliation of ACA tax credits with what the federal or state exchange said they advanced to your health plan.

Family of 4 at 8.1%

In the following table I have laid out two different scenarios based on the family of 4 and a MAGI of $60,000. In scenario I the family chose a Silver plan that was more expensive than the 2nd least expensive Silver plan because they wanted to keep their doctors that weren’t in-network of the lower priced health plans. Consequently, they paid more in premiums than the 2nd lowest plan. But subtracting what the ACA considers affordable, 8.1% or $4,860 of their MAGI, from the annual premiums of the 2nd lowest Silver, the household is entitled to a maximum tax credit of $3,216.

| Based on Form 8962 Calculations | I | II |

| A. Annual health plan premium for purchased plan | $8,412 | $6,012 |

| B. Annual premium for 2nd least expensive Silver | $8,076 | $8,076 |

| C. Expected annual household contribution, Line 8 | $4,860 | $4,860 |

| D. Maximum annual tax credit, C minus B | $3,216 | $3,216 |

| E. Maximum tax credit allowed, smaller of A or D | $3,216 | $3,216 |

| F. Advance Premium Tax Credit reported from Exchange | $2,900 | $4,700 |

| Credit or Excess Repayment | $316 | $1,484 |

More premium tax credit to be claimed

The maximum tax credit is the lower amount of the actual amount of the annual health insurance purchased or the difference between the cost of the 2nd lowest Silver and their 8.1% expected contribution. For this family, $3,216 is the maximum tax credit. The Exchange Statement they received, Form 1095a, reported that a total of $2,900 or approximately $241 per month was advanced to their chosen health insurance carrier to lower their monthly premiums. This particular family over estimated their monthly income resulting in a lower APTC amount. Because the family in scenario I is entitled to a greater tax credit than they received during the year, they will report the under payment on Form 8962 and receive a tax credit on their 1040 federal tax return.

Excess APTC must be repaid

The same family in scenario II chose a less expensive Bronze plan and they under estimated their income resulting in a larger APTC per month. They are still entitled to a tax credit even though they selected a plan with a premium less than 2nd least expensive Silver plan. Their maximum tax credit is $3,216 based on their $60,000 MAGI. However, because they under estimated their household income the exchange advanced $4,700 for the year to lower their monthly premium to their chosen health plan. The difference between their calculated maximum tax credit and the tax credit paid on their behalf has to be repaid to the IRS as excess APTC.

Tax credit limited to total annual premiums

They will report the excess APTC amount of $1,484 on their 1040 tax form. While it isn’t outlined on Form 8962, there are limits to how much an individual or household must repay in excess APTC if their income is below 400% of the FPL. On a side note, a household can claim a tax credit no greater than the annual premiums for the health plan they have chosen. If a family chooses an inexpensive Bronze plan with annual premiums of $5,000 per year, but they were entitled to $6,000 based on the 2nd lowest Silver, they can only claim a tax credit of $5,000. In this scenario, the monthly tax credits would have completely paid the monthly premiums of the health plan.

Don’t..Get..Married

For many households and individuals, if they reported any changes to income or family size during the year they will have received varying amounts of APTC in different months. Form 8962 repeats the above steps only on a month by month basis for this type of scenario. If an individual shared a policy with another tax payer or got married during the year there are alternative tax credit calculations that can be used on Form 8962. The alternative calculations for shared policies or getting married are outlined in the IRS Final Regulations for Health Insurance Premium Tax Credit which can be downloaded at the end of the post. I assume that the IRS will also prepare a complete set of instructions for completing Form 8962 for the alternative calculations because very little in the previous steps matches the boxes in Part 4 or Part 5 of the form.

Self-employed families most vulnerable

What the release of these draft IRS ACA reporting forms emphasize is that the tax credit is an annual amount based on the individual’s or families’ modified adjusted gross income in relation to the household size and Federal Poverty Line. The health insurance exchanges are focused on determining the monthly tax credit and may have induced households to inadvertently under-estimate their 2014 income. The probabilities for receiving excess tax credits, that will need to be repaid is especially high for the self-employed or people who large fluctuations in monthly income because contractual arrangements.

IRS is pushing for a single-payer system

With the release of the draft ACA reconciliation calculation forms for the APTC the IRS is either trying to ensure most tax payers file with the aid of a computer program OR they are secretly undermining the Affordable Care Act in favor of a single-payer plan. If nothing else, the tax preparation business will get a big boost as tax payers who may never have filed anything more complicated than a 1040-EZ, now find themselves faced with APTC statements from either the federal or state exchange and potentially other documents from employer sponsored health plans. I can only hope the exchanges pour as much money into educating people about reconciling the APTC on the income tax forms as they did to encourage people to sign up for the subsidized insurance. Perhaps all those exchange enrollment telephone staffers can be converted into tax preparation hot line staff.

[wpfilebase tag=browser id=26 /]

[wpfilebase tag=file id=120 /]

[wpfilebase tag=file id=140 /]