At a time when there are plenty of examples of California bureaucratic failures and scandals (EDD, BOE, DMV, etc.), Covered California stands out as a relative success story. This organization uses no taxpayer funds for its operation, there are no scandals, and they are delivering on their purpose that is to distribute health insurance subsidies on behalf of consumers.

Covered California Meeting Their Goals Without Taxpayer Money

Why is Covered California succeeding when so many other California state agencies are failing? First, they are a relatively young bureaucracy having only been formed with the Affordable Care Act back in the early 2010s. Second, the software and computer network is 21st century. Third, management is not bloated with scads of political appointees. The Board, who are politically appointed, hires an Executive Director to run the organization like a business.

Covered California is a commercial venture. Their website is CoveredCA dot com, as opposed to a tax payer funded agency that has a website URL ending in dot gov. Covered California is an enterprise of the California Health Benefits Exchange, which is a formal government agency (https://www.hbex.ca.gov/). Both of these organizations are nested under the Department of Managed Health Care. Also within this family of agencies is the Department of Health Care Services that manages the Medi-Cal programs. Consequently, Covered California must comply with many rules and regulations that apply to state government, for better or worse.

Covered California Budget Reveals The Details

Covered California formulates a budget, based on a fiscal year, that is transparent and revealing. They list all of their revenue sources and expenditures within the budget. Since 2016, with the end of federal grant money to establish health insurance market place exchanges, Covered California has been self-supporting.

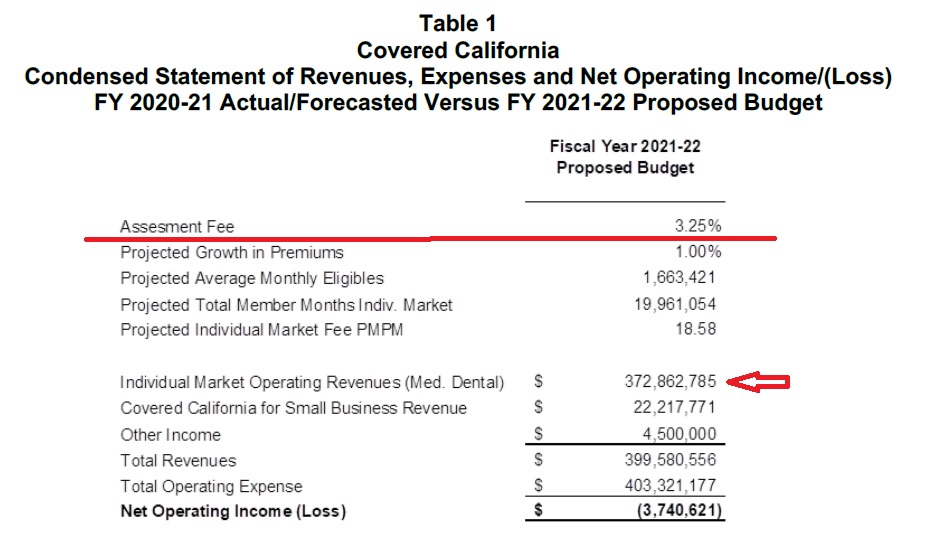

The main revenue source for Covered California are the assessment fees levied on the insurance carriers participating in the exchange. Carriers that pay the assessment fee are the health plans in the individual and family market, small groups participating the Covered California for Small Business exchange, and the dental plans. The bulk of the revenue comes from the 3.25 percent assessment on the carriers in the individual and family market. Those fees are estimated to be $372.9 million for fiscal year 2021-22. The small group assessment is estimated to be $22.2 million. Those two revenue streams plus another $4.5 million in other income comprises a total revenue for the fiscal year of $399.6 million.

The expenses for fiscal year 2021-22 are forecast to be $403.3 million. This leaves a budget deficit of $3.7 million that will be covered by the reserve. When you consider the unprecedented and volatile eighteen months of the Covid pandemic, with the associated closures and unemployment, a budget deficit of $4 million is very good. It was during the pandemic that Covered California increased their marketing by $30 million and beefed-up service center staff to the tune of $10 million to help thousands of individuals and families seeking health insurance.

To the credit of Covered California, they have worked to keep assessment fees levied on the health plans as reasonable as possible. The fee started out as a per member per month (PMPM) flat fee, which was approximately $13.95 back in 2015. The carriers would pay Covered California $13.95 for each person enrolled in their health plans, regardless of age, for each month. Then they transitioned to a percentage of the total premium amount. The percentage has dropped over the years until for fiscal year 2021-22 it is set at 3.25 percent. For each $100 of premium collected each month for an enrolled individual, the carrier pays Covered California $3.25. The budget notes the PMPM equivalent is $18.58, which is higher than the earlier years.

For comparison purposes, an insurance agent who assists a consumer with enrollment through Covered California is paid $5 – $16 per member per month. Some carriers still pay a percentage commission to agents on the total premium value that ranges from 1 to 3 percent on average.

I don’t know how the health plans view the Covered California assessment fee as a function of the value received from increased enrollments. Some carriers have seen a real increase in their own revenue because of Covered California and the Affordable Care Act. I suppose if they felt the fees were too high they would not participate. There is only one major health plan, Sutter Health Plus, that does not participate in Covered California individual and family plans.

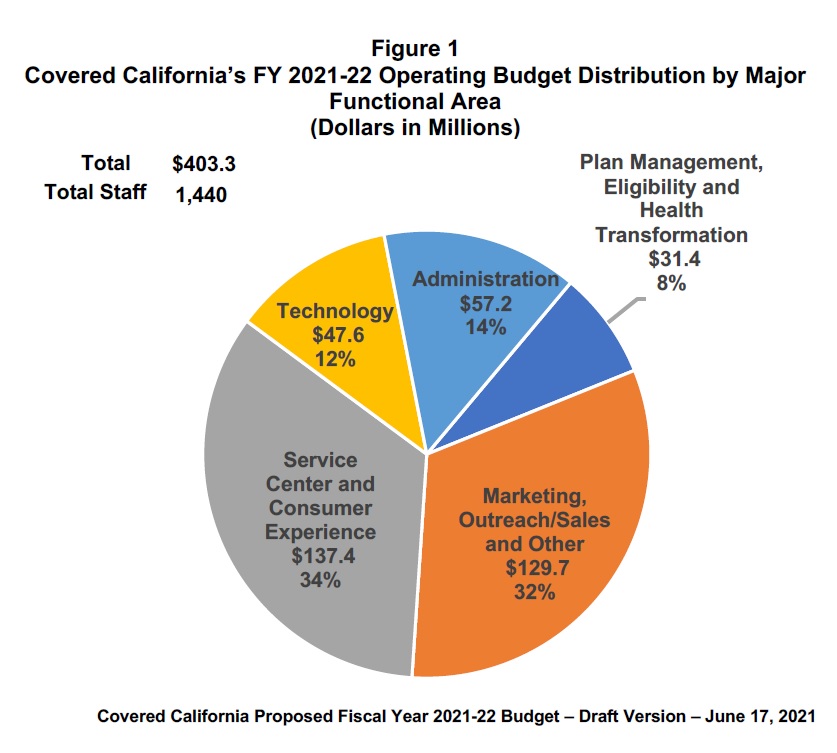

Where does all of the Covered California revenue go? Technology absorbs 12 percent of the budget. Since the backbone of Covered California is the online application system (CalHEERS) the software must be continually updated to reflect new regulations and meet security requirements. This is a good investment. Customer service gets 34 percent of the budget. Advertising and outreach account for 32 percent of the budget. All of the managers and administrative staff filling out reports chew up 14 percent of revenues. Finally, the policy wonks and actuarial type folks working on the health plan designs receive the remaining 8 percent of the budget.

I’ve been following the California Health Benefits Exchange and Covered California since their inception. They really have delivered on their mission to administer the Affordable Care Act subsidies to consumers. They have not become a black hole of taxpayer money to fix rotten and decaying computer systems. They have not become a cesspool of nepotism and cronyism that has characterized some California agencies. They have not become famous for indiscreet and corrupt employee expenses for parties and trips to Hawaii.

When you review an essentially balanced budget, with prudent reserves, and an absence of bureaucratic bloat and mismanagement, Covered California really is a success story. Is Covered California perfect? No. I have plenty of gripes and complaints. I can also throw plenty of stones at the health plans for similar issues I come across at Covered California.

One of the hallmarks of properly managed enterprise is the acknowledgement of problems and the development of a plan to correct the issues. Covered California rises to the mark of being pro-active to fix problems and is on alert for future issues. I work with individual and family plans, small groups, and Medicare health and drug plans. Covered California is a model for easy and secure enrollment for agents and consumers. They have done a good job and I hope other markets will copy their successful model.