Covered California is making a big advertising blitz to get off-exchange health plan members and people with no health insurance to enroll through Covered California with the larger health insurance subsidies authorized by the American Rescue Plan. But is it the correct time to switch and what are the draw backs to enrolling through Covered California?

Estimated reading time: 9 minutes

Larger Covered California Subsidies For Some Households

The only way to receive a subsidy to lower the cost of your monthly health insurance premium is to enroll in Covered California if you are a resident of the Golden State. Even though Covered California is advertising plans as low as $1 per month, that is not the full story. In addition to the subsidies that can dramatically lower the health insurance premiums, there are other factors to consider before you switch.

COBRA

If you have lost your employer sponsored health insurance because of the covid pandemic, you may be eligible to have your COBRA health costs covered 100 percent through September. Call your human resources department to see if you qualify for coverage of your health insurance premiums. There is no need to pay for health insurance if you can benefit from the ARP COBRA plan.

Grandfathered Plans

Many individuals have grandfathered health plans that are no longer available at much lower rates than current health plan offerings. Carefully review the benefits of the grandfathered plan compared to the current plans along with the subsidized rate for the new health plan. Usually, the new plans have better coverage, but that comes at the cost of higher health insurance premiums.

Off-Exchange Non-Standard Benefit Designs

Several carriers offer health plans that are not offered through Covered California. These are known as non-standard benefit designs. The plans are fully ACA compliant and cover all the same health care services as the standard benefit design plans. It is the member cost sharing that is different.

For example, Kaiser offers a Silver 70 2500/45 and a Silver 70 HDHP 3250/20% health plan that are not offered through Covered California. If you switch to Covered California, you can’t keep these non-standard benefit design plans. Both of these plans are less expensive than the standard benefit Silver 70 plan.

Sutter Health Plus & Health Net Full PPO

Sutter Health Plus HMO plans are not offered on Covered California. The only health plan that really has Sutter providers in-network is the Blue Shield PPO plans. You can switch to a Blue Shield PPO plan, but any cost-sharing accumulation will not track from the HMO to the PPO.

Health Net Full PPO plans are not offered on Covered California. There are other Health Net plans that offer the same coverage, but none will have all of the providers of the Full PPO network. Specifically, Stanford doctors and hospital will not be in-network with any of the plans offered through Covered California in most instances.

Accumulation of Cost-Sharing

Covered California has worked with the health plans to transfer any accumulation of member health care expenses from the off-exchange plan to a new on-exchange plan through Covered California. For example, if you have spent $1,000 toward meeting your deductible under your current plan, that $1,000 accumulation would be transferred to the new plan. Many health plans have announced they will participate in the transfer.

However, there can be restrictions related to transferring accumulated member cost-sharing dollar amounts. It is unclear if the transfer will happen from a grandfathered plan to a new plan. There may be restrictions on the metal tier level. You may only be able to transfer dollar amounts between mirrored plans such as from a Bronze 60 off-exchange to a Bronze 60 on-exchange. In addition, moving from an HMO plan to a PPO plan is like starting a new plan altogether and there will be no transfer. Check with your health insurance carrier to confirm the transfer of accumulated member cost-sharing amounts.

Covered California Silver Plans Cost More

All Covered California Silver 70 plans have an additional surcharge of 10 to 15 percent on top of the base rate. This means that a Silver 70 off-exchange plan will cost 10 to 15 percent less. Consequently, any subsidy you receive needs to be large enough to cover the surcharge and reduce the health insurance premium enough for the switch to make economic sense. If you are currently enrolled in a non-standard benefit design Silver plan, the subsidy will have to be even greater to make up for the cost differential. Bronze 60, Gold 80, and Platinum 90 standard plans have the same rates off-exchange as their on-exchange mirrored counter parts.

Do You Earn Enough For A Subsidy?

Many people have off-exchange plans – those health insurance plans bought directly from the insurance carrier – because they don’t have enough taxable income to qualify for the subsidy. This may sound absurd, but many people are living off of accumulated savings and have very little taxable income.

If the Modified Adjusted Gross Income [federal AGI + Social Security + Tax Exempt Interest + Foreign Earned Income] for the family size is below 138 percent of the federal poverty level for adults, 266 percent for dependents under 19 years of age, there are no subsidies. The applicant and/or dependents are determined eligible for Medi-Cal.

Even if you wanted a lower health insurance premium, if you don’t earn enough income, you can’t get the huge subsidies that Covered California is advertising.

How Big Are the Subsidies?

The subsidies are much larger under the American Rescue Plan than before its passage. The most tantalizing aspect is that there is no income cap. Under the prior system, income over 400 percent of the federal poverty level was not eligible for a subsidy. Under the American Rescue Plan for income over 400 percent, the subsidy is tethered to a household contribution of no more than 8.5 percent of the household income.

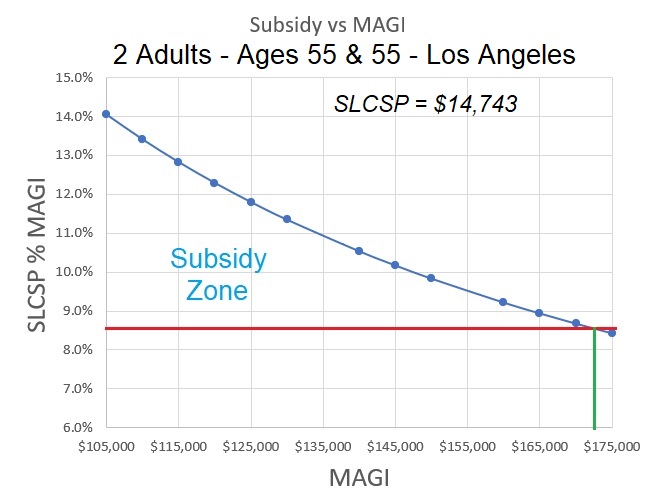

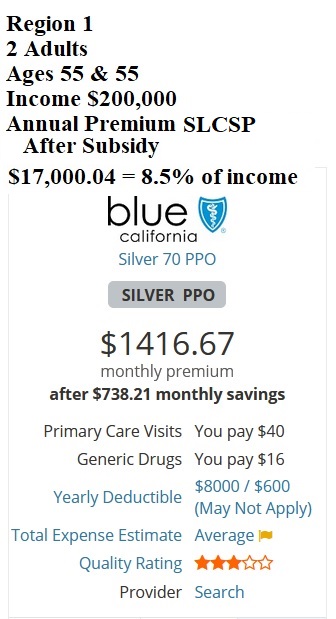

In other words, if the Second Lowest Cost Silver Plan – the benchmark health plan rate – is 10 percent of the household income, the subsidy will be the dollar amount between 8.5 and 10 percent. Because health insurance rates vary by region in California, so will the subsidies. A couple in Northern California may get a subsidy to lower their health insurance rate while a couple in Los Angeles may not get any subsidy.

For example, a couple, both age 55 years old, with an income of $200,000 will receive a subsidy if they live in Region 1 of Northern California. If the couple moves to Los Angeles County, with the same income, they would not receive a subsidy. This is because the annual cost of the Second Lowest Cost Silver Plan is less than 8.5 percent of their household income. You can apply the subsidy to any metal tier level plan or carrier. The subsidy applied cannot be greater than the cost of the health plan. Some people will see $1 health plans because the subsidy is larger than the cost of the health insurance.

Tricky Covered California Income Section

If it makes economic sense to switch to Covered California, you need to pay careful attention to the income section of the Covered California application. First, you need to state your income from the beginning of the year so that the full estimated income amount is captured. Second, the income section is very date sensitive. If your income stream fluctuates, make sure that the month in which you apply, the monthly income is over the Medi-Cal limit

Covered California screens from Medi-Cal eligibility based on monthly income. If you list $100,000 income for January through March, but show $0 for April, you will be determined Medi-Cal eligible. Finally, before you submit the application, make sure that the monthly income reflects an average for the year and that the annual income is pretty close to what you estimate your MAGI will be for the year.

Tax Consequences

The American Rescue Plan is in effect through 2022. Beyond that we don’t know what will happen. We also have not seen any updated guidance from the IRS on how they will treat excess premium subsidy repayment. Before, if the income was over 400 percent of the federal poverty level, all the subsidies had to be repaid. That obviously is not the case since there is no longer an income cap.

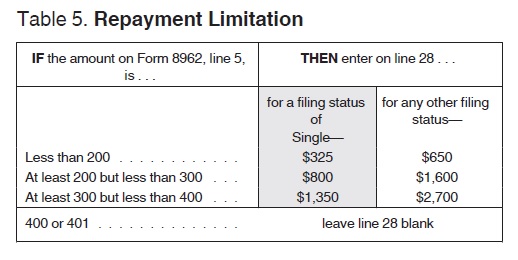

The question remains as to repayment of the subsidies if your income is considerably higher than you estimated. Under the old rules, if the income was under 400 percent of the federal poverty level, there was a repayment limitation; you did not have to repay all of the excess subsidy amount. We don’t know if that repayment limitation rule will still be in effect for 2021 or if it will somehow be modified.

The worst-case scenario is that if your final taxable income is sufficient enough to make the annual premiums for the Second Lowest Cost Silver Plan less than 8.5 percent of your income when you file your 2021 income tax return, you will have to repay all of the subsidies. However, you don’t have to take the subsidy. You can zero out having any subsidy being applied to your monthly insurance premium and then reconcile it when you do your 2021 federal income tax return.

The only way to get the subsidy is to enroll through Covered California. You can opt out of receiving the subsidy, then when you do your taxes and your income is in the zone for a subsidy, you will get the full Premium Tax Credit on your income tax return.

The special enrollment period for Covered California will last through the end of 2021.