Of all the different health insurance products on the market, vision insurance is one of the most difficult to assess when it comes to the cost of the premiums versus the value of the benefits. With the addition of new vision plans from VSP vision in 2022, I set about to determine if vision insurance makes financial sense. The answer is maybe.

Vision insurance, in general, is a little squishy in the sense that many of the benefits don’t have set copayment amounts. The plans seem designed more to drive traffic to optometrists than to limit the costs of the members. Granted, lens styles, special enhancements, and frames can vary greatly in cost. But the benefit summary of the vision plans does not give a clear indication of what a pair of glasses is going to cost or if the glasses are a good value after the insurance discounts.

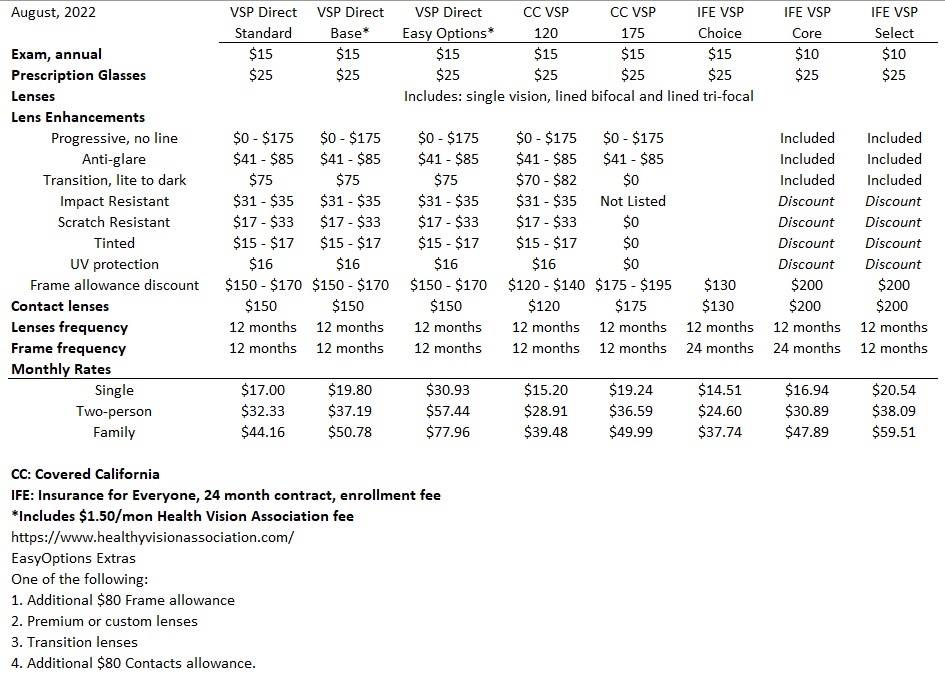

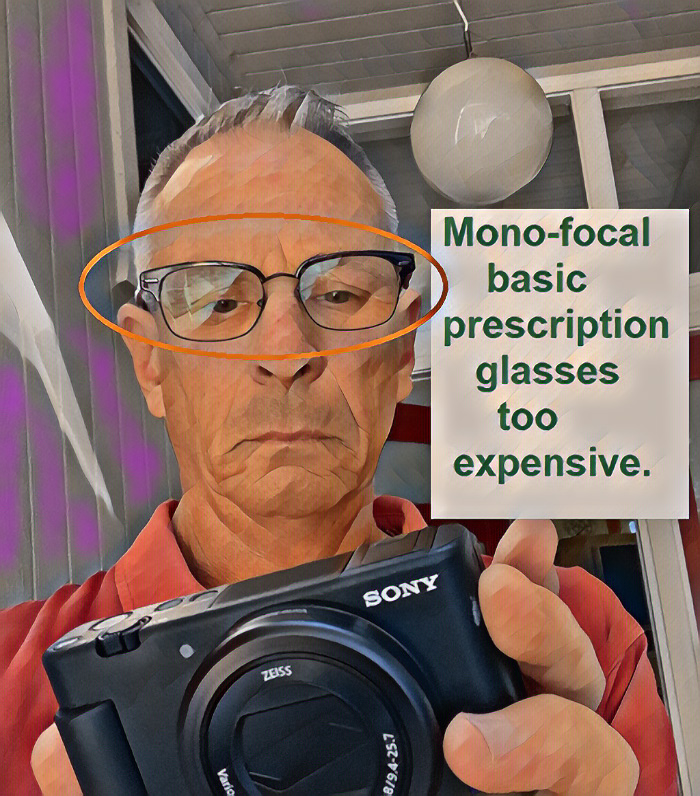

There are two set copayments in the VSP vision plans. The first is for an eye exam with a VSP provider ($15 or $10) and the second is for a pair of eye glasses at $25. The material copayment gets you one set of monofocal lenses to meet your prescription without any enhancements like progressive bifocal, photo-chromatic transition, anti-glare, anti-scratch, etc.

In addition, VSP individual vision plans have multiple sales channels. You can enroll in a vision plan direct with VSP, there are separate Covered California branded plans, and then there is Insurance for Everyone association VSP plans. All of these plans have slightly different benefits and premiums.

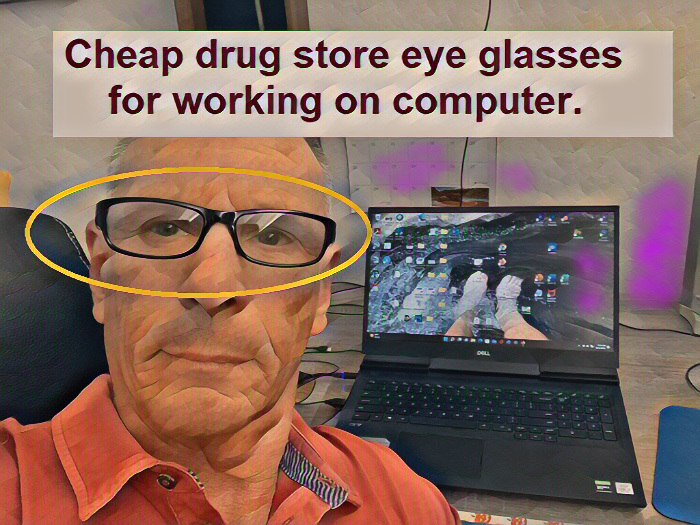

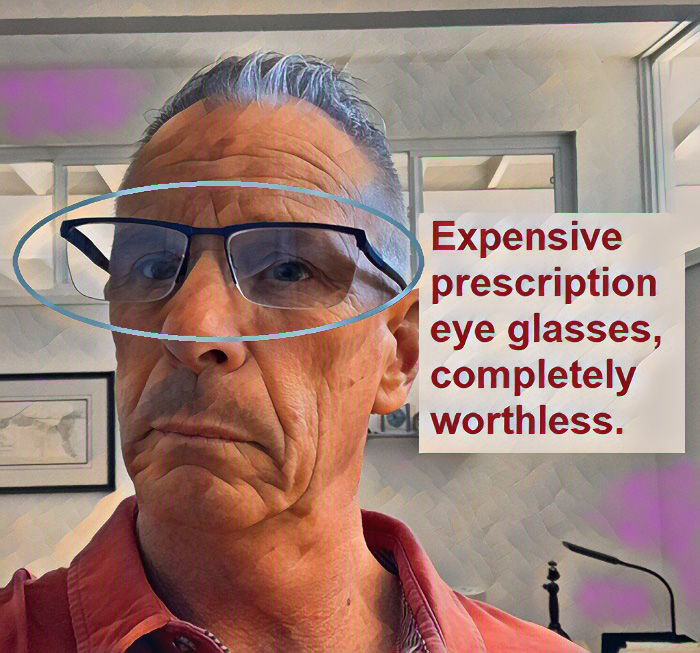

The basic exam and frames with mono-focal prescription will be about $40. This type of monofocal lenses and frame are similar to what you might find at your local drug store. From experience, the local retail store with a magnification of 1.5 to 3.0 will range from $25 to $45. I buy the local drug store glasses to work on the computer and none of my expensive “computer” eye glasses work as well as the cheap readers.

The downside to the drug store reading glasses is quality. Most of the frames you get from an optometrist are of a much higher quality. You will get many years of service from your optometrist frames where you may only get one or two years from the cheap readers.

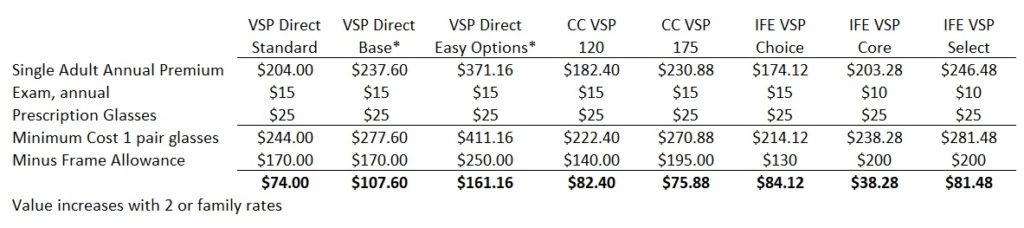

All of the vision plans will have a frame allowance. In general, the larger the frame allowance, the higher the premium. When attempting to do an analysis of the value of vision insurance, the frame allowance was one of the set amounts in the plan member’s favor. To determine some sort of rough comparison between the vision plans, I took the annual premium for a single adult and added the cost of the eye exam and basic material copayment. That totaled a specific amount without any fuzzy costs for lens enhancements. I then subtracted the frame allowance to arrive at an imperfect plan member cost.

This comparison probably is most accurate for individuals who wear contact lenses. The frame allowance really helps lower the cost of contacts without all of the uncertainty of the lens enhancements or fancy designer frames. Of the VSP direct plans, the Standard plan without the Health Vision Association fee seems to be the best base value. For the Covered California branded VSP plans, the 175 plan seems to deliver better value primarily because of the higher frame allowance. Finally, the Core plan of Insurance for Everyone is the best value with the modest premium and high frame allowance.

Of course, the frame allowance is only realized if you are purchasing expensive frames. You may like frames that are only $100. In that case, a plan with a $200 frame allowance, and higher premium, would be a waste of money.

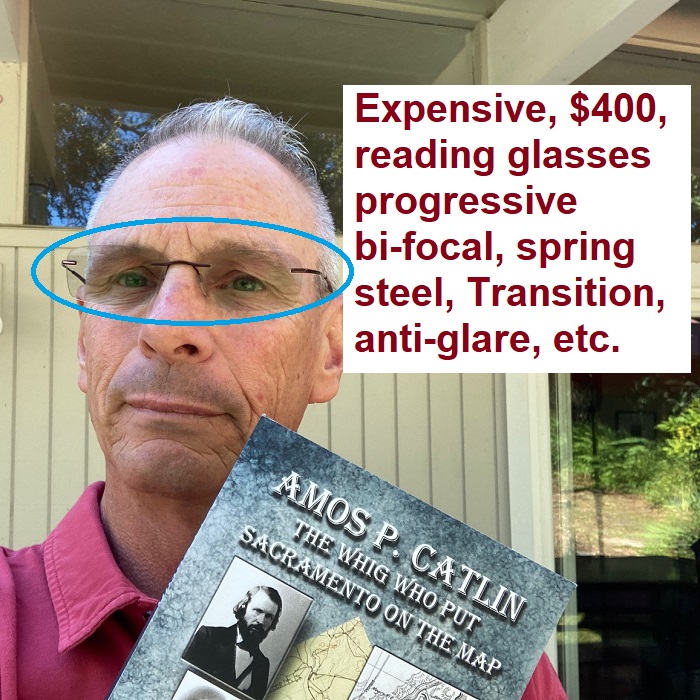

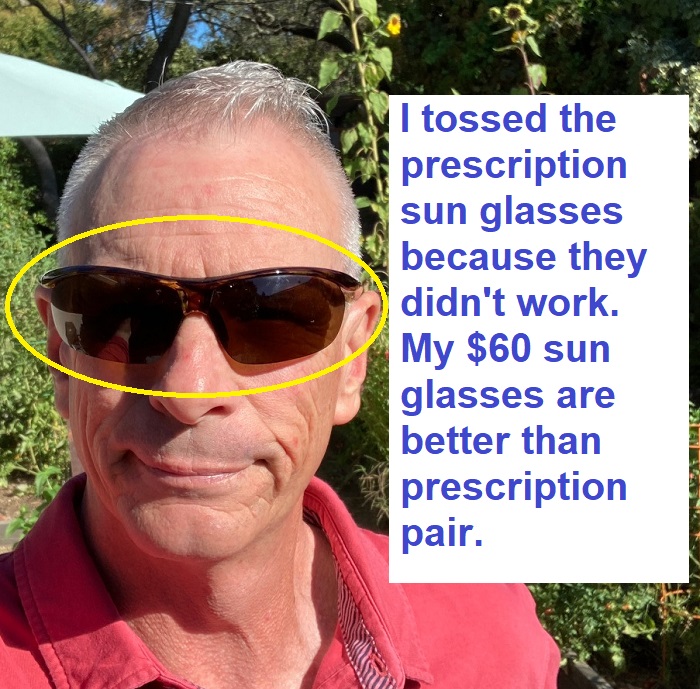

People like me, who want numerous types of enhancements to the lenses and durable frames can save money with vision insurance. However, it is really hard to determine the savings. After the exam, you have to sit with the frame fitter or closer. This is where the closer encourages you to load up the lenses with every extra available. This is where the optometrist makes their money. It is just hard to know if the prices for the enhancements have been inflated to cover the allowances within the vision plan.

I don’t think I’ve walked out of an optometrist office without spending $300 to $400 for a set of eye glasses, and that was after the supposed discounts of the vision insurance. I admit I want, and sometimes need, the lens enhancements extras for my various activities. But I’m not sure if I’m saving all that much money since the optometrist list prices and discounts seem to fluctuate.

Employer based vision plans usually have the lowest monthly premiums and best benefits. Unfortunately, employer-based vision plans are not portable. When you leave the employer, the vision insurance terminates. Remember that most all California health plans included pediatric vision for children up to the age of 19. Optometry exams are good as the optometrist can pick up on other health related issues such as glaucoma, cataracts, and diabetes. If I have any recommendation it is to lean toward vision plans with a lower premium amount. There are many vision plans in the $13 to $18 range that deliver value for the basics of eye exam and frames.

2022 VSP

- Covered California VSP 120 Plan Details

- Covered California VSP 175 Plan Details

- Insurance for Everyone VSP Choice Plan Summary

- Insurance for Everyone VSP Core Plan Summary

- Insurance for Everyone VSP Select Plan Summary

- VSP Direct 150 Standard Plan Summary

- VSP Direct Base Plan Summary

- VSP Direct EasyOptions Plan Summary