Audit of the IRS verification process for tax filers who claim the ACA subsidy and if the Premium Tax Credits were properly calculated.

The Treasury Inspector General for Tax Administration (TIGTA) has made several recommendations to the IRS for improving the reconciliation of the ACA Premium Tax Credits (PTC) claimed by tax payers on their federal income taxes. In a 2016 review of the 2016 tax filing season, the TIGTA found 16,375 taxpayers potentially received approximately $5.2 million more in the PTC than they were entitled to receive, and 15,118 returns potentially received approximately $6.7 million less in the PTC than they were entitled to receive.

One of the largest challenges facing the IRS, as identified by TIGTA, is matching the electronic report of the Advance Premium Tax Credits (APTC) authorized by the state exchanges and the subsequent 1095-A tax forms issued by the exchanges to the tax payer. TIGTA summarizes the overall process of the APTC and IRS reconciliation as background to their report. The audit report is titled Affordable Care Act: Verification of Premium Tax Credit Claims During the 2016 Filing Season, dated March 2017. Download the full report at the end of the post.

Reconciliation of APTC amounts received and PTC claims

The IRS is responsible for determining the amount of the PTC a taxpayer is entitled to receive based on the household income and family size reported on his or her tax return. Taxpayers who purchased insurance through an Exchange are required to file a tax return and attach Form 8962, Premium Tax Credit (PTC), to claim the PTC and reconcile any APTC payments made to an insurer on their behalf. This reconciliation is necessary because the actual household income and family size reported on their tax return can be different from the estimates used by the Exchange to determine the allowable APTC. In addition, taxpayers who did not receive the benefit of the APTC must file Form 8962 to claim the PTC.

IT Data Missing Or Late To Verify ACA Subsidies

The IRS’s process to verify the amount of allowable PTC an individual is entitled is complicated. Once the IRS receives data from the Exchanges, the IRS must group the data to identify the tax household. The IRS then totals the premium amount fields, which requires using multiple files. The calculated taxpayer contribution amount along with the insurance premium amount and the Second Lowest Cost Silver Plan (SLCSP) premium amount determines the taxpayer’s allowable PTC. Finally, the allowable PTC amount needs to be reconciled with information from the Exchanges regarding the amount of the taxpayer’s APTC. The report states,

Taxpayers who are entitled to more PTC than was received in advance receive the additional credit as a refund on their tax returns. However, taxpayers who received more PTC in advanced payments than they were entitled must repay the excess when filing their tax return. The amount to be repaid is subject to certain limitations because the ACA limits the amount of the APTC that individuals with household income between 100 percent and 400 percent of the Federal Poverty Level (FPL) will have to repay. Individuals whose actual household income exceeds 400 percent of the FPL are not eligible to receive the PTC and are required to repay the full amount of any APTC they received. Figure 3 lists the repayment limits for individuals with household income less than 400 percent of the FPL.

The IRS requires Federal Exchange (Healthcare.gov) and State Exchanges to report enrollment data on a monthly basis. This reporting is known as Exchange Periodic Data (EPD). The EPD is supposed to contains the households enrolled, monthly premiums, amount of APTC, and other data. The monthly EPD reports should mirror the information supplied to the tax payer on their 1095-A form they receive after the plan year has ended so they can use it to reconcile the APTC on their tax return using Form 8962. The reconciliation matches the tax payers final Modified Adjusted Gross Income with the ACA Premium Tax Credit they are actually entitled to. If the tax payer received too little APTC during the year (because of they over estimated their income), they are eligible for an additional Premium Tax Credit. If the tax payer earned had an income higher than what was estimated, they may have to repay some or all of the APTC back to the IRS.

Reconciliation of APTC amounts received and PTC claims

The IRS is responsible for determining the amount of the PTC a taxpayer is entitled to receive based on the household income and family size reported on his or her tax return. Taxpayers who purchased insurance through an Exchange are required to file a tax return and attach Form 8962, Premium Tax Credit (PTC), to claim the PTC and reconcile any APTC payments made to an insurer on their behalf. This reconciliation is necessary because the actual household income and family size reported on their tax return can be different from the estimates used by the Exchange to determine the allowable APTC. In addition, taxpayers who did not receive the benefit of the APTC must file Form 8962 to claim the PTC.

The TIGTA has repeatedly noted delays and discrepancies between EPA information and the 1095-A issued to tax payers.

In March 2016, we reported9 that delays in receiving Exchange data reduced the IRS’s ability to verify PTC claims efficiently. Our analysis of tax returns filed between January 20, 2015, and May 28, 2015, identified 438,603 tax returns for which the IRS either did not have the EPD at the time the tax returns were processed or the EPD were incorrect. Without the required EPD, the IRS is unable to ensure that individuals claiming the PTC purchased insurance through an Exchange as required. The IRS developed processes to verify PTC claims for which it did not have the EPD, including manually verifying claims to available Form 1095-A data. However, even with the use of Form 1095-A data, the IRS was unable to verify all PTC claims because not all State Exchanges submitted Form 1095-A data to the IRS timely or in a usable format.

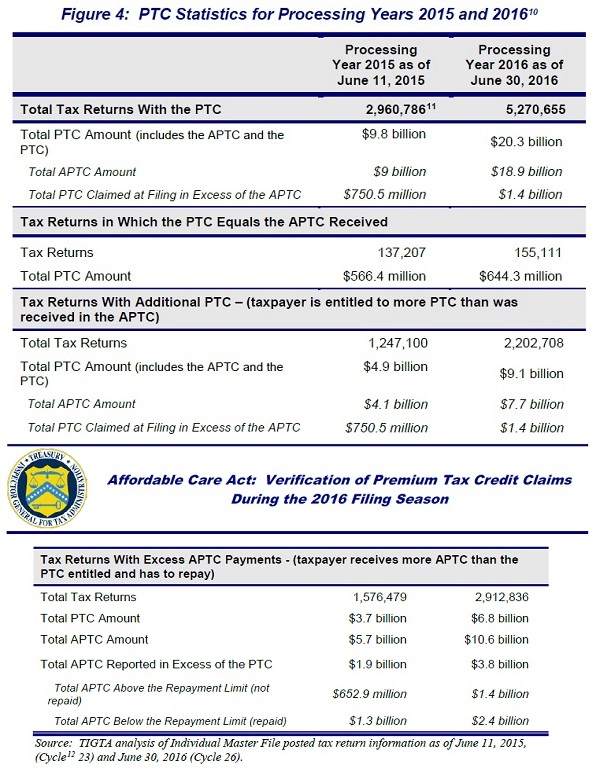

The TIGTA reported the results of their review for program years 2015 and 2016.

As of June 30, 2016, the IRS processed more than 5.2 million tax returns for which taxpayers received approximately $20.3 billion in the PTC received in advance or claimed at the time of filing.

ACA Premium Tax Credit subsidy amounts based on tax filings for 2015 and 2016.

Unfortunately, the IRS did not receive the EPD information from several states in a timely fashion. In other words, families may have been submitting their tax returns before the IRS had the EPD information. This meant they had to rely on the 1095-A submitted by the consumer, which as we know, is not always correct.

Our review of tax returns with PTC claims filed between the period of January 25, 2016, and March 4, 2016, identified 33,248 returns associated with Exchanges for which the IRS did not receive the EPD or the EPD provided was unusable. Similar to the 2015 Filing Season, the IRS continues to use manual processes developed in an effort to verify PTC claims associated with the Exchanges that did not provide the required EPD.

There were also delays with states issuing the 1095-As to tax payers.

Similar to what we reported for the 2015 Filing Season, not all Exchanges provided Forms 1095-A data as of January 31, 2016, as required. For example, the IRS did not receive Form 1095-A data from six State Exchanges (Connecticut, District of Columbia, Hawaii, Idaho, Kentucky, and Maryland).

Without the EPD and 1095-A data, the manual verification of a tax payer’s APTC and PTC is time consuming for the IRS. The TIGTA made 6 recommendations to the IRS to improve the situation. The report includes the responses from IRS managers. The six recommendations were encompassed in three general areas.

- Working with Exchanges to ensure they submit required data

- Modifying system PTC verification process to include Form 1095-A data

- Updating the verification process that results in individuals receiving potentially erroneous PTC.

Recommendation 2 was that the Commissioner, Wage and Investment Division, should revise the systemic PTC verification process to include Form 1095-A. The IRS disagreed with this recommendation. The Office of the Audit included a rebuttal comment to substantiate their recommendation.

The Allowable Premium Tax Credit Was Computed Correctly for the Majority of Tax Returns; However, Some Claims Continue to Be Processed in Error

We evaluated more than 5 million tax returns processed by the IRS as of May 1, 2016, in which the taxpayer either claimed the PTC or should have reconciled the APTCs per the EPD. We were unable to determine the accuracy of the processing of 157,931 tax returns because of discrepancies between the EPD available at the time we performed our review and the EPD that the IRS used to process the tax returns. For example, the IRS may have had the EPD that showed $3,000 for total monthly premium and no amounts for the SLCSP or the APTC at the time it processed the tax return, whereas the EPD that TIGTA relied upon may have shown $2,800 for total monthly premium as well as amounts for the SLCSP and the APTC. We provided these returns to the IRS for further evaluation. However, it should be noted that 150,185 (95 percent) of the 157,931 tax returns would not have been identified by the IRS for further review as the dollar amount of the PTC discrepancy was below the IRS’s tolerance to address the discrepancy.

For the remaining 4.9 million tax returns, the IRS accurately determined the amount of allowable PTC on more than 4.7 million (97 percent). For example, we found that the IRS’s at-filing error screening and identification processes are working as intended. The IRS appropriately identified tax returns with discrepancies between amounts reported by the taxpayer and amounts reported in the EPD for monthly premium, the SLCSP, and the APTC. For the remaining 154,744 (3 percent) tax returns, we determined the following:

123,251 tax returns – the IRS did not identify the claim as potentially erroneous as the discrepancy between the amount reported by the taxpayer and amount reported in the EPD was below the dollar tolerance for which the IRS will review a claim. Our analysis of these cases identified that the use of a dollar tolerance is resulting in the IRS not verifying high-risk PTC claims. The 123,251 returns include:

123,084 tax returns for which there was no EPD for the taxpayer. Our additional analysis identified that the IRS received a Form 1095-A for 59,621 (48 percent) of the 123,084 tax returns confirming the individual enrolled in an Exchange. For the remaining 63,463 (52 percent) returns, the IRS had no EPD or Form 1095-A. These returns received the PTC totaling $123 million.

167 tax returns for which a blank Form 8962 was included with the tax return. Even though the Form 8962 was blank, the IRS treats the tax return the same as if the Form 8962 included actual amounts. The IRS performed no review of these claims as the PTC discrepancies were below the IRS dollar tolerance for selection. Had the IRS treated these taxpayers the same as taxpayers who did not file a Form 8962, the IRS would have identified these 167 returns for additional review. As a result, these taxpayers received $87,580 more in the PTC than they were entitled to receive. IRS management informed us that the decision to treat taxpayers who file a blank Form 8962 the same as those who file a completed Form 8962 allows for consistent treatment of APTC discrepancies in all filing situations by simply looking for the presence of a Form 8962. IRS management informed us that they would consider revising the IRS’s treatment of these types of PTC claims. However, management indicated that the IRS would be unable to make any changes to existing processes until at least Processing Year 2018.

31,493 tax returns – programming errors caused the IRS to incorrectly compute the allowable PTC amount. As a result, 16,375 taxpayers potentially received approximately $5.2 million more in the PTC than they were entitled to receive, and 15,118 returns potentially received approximately $6.7 million less in the PTC than they were entitled to receive. IRS management informed us that programing was updated on or before July 31, 2016. We will evaluate the IRS’s corrective action in our annual assessment of the 2017 Filing Season.

Another recommendation dealt with updating the verification process for tax payers who submit a blank Form 8962, have a Shared Policy Allocation for mix households, and families who elect the Alternative Computation of Year of Marriage PTC calculation.

The overall report highlights the complexity of properly reconciling the APTC issued by the Federal Exchange and State Exchanges, with the tax return filed by the tax payer. The data provided in the report show that all the agencies involved from the Federal Exchange, State Exchanges, and the IRS continue to make improvements to the reporting system to reduce either over payments of the ACA subsidy or underpayment to eligible tax payers enrolled in health plans qualified for the Affordable Care Act Premium Tax Credit subsidies.

I would like to include a note of appreciation to Certified Insurance Agent Steve Schorr of San Pedro, California, for bringing this report to my attention.

Download and read the full report below

2016_Verification_Premium_Tax_Credit_IRS

TIGTA’s analysis of approximately 4.9 million tax returns processed by the IRS as of May 1, 2016, found that the IRS accurately determined the amount of allowable PTC on more than 4.7 million (97 percent) returns. For the remaining 154,744 tax returns, either programming errors resulted in an inaccurate PTC computation or high-risk tax returns were not identified as potentially erroneous because the discrepancy amount was below the dollar tolerance for which the IRS will review a claim.