Dave Jones scolds Aetna for rate increases but ignored Health Nets.

California Department of Insurance Commission Dave Jones excoriated Aetna in a news release on December 18th over Aetna’s planned small group premium increases but he was noticeably silent when Health Net submitted a similar rate increase for individuals and families. The average increase for the 2015 Health Net IFP PPO plans is 10.8% while the Aetna small group increase is 10.7%. Jones excoriation of Aetna hints more to sour grapes over the loss of Proposition 45 than a consistent champion of lower consumer health insurance rates.

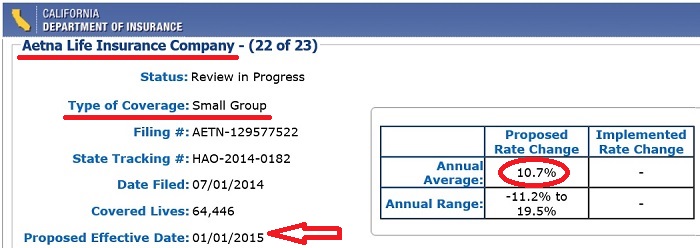

Jones says Aetna’s 10.7% increase unreasonable

“In the final days of 2014, one of the best gifts California small business owners could receive would be the promise of reasonable health insurance rates for the new year,” said Insurance Commissioner Dave Jones. “Unfortunately, California law does not protect consumers and businesses from excessive and unreasonable health insurance rates. The ongoing trend of unreasonable rate increases imposed on California businesses and families over the last decade is likely to continue in 2015.” – CDI news release 12/18/14. See the full text at end of post.

Aetna 2015 small group rate increase averages 10.7%.

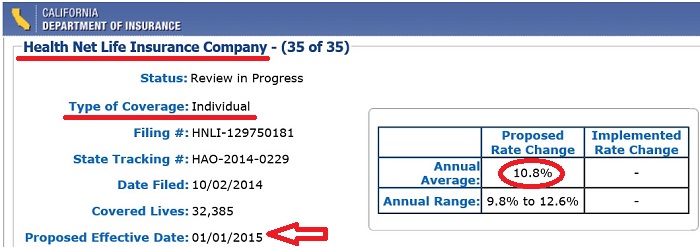

Jones quiet on Health Net’s 10.8% rate hike

But where were the pro-consumer words from Jones when Health Net filed the rate increase for their PPO individual and family plans (IFP) in October? Not only must members of Health Net’s IFP PPO plans absorb an average 10.8% rate increase, these plans will no longer be offered through Covered California. That means that families that had received ACA tax credits to reduce their Health Net PPO premiums are facing rate increases of several hundred percent if they want to keep their PPO plans.

Health Net individual and family PPO rate increase averages 10.8% for 2015.

Small groups are no better than family plans

Individuals and families that purchase their health insurance directly from Health Net or Covered California are no less worthy of being represented by the Insurance Commissioner than households who receive employer sponsored health plans. While the California Department of Insurance reviewers noted several issues with the Aetna justification for a double-digit rate increase, the consumer doesn’t care. From the perspective of the health plan member, how can any rate increase of over 10% be justified when inflation is less than 2%?

California Department of Insurance Aetna rate hike news release

For Release: December 18, 2014

NEWS RELEASE Major health insurer imposes unreasonable rate on California businesses

Aetna’s gift to California’s small businesses—a hefty increase in health insurance rates

SACRAMENTO, Calif. – Insurance Commissioner Dave Jones announced today that his department actuaries found Aetna Life Insurance Company’s recent rate filing on its small group policies both excessive and unreasonable. The average increase of 10.7 percent is effective January 1, 2015 will impact more than 64,000 individuals. For small business with renewal dates in the first quarter of 2015, the maximum increase is 19.5 percent.

“In the final days of 2014, one of the best gifts California small business owners could receive would be the promise of reasonable health insurance rates for the new year,” said Insurance Commissioner Dave Jones. “Unfortunately, California law does not protect consumers and businesses from excessive and unreasonable health insurance rates. The ongoing trend of unreasonable rate increases imposed on California businesses and families over the last decade is likely to continue in 2015.”

Department of Insurance actuaries reviewed the rate filing submitted to the department and found that the average 10.7 percent increase unreasonable. Unfortunately, Aetna’s small group policyholders were charged an unreasonable rate in 2014 after the department found its April 2014 rate increase unreasonable, and 2015 is not any better, as policyholders face another unreasonable double-digit rate increase.

After the Department’s health actuaries completed their analysis of the rate filing, the results were shared with Aetna’s leadership and the department requested they reduce the rate. Aetna is moving forward with this unreasonable rate increase, which will cost small businesses a projected $23.5 million in excessive premium, based on the company’s own projections.

Media Notes: The Department of Insurance actuaries found this rate increase unreasonable based on a number of factors:

Aetna’s Morbidity Adjustment is Unreasonable

The company’s assumption that members in the new ACA-compliant plans are less healthy than members in the older plans contradicts Aetna’s actual experience. Moreover, any such adjustment should be offset by the federal risk adjustment program, so this should not result in a rate increase.

Utilization Assumptions

The company’s assumption that utilization will grow by 2.5 percent in 2014 and 2015 in unjustified. This assumed growth in utilization is excessive given the recent history of utilization growth in the company’s health plans and current trends among carriers.

Aetna’s Extra Loading to the Rates for Groups Issued or Renewed during 1Q2105 is Inaccurate

The company has applied its pricing trend over a full quarter using an annualized trend rate of 9.4 percent. The company should have applied the pricing trend to only one and one-half months. Also,the trend rate used (9.4 percent) is larger than and inconsistent with other trend assumptions used in the filing.

###