Kaiser and Covered California teamed up to create duplicate enrollments and subsidy. This caused a family to receive too much Advance Premium Tax Credit (APTC) subsidy for health insurance that showed up as liability they have to repay on their 2019 federal income tax return. The errors are complicated in terms of bookkeeping and can be easily missed.

It has taken me hours to partially untangle and identify the bookkeeping mess created by Kaiser and Covered California. What is frustrating is that one would assume that both of these large organizations would have audits in place to catch the very obvious problems with one of their accounts. The following is a recitation of the events and how we addressed them.

Kaiser Cancels Plan Family Paid For

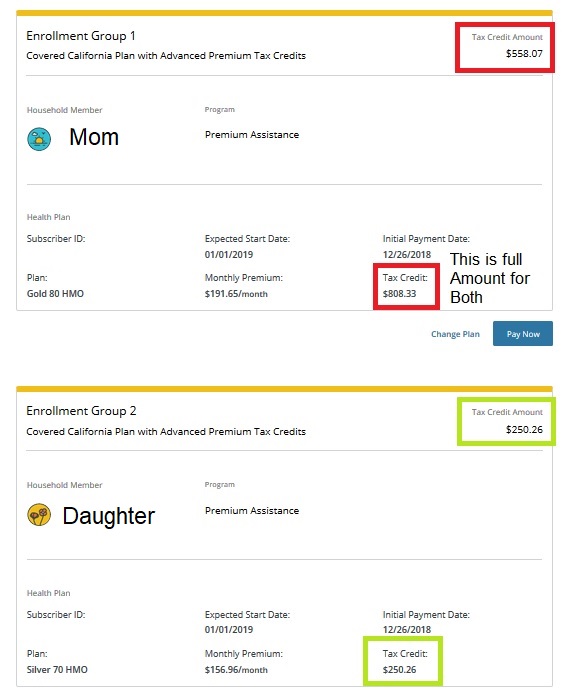

The primary applicant, who is my client, decided in December of 2018 that she wanted to split the household members into different health plans. The primary applicant wanted a higher benefit level health plan from Kaiser. In 2018 she and her daughter were enrolled in a Kaiser Silver plan. We enrolled the primary applicant, Mom, in a Kaiser Gold plan and her daughter on a Kaiser Silver plan for 2019.

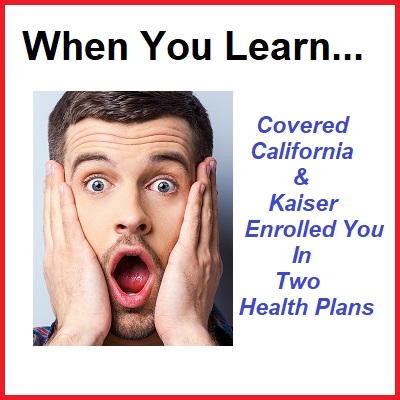

I split the household on December 9, 2018 and immediately recognized that the Covered California system had applied the appropriate amount of federal APTC subsidy to the daughter, but the system awarded APTC to the mother in the amount that was equal to both household members. The screenshot that I grabbed even shows APTC should be $558.07, but $808.33 APTC was applied to her Kaiser Gold premium.

APTC Mom $558.07 + APTC Daughter $250.26 = $808.33 ATPC Total. The $808.88 APTC was the amount that was applied when both Mom and daughter had been automatically renewed into the Kaiser Silver plan for 2019.

Because splitting the household members was a significant change, and Mom was beginning a new plan, I opted to work with Mom to make the first month’s binder payment for the Silver and Gold plan through the third-party application through Covered California for the new Kaiser enrollments

I grabbed screen shots of the Kaiser confirmation page that shows that Mom made a binder payment of $191.65 for her Gold plan that we knew was inaccurately low. She also made a payment of $156.96 for her daughters Silver plan for January 2019.

Covered California Duplicate Enrollment

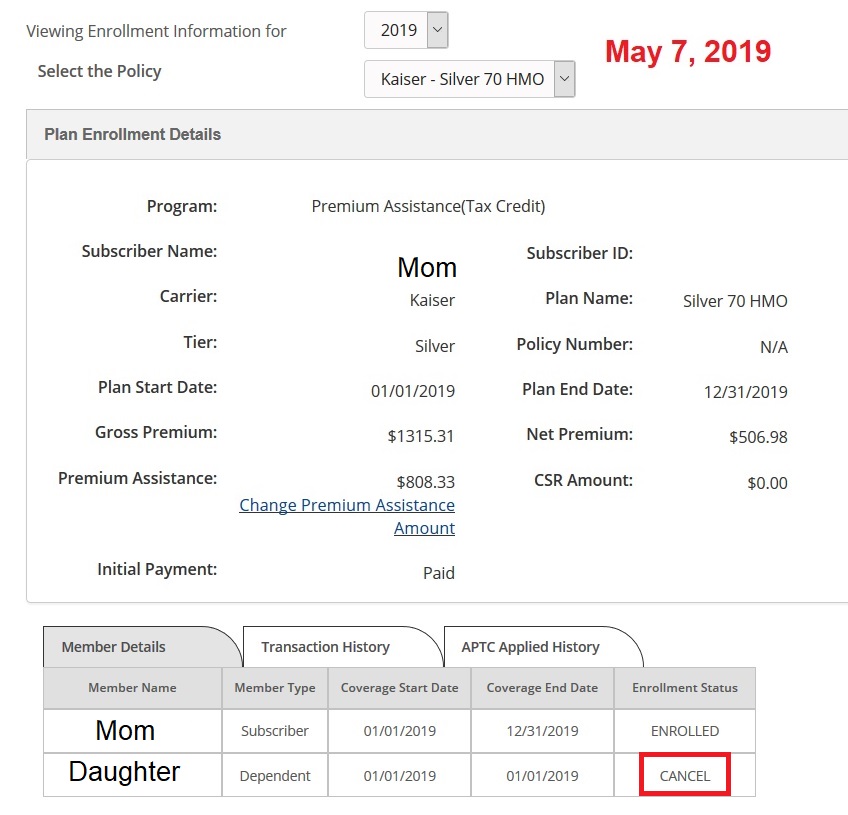

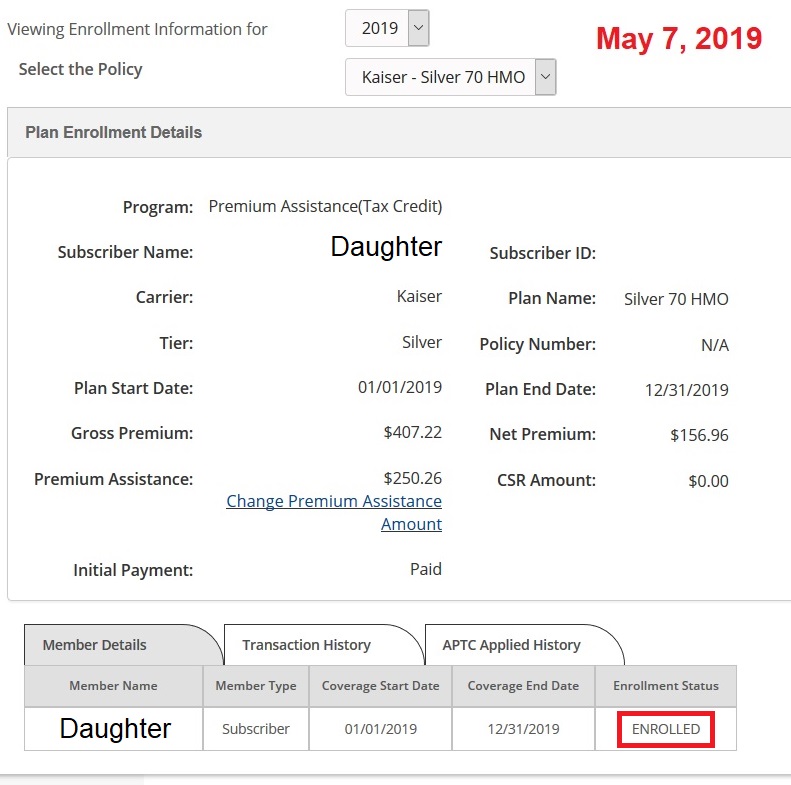

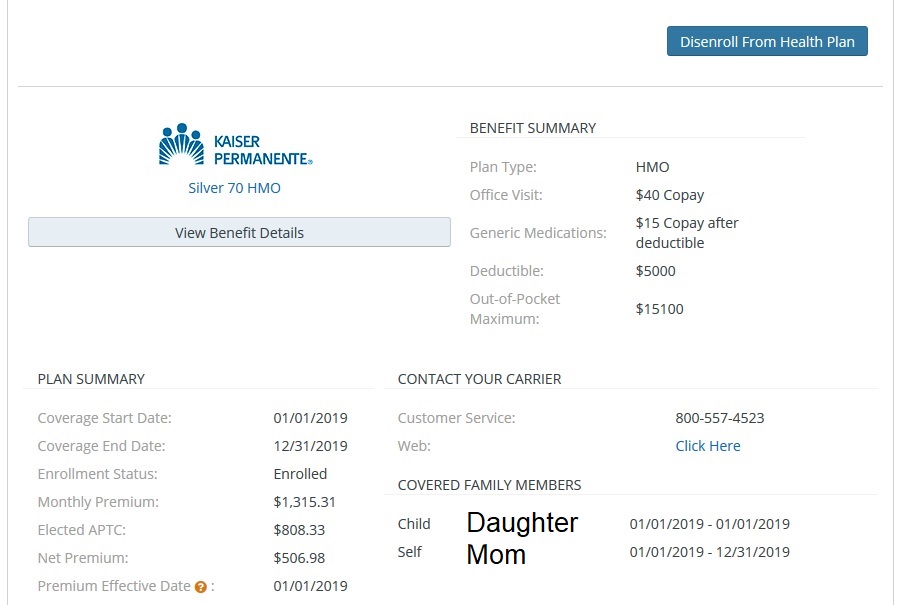

I was assured by Covered California in December of 2018 that the excess subsidy issue on Mom’s Gold plan would all be straightened out after open enrollment closed. However, in May of 2019 the billing issues continued. Covered California showed Mom enrolled in a Silver plan with a rate that looks like it was for both her and her daughter with the full APTC applied, BUT the daughter was cancelled from the plan. In addition, the daughter had her own enrollment for a Silver plan in the Covered California account.

There was no Gold plan for Mom. I would later find out that the Gold plan had been cancelled by Kaiser for lack of payment on February 25, 2019. But of course, we have the screenshot that Mom did pay for the Gold plan.

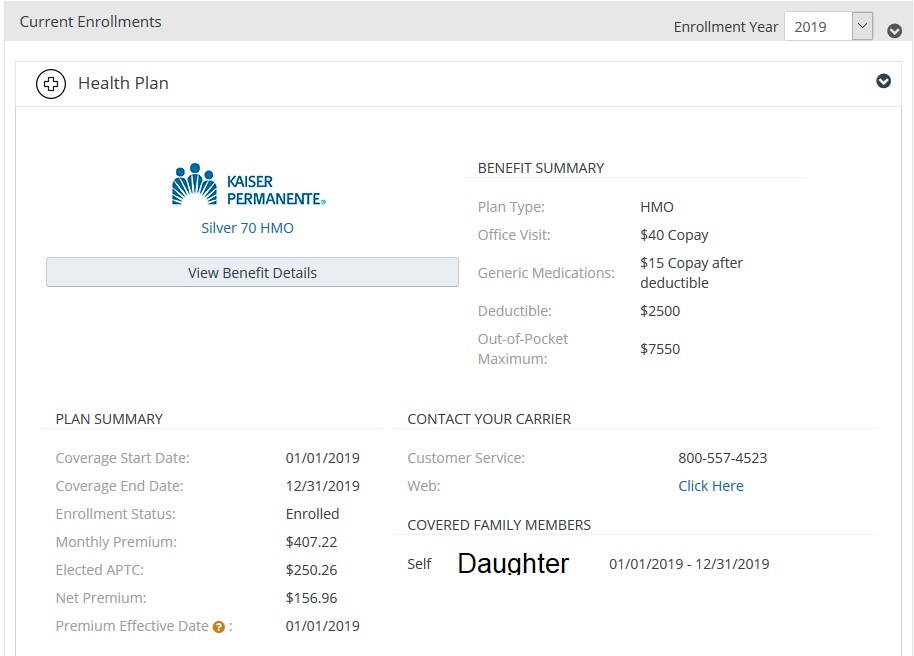

All of this was reported to Covered California on 5/7/2019 and I was again assured that the issue would be taken care of. What Covered California did was just reverse the cancellation of the daughter from the Silver plan with Mom. For all of 2019, Covered California shows the Daughter enrolled in 2 different Silver plans, Mom enrolled in a Silver plan she did not want, and that they had cancelled her Gold plan that Mom had paid for.

Duplicate Subsidy And Big IRS Tax Bill

The 1095-A that the family received reflects the APTC paid on behalf of the daughter’s Kaiser Silver plan of $250.26 per month, AND, the APTC paid for Mom and Daughter in another Kaiser Silver plan of $506.98 per month.

They received far too much APTC in 2019 for their income. One household member was enrolled in 2 Kaiser Silver plans. Mom never was enrolled in the Gold plan she paid for. But Mom was charged for the Kaiser Gold plan. The family has the records of not only the original payments in 2018, but the ongoing monthly payments that are equal to Mom with a Gold plan and her daughter with a Silver plan.

The Advance Premium Tax Credit subsidy is based on the household size and income. It doesn’t matter too much what plans are selected, unless it is a Bronze plan where the subsidy is greater than the health plan rate. For this family, Covered California forwarded to Kaiser the full amount of the APTC they were due, based on income and household size, PLUS, an additional $3,000 of APTC subsidy for the daughter’s second Silver plan.

The extra $3,000 is clearly stated on the 1095-A. I have seen it. The question is, “What did Kaiser do with the extra $3,000 and how did they not figure out that they were receiving no consumer premium to attach to the monthly subsidy?”

If we are pointing fingers, “How did Covered California allow an individual to be enrolled in two health plans and receive two subsidies simultaneously?” We have filed a 1095-A dispute with Covered California and requested a State Fair Hearing through the Department of Social Services to correct errors being attributed to the family in the form of having to repay APTC they never received.

Usually, if a family receives too much APTC subsidy because they earned more money than they estimated, there is nothing we can do. The family must repay the excess tax credit subsidy back to the IRS. In this situation, Covered California erred and paid too much subsidy for a second enrollment that Kaiser gladly accepted. Those two large professional organizations need to get together and sort this out.

If this can happen to this nice little family, it can happen to you too. Don’t blindly accept what your tax preparer has calculated for either any additional Premium Tax Credit, OR, the repayment of excess Premium Tax Credit back to the IRS. Crunch the numbers yourself using IRS form 8962. There is a good chance that the numbers are correct and accurate. However, there is also a chance they may be wrong. Your tax preparer is just following the information your give him or her. They don’t know if Covered California or your health plan has made a big boo-boo.

2019