California lacks good consumer data to rate health plans.

There is little complete data on consumer experience or ratings of health plans offered through Covered California. The Office of Patient Advocate (OPA) released their latest report cards in early October, but even they are devoid of a complete consumer experience with California health plans in 2014. Covered California, who should be in the lead of producing consumer reports, hasn’t provided much relevant data to help consumers make an informed decision for the 2015. Without complete health plan reviews or ratings it is difficult for consumers to really comparison shop between plans.

New health plans for 2014

PPO and EPO health plans offered through Covered California and off the exchange in 2014 were significantly different from previous offerings. The implementation of nineteen different rating regions, narrow provider networks, new rules governing gender non-discrimination, and the introduction of Exclusive Provider Organizations (EPOs) makes a comparison to previous year’s consumer experience virtually null and void.

Old data on Covered California website

A review of health plan ratings on the Covered California website notes the data is from 2011 (as of 10/19/14). Before 2014 health plans could pick and choose who they wanted to insure. This health discrimination based on pre-existing conditions created a pool of relatively healthy individuals that were less likely to need health care services and have to interact with their health plan for necessary services and authorizations for services.

Customer service isn’t a high priority

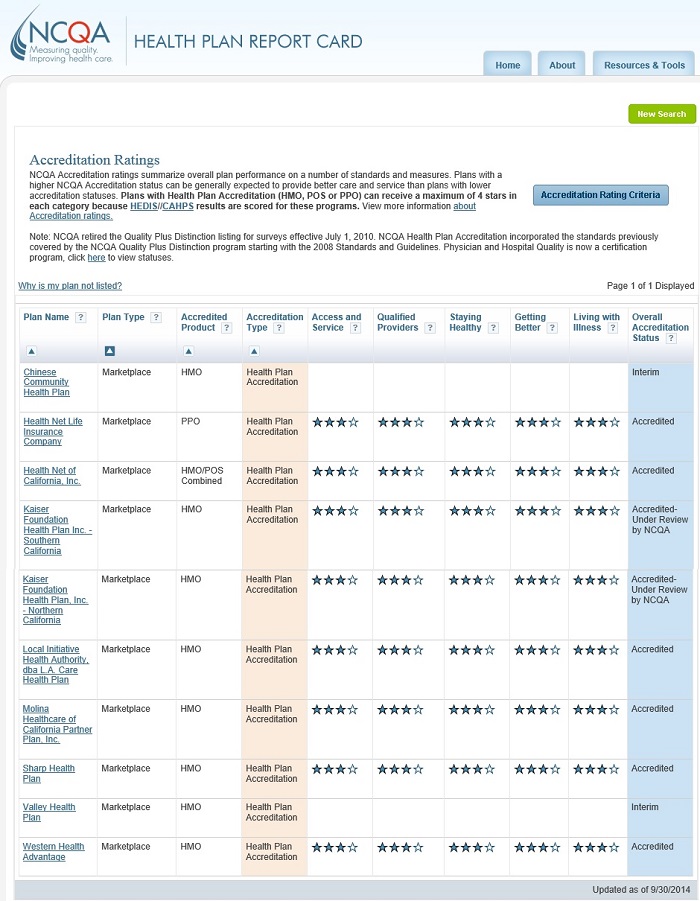

Before the OPA report cards were released I scoured the big health plan rating organizations such as NQCA for information. (See NCQA market place ratings at end of post). Because a health plan’s accreditation may have occurred before the ACA was fully implemented in January 2014, there appeared to be no current data on the newly redesigned health plans. While the OPA report is a good start, they are only measuring certain aspects of the health plans. Some of the fundamental interactions consumers have with their health plans such as simple customer service may not be fully measured.

PPO health plans rating 2014

HMO health plan ratings 2014

Medical Groups

Just as important as your health plan paying for health care are the doctors providing you the health care. There seems to be even less information about individual doctors and medical groups than health insurance plans. The OPA has accumulated some data on medical groups that operate in forty different counties of California. The data are from medical groups that participate in HMO plans. So while it may not be the most representative for PPO plans, some ratings are better than nothing. To view the medical groups by county visit the Medical Group by County page.

19 Rating Regions

California was broken up into nineteen different rating regions where carriers could offer health plans with different rates based in the regions health care costs from doctors, hospitals, labs, outpatient surgery centers, etc. The result for some regions is that only one health insurance company was offered. This is the case in Monterey where the only option through Covered California is Anthem Blue Cross. The major carriers also decided to offer only certain types of health plans such as PPO, EPO or HMOs in specific regions. This further complicated and dilutes consumer experience statewide.

Narrow Networks

The next and perhaps the most significant change to the health insurance landscape were the narrow networks created by the carriers. Suddenly consumers found long time family physicians and other providers no longer in-network. Aside from lawsuits against several carriers for misrepresenting their networks, there is no consumer data on how these narrow networks have denied and delayed care. There is also no data on how out-of-network costs, created by the narrow networks, have added to consumer out-of-pocket expenses for health care services that may have been covered before the ACA.

Access to covered care

The consumer reports I have reviewed have also failed to quantify the difficulty some consumers have had accessing care under California’s Gender Non-Discrimination Act. Several of my clients have had huge problems getting care for transgender health related services from the carriers. While I understand these are new covered benefits in California, the lack of preparation of the carriers to approve these services has amounted to a consumer nightmare.

Exclusive Provider Organizations

With the roll out of the Covered California health plans consumers were introduced to the Exclusive Provider Organization (EPO) health plan model. EPOs are similar to PPOs but there is no out-of-network coverage. To compound the confusion, Blue Shield was limiting in-network providers to only those within the region in which the health plan member resided. Consequently, a person could not go to a neighboring county or region to see a specialist even if that provider was in-network for the similar plan in that region.

Where’s the consumer reports on health plans

It’s amazing that magazines can devote whole issues to the consumer satisfaction ratings of the latest automobiles but finding simple and honest evaluations of health plans and doctors is virtually non-existent. If you would like to contribute to a non-scientifically designed survey of consumer evaluations of 2014 California health plans please visit my survey page Consumer Health Plan Experience Survey. With enough responses I will publish the data to help consumers make choices for their individual and family health plans in 2015.