One would assume that the probabilities of a second Covered California enrollment nightmare would be less than being struck by lightning. But for one family, lightning has struck not once, but twice. Covered California and Blue Shield have teamed up to disenfranchise all but one family member because the mother delivered a healthy baby boy in May.

Family first struck by Covered California lightning in December

The first lightning strike came when the family attempted to enroll in a Covered California health plan in December to begin January 1st. Mrs. L contacted me in December when her online application was never transferred to Blue Shield. I could find no reason why Mrs. L family application was in limbo. I had no better luck when I enrolled the family through my agent portal. Both the online applications from the family and my enrollment as their agent for the family through the Covered California website were lost in space. Blue Shield swore they never received either application from Covered California. (See: Covered California ignores pregnant mother where I wrote about the first lightning strike.)

Covered California mandates plans be cancelled

Since Mrs. L was pregnant with the family’s third child and had prenatal appointments set up for January, they had to get a health plan in place because Covered California mandated that their old plan be cancelled. All through the first part of January we wrestled with both Covered California and Blue Shield to find the enrollment and start the plan. With no luck and Covered California and Blue Shield pointing fingers at one another, we just enrolled the family in a health plan outside of the exchange with no subsidies. Unfortunately, the earliest the off-exchange plan could start was February 1st. So the family was not covered in January.

I publicly begged for help

At the January Covered California Board meeting I made public comments stating the plight of this family who were left with no health insurance because of the state exchange. That got the attention of several people at Covered California and they worked diligently to get the family enrolled. All the enrollment data for the family was sitting at Covered California, but for some reason, Blue Shield wasn’t able to process it to put the family plan in place.

New fight over Blue Shields beleaguered billing system

When Blue Shield finally received the family’s enrollment information, the next challenge for the family was fighting with Blue Shield over their billing system. The Covered California plan was retroactive to February 1st, the same date as the off-exchange plan the family had purchased. We terminated the off-exchange plan but Blue Shield couldn’t figure out how to apply the premium payments from the off-exchange plan to the Covered California health plan. The children’s dental plan, which was a separate policy, was another billing nightmare all unto itself. (See: My visit to Blue Shield to fix client’s billing nightmare)

New baby causes a storm

After hours of working with Blue Shield, the billing issues were finally settled at the end of April. We figured it would be smooth sailing from there. When Mrs. L had her baby we would just add the newborn to the household and there would be no problems. I just don’t know how I didn’t see those ominous clouds building over this family’s house. Another storm was coming.

Covered California not ready to handle newborns

In her meticulous attention to details, Mrs. L emailed me the day after she delivered her baby boy to have me add the new bundle of joy onto their family plan through Covered California. All of guidance said that when a newborn is added to a family policy the health coverage becomes retroactive to the child’s date of birth. However, when I tried to add the newborn baby boy, the Covered California CalHEERS enrollment system wasn’t recognizing the date of birth as the effective date. To be on the safe side, because of the horrors that family had already gone through, I called Covered California for their recommendations on how to proceed. (See: Adding a baby may cost you double)

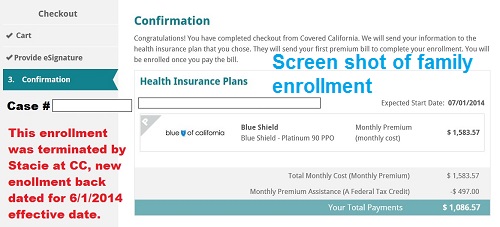

Since I don’t trust the Covered California enrollment system, I always take screen shots of application pages.

Tricking the system to work

The service center representative said they were aware of the limitation of the Covered California system for adding a newborn but they had a fool-proof method for adding a child . So I let the Covered California representative terminate the old plan and create a new enrollment application with the day-old baby boy as the latest member of the household. We thought everything was taken care of until Mrs. L had her first follow-up doctor visit for her and her child. She was told by the doctor’s office that the only person on the health plan was her, the mother of the baby. But how could that be, she had been paying the new health plan premium that reflected the enrollment of five members in the household: two adults and three children.

Lightning strikes a second time

Upon frantic phones to Blue Shield, we learned that the only person on the health plan was indeed the mother. Blue Shield again said it was Covered California’s fault for a bad data transfer. Covered California threw it back to Blue Shield. Lightning had struck a second time in almost the same spot for this family. We reported the problem in the middle of June and received a response from Covered California a couple of weeks later.

Recently you requested personal assistance from our support center. Below is a summary of your request and our response.

Subject INCPSxxxxxxx.

Response By Email (Erin) (06/27/2014 08:46 AM)

Reference No.: INCPSxxxxxx

Summary: Covered California-Consumer Portal – Enrollment-AHBX

Your reported issue/request has been resolved with the following resolution:

A maintenance release has gone out this week where adding a newborn is supported.

An SCR will need to cancel the current plan, re-enroll with a back-dated application for 3/1/2014 WITHOUT the baby.

After selecting plan, the user can submit a change report to add the baby. An effective date will be sent out for the baby with a begin date of the baby’s birthdate.

Please do not hesitate to contact the Help Desk should there be any further questions or inquiries regarding your issue/request. Please quote your assigned Reference Number.

Customer By Phone (Erin) (06/18/2014 08:32 AM)

case xxxxxxxxx – created sys tkt INCPSxxxxx. – carrier did not get addition of new baby

Issue Summary:834 feed requested

Last Action before Issue:added baby on to app 5/29 – carrier does not see this

Application ID:xxxxxxxx

Case ID:xxxxxxx

Message Identifier:carrier does not see newborn

User ID:insuremekevin

Page Title at top of page):enrollment

Question Reference # 140618-xxxxxx

• Date Created: 06/18/2014 08:32 AM

• Date Last Updated: 06/27/2014 09:00 AM

• Status: Closed

The IT solution caused the problem

The help desks “work around” solution is crazier than anything I could have dreamed about. Their solution is essentially what the customer service representative did in the first place. Aside from the fact that the enrollment date of the new plan was June 1st, there was no reason to withdraw the new application, re-enroll without the child and then add him back in. At least no one at Covered California was going to do that and I certainly wasn’t going to add another cook to the kitchen by making my own adjustments. Covered California said they would resend the data feed to Blue Shield. As of July 7th, Blue Shield only recognized Mrs. L as being on the health plan.

Another 834 feed request

As of today, we are waiting for yet another “enrollment data transfer” (aka 834 feed request) from Covered California to Blue Shield. I have no faith that it will work, but perhaps with the “incident report” number Covered California gave me, Blue Shield will be able to trace at what point the problem is occurring for this family. It is an understatement to say the Mrs. L has had her fair share of stress from battling for coverage when her first plan was lost to the billing nightmare and now no coverage for her newborn baby, daughters or husband. They were struck twice by the Covered California lightning of a failed software program.

Did anyone create a procedural manual?

As best I can tell the vortex of the problem started when the service representative cancelled the family’s first plan. With that cancellation or withdrawal I have learned that all the uploaded documents to verify income and residency vanished from the Covered California account. Blue Shield issued a new member ID indicative of a whole new health plan enrollment, not just the addition of a new family member. Plus, I, as the Broker of Record, was stripped off the account in the data transfer to Blue Shield. This probably occurred because the service center person initiated a completely new application for the family. While I can see the family in my Covered California agent dashboard, Blue Shield restricts my ability to advocate for the family with them because I am not listed as the agent.

Babies aren’t the problem, Covered California is the problem

Six months into this $200 million plus Covered California ACA health plan enrollment system and it still can’t handle simple and routine insurance issues such as adding a newborn. For this family and agents such as me who have had to endure the tortures of this seemingly broken system, we recoil and wince as if we are about to be struck by lightning when we hear the words “Covered California”. That doesn’t mean that I’ve given up on the ACA or California’s exchange. I have lots of clients who have had no problems. But they haven’t had any babies either. So I guess we will all press forward trying to sort out the problems that Covered California presents to us because affordable health insurance for families and individuals is more important than a foundering state bureaucracy that can’t figure out how to solve the simplest of problems.