The first challenges individuals and families faced with the smaller provider networks offered in California was keeping their current physician or finding doctors that would accept the new health plans for health care treatment. The next hurdle has been doctors referring or using out of network physicians for patient care. Patients are now getting slapped with health care invoices for services or medications not covered by their health plans.

Doctors refer and use out-of-network providers

When a primary care physician recommends tests from a local lab, medications from pharmacy or perform a procedure with other doctors, it’s assumed that those services will fall under the new health plans. Sadly, doctors and their office staff are not taking the time to research that the referred labs, pharmacies or participating physicians also accept the new individual and family PPO or EPO health insurance. If those providers don’t accept the new health insurance, patients are being stuck out-of-network costs under a PPO plan or must entirely shoulder the expense if they are in an EPO plan.

Lab tests not covered

One client had his doctor refer him a laboratory for routine blood tests. The quote from the lab seemed very high to him for simple blood tests. Upon further research he found out that the lab wasn’t an in-network provider with his health plan. Instead of the modest copayments for the routine tests he was being asked to pay the full retail price. Fortunately for him he researched the issue and avoided a $900 lab test invoice by finding a provider who was in-network. The big question was why the doctor or at least the office staff didn’t know they were subjecting the patient to excessively high health care costs because the lab they referred was out-of-network?

Doctors use out-of-network doctors during procedures

Another client called and said the anesthesiologist their doctor had used was not in-network and they were now facing out-of-network charges. This client properly assumed that the out-patient procedure, completely arranged by the physician, would fall under their health plan. While the procedure was covered, the anesthesiologist the surgeon contracted with was not in the network. The invoice liability was partially muted by the fact that the patient has a PPO plan and the costs would accrue to the out-of-network column to meeting the annual maximum out-of-pocket maximum for out-of-network expenses. Had the client been enrolled in an EPO plan, none of the expense would be covered or added to meeting the maximum out-of-pocket amount.

Doctors are confused over EPO vs. PPO

Shortly after the first of the year, when the new plans took effect, I got a call from a client saying the OBGYN she had been seeing for her pregnancy was NOT in-network with her new health plan. She had already seen the physician on numerous occasions. Because she was in an EPO and the doctor was out-of-network, there was no coverage for the cost of the office visits. (See: Doctors kick patients out of practice).Part of this coverage failure resulted from Anthem Blue Cross EPO member ID cards erroneously stating the plan was a PPO. Even though the card said “Tiered Network” indicating an EPO, the doctor’s office staff assumed the patient had a PPO and would be covered. (See: Anthem Blue Cross changes EPO member card.)

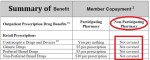

Locate Summary of Benefits for health plan coverage

There also seems to be problems with pharmacies and labs either accessing or understanding the copayments for the new health plans. People are being quoted prices higher than the copayments listed within their plans for medications and lab tests. It’s important that health plan members know their plan benefits, deductibles, coinsurance, copayments and covered medications. All of this information can be found in the Summary of Benefits for the health plan and it’s sometimes printed on the member ID card. The Enhanced Silver Plans purchased through Covered California, based on household income, have reduced cost sharing for many of the office visits, labs and pharmaceuticals. (When available I have list the Summary of Benefits for each health plan on my website for downloading under the Health Plan menu tab.)

Health plan may be of no help

Even as this story depicts in the L.A. Times, (Recording seems to refute claims made by Anthem), health plan members can’t even rely on the health plan to direct them to providers that are in the network. All of the health plans offer websites that allow members to search for doctors, hospitals, labs and pharmacies in their area that are in-network. But it is still best to call the provider to make sure they really are “in-network” as many doctor offices are still confused about their participation. And if a doctor’s office says, “Yes, we take all PPOs”, press them to learn if they are actually in-network. Out-of-network costs associated with a PPO can still be substantial and won’t necessarily contribute to meeting the annual maximum out-of-pocket amount for “in-network” services. See: What is the difference between PPO, EPO, HMO plans?