Covered California small business plans will offer competitive choices for employers

Covered California released their small business health option plans (SHOP) for small employers and they might prove competitive for some companies with less than 50 employees. In order for SHOP to be successful, Covered California will have to overcome the reticence that small businesses have with the Affordable Care Act and show them the value of participating in the new exchange. This task has become more challenging with the resignation of the Sales and Marketing Director Michael Lujan.

Small Business Plans will be a mix of types and carriers

Covered California SHOP has contracted with six different insurance companies to offer small group plans through out the state. Not all plans will be offered in all of the 19 rating regions in California. Each region will have a minimum of three carriers to select from and a Bronze, Silver, Gold or Platinum level of coverage. There is a mix of PPO, HMO and HSA plans being offered. Participation will be limited to companies that employ 50 or fewer eligible employees.

SHOP plans are being offered from these carriers –

- Blue Shield of California: All regions

- Chinese Community Health Plan: San Francisco and San Mateo

- Health Net: All regions

- Kaiser Permanente: All regions with restrictions

- Sharp Health Plan: San Diego

- Western Health Advantage: Sacramento and North Bay

Benefit details are lacking

It would have been nice if Anthem Blue Cross would have stayed in the program to offer another alternative to Blue Shield and Health Net which will be the only options for some remote counties of California. Upon reviewing the SHOP plan booklet of excerpted rates they seem competitive to what is being offered in the market place today. Unlike their individual plan booklet, they don’t give a detailed summary of benefits for the plans being offered. Consequently, it is hard to do a comparison between the plan levels and carriers.

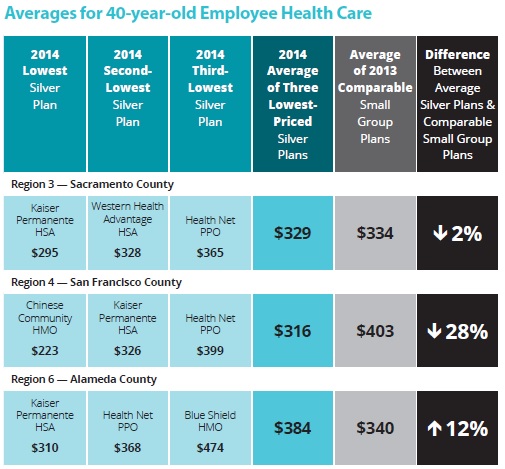

Northern California comparison of health insurance premiums for a 40 year old employee through Covered California SHOP.

Simplified plan choices

Employers will select an “Anchor Plan” and tier level that will be the bench mark for the company. Employees can then choose from the Anchor Plan tier level of any plan offered in their region. The anchor plan sets the contribution level of the employer. If the employer selects a Health Net Silver Plan, the business only has to contribute 50% of that specific plan’s premium toward the employee premium. The employee can choose a Blue Shield Silver Plan that has a higher premium, but the employer will only be contributing the 50% of the amount of the less expensive Health Net Silver Plan.

Maximizing small business credits

Employers can maximize their participation in SHOP if they have fewer than 25 employees with an average annual wages of $25,000 per employee or less. This allows the small business to qualify for the 50% tax credit in 2014 on federal taxes for employer contributions toward their employee’s health insurance. A small business doesn’t have to purchase health insurance through Covered California SHOP in order to qualify for the tax credit.

Is there a need for SHOP?

California already has an exchange called Cal Choice that is similar in design to Covered California SHOP. In addition to employee choice like SHOP, Cal Choice also offers ancillary benefits such as dental and vision insurance plus features like payroll services and human resources support. The existence of Cal Choice and the strong marketing and sales structure that most insurance companies already have in place was rumored to be the reason for the pull out of Anthem Blue Cross from SHOP and why other carriers such as Aetna and United HealthCare did not participate.

Small business is skeptical of health care reform

A two edge marketing sword for Covered California is that they will actually be handling the billing for the small groups. The positive edge is the consolidated format where employers can handle all the changes to the insurance from adding employees, changing employee coverage or adding dependents. The serrated negative edge is that many small business owners are skeptical and suspicious of interacting with any government agency. There will absolutely be small businesses that will not participate because they don’t want to support any government bureaucracy, even if it is to their benefit.

Maybe small group insurance is a thing of the past

The Small Business Health Insurance Options Program was authorized under the Affordable Care Act to encourage small employers to either establish a small group plan or continue offering health insurance to employees. The logic to create a robust and competitive small group market where employers contribute to the employee’s premium, not necessarily the employee’s dependents, has been deflated somewhat with the competing health insurance marketplace that offers subsidies not only for the employee but their family as well.

SHOP is worth a look for small businesses

There are some real benefits to the Covered California SHOP plans for small businesses. Unfortunately, they are at a competitive disadvantage with existing programs that can also offer dental, vision and life insurance all rolled into one package. Covered California SHOP is also competing with the very attractive plans and subsidies offered on their individual and family side. The excellent individual health insurance offered may entice many of Covered California’s prospective clients to scuttle their small group plans and let the employees use the individual health insurance market place.

[wpdm_file id=84 title=”true” desc=”true” ]

———————————————————————————————

Covered California News Release, August 1, 2013

SMALL BUSINESS HEALTH OPTIONS PROGRAM HEALTH PLANS AND RATES

Today, Covered California™, the state’s new health benefit exchange, announced the insurance carriers and rates for its small-group market, the Small Business Health Options Program (SHOP). With nearly half of all Americans receiving their health insurance from their employer, small businesses play an important role in ensuring Californians have health insurance coverage. Most business owners understand the competitive advantages of providing quality health insurance to their employees, as it helps businesses find and keep the best employees — keeping them healthier, happier and more productive.

Below are key facts about Covered California’s SHOP.

- While rates vary by regions, the Covered California SHOP premiums are generally comparable to 2013 small-group market rates and, in some cases, can save small businesses money on their premiums.

- Covered California will offer health insurance options to small businesses from six carriers: Blue Shield of California, Chinese Community Health Plan, Health Net, Kaiser Permanente, Sharp Health Plan and Western Health Advantage. The plans were selected by a competitive bidding process.

- Small-business owners, with 50 or fewer employees, may enroll in the Covered California SHOP plans when the health benefit exchange is launched on Oct. 1, for coverage effective Jan. 1, 2014. Like the health insurance plans in Covered California’s individual market, Covered California’s SHOP plans were negotiated to bring a standardized set of benefits, a robust provider network, a broad choice for employers and their employees, and competitive prices.

- Covered California’s SHOP anticipates making a broad choice of health plans available to more than half a million small businesses and more than 1 million uninsured workers in 2014.

- Small businesses are eligible for a federal health care tax credit if they have fewer than 25 full-time-equivalent employees for the tax year, pay employees an average of less than $50,000 per year and contribute at least 50 percent of their employees’ premium cost. Employers with 10 or fewer full-time-equivalent employees with wages averaging $25,000 or less per year are eligible for the maximum amount of tax credits. To be eligible for the federal tax credits, small businesses must purchase coverage through Covered California’s SHOP.

- The plans will be sold through licensed agents who are trained and certified by Covered California.

###