The Centers for Medicare and Medicaid Services (CMS) released the final rule changes suggested by Dr. Oz on behalf of Donald Trump. Some of the proposed rules have been modified and won’t strictly apply to state-based health insurance marketplaces such as Covered California.

The underlying rational for the new rules is that CMS perceives consumers to be cheating the system. With no evidence presented, CMS believes that consumers are receiving subsidies and health insurance they are not entitled to. They accuse individuals, families, and agents of committing fraud. Again, they present no evidence to support their supposition. The focus of CMS is to save money and if people are denied health insurance and health care, that is simply collateral damage to achieving the goal of less federal expenditures. The new rules are meant to save money and help the health insurance companies.

Past Due Premium Repayments

Health plans may demand the payment of past due health insurance premiums that were terminated for non-payment. The number of months can be limited by state law. Some states may allow the collection of three or more months past due invoices to be collected.

Example: You were enrolled in AllBetter Health Plan in 2025. In October, for whatever reason, your health insurance premiums were not paid and the health plan was terminated.

You would like to re-enroll in AllBetter for 2026. AllBetter may demand that you pay the past due premiums for October, November, and December before any payments will be accepted for the 2026 health plan.

This will be specific to the health plan that was terminated for nonpayment. If you decide to enroll in a different health insurance, such as Coastal Health Plan, the past due premium condition will not apply. However, if all of your doctors are with the AllBetter HMO plan, you may be stuck paying for health insurance you never used for the last three months of the year.

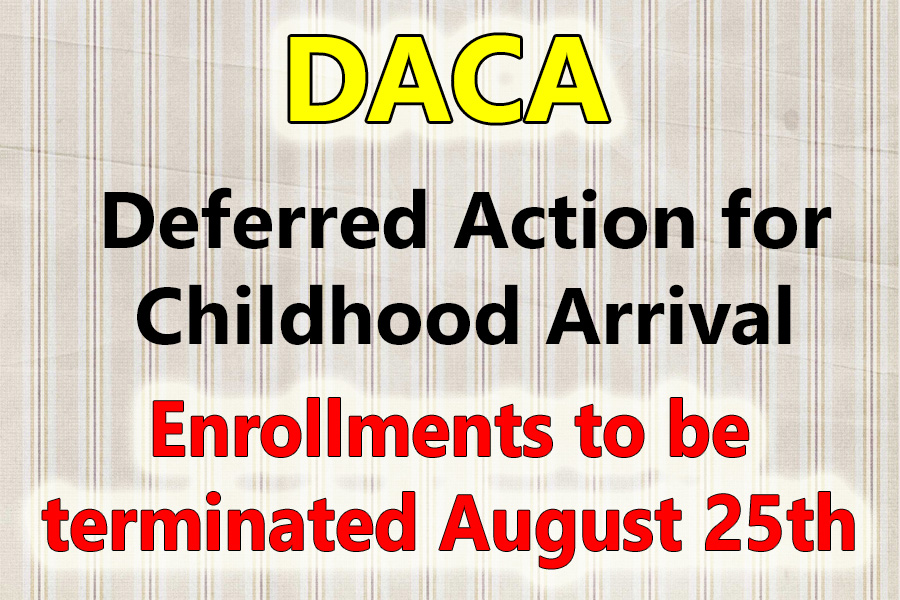

Deferred Action for Childhood Arrival

All DACA individuals who enrolled in health insurance through Covered California will have their plans terminated at the end of August. No individual with Deferred Action for Childhood Arrival will be able to enroll in health insurance through Covered California.

Covered California DACA Guidance

Between November 1, 2024, and June 30, 2025, DACA recipients were considered lawfully present for Covered California eligibility purposes and a DACA Special Enrollment Period (SEP) was available.

Starting July 1, 2025, for the purposes of Covered California eligibility, individuals who are under Deferred Action for Childhood Arrivals (DACA) are not considered lawfully present.

These individuals:

• Are not eligible to buy a Covered California health or dental insurance plan or receive financial help to lower their health plan’s monthly premium payment because one of the requirements to buy health insurance through Covered CA is to be lawfully present.

• May be eligible for full-scope Medi-Cal depending on their income. They can apply for Medi-Cal through Covered California or at their local county Medi-Cal office.

• Can buy private health insurance on their own outside of Covered California directly from an insurance company or broker, regardless of their immigration status, during Open Enrollment or a Special Enrollment Period.

o The loss of Covered California coverage is considered a qualifying life event for special enrollment as long as the loss of coverage was not due to nonpayment of premium, voluntary cancellation, or fraud.

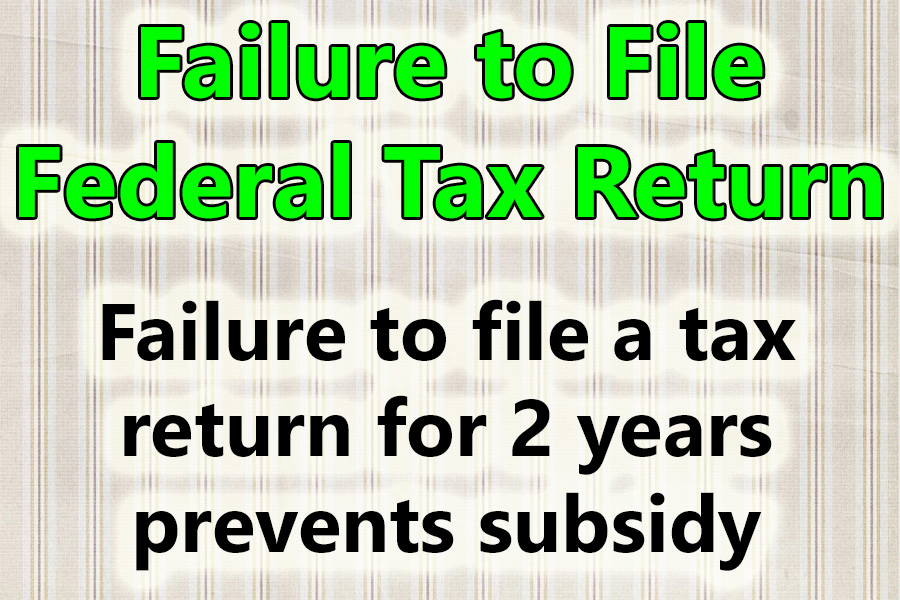

Failure to File Federal Tax Return

Consumers will no longer be able to receive the health insurance subsidies if they failed to file a federal tax return for two consecutive years. The limit will now be one year. If you have not filed a federal tax return for the last two years, Covered California will not be able to extend the Advance Premium Tax Credit subsidy to lower the health insurance premium.

The rational from CMS was there were too many improper enrollments with a $0 premium after the subsidy was applied. They believe that $0 premium enrollments are most likely fraudulent.

No More 60-Day Extension to Provide Verification

If there is an inconsistency between stated income and the estimated income on the application, applicants are given a 90-day period to provide documentation of the income. This reasonable opportunity period of 90 days could be extended for another 60 days. The 60-day extension will no longer be allowed.

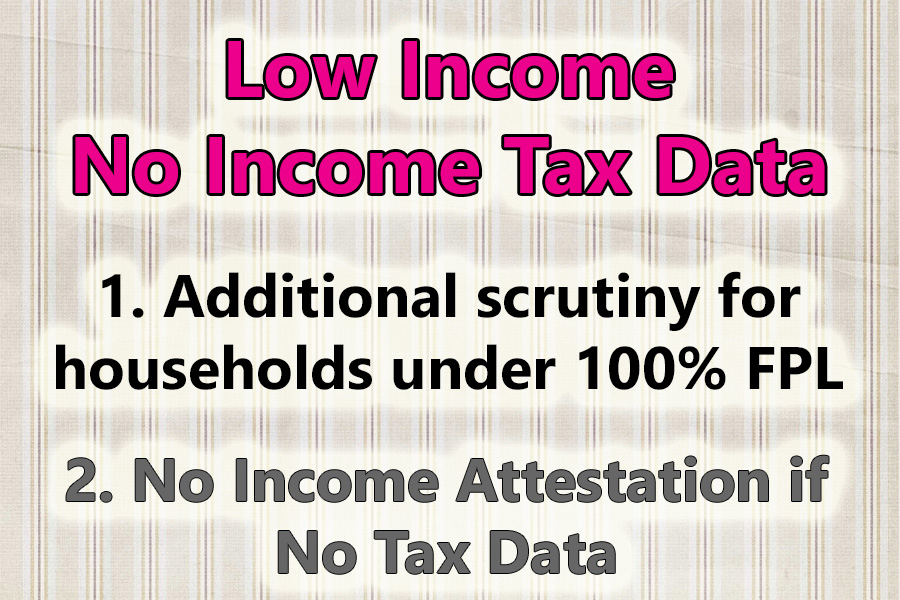

Income Verification Less than 100% FPL

Covered California and other exchanges must track enrollments of individuals and households if the last filed tax return shows the income was below 100 percent of the federal poverty level. Additional income proof may be requested to continue receiving subsidies.

Income Verification When No Tax Data Available

Consumer’s will no longer be able to self-attest to their Covered California income estimate if the IRS has no record of a federal income tax return. Consumers will be required to submit documentary evidence to verify their income. In some cases, recent income data from trusted sources may be able to verify the income estimate. This could be the case if an individual begins Social Security retirement or disability benefits.

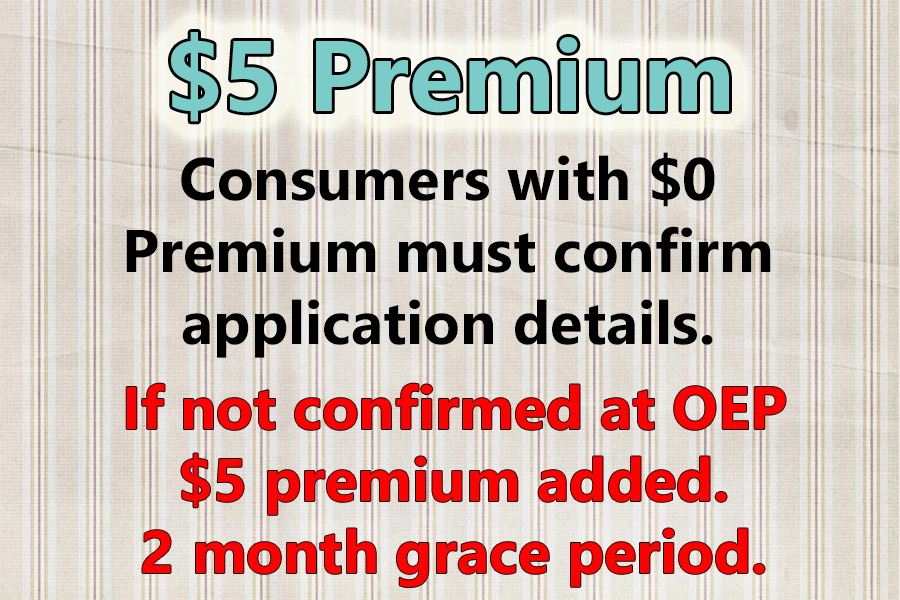

Minimum $5 Premium

For consumers who are enrolled in a health plan with $0 premium because the subsidy is greater than the health insurance premium, the consumer will need to confirm income during open enrollment. If the consumer fails to confirm their income application is correct, they will receive a $5 premium bill for their health insurance.

If the consumer fails to pay the $5 premium, and revert to a $0 premium, the health insurance will be terminated after two months of non-payment.

Less than 150% FPL SEP

Consumers with an income less than 150 percent of the federal poverty level had a continuous special enrollment period (SEP.) CMS is terminating the SEP for low-income households.

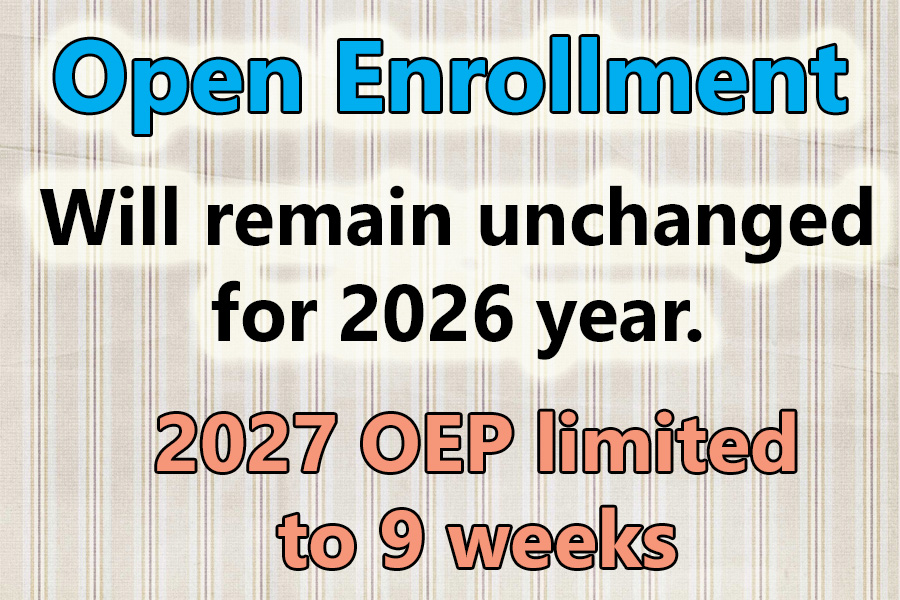

Open Enrollment

The open enrollment period will remain the same for the 2026 plan year. For the 2027 plan year, state exchanges like Covered California will have some flexibility. For 2027, the open enrollment period cannot exceed 9 weeks, and all plans must be effective January 1st. There will be no open enrollment period where a health plan could be effective February 1st.

Implications

Some of these new rules will be a surprise to many consumers in Covered California. Carefully review all letters from your health plan and Covered California. If there are any alerts or requests for verification, make sure you know what they are asking for and provide the correct information. Failure to comply could mean the loss of the subsidy or even termination of the health plan.

Covered California Briefing

Recently, Covered California learned that the Centers for Medicare & Medicaid Services published the final rule addressing Marketplace Integrity and Affordability. The final rules have significantly changed some provisions from the proposed rules published in March, while others remain unchanged. Covered California is still evaluating the full extent of the new final rules and tracking provisions of the federal budget reconciliation bill that may impact state-based marketplaces. We will share further updates as federal policy continues to change. In the meantime, I want to highlight some key points from our preliminary review of the new rules for our valued enrollment channel partners:

• Beginning with Open Enrollment for Plan Year 2027, the period will be shortened to a maximum of nine weeks, running from November 1 to December 31, with coverage beginning January 1.

• DACA recipients will no longer be eligible for Health Insurance Marketplace coverage; Covered California will need to terminate coverage by the end of August for those who are already enrolled. Additionally, the DACA Recipients SEP will no longer be effective as of July 1, 2025.

• Gender-affirming care will no longer be considered an Essential Health Benefit (benefits covered by all plans) starting with Plan Year 2026.

• Health Insurance Marketplaces must now require tax data for income verification, discontinuing the acceptance of consumer attestation when tax data is unavailable.

CMS Marketplace 2025 Rule Changes

YouTube video of the rule changes.