There is no gap or short-term health insurance in California. Those plans were banned because they did not meet the definition of creditable health insurance in California. The lack of an insurance product to cover a short period of time between health plans means the individual or family must plan and possibly have 2 health plans in place at one time or be without health insurance for several weeks or a month.

Loss of coverage is a Qualifying Life Event for a Special Enrollment Period into an individual and family plan. The problem for many people is the timing of the enrollment and the effective date of coverage. You must apply for an individual and family plan in the month prior to the effective date. Individual and family plans – in most instances – always become effective on the 1st of the month. There is no retroactive effective date offered.

No Short-Term Health Plans, Plan to Avoid a Coverage Gap

If your current health plan ends June 30th, you must apply for an individual and family plan in June for it to become effective July 1st. The individual and family plans do not have retroactive effective dates. Consequently, you cannot apply on July 5 and request a July 1 effective date. This is where the gap or short-term health plans provided bridge between coverage because they could start immediately during the middle of the month.

Individual and family plans have different rules for coverage relative to Medi-Cal or employer group plans that can have retroactive effective dates. Individual and family plans are those offered through Covered California with the health insurance subsidies or directly from your preferred carrier such as Kaiser or Blue Shield.

Tom called me on July 6th and said his employer group coverage was ending July 17th. He needed a short-term health plan until the next month. I found it odd that Tom’s employer plan would terminate mid-month until I learned that the plan was issued through a different state. With most California employer group plans coverage will run through the end of the month.

Because Tom lived in California, there was no gap coverage available to him for those last 2 weeks of July. The soonest Tom could get coverage to start was August 1st. This highlights the different rules between the various states. Some states allow short-term health plans and the termination of group plans in the middle of the month.

Application Dates Are Important For 1st of Month Start Date

In California, you can apply for health insurance on the last day of the month in which you lose your coverage and have the plan become effective the 1st of the next month. Since most California health plans run through the end of the month, there will not be a gap in coverage. Unfortunately, Tom was the victim of states setting different rules for their health plans coverage dates.

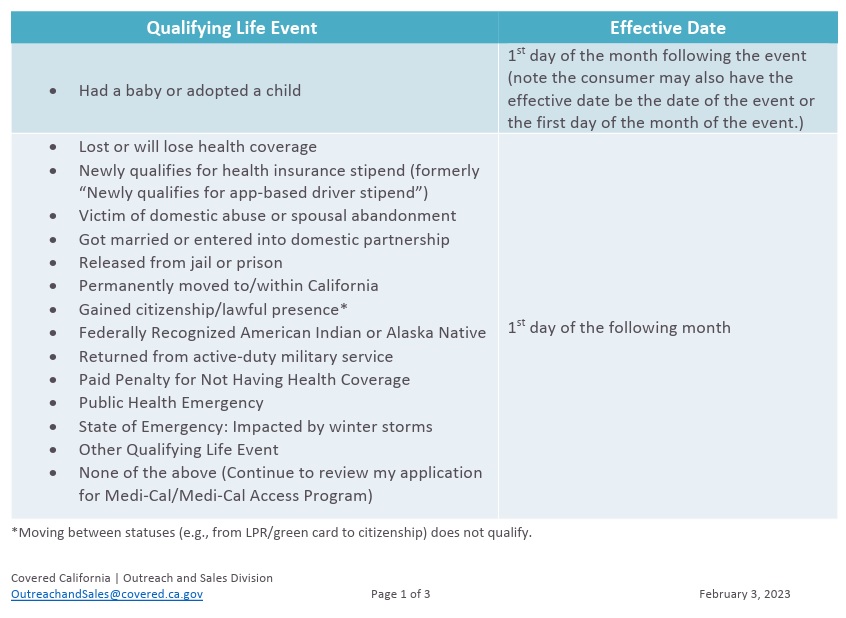

All of this underscores the necessity of planning for future coverage. However, there are still some rules that must be considered within the individual and family marketplace for health insurance. With Covered California, virtually all enrollments will be effective the 1st of the next month after you apply for coverage. All you need is a Qualifying Life Event for Special Enrollment Period. The Special Enrollment Period will last for 60 days from the date of the event.

Qualifying Life Events for Special Enrollment Period

Some Enrollments Require Earlier Application Date

Apart from having a baby or adopting a child, where the coverage start date can be retroactive to the date of the event, no health plans will be back dated with a start date. This means it is absolutely crucial to apply for coverage before your coverage ends. If your Medi-Cal is terminated June 30th, you must apply for coverage no later than June 30th for a July 1 start date.

You May Documentation to Prove Qualifying Life Event

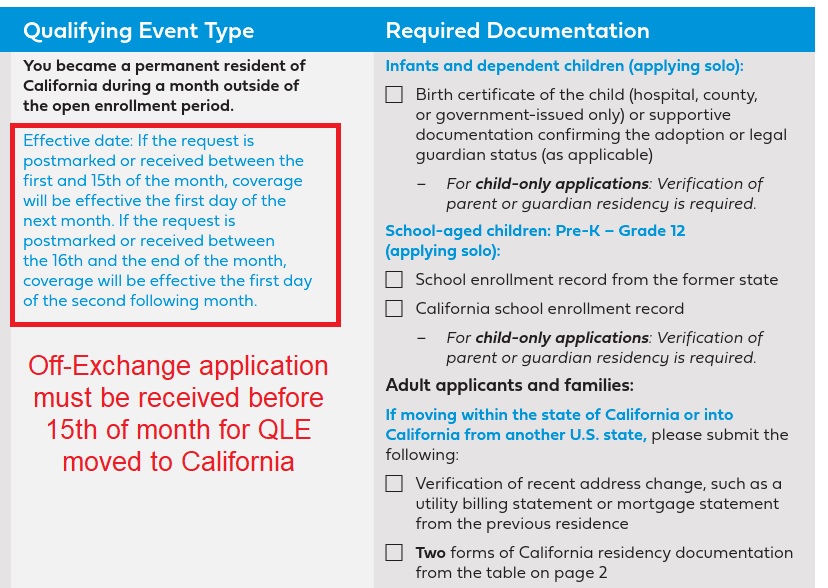

If you intend to enroll off-exchange, not through Covered California, direct with your preferred carrier, the application dates may be slightly different. For example, Blue Shield, with the Qualifying Life Event of moving into California, you must apply before the 15th of the month for the health plan to be effective the 1st of the next month.

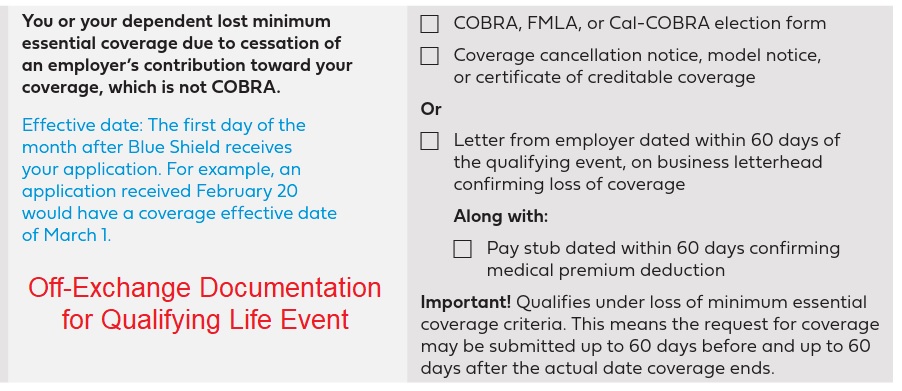

Off-exchange enrollments will require documentation to verify your Qualifying Life Event for the Special Enrollment Period. If you are applying because of a loss of coverage, you will need to supply the carrier with a letter documenting the termination of the health plan. With loss of coverage, you can apply the last day of the month for an effective date of the 1st of the next month. However, enrollment may not be approved until several days into the new month after the carrier has reviewed the documentation to verify the qualifying life event. The plan, once approved will be effective the 1st of the month. But it is important to apply in the previous month.

Because California has no gap or short-term health insurance, you need to plan to apply for an individual and family plan before your coverage ends. You may only need the coverage for 1 or 2 months until the other coverage such as employer plan or Medicare becomes effective. You can then cancel the individual and family plan. Health insurance is a month-to-month contract. There are no penalties for using an individual and family plan for a month or two as long as you continue on with creditable health insurance from another source.