With the implementation of the Affordable Care Act (ACA) in 2014 a new term entered the lexicon of health insurance: exchange. The exchange, as envisioned by the ACA, would be a centralized online marketplace for consumers to view, compare, and enroll in a health plan. Because not all individual and family health plans are listed on the marketplace exchange, we have on-exchange and off-exchange health plans.

The Difference Between On and Off Exchange Health Plans

In order for an individual or family to be eligible for the Premium Tax Credit subsidy to reduce their monthly health insurance premium, they must enroll in a health plan through the marketplace on-exchange. If you enroll in a health plan directly with the insurance company – off-exchange – you cannot claim the Premium Tax Credit on your federal income tax return.

While all individual and family health plans must have certain elements mandated by the ACA (no pre-existing conditions, maternity coverage, mental health, etc.) each state can have different laws that affect the plan design and eligibility for off-exchange health plans. This post will focus on the marketplace in California.

Off-Exchange Rates Are Close To Covered California Full Monthly Premiums

In California, every standard benefit design plan offered through the exchange, Covered California, is also offered off-exchange direct from any carrier that offers health plans in your region. The full monthly premium rates for the Bronze, Gold, and Platinum plans are essentially the same whether you buy the plan through the exchange or off-exchange. However, aside from any subsidy you may be eligible for, all enrollments receive a $1 credit from Covered California.

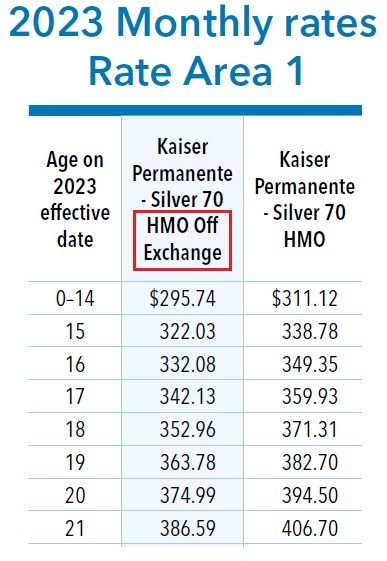

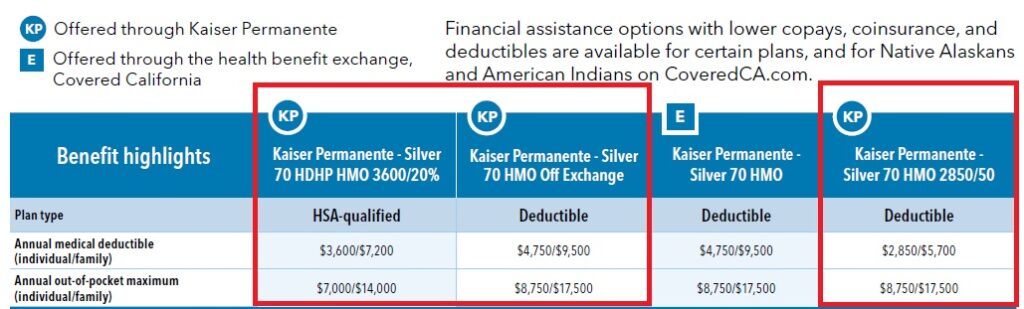

The Silver 70 plans, on or off exchange, are almost identical, except for the full monthly premiums. The Covered California Silver plans are inflated 5 to 10 percent, depending on the carrier. The extra amount or surcharge is used to pay for the reduced cost-sharing benefits of the enhanced Silver plans 73, 87, and 94. You can only enroll in an enhanced Silver 73, 87, or 94 plan through Covered California and the eligibility for the plans is based on the household income. There are no off-exchange enhanced Silver 73, 87, or 94 plans.

The carriers will offer both the Silver 70 exchange plan and a lower cost Silver 70 off-exchange plan. If you never expect to qualify for a subsidy through Covered California, but want a health plan with Silver 70 cost-sharing benefits, you can enroll in a off-exchange Silver 70 plan and save some money.

There are non-standard benefit design health plans offered by carriers off-exchange. You cannot enroll in a non-standard benefit design plan through Covered California. The off-exchange non-standard benefit design plans are usually in the Bronze and Silver metal tier categories. There are more High Deductible Health Plans (HDHP) that are health savings account compatible offered off-exchange.

Off-Exchange Health Plan Covered Benefits & Cost Sharing

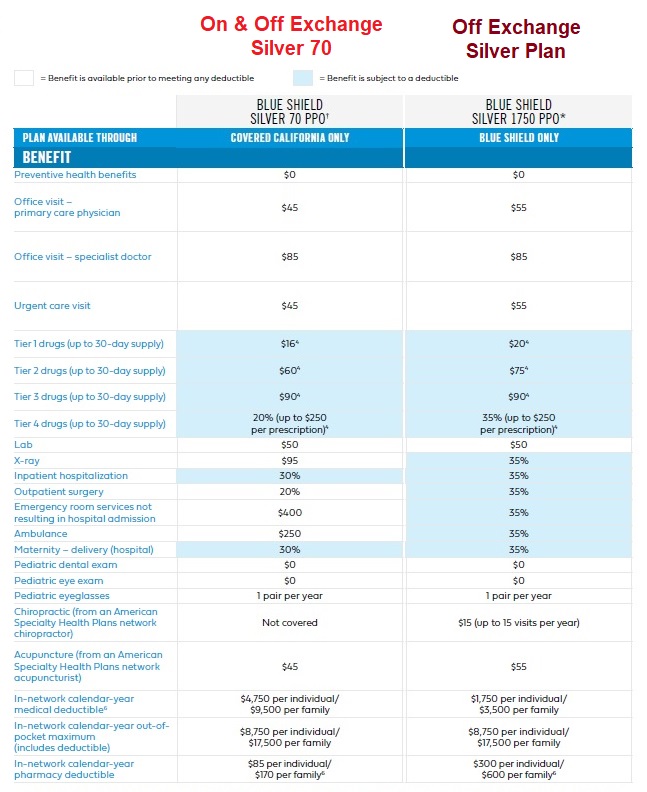

All of the non-standard off-exchange plans adhere to same mandated coverage benefits. The off-exchange plans will also have maximum out-of-pocket annual amounts that closely align with standard Bronze, Silver, Gold and Platinum plans. The primary difference is the member cost-sharing for the different health care services and prescription drugs. The non-standard designs may have higher or lower copayments, coinsurance, and deductibles for certain health care services and prescription drugs.

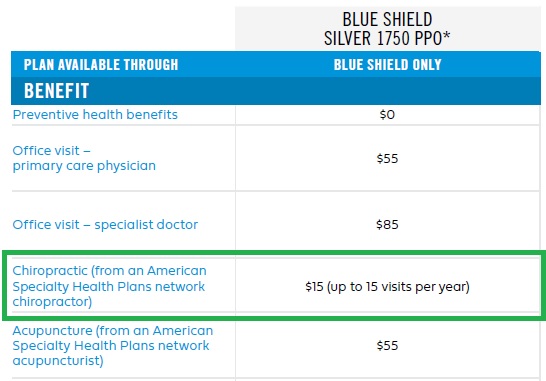

Some off-exchange plans will include other benefits banned from the Covered California standard benefit design plans. Blue Shield offers a chiropractic coverage benefit in some of their non-standard off-exchange plans.

There are also carriers that offer individual and family plans who do not participate in Covered California. Sutter Health Plus offers standard benefit designs only off-exchange. While the health plans are not eligible for any subsidies, they are competitively priced for an HMO with the assurance that Sutter doctors and facilities are in-network.

The off-exchange plans adhere to the same open enrollment and special enrollment periods as Covered California. They also share most of the qualifying events that can trigger a mid-year special enrollment period such as moving into the state or involuntary loss of coverage. However, Covered California may offer some special enrollment periods that the off-exchange plans don’t participate in. In addition, off-exchange plan enrollment may require a higher level of documentation regarding the qualifying life event such as a notice of loss of COBRA coverage.

There are also on and off exchange dental and vision plans. There are no open enrollment periods for off-exchange dental and vision plans. You can enroll in those plans at anytime of the year with no qualifying life event.