If the lab doing your test is not in your health plan network, you may be hit with an expensive out-of-network bill for the results.

Add one more thing health insurance consumers must be on the watch for; expensive tests done by out-of-network labs. While most blood and urine lab tests are routine and don’t cost very much, even without health insurance, some specialty diagnostic lab tests can cost over $8,000. If the lab is not in-network for your health plan, you may be on the hook for a very large bill with little recourse for reimbursement from your health insurance.

Nasty Out-of-Network Lab Costs Ordered By The Doctor

I was recently contacted by a client who had received an Evidence of Billing summary from their health plan stating the family was responsible for over $6,000 for a specialty lab test ordered by the family physician. In this particular case, the doctor wanted to check to see if the family had a genetic predisposition to cancer. A sample from a biopsy was sent in to a specialty laboratory to look at the DNA and whether it might indicate a higher probability for cancer.

To the family, the doctor’s approach to sounded proactive and reasonable to them. What they didn’t know was that the lab was out-of-network and the test possibly needed prior authorization from the health plan before they would acknowledge the claim. The family received an Evidence of Billing (EOB) from the health plan showing the total amount billed by the lab, the Allowed Amount, and what the health plan would cover as there portion of the bill. Enclosed with the EOB was check to the family for the health plans portion of the bill. Unfortunately, the check only covered 20% of the entire bill.

Out-of-Network (OON) or Non-Preferred Providers have not agreed to a contracted rate for health care services with a health plan. This means that the provider can charge whatever price they want for the service. For OON services, PPO health plans have an Allowed Amount. The allowable amount is the price the health plan will recognize for member cost-sharing purposes. The Allowed Amount is usually lower than the billed amount.

Under the terms of this PPO health plan, the member is responsible for 50% of the Allowable Amount plus any balance billing. In other words, once any OON deductible is met, the health plan will pay 50% of the allowed amount. The member is responsible for the other 50% of the allowed amount plus the balance of the provider’s charges.

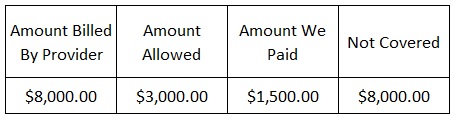

Your health plans Evidence of Billing will detail the amount the provider billed, the allowable amount for the service, the amount they paid, and the amount not covered and is the member’s responsibility.

In the case of this specialty genetic laboratory test, the lab billed $8,000 for the test. The health plan determined that the Allowable Amount was $3,000 for the test. The health plan paid 50% of the allowable amount in the form of a check to the plan member. Oddly, the Evidence of Billing indicated that none of the $8,000 claim was covered, even though they sent a check to the plan member for 50% cost-sharing for the test. Regardless, the plan member is still responsible for full $8,000 to the lab for the test.

Negotiating A Lower Lab Test Cost

For a family on a tight budget, an unexpected $6,500 medical expense is just a huge burden. So what are the options for consumers who get saddled with such a bill?

- First, health plan members can file an appeal requesting that the whole health care cost be covered. This is a long shot but worth a try. Sometimes claims are coded incorrectly and the Allowable Amount might actually be higher or the provider may really be in-network.

- Talk to the doctor about the situation. He or she may not have known the high cost of the test or that the provider was out-of-network for your health plan. The doctor might be able to go to bat for you and talk to the lab and negotiate a lower fee for the test.

- You can also contact the lab and explain the situation. Ask if you can pay a lower amount for the test because the lab is out-of-network and you will be shouldering the bulk of the invoice. Some providers have been known to negotiate charges that are not recognized by the health plan and discounts given for cash payment.

From my perspective, a good chunk of the fault for an outrageous out-of-network lab test should be apportioned to the doctor. When we take our cars in to be repaired we are given a written estimate and called if additional work needs to be done with an updated cost estimate. Some doctors just order tests or send patients to the most expensive provider without a second thought. They don’t recognize that they have any responsibility for apprising the patient of the costs, if the provider is in-network, or of the cost-sharing of the patient’s health plan.

To protect yourself from unexpected high cost lab bills, contact your health plan to make sure the lab your doctor wants to conduct the test is in-network.

I’ve heard from numerous clients that have received surprise out-of-network bills from providers and labs all because they were following the doctor’s orders. They place the blame squarely on the doctor, but they refuse to confront the doctor because they don’t want to lose him or her as their physician. I completely understand the logic behind the decision to fight with the health plan instead of fighting with your doctor. But until these doctors start running their practices with the same consumer protections as an auto repair shop, consumers will continue to be slapped with large unexpected medical bills.