It’s never an easy task to select a Part D Prescription (PDP) drug plan. When you have several medications the task is more difficult. While the Medicare.gov website provides a good overview of available plans and costs, some of the potentially crucial details may be lost until you create a side by side by comparison of plans.

It’s never an easy task to select a Part D Prescription (PDP) drug plan. When you have several medications the task is more difficult. While the Medicare.gov website provides a good overview of available plans and costs, some of the potentially crucial details may be lost until you create a side by side by comparison of plans.

For example, while working with a client, the Medicare website showed that a particular carrier covered all the his drugs. When we did a detailed comparison we found that only one of the most expensive PDP’s from the carrier actually covered all the drugs. The other two less expensive plans only covered 5 of the 7 drugs he was taking.

Tiers, Copays, & Deductibles…Oh My!

Even though all plans must cover a base list of drugs, they don’t have to offer all the brand name alternatives. A single carrier may offer several plans with the same drugs on different tiers, copays, and deductibles. As a tool to help you make your decision I have found it useful to perform a side by side comparison using the estimated yearly drug and plan costs as a guide to making the best selection.

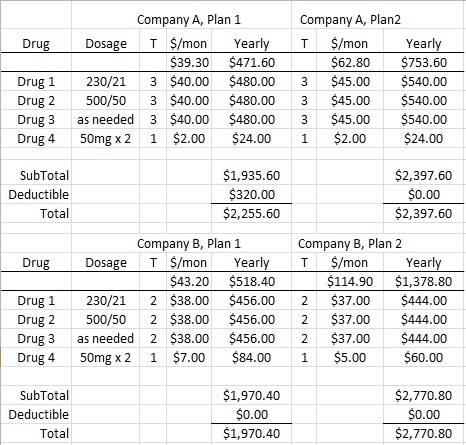

I have created a spreadsheet that is fairly simple to pop in premiums, monthly drug copay and any deductible to determine a yearly estimated cost of the plan. Perhaps the most daunting aspect is collecting the data. Each plan publishes a drug formulary that will list if the drug is covered, the tier, copay for each tier and any deductible.

In this comparison, you can see that Company B, Plan 1 has the best estimated yearly total expenses even though it has a higher premium per month than Company A, Plan 1 and higher copays per drug than Company B, Plan 2. Note that some plans don’t have a deductible; you go straight into copay. This also illustrates that the Tier ranking of a specific drug can’t be compared between companies and sometimes within a company’s same plans.

What about the coverage gap?

This spreadsheet will only be a guide for estimated expenses for the year up to the coverage gap or initial coverage limit. At that point, some plans offer some assistance in addition to the standard PDP terms. If you think you will hit the coverage gap it is important to focus on plans that may give you some additional relief for drugs in the donut hole.

How do you compare plans that don’t cover all the drugs?

It is difficult to compare plans if you can’t estimate the yearly copay expense. In some cases the drug will be missing from all the plans or will be included only in the most expensive plans. Another issue is that the expense of a drug not covered does not go towards your total out of pocket costs when figuring the coverage gap or catastrophic levels. The best course of action is to consult with your physician to find an alternative drug that may be covered.

Are there other plans to compare?

I was surprised that not all the plans offered in California didn’t show in the Medicare.gov website on the first page. They are obviously trying to rank or match the best plans to the drug list I entered. I was able to find a plan not on the top Medicare ranking that my client determined was a better fit for his needs after we compared it to the others.

What if the copay is a percentage?

Some plans will stipulate a percentage of cost for not only the upper tiers like 5 and 6, but also tiers 2 and 3. You will have to contact the pharmacy and find out the retail price multiplied by the plans coinsurance percentage to determine the monthly cost.

Mail order discounts?

Some plans will offer better prices for prescriptions ordered through the mail and 90 day supply. Always check the offerings especially if the plans you are considering are close in their yearly estimates. The extra little discounts for mail order may make one plan look better over another. This spreadsheet is meant to create a relatively even measurement of plan costs. It is always important to look at all the benefits of the plans when selecting a PDP.

Where can I get help?

If a family member or a representative of your local HICAP office can’t help you fill in the spreadsheet, try finding an independent insurance agent that is certified to represent Medicare Advantage and Part D Prescription drug plans. Many agents will only represent one carrier and will not be interested in comparing plans they don’t represent. However, a good independent analysis of the PDP plans can save you hundreds of dollars for the year. (Small self-promotion: I am usually certified for multiple plans in California)

Click the button below to download the spreadsheet.

[wpdm_file id=1]

I couldn’t down load on my iPad, so if you run into problems, contact me and I can email it to you.