In an unprecedented outreach to the Covered California health insurance agent community, Peter Lee, Executive Director of Covered California, addressed agent commissions and health care sharing ministries on a recorded webinar with accompanying slide presentation. At issue are Covered California staff recommendations to the Covered California Board of Directors regarding potential requirements for minimum agent commissions for individual and family plans and squashing agents from representing health care sharing ministries plans to consumers.

Peter Lee Address Agent Compensation

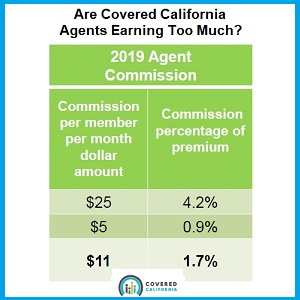

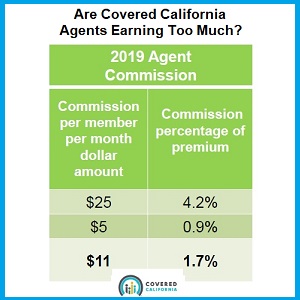

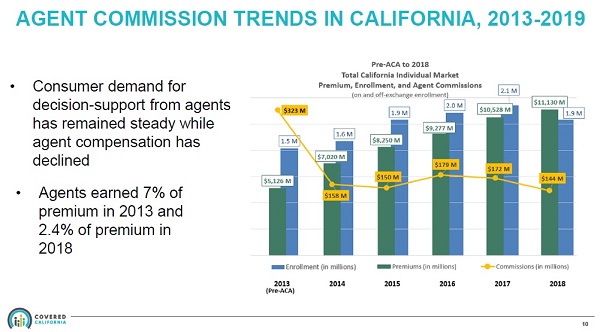

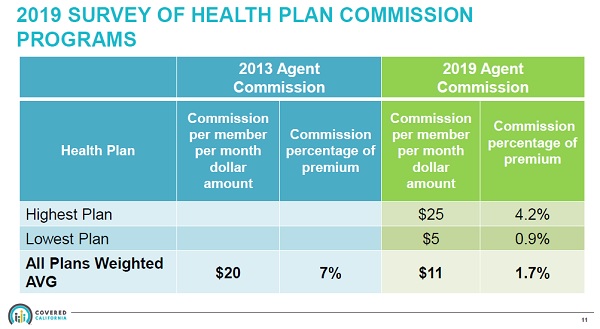

With the launch of Covered California in 2014 and the ensuing erosion of commissions paid by the health plan carriers, agents have been vocal that the lower compensation for enrolling consumers in health plans through Covered California is a money losing proposition for the agents. Peter Lee in his comments on the webinar, Covered California Evaluation of Agent Commissions Sharing Ministry Plans 3/1/19, made the case that even though commission percentages have dropped from a 7% average before the ACA, to 1.7% after Covered California came online, the weighted average per member per month (pmpm) compensation had not dropped as precipitously. The average pmpm agent commission, from the presentation, is $11 for 2019. In 2013, the average pmpm compensation was $20.

Peter Lee concluded that the drop in the pmpm compensation was relatively fair since agents no longer have to do field underwriting. Field underwriting was the long questionnaire of health challenges that a prospective health plan member may have. Those responses would determine if the applicant was denied health insurance coverage or offered a plan, only at a higher rate. However, that list of health underwriting questions was only a minor annoyance to agents and did not represent a significant portion of time when enrolling individuals and families. Today, health insurance is guarantee issue, which means the applicant cannot be denied enrollment based on pre-existing conditions.

While it was not acknowledged during the discussion involving the commission structure, Peter Lee did recognize later in the presentation the additional time requirements agents face when working with mixed households. These are families who have children eligible for Medi-Cal, while the adults received the premium tax credit subsidy for a private health plan enrollment. With regards to minimum agent compensation, that may be set by the Covered California board, Peter Lee outlined four areas of consideration.

- Looking at agent compensation as one component of total acquisition costs and impact to consumers.

- Evaluating adequacy of compensation programs.

- Recognizing the value of the independent agent channel to have predictable revenue streams to plan and invest in their operations.

- Ensuring agent incentives align with consumer protections.

For those unfamiliar with agent compensation for individual and family plans, Covered California does not pay agents. The health plans pay agents a percentage of the total monthly premium rate or a set per member per month amount. Certified Covered California agents can enroll individuals and families in health insurance through Covered California OR they can enroll people in off-exchange plans directly with the carriers such as Blue Cross, Blue Shield, Health Net, Kaiser, etc.

I cannot fault Covered California or Peter Lee for not completely understanding that agents must work with two systems. We must work with the Covered California CalHEERS online application system AND we must be fluent in working with the carrier’s enrollment system. Any agent will tell you that one hiccup with Covered California can lead to serious problems with enrollments on the carrier side. I won’t even get into the nightmares that county Medi-Cal offices create for agents when they tinker with a Covered California consumer’s account.

From the standpoint of Covered California, agent compensation is primarily focused on acquisition. That is how they see agents. We are a marketing arm of Covered California to deliver consumers to their door step for enrollment. If all agents did was acquire new business, with no customer service after the sale, the current commission structure, with its tremendous variability from carrier to carrier, is relatively sufficient.

Low Compensation Impacts Customer Service

Unfortunately, the low agent compensation does not factor in the after-sale customer service. Agents spend more time interacting with the Covered California application after the enrollment than they do with the carriers. Agents upload the requested Covered California verifications for income and immigration status, adjust the consumer’s estimated income, change plans, make changes to the consumer’s address, and spend hours on the phone with Covered California trying to determine how to fix what Medi-Cal has screwed up in the account.

Agents are not compensated for working with the Covered California system. The commission structure is too low for agents who have customer service representatives provide decent service to their clients. The low commissions don’t necessarily prevent the acquisition of new enrollments, they hamper decent customer service after the enrollment.

The issue of agent commissions is set to be address by the Board of Directors at their March 14th meeting. Peter Lee indicated that staff is considering three proposals.

- Set a minimum agent commission requirement

- Set rules or limits on agent commission decreases.

- Take no action

The proposals would apply to the carriers offering plans through Covered California. Technically, the commissions for on-exchange, plans sold through Covered California, and plans sold off-exchange are supposed to be the same. So whatever Covered California dictates to the carriers for on-exchange plans will be applied off-exchange. This is somewhat of a conflict of interest for Covered California. They don’t want to see enrollments going off-exchange, by-passing Covered California. Consequently, they don’t want carriers offering higher commissions for the off-exchange plans. Covered California makes their money on the fees they charge the carriers for each enrollment through Covered California. They make no money on the off-exchange enrollments.

Peter Lee did mention that some of the board members were concerned about setting minimum agent compensation amounts for fear of creating a race to the bottom. Let me tell you, the commissions are already at the bottom. Peter Lee did highlight that certified Covered California agents are contractually bound to represent all plans equally and not steer consumers to a plan that might compensate the agent better if the plan is not in the best interest of the consumer. Each carrier has a slightly different compensation structure with Blue Shield and Kaiser having some of the lowest agent compensation structures on average.

I can only assume that Lee is purposefully averting his gaze from some of the other distortions in the market place that affect agents. If an agent is not appointed with Chinese Community Health Plan (CCHP) in San Francisco, and the agent is working with an individual considering a plan in that county, what is the incentive to even mention CCHP if there is no prospect of any compensation on the part of the agent? To fairly represent all plans, agents must be appointed with all plans. To ferry this along, Covered California needs to work with the carriers to appoint all Covered California certified agents for all carriers offering plans through the exchange.

I routinely work with people from all over California. Sharp Health Plan is only offered in San Diego County. I’ve enrolled consumers in Sharp Health Plans because I’m appointed with Sharp, even though I don’t live in San Diego County, I live in Placer County. In other words, the disincentive not to discuss Sharp or CCHP with a client is not an issue for me or other agents appointed with those carriers. But there are plenty of agencies that hire seasonal agents and those agents are only appointed with certain carriers.

It is interesting that individual and family plan commissions are so much lower than small group plans. Small Group plans pay a commission of approximately 3% to 5%. In addition, the small group rates are lower than individual and family plans in many regions. Regardless, there are compensation models that Covered California can investigate. Medicare dictates that compensation for enrollments by agents into Medicare Advantage plans follow certain rules.

- Compensation for the initial year enrollments cannot exceed a fair market value (FMV) published annually by CMS.

- Compensation for renewal year enrollments cannot exceed 50% of the FMV cut-off.

Agents, Low Cost Covered California Staff

The issue of agent compensation is very complicated. I applaud Peter Lee for tackling this issue because in reality, he doesn’t have to touch it. The value of agents to Covered California is a lower staff cost at open enrollment. Agents represent 45% to 50% of the enrollment applications into the Covered California system. This represent several hundred thousand online applications that Covered California does not have to hire staff to perform. This lowers Covered California’s operating cost as the expense is push over to the carrier in the form of an agent commission.

Covered California could just make all their customer service representatives licensed insurance agents, jettison the independent certified agents like myself, and take everything in-house. Covered California could negotiate with the carriers to a reduced commission rate for the enrollment in additions to the monthly fee they charge the carrier. This would solve the problem of having to address low or minimum agent compensation. And I would then become a greeter at Walmart.

Health Care Sharing Ministries

The next big topic that Peter Lee tackled was the rise of enrollments in Health Care Sharing Ministries (HCSM). HCSMs are unregulated organizations that promise to pay on certain health care services as long as the member agrees to live by a lifestyle code of conduct. The code is usually certain biblical principles determined by the organization. HCSMs do not have cover pre-existing conditions, can have caps on maximum coverage payments, and routinely exclude certain medical conditions such as pregnancy from being covered. HCSMs are not insurance, and are not regulated by either the California Department of Insurance or the Department of Managed Health Care. They are, however, recognized by the federal government as an alternative to creditable health insurance.

From the perspective of Covered California, the big factor in the decrease of new enrollments for 2019 was the elimination of the individual mandate on the federal level. Peter Lee noted that the renewals for Covered California from existing consumers with 2018 coverage for a 2019 health plan was very strong. The HCSMs appeal to individuals and families who receive very little tax credit subsidy from Covered California, or are not eligible for the subsidy at all because their income is too high. Peter Lee even acknowledged California’s high individual and family rates as a deterrent for some people to even enroll in a health plan.

Of course, the percentage of consumers in Covered California who are un-subsidized, not receiving a tax credit to lower their monthly health insurance premium, is usually less than 3% in many regions of the state. Because of the way the Advance Premium Tax Credit is calculated on the household’s Modified Adjusted Gross Income, most Covered California consumers are insulated from over-the-moon health insurance rates. The subsidy will always bring down the consumer’s portion of the health insurance premium to less than 9.56% of the household income, and in many cases, less than 6%.

Healthy Pool, Lower Rates

So why is Covered California even concerned with the growth of HCSMs if it is not affecting their enrollments? I have listened to Peter Lee enough to know that he has a solid grip on the individual and family market and the economic realities of the total pool of consumers enrolled in those plans. Specifically, he is a big promoter that Covered California needs to attract consumers into the individual and family pool who do not have high utilization rates of health care services. All the premiums for the relatively healthy people are needed to fund the health care services for people with chronic or high cost health care challenges. It’s the big picture. And without the correct balance of people in the pool, the rates will continue to skyrocket.

Peter Lee was also vocal that the HCSM plans were a dubious proposition for some families. There is no guarantee of solvency for these plans, no contractual obligation to pay claims, and no government oversight. In short, even though the HCSM plans can be less than half the cost of ACA compliant health insurance, they still pose a substantial financial risk to individuals and families. In other words, they may not cover health care expenses of the enrolled member under a variety of circumstances, leaving the consumer on the hook for thousands of dollars’ worth of health care.

Prohibit Agents From Selling Sharing Ministry Plans

One of the fears expressed by Peter Lee was a consumer walking into insurance agency that prominently displayed their participation in Covered California and leaving with a HCSM plan. To prevent this from happening Covered California staff is looking at three proposals for the board to consider at their March meeting.

- Prohibit Covered California Certified Agents from selling HCSM plans.

- Require the agents to provide clear information on the risks and benefits of the HCSM plan, including the agent commission, which is usually 15% to 20% of the monthly sharing contribution, also erroneously referred to as a premium, but it is not insurance.

- Take no action.

On the prohibition, I don’t think Covered California can legally prohibit certified agents from selling HCSM plans. It’s called restraint of trade and Covered California is offering no compensation to the agent for giving up the potential lost revenue of selling HCSM plans. The requirement that agents be forced to read a disclosure about HCSM plans is in a similar gray area. This would be forced speech unrelated to a product or service associated with Covered California. Currently, there is a case involving a California law that forces anti-abortion family planning clinics to disclose to a pregnant woman that she has options for an abortion. While some courts have upheld the law, the U.S. Supreme Court has sent the case back to the lower courts for reconsideration. (National Institute of Family and Life Advocates, DBA NIFLA, et al. v. Xavier Becerra, Attorney General of California, et al. https://www.supremecourt.gov/opinions/17pdf/16-1140_5368.pdf) The issue is the government compelling an individual or organization to engage in speech, dictated to them by the government, can be a violation of the first amendment.

Peter Lee did recognize that California has passed a law banning short term medical plans. This lack of a health insurance coverage option leaves many people who missed open enrollment and who do not have a qualifying life event for a Special Enrollment Period with no health insurance coverage. Hence, the HCSM plans are appealing to this group of folks for the potential promise of coverage from high emergency room bills if nothing else. The problem for the health insurance carriers is not the individual who was absent during open enrollment, the carriers are concerned about the healthy high-income earner enrolling in these HCSM plans.

These folks, who make too much to qualify for the Covered California subsidies, and are rightfully outraged at the high cost of health insurance in California, are opting into the HCSM plans. This threatens the integrity of the pool of consumers in the individual and family plans. I don’t think it is Peter Lee and Covered California staff who are pushing the prohibitions against selling HCSM plans by agents. I think the carriers are putting pressure on Covered California to reduce or squash the HCSM enrollments. The easiest means for reducing enrollments in HCSMs is to prohibit Covered California Certified Agents from selling these products or force the agents to scare the consumer away from them with complicated disclosure requirement.

Peter Lee said it was the California legislature who passed the ban on short term medical plans. If the carriers feel threatened by the HCSM plans, they should lobby the legislature to ban those plans as well. Don’t use health insurance agents, under the guise of retribution from Covered California, to achieve the objective of limiting the enrollment in these plans. I completely get that if all the healthy people leave the pool, the carriers are going to have problems paying claims, and may exit the market altogether. We don’t want this to happen. But I’m just the agent. Don’t shoot me to protect your business model.

Heck, I don’t like these HCSM plans. I have enough anxiety dealing with Covered California and Medi-Cal. I don’t need more reasons to be kept awake all night if a client has a health care claim one of these HCSM plans refuses to pay on. But I also hate telling people with no health insurance I have no options for them. Perhaps enrolling in a HCSM is better than being naked and vulnerable to costs of a hospital’s emergency room treatment.