Many individuals and families renewing their household income for 2021, or applying for the first time, will be asked to verify their estimated income. While there are many different documents a household can submit to verify the income, the Attestation Form, when appropriate, is the quickest and easiest to meet the proof of income requirement.

Attestation of Income Form

A verification of income request is triggered when the estimated income deviates from the last federal income tax filing. I have been told by Covered California that if the estimated income is plus or minus 20 percent of the last filed Adjusted Gross Income, that triggers the proof of income request.

Many households, whose income has not changed, still have the proof of income request triggered. First, Covered California cannot see your federal income tax returns. Their CalHEERS systems pings a federal database on certain fields of your last filed income tax return. For most individuals and families, the Adjusted Gross Income (AGI) (line 8b of the 2019 1040 form) can be the Modified Adjusted Gross Income (MAGI) for the federal Premium Tax Credit subsidy.

However, the AGI is modified by Social Security retirement and disability income, plus foreign earned income and tax-exempt interest. It is unclear if the MAGI number is calculated when the Covered California system compares your estimated income to your last filed income tax return. If the system relies only on the AGI data field, and you have properly included any of the other income streams on your application not captured in the AGI, then your income will always be different. In other words, if you added $6,000 your spouse gets from Social Security, your estimated MAGI will be higher than what is reflected by the AGI. This in turn would trigger the income verification request.

There are a variety of documents you can use to verify your income: income tax returns, payroll stubs, contracts, W-2s, profit and loss statements, social security award letters, etc. Most of these documents have loads of personally identifiable information not only about you, but potentially other people as well. In the interest of privacy and security, you want to share this information over the internet with as few people as possible, and usually only trusted sources.

In addition to the confidential nature of the documents, they can also be complicated. Relatively speaking, there are few people who understand the various IRS schedules and forms, or how to read a profit and loss statement. Plus, it can take fifteen or thirty minutes just to review some of the complicated documents you send to Covered California to determine if they verify your estimated income. The process and time to review the documents from 300,000 families is daunting task at best.

The Affordable Care Act allows people to supply Covered California with an affidavit to verify their income. Affidavits typically need to be notarized. Many people have sent in hand written and notarized affidavits to Covered California. I have seen and attempted to read the hand writing of some of the affidavits and I can say a thirty-page tax return was easier to decipher.

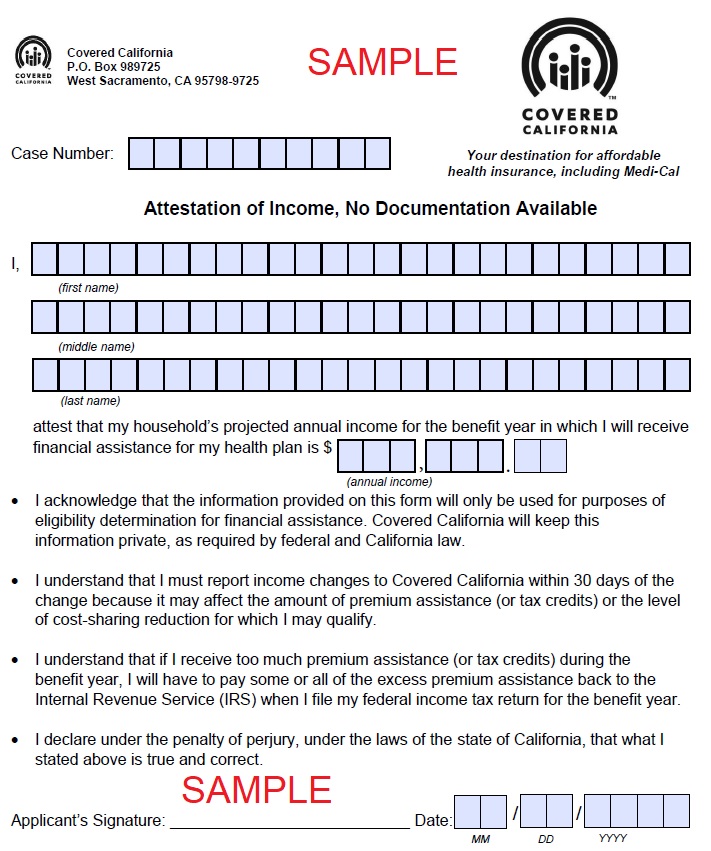

A couple of years ago Covered California introduced the income attestation form for households with no documentation to verify their income. The attestation form has sped the process up for my clients tremendously, especially if they are self-employed. All you do is fill out the Covered California case number, name, estimated income, sign, and date. Carefully read the bullet points on the attestation. You are attesting to your income under penalty of perjury. This is a serious legal form and should not be used to over estimate your income to avoid Medi-Cal or under estimate your income just to receive the subsidies.

You use the Attestation of Income form after you have diligently reported your MAGI using the Covered California income section of the application. The most difficult part of the Covered California application is the income section. Take your time and make sure the entries are correct and ensure that the start and stop dates of the income streams are also correct.

How To Upload The Attestation of Income Form

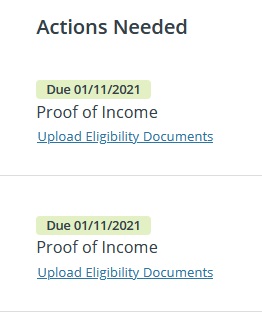

If your income estimate does trigger a verification request, the household members needing to supply documents will be tagged by red dots, indicating action is needed.

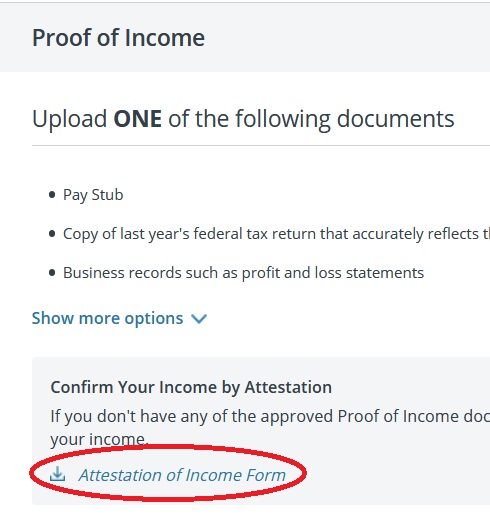

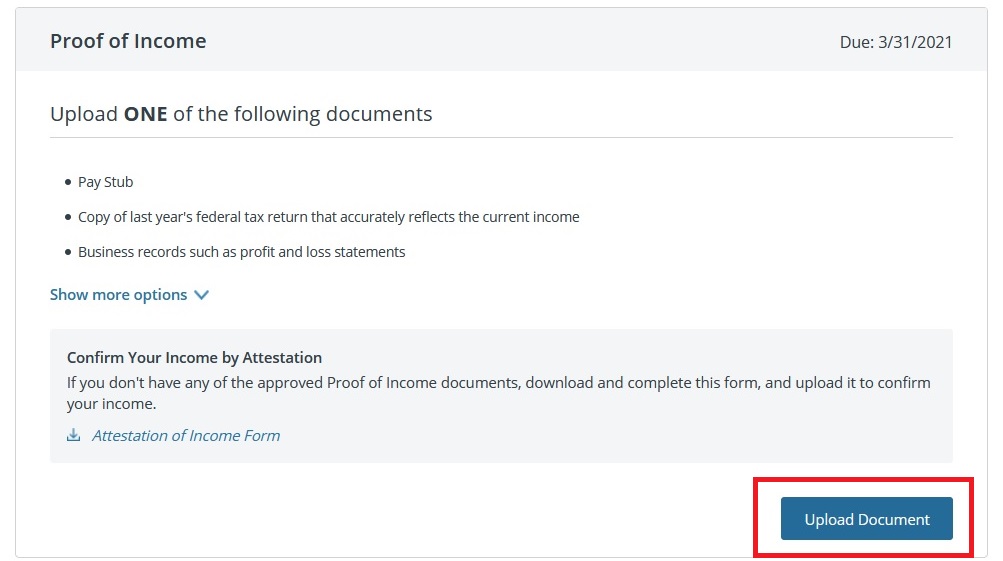

The next page will show what sort of verification is required.

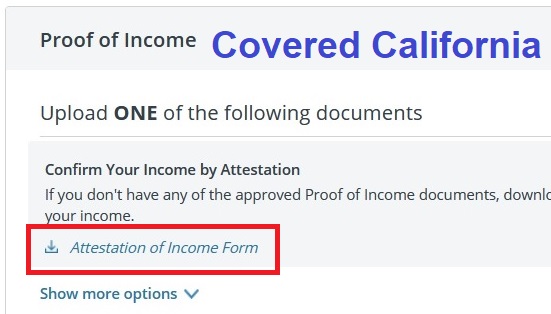

When you click the upload eligibility documents link you will be taken to the page for the specific verification needed. Here, you can also download the Attestation of Income Form.

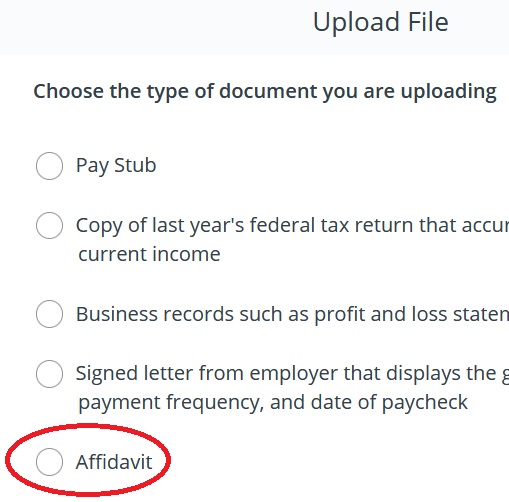

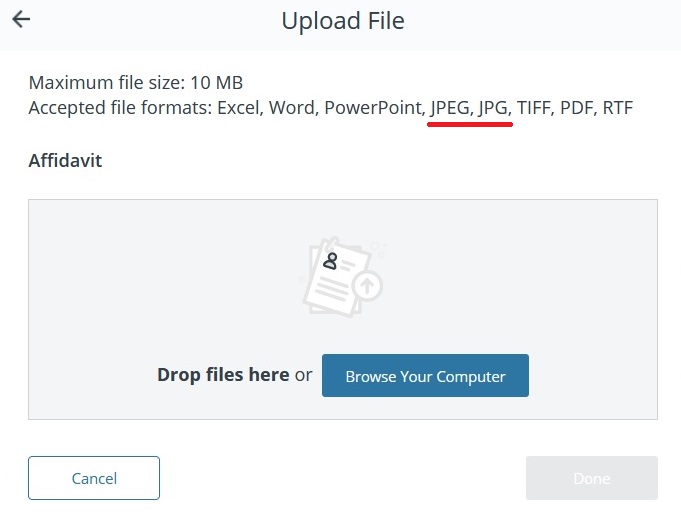

After you select to upload a document, if you are uploading the attestation form, indicate you are uploading an Affidavit.

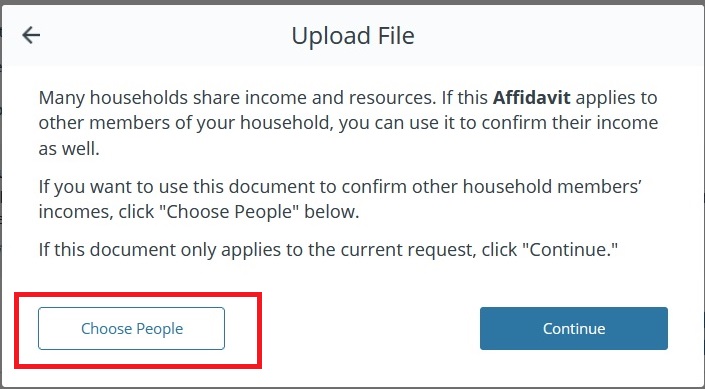

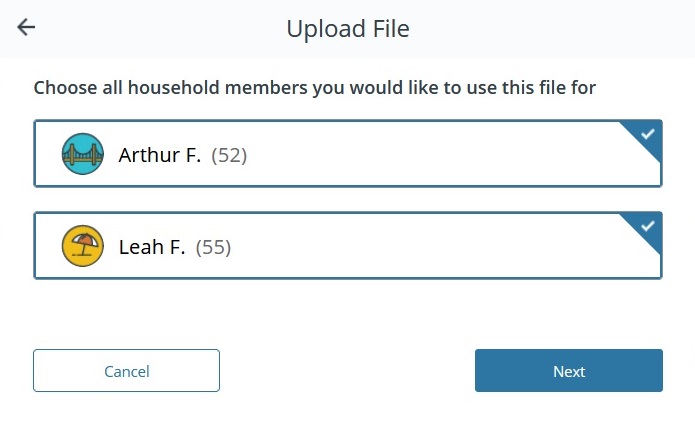

If there is more than one household member, you will be given the option to select household members for whom the attestation is applied to.

Select all the household members. Only fill out one attestation form for the entire household. Do not create duplicate attestations, one for each spouse, because you have then doubled the income you are attesting to. It is just the primary applicant who needs to file the proof of income for the entire family as all that income goes onto the primary tax filers tax return in most situations.

You then get to browse your computer’s hard disk for the file with acceptable file extensions. Perhaps corrected, I have had problems with some image files sent over from mobile devices. I usually have to open the image up in Microsoft Paint and save it as a .jpg file before it will properly upload.

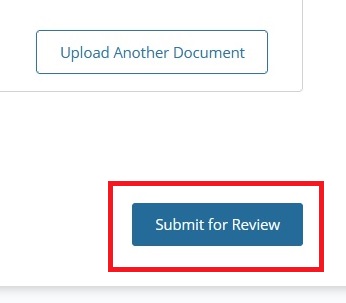

Once it is uploaded, scroll down and click the button Submit for Review

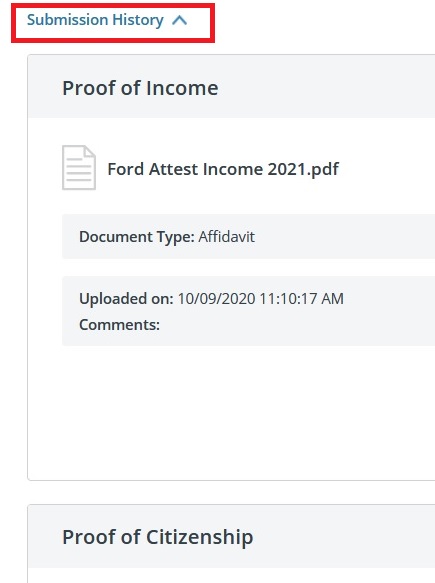

Then check the submission history tab. Oddly, I have submitted documents that showed uploaded, but were not recognized. If this happens, just go through the process again. There are times when some of the confirmation popup windows are either blocked or don’t show, preventing the document from being properly uploaded.

A chronic issue is that even though you uploaded the document, Covered California still sends you a letter telling you to upload the income verification. Apparently, a Submit for Review does not prompt anyone to immediately look at the file and reset the database flag that income verification has been approved. In 2020, it seems like no one check the income verification for several months past the due dates. I have been able to call a customer service representative who will review the submission and then check that it was properly submitted. With all the turmoil created by Covid-19, Covered California seems to be doing a pretty good job of getting through the submitted documents, all things considered.