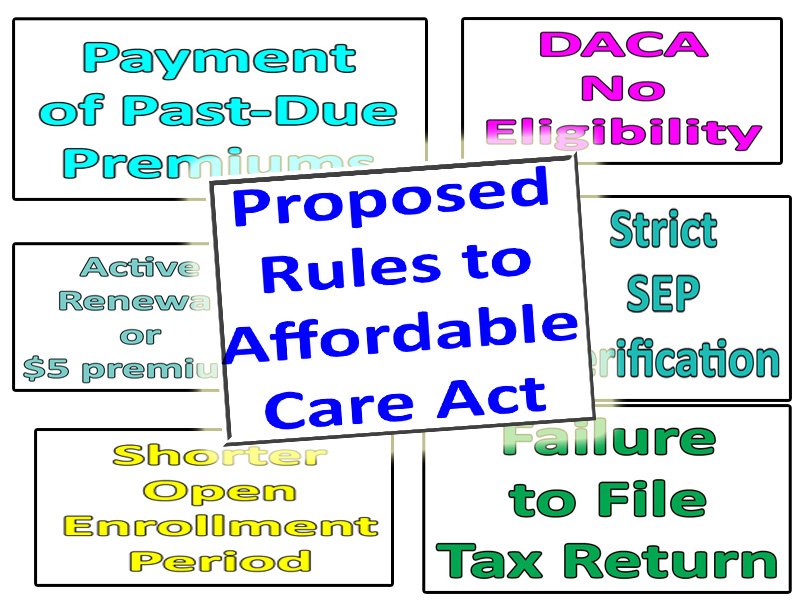

Under the direction of Trump, the Centers for Medicare & Medicaid Services (CMS) have proposed new rules for the Affordable Care Act that is facilitated by Covered California. Some of the proposed rules will create challenges for Covered California consumers. The rules focus on issues such as income verification, enrollment periods, repaying past premiums, and preventing DACA individuals from participating in the marketplace exchanges.

The proposed rules, some of which are implementing conditions from the first Trump administration, were released March 10th. They will undergo a period of public comment before potentially being adopted by CMS. Some of the proposals directed at health care benefits may not affect California as each state regulates their own health plan benefits and coverage.

Payment of Past Due Premiums

This rule, previously adopted in 2017 and reversed by President Biden, would require consumers to pay past premiums for coverage that was terminated for lack of payment before any new enrollment could be effectuated. The requirement to pay past-due premiums would be at the discretion of the health plan.

For example, you let your health insurance cancel in November for nonpayment of premiums because you were on an extended trip. During the open enrollment period you reapply for health insurance coverage to begin January. You may have to pay the premiums for November and December before the new health plan can become effective.

The new health plan may not even be with the prior carrier. The new health plan will have the option of requiring payment of past-due premiums. CMS believes the past-due premium rule will stop people from enrolling in a health plan, receiving health care, and then dropping the coverage so they don’t have to pay the premium. I believe this will just increase the uninsured population. There are many people, faced with the prospect of paying for months of health insurance they never used, will just go uninsured.

Shorter Open Enrollment Period

Apparently, the current Open Enrollment Period that is from November 1st through January 15th (January 31st in California) is too confusing for consumers. CMS proposes shortening the Open Enrollment Period to run from November 1st through December 15th.

This means that if you become aware that you were automatically renewed into a health plan on December 20th, you will have no option but to keep the health plan. The rational from CMS is that the shorter open enrollment period aligns better with employer plans and Medicare Annual Enrollment Period. Unfortunately, this means a crunch of consumers scrambling to enroll adding to pressure on agents and enrollers trying to help everyone with a shorter window of opportunity.

DACA Recipients Kicked Out of Health Insurance

Currently, individuals in the country under Deferred Action for Childhood Arrival (DACA) status can participate in a health insurance marketplace exchange and receive the subsidies for a health plan. CMS proposes DACA recipients be excluded from enrollment into a health plan with the subsidies. This is just a cruel rule.

Failure to File Federal Tax Return

This rule change would make households ineligible for the health insurance Premium Tax Credit subsidies if they failed to file a federal tax return from a previous year that they received the health insurance subsidies. Currently, there is a two-year maximum of non-filing before the subsidies are terminated. This rule would change it to one-year.

We don’t know if people who have filed an extension for their income tax return will be in compliance. Reconciliation of the Premium Tax Credits is handled on the federal income tax return. If the IRS is slow to update their database of completed tax returns, some people may not be able to access the health insurance subsidies.

Verifying Income

Marketplace exchanges like Covered California would not be able to accept an applicant’s self-attestation of income estimate if there is no IRS data to verify the income estimate. This rule would require applicants to provide evidence of their income. The rule change of eliminating the income attestation could impact self-employed individuals.

Active Renewal Process

Some households are automatically renewed into health plans where the subsidy covers the premium resulting in a $0 monthly health insurance cost. CMS proposes that consumers must actively confirm their eligibility within their accounts at the time of renewal. If the consumer does not confirm their eligibility, they would be subject to a $5 monthly premium.

The consumer would have to pay the $5 premium until they confirm their eligibility for the $0 cost health plan. The $5 premium would be credited back to the taxpayer when they file their tax return.

Removal of Bronze to Silver Upgrade

Marketplace exchanges like Covered California have been allowed to upgrade a consumer from a Bronze plan to a Silver plan during automatic renewals, when there is no difference in the monthly premium. The new rule would stop Marketplace exchanges from upgrading consumers into better coverage Silver plans.

The rational is that a consumer has made the selection of a Bronze plan and that selection should be honored. CMS does have a valid argument that households upgraded to a Silver plan necessarily receive more Advance Premium Tax Credit subsidies. This can mean that the primary tax filer will have to repay more excess premium tax credit if their final income is higher when they file their taxes.

Strict Special Enrollment Verification

This proposed rule would mandate strict verification of an individual’s or family’s qualifying life event in order to enroll in health insurance during a Special Enrollment Period (SEP) outside of Open Enrollment Period.

For example, if you lose employer coverage, you will need to supply a document verifying the loss of coverage for SEP. Currently, Covered California states they randomly request verification of the qualifying life event for consumers enrolling outside of Open Enrollment. The new rule would require proof of the qualifying life event for at least 75 percent of SEPs.

Prohibiting Sex-Trait Modification Services

CMS proposes that Marketplace health plans may not include coverage for sex-trait modification services. In other words, no health care services that are focused on helping transgender individuals achieving the gender they identify as. However, because states regulate benefits over and above the Essential Health Benefits of the Affordable Care Act, this may not impact California health plans.

There are some other technical rule changes regarding determining the actuarial value and premium adjustment percentage methodology of health plans. These technical rule changes, like the one’s outlined above are tilted in favor of the health insurance companies and not the consumers.

The explanation of the rule changes by CMS is peppered with terms like “protect consumers”, “stable marketplace”, “reduce adverse selection”, and “improve risk pool.” However, the individual and family market has been very stable for many years. I have not heard of any California health plans getting sick, going bankrupt, or dying because they could not get health care.

There is also an underlying theme that health insurance agents are secretly enrolling individuals into $0 cost health plans without the consumer’s knowledge. I suppose this happens, but I have never seen any research identifying rogue health agents surreptitiously enrolling consumers without their knowledge.

On the bright side, CMS is moving forward with the expectation that the Affordable Care Act will remain in place. It remains to be seen if all of CMS’s rule making is an exercise in futility if Congress repeals the ACA.

2025

YouTube video reviewing the Trump CMS ACA Rule Changes