Removing a member from the Covered California household because they gained other covered or are no longer a part of the tax household.

There are a variety of reasons why a household member needs to be removed from a family’s Covered California account. In some unfortunate instances a family member has died. Other times a young adult ages-off the plan or a spouse gains other coverage such as Medicare. The circumstances surrounding the removal and individual’s status within the household prevents one easy set of steps to properly remove a household member.

Household member with other coverage

A household member can be removed from the health plan and still remain a member of the household. This usually occurs when an adult gains other coverage such as Veterans Administration health care or employee only coverage from a job. Even though the household member may not be eligible for Covered California health insurance because of the new plan, they still need to remain as part of the household because the number of household members is used to determine the Advance Premium Tax Credits (APTC) or monthly premium assistance.

Covered California still needs household member income

It’s also possible that the adult member has income that is contributing to the total household Modified Adjusted Gross Income, also used to determine the APTC. In most instances, when a young adult turns 26 they are no longer eligible to be included on the family plan. In this case the young adult would be removed from the plan and the Tax Filing Household if the primary tax filer does not claim him or her as a dependent on their tax return.

For households with individuals enrolled in Medi-Cal skip to the end of the post

Removing household member may be two-step process

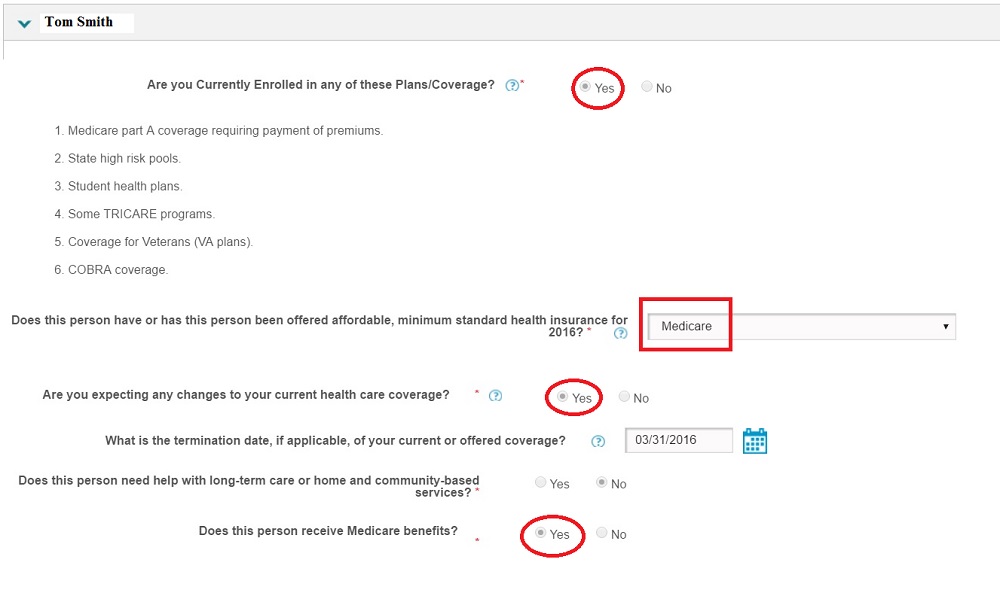

Just reporting to Covered California that a household member has gained other health insurance will not necessarily remove them from the family plan. A separate step of actually selecting the individual to be removed from the plan must also be taken. However, this isn’t the case if the person gains Medicare coverage. Simply reporting that the individual has acquired Medicare will remove the person from enrollment in the health plan.

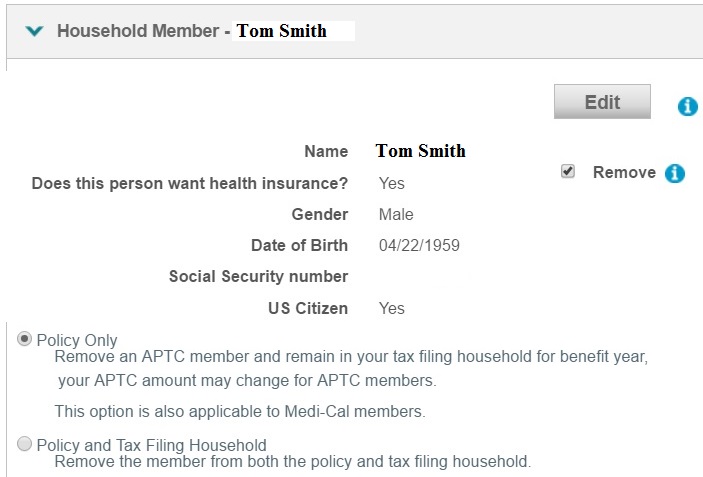

To remove a household member you need to open your Covered California account and select Report a Change from the Actions menu on the right side. This will bring up the different areas of the application you can access for making a change. Scroll down until you find the section that says Household Member – Tom Smith. Click the Remove button and you will be give two options to select.

- Policy Only – Remove an APTC member and remain in your tax filing household for benefit year, you APTC amount may change for the APTC members.

OR

- Policy and Tax Filing Household – Remove the member from both the policy and tax filing household.

The Household Member – page on Report a Change allows you to check mark the Remove box to delete the individual from just the health plan policy or the entire tax filing household.

Select “Policy Only” if the household member is gaining other health insurance coverage but will still part of the federal IRS tax return as either the primary tax filer, spouse, or dependent.

Select Policy and Tax Filing Household if the person is no longer a member of the household. This could be the case if the individual has gotten married, is turning 26 years old, or has died. However, if the person to be removed completely from the policy and household, and he or she is the primary applicant, you will have to terminated the application and re-apply with a new person as the primary applicant.

New health insurance coverage for family member

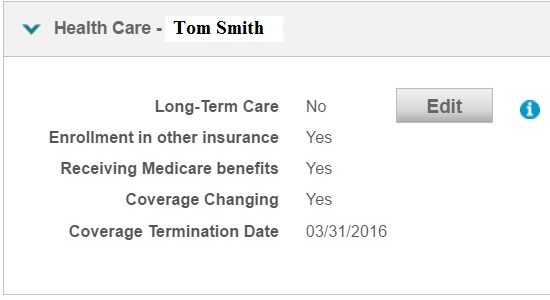

The Health Care – on Report a Change allows you to update the insurance coverage for a household member.

To report that a household member has gained health insurance from another source (Medicare, State high risk pools, student health plan, some TRICARE programs, or Coverage for Veterans), go to Report a Change and scroll down until you find Health Care – Tom Smith box for the specific person. Click on edit and fill out the form. My experience has been that if the person is gaining Medicare, the Covered California system will automatically remove the person from the policy, but not the household, which is correct. But if the person is gaining the other coverage, you will still have to remove the person from the policy.

The Health Care – options page allows you to indicate a member of the family has gained Medicare or other health insurance.

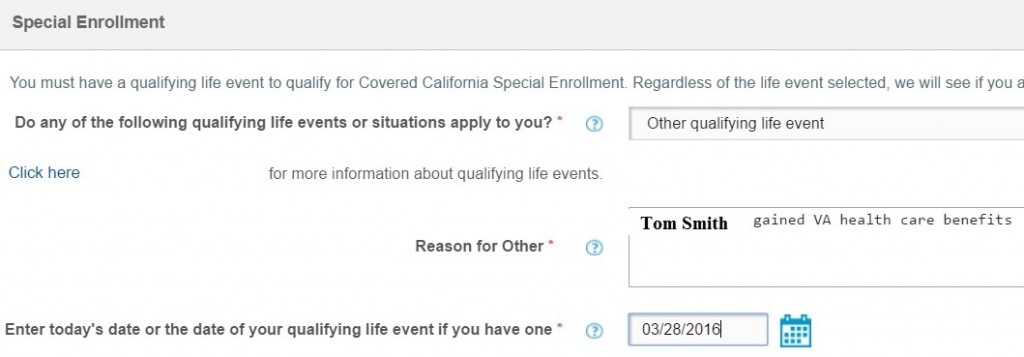

Special Enrollment Page

When you are done with all the changes you will come to a screen about Special Enrollment. You will want to select Other Qualifying Event as the reason. (The Covered California system looks at these changes as Special Enrollments, even though you already are enrolled and keeping the same plan). For the qualifying life event I usually enter that the person gained health insurance and note the type. I use the date I am making the change for the date of the qualifying event. You may have to fill out a bunch of drop down boxes with particular reasons for the change with the date. The available reasons in the drop down menu may not match the true reason. If you can, just select “Other” as the best match. Currently, Covered California is not cross checking the reasons but they probably will in the future.

Removing a member or reporting other health insurance is “Other qualifying life event” on the Special Enrollment page.

The Covered California system is very date sensitive. I avoid entering dates that may trigger retroactive changes. My experience is that it creates more headaches than it accomplishes. If you are making changes and the “Today’s Date” is before the 15th of the month, the changes will take affect the 1st of the next month. If you are making changes after the 15th, they will become effective the 1st of the following month. This may mean that the person gaining other coverage, if reported after the 15th but before the 1st of the next month, will have dual coverage for the next month.

Check eligible household members

Once you submit the application the Covered California system crunches all the numbers and comes back with an eligibility summary. If everything worked, the household member that you removed will no longer be listed as one of the family members eligible for coverage. Continue with the Health Plan selection. Covered California is always updating and tinkering with the online application fixing bugs and adding features. When in doubt, call your agent or Covered California to walk you through the steps.

Medi-Cal mixed households

If you have a mixed household, one where some members receive premium assistance and others are on Medi-Cal, your options for removing a household member will be limited. All requests to remove a household member for consideration of health insurance needs to be done through your local county Medi-Cal office, similar to all income changes. From the County Medi-Cal Operational FAQ database Entry 4913, date March 1, 2016 (see: FAQs from County Medi-Cal Eligibility Workers)

Question

I received the following question from an eligibility worker: Can income changes only be entered by the county case worker when the customer is a part of a mixed HH? We received a call from a customer stating that she received an e-mail from a Covered CA CSR advising her that since some members of her household are receiving Medi-Cal that they (Covered CA) cannot update her record in CalHEERS, but that she must contact the county case worker.

I know that for redetermination that the county worker is responsible for making the change since it may impact eligibility on the Medi-Cal case. If there isn’t an RE due for MC or Covered CA and the APTC individual has an application pending in SAWS, is this report of income considered a change of circumstance for the Medi-Cal Household members? The person who is currently APTC eligible just had their MAGI case linked to the existing Medi-Cal case on 3/16.

Answer

The current policy is that mixed households are case managed by the counties. I’m not sure where it is in writing, but in many calls I’ve heard the direction that any updates to a mixed household need to be made by a county worker. I’m not sure I follow this scenario. If this is the same consumer above, the information is now at the county level and they can change the information. It is a change in circumstances for that consumer, and the county worker should be updating the case and re-running eligibility once that is done. For a Medi-Cal eligible, the county worker can update the information any time the consumer reports it. It can be outside of annual redeterminations. The consumer is obligated to report the changes within 10 days.