If you are retiring in the middle of year and want to enroll in Covered California for subsidized health insurance, you need to pay particular attention to how you enter your income. If you incorrectly characterize your income or make date errors you may misstate your annual or monthly income. This could trigger a Medi-Cal eligibility determination.

The Covered California subsidies are based on your annual income. Consequently, you need to include both the income you received while you were employed and your expected retirement income for the remainder of the year. If you don’t enter your employment income, you are under estimating your annual income and you will receive too much monthly subsidy. When you do your federal income tax return for the year, you’ll have to repay the excess subsidy.

Properly Report Retirement Income to Avoid Medi-Cal

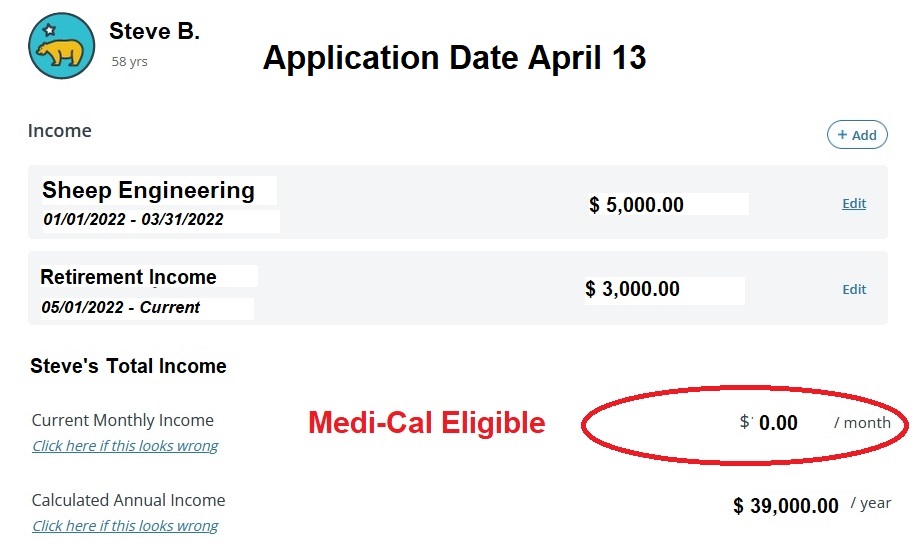

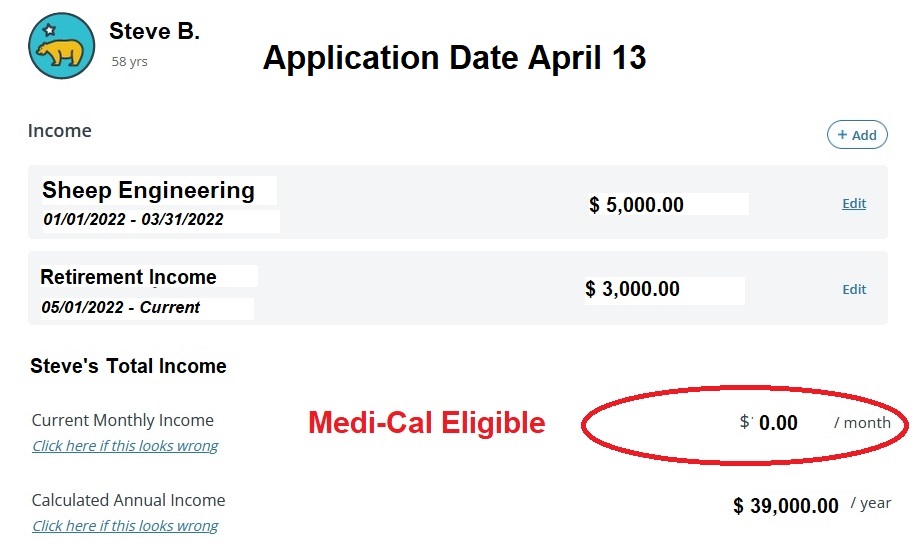

The income section of the Covered California application is very date sensitive. If your application does not show any income in the month you are applying, you will be determined eligible for Medi-Cal. This is because Covered California screens for Medi-Cal eligibility based on your monthly income, regardless of how much income you earned prior to applying for Covered California.

In this example, Steve retires or separates from his job at the end of March. He enters his employment income as being from the beginning of January to the end of March. His employer sponsored health insurance will terminate at the end of April and his retirement withdrawals will begin in May. The Covered California application will show that he has no income in April, the month in which he is applying for health insurance. Because it shows no April income, he will be determined for Medi-Cal, even though he stated that his retirement income starts in May and his annual income is over the Medi-Cal eligibility limit.

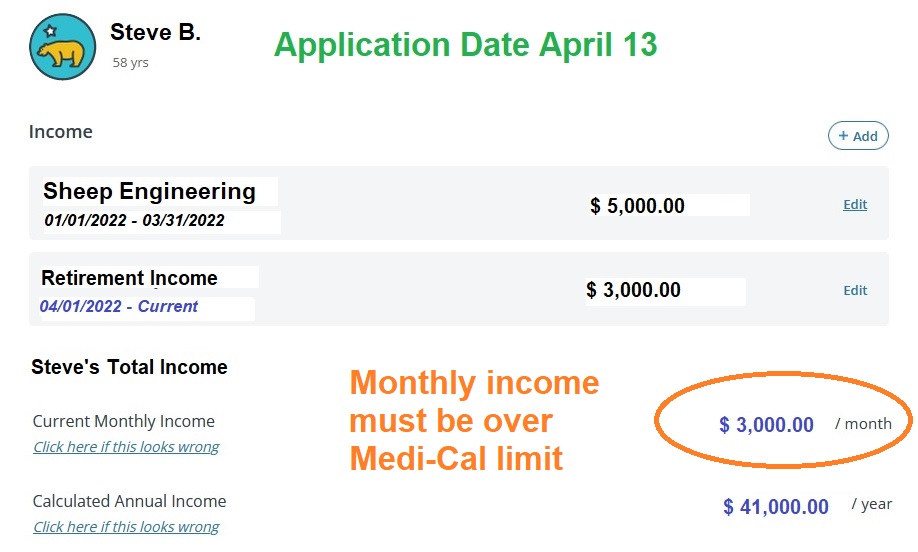

To avoid the Medi-Cal determination, Steve needs to report that his retirement income starts in April. That will show that he has income in April and he will not be determined eligible for Medi-Cal.

Of course, starting the retirement income one month earlier increases his annual income that will lead to a decrease in the monthly subsidy. One way to avoid this is to shave dollars from the employment income or the retirement income so that it matches his estimated annual income of $39,000.

Covered California Income Section

The Covered California income section doesn’t care how you characterize the dollar amounts. The most important thing is that your monthly income is high enough for the health insurance subsidies and the estimated income is where you expect it to be. For instance, even though formal employment income may have ended, the retiree may still receive unused vacation and sick pay amounts. Those amounts can be separate entries or lumped into the employment income.

Finally, Covered California allows you to characterize your income on an hourly, weekly, monthly, or annual basis. It is common mistake to state that the previous income of $15,000 (3 months times $5,000) as an annual income. The problem occurs if you enter the end date of March 31. The Covered California income system takes the $15,000 and chops it into 12 equal increments assuming the income is $1,250 per month. If you enter that the income ended on March 31, the system will only tabulate $3,750 to your annual income (3 times $1,250.) This low monthly income under estimates your annual and monthly income.

After you have entered your income amounts from employment and future retirement (including Social Security benefits) carefully review the entries for you and your spouse, and the final household monthly and annual amounts. Don’t submit the application until you are confident that the system is properly recognizing your monthly and annual income amounts.