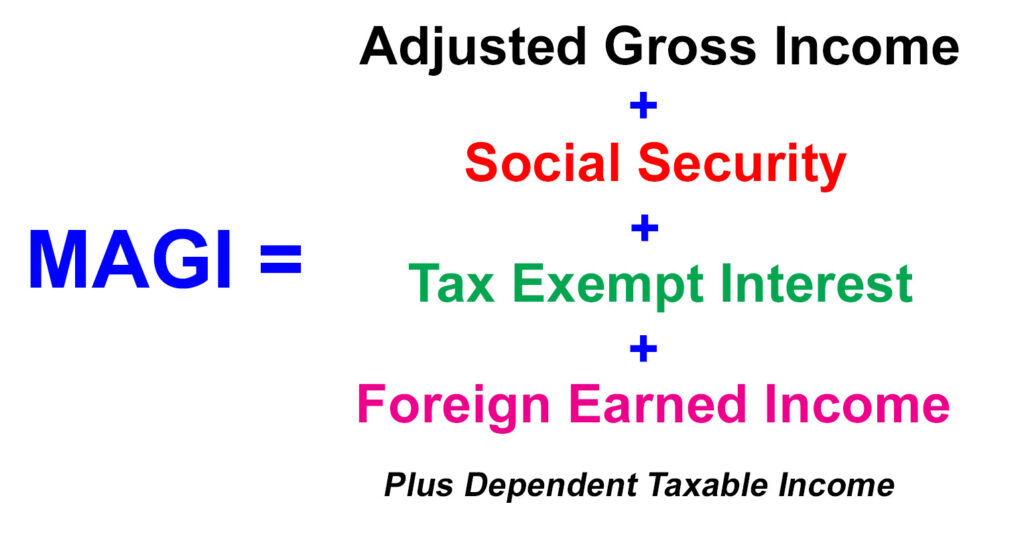

The income you report on your Covered California application is called your Modified Adjusted Gross Income (MAGI.) MAGI is an IRS definition. Covered California has issued a document called Countable Sources of Income that refers to the federal income tax return lines where you can find specific income amounts to include on your application.

Modified Adjusted Gross Income

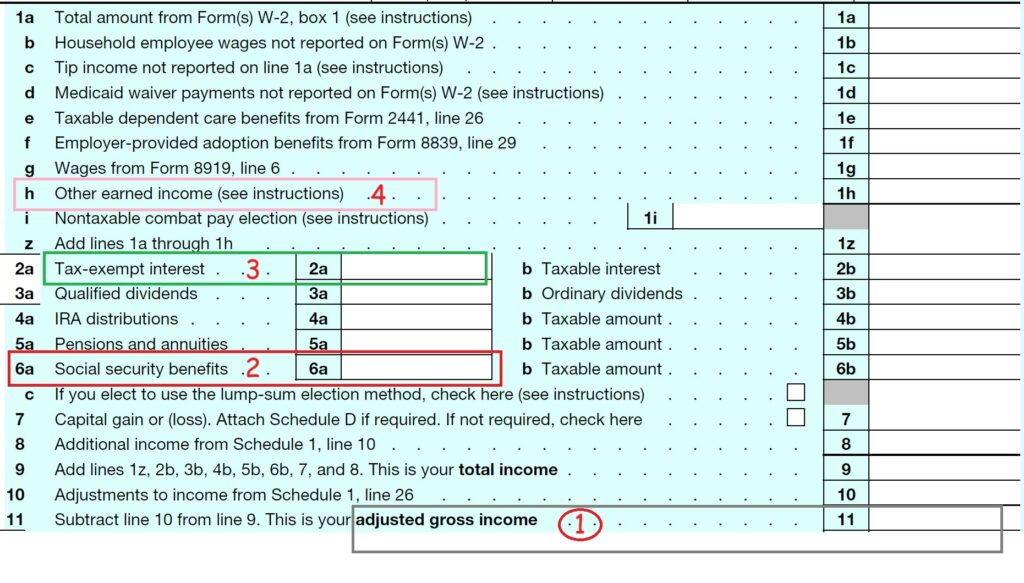

Modified Adjust Gross Income is the adjusted gross income reported on form 1040, modified by the addition of Social Security, tax-exempt interest, and foreign earned income. Your dependent’s income is included if the dependent must file a federal tax return because they owe federal income tax on their earnings.

The MAGI is generally reported on lines 11, 6a, 6b, 2a, 2b, and 1h. Income from the schedules, such as schedule C Profit Loss from a business, is funneled onto line 11. You may need to find a specific schedule to determine the income or deduction to properly estimate your future income for Covered California. This is an income estimate. It is not necessary based on your last filed federal tax return.

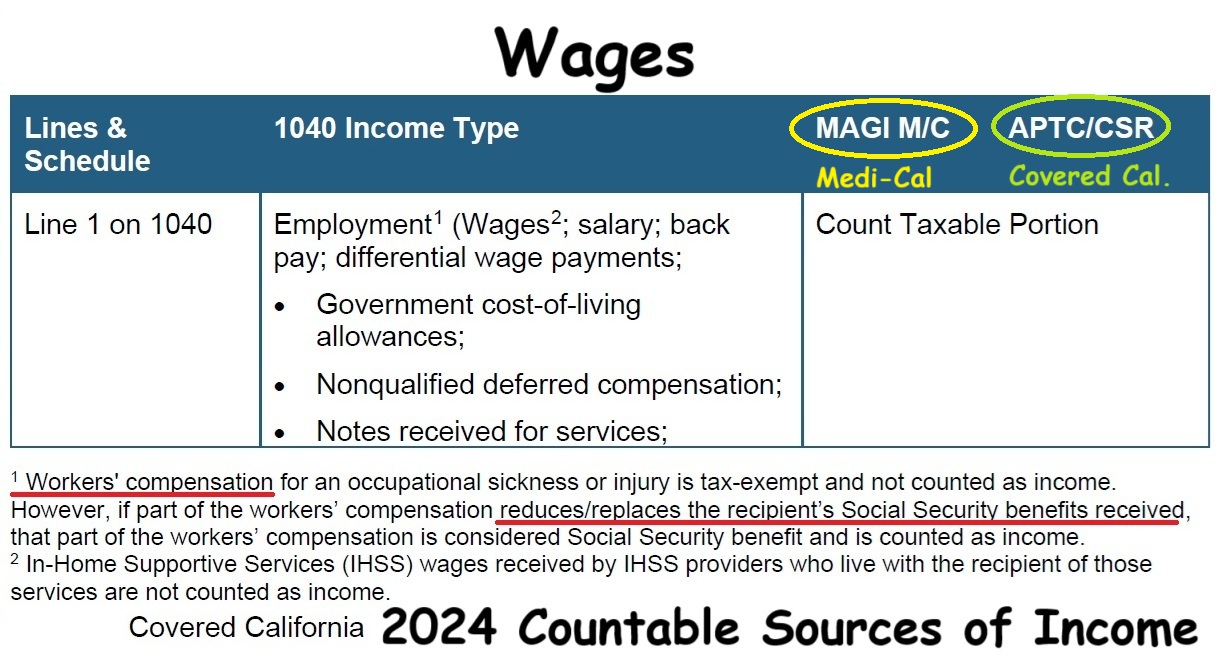

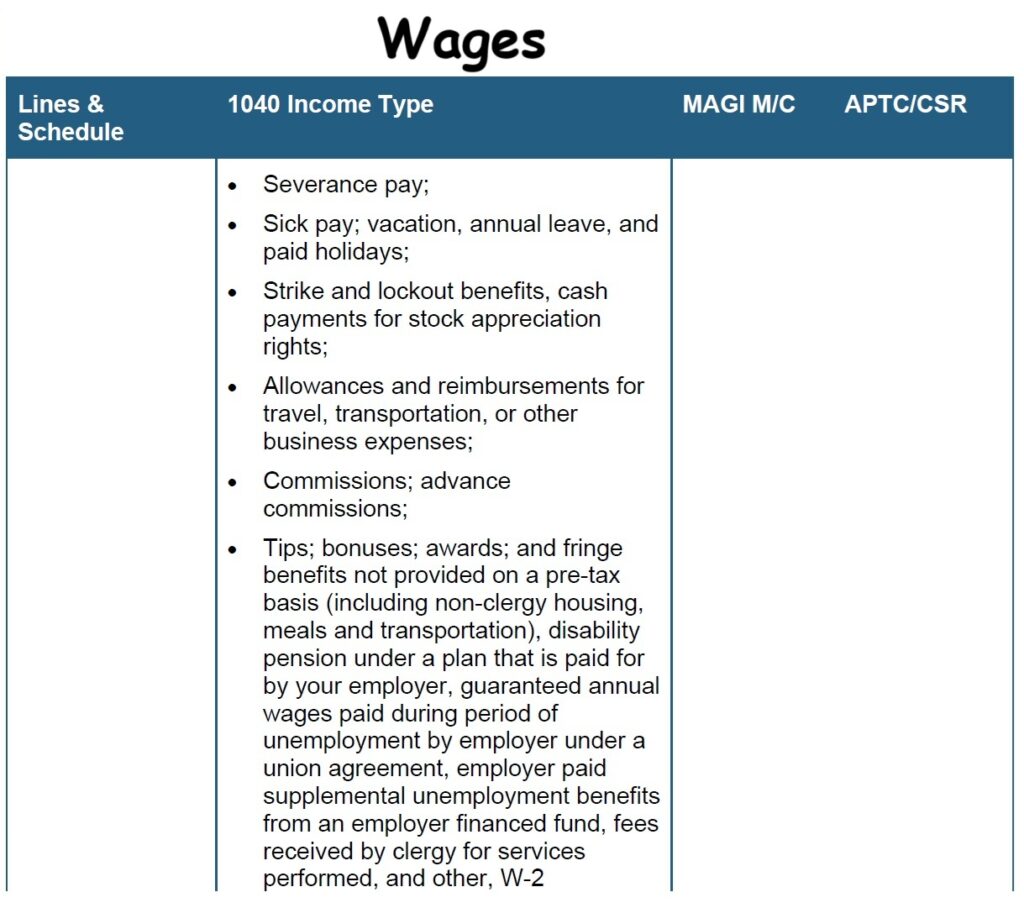

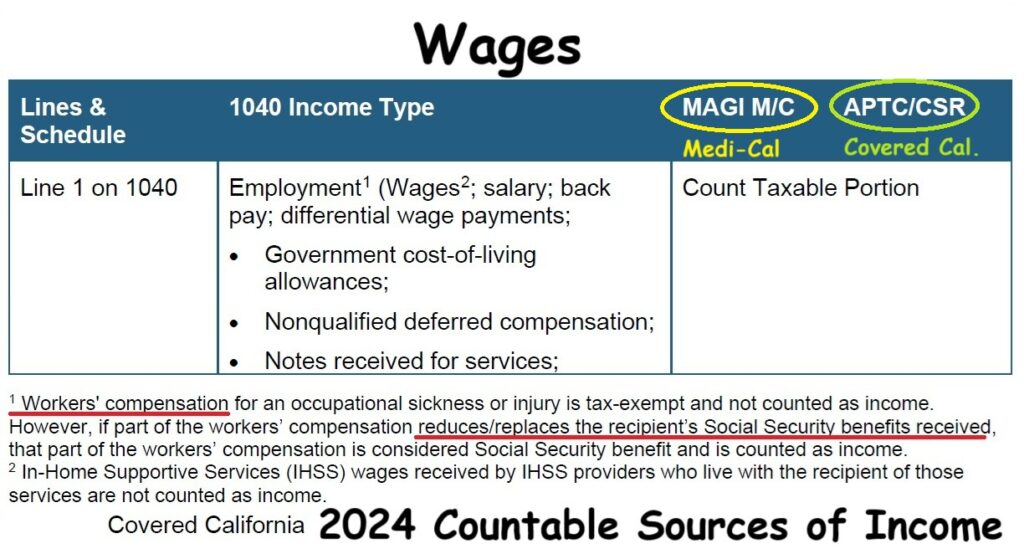

Wages are part of the MAGI. The Covered California Countable Sources of Income will note the line to find the income on the 1040 and if the income is subject to Medi-Cal or Covered California (APTC/CSR.)

Some payments received from your employer may be taxable income that need to be included, such as bonuses and fringe benefits.

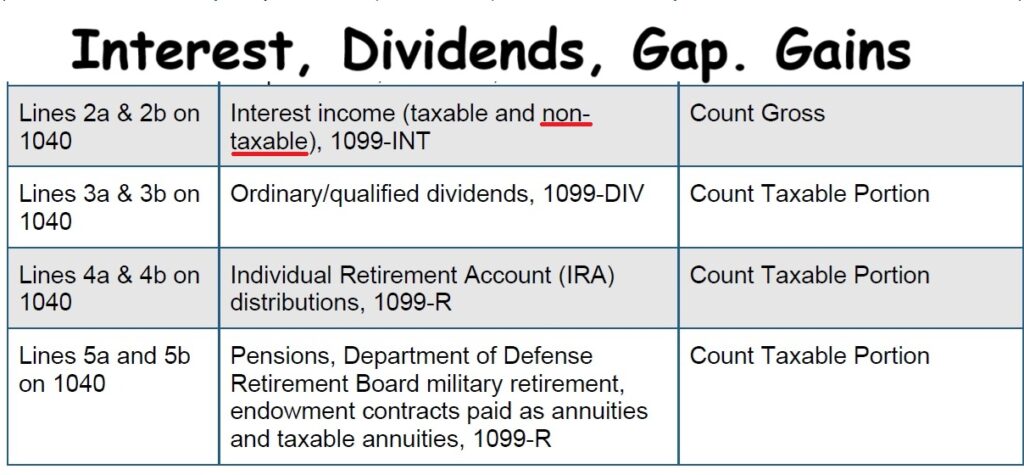

In addition to taxable interest, dividends and capital gains, non-taxable interest (i.e. municipal bonds) should be included.

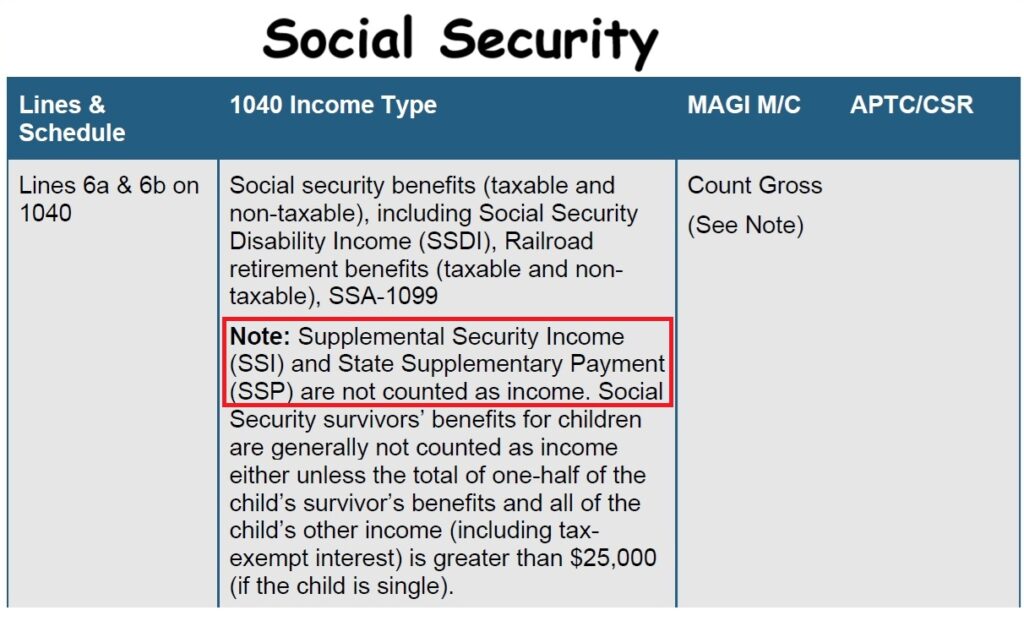

Supplement Security Income from the Social Security Administration is not counted. Social Security retirement and disability income is counted.

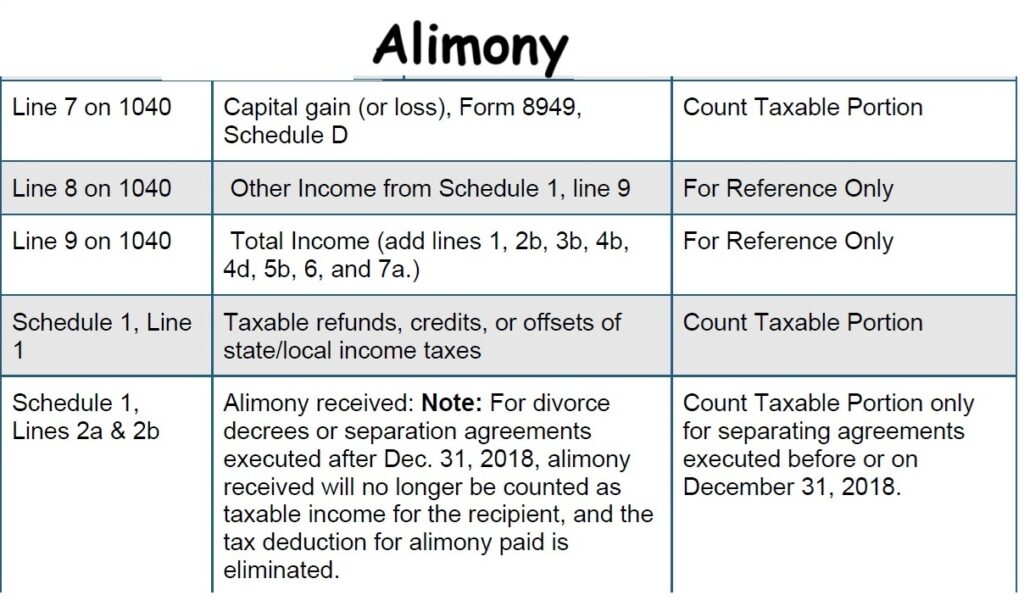

Alimony from divorce decrees prior to 2019 may be considered as a countable source of income.

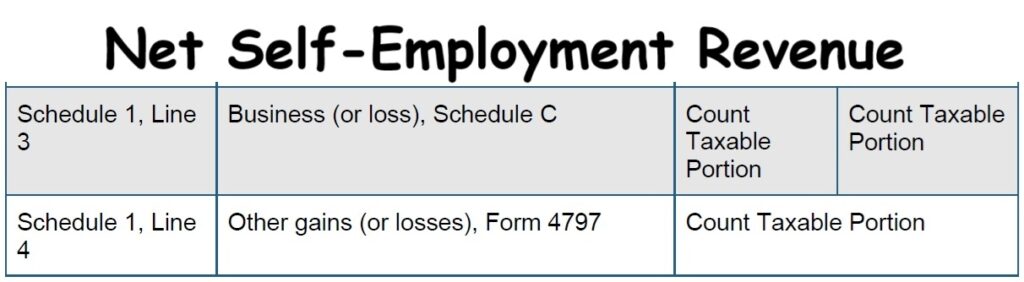

Covered California wants to know your net self-employment income. That is the gross revenue minus expenses as calculated on schedule C, Profit Loss from a business.

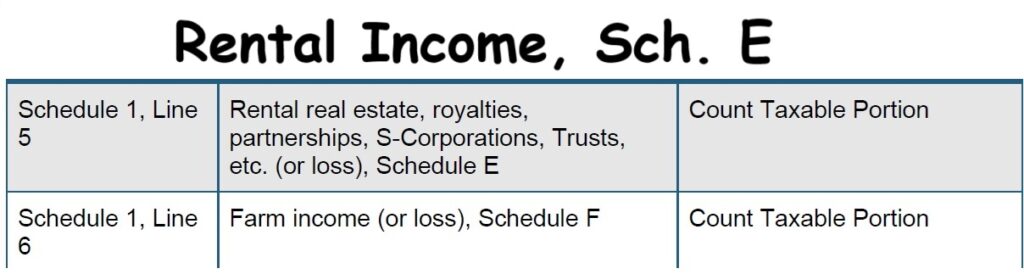

Schedule E will show the net taxable income from your property rentals after expenses and depreciation have been factored into the equation.

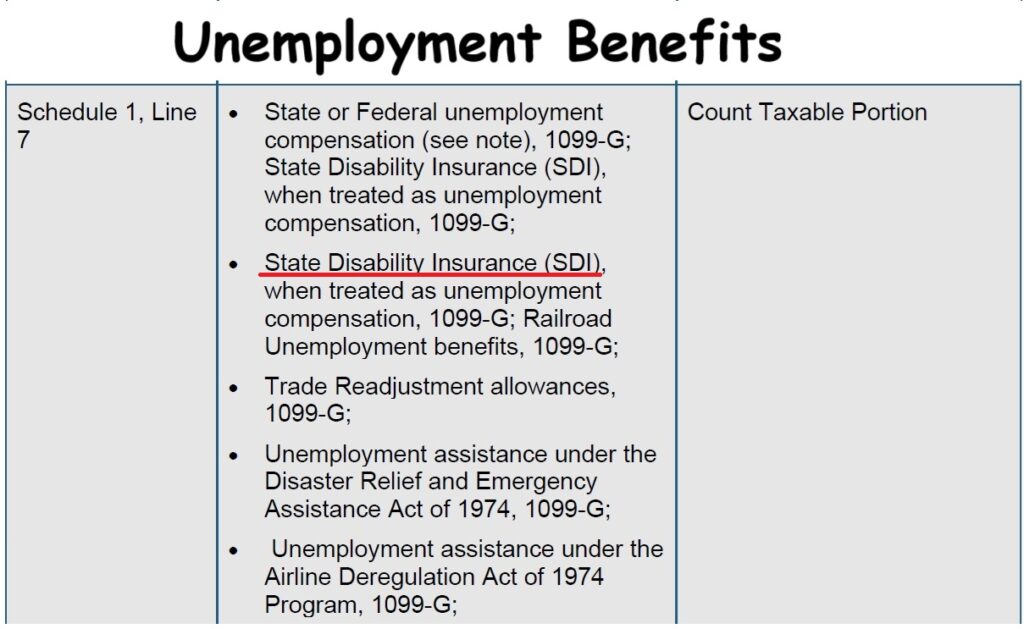

Unemployment insurance benefits are counted as income. State Disability Insurance payments are counted if the payment is treated as unemployment insurance.

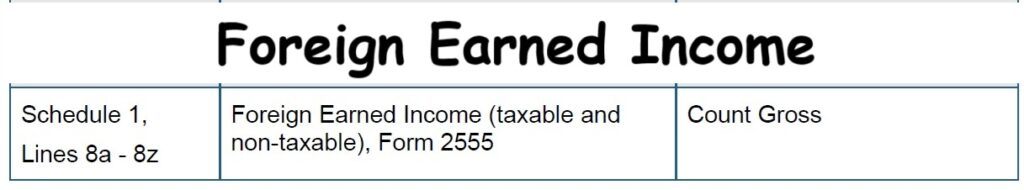

If you receive foreign income, it will most likely need to be counted as part of the MAGI.

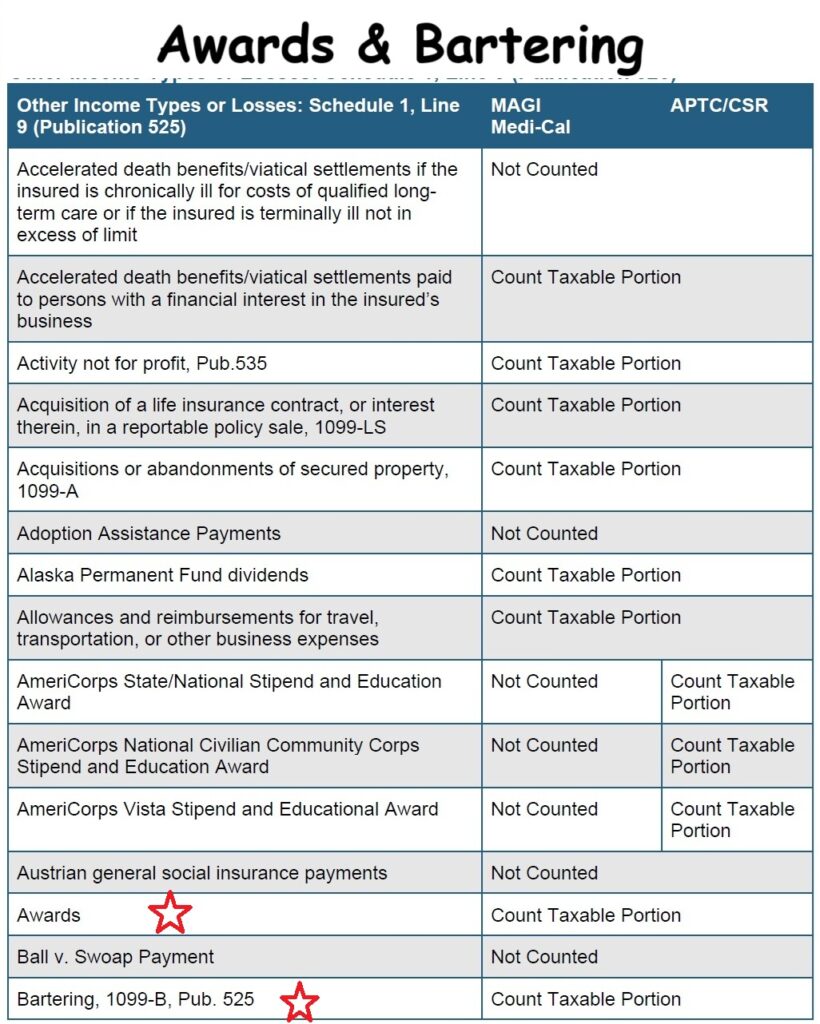

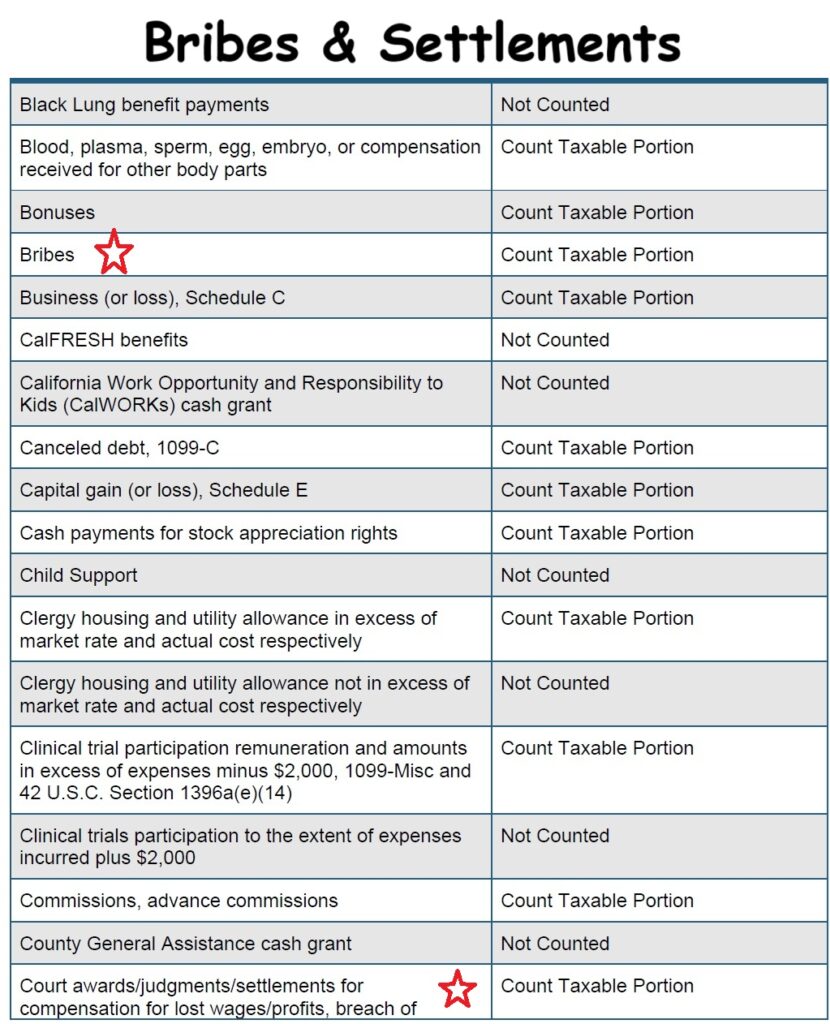

Not all income streams are counted towards the MAGI for Medi-Cal. Some death benefits from accelerated payment – before the death of the insured – are also not counted for either Medi-Cal or Covered California.

Bribes are counted as income for Covered California. Cancelled debts and settlements can also be considered income.

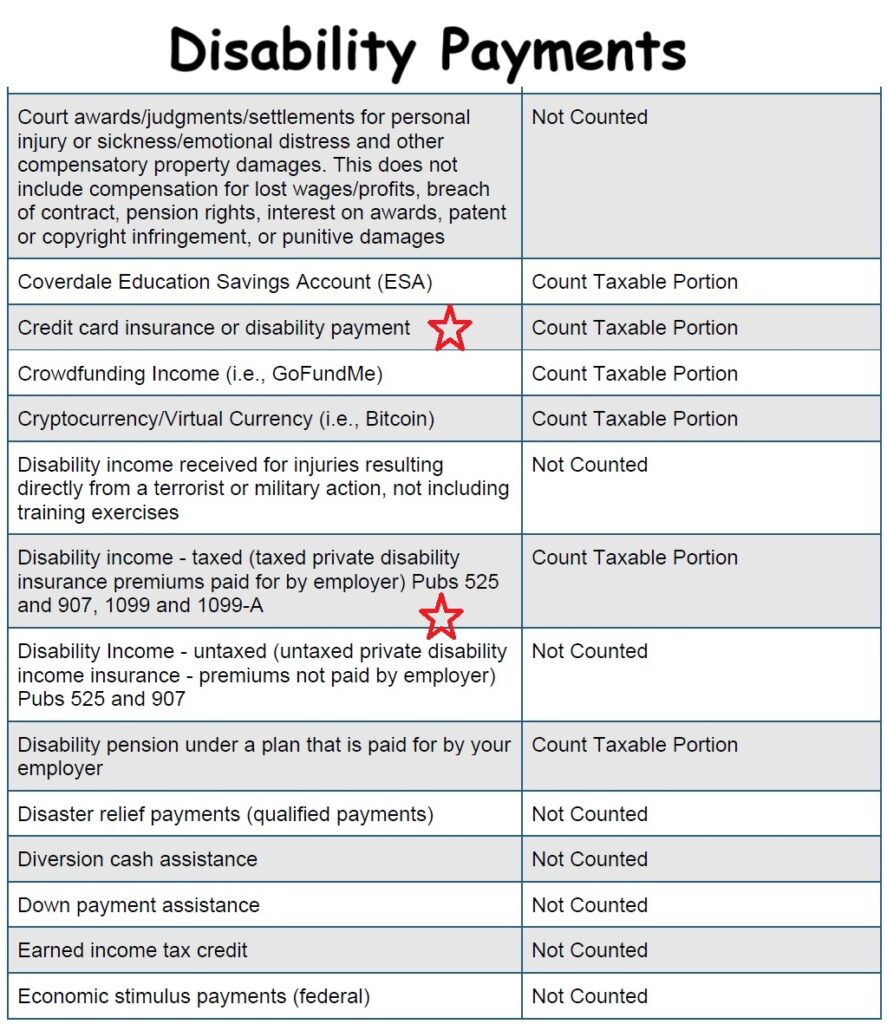

Disability payments from a policy where the premiums were paid by the employer are generally considered income. If the disability policy premiums were paid by the employee or insured, they are generally not counted as income.

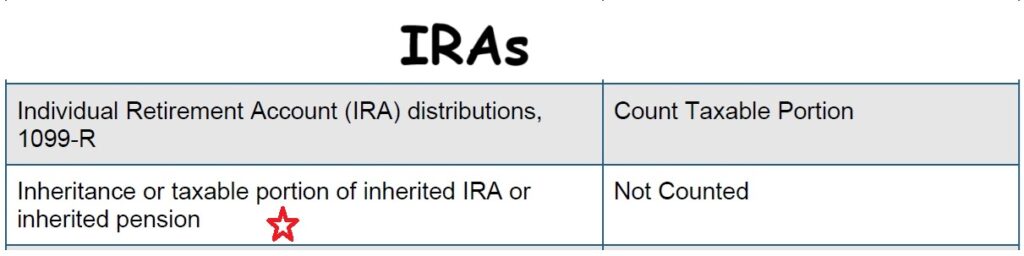

Traditional IRA distributions are considered income. Covered California lists inherited IRAs as not being counted for income.

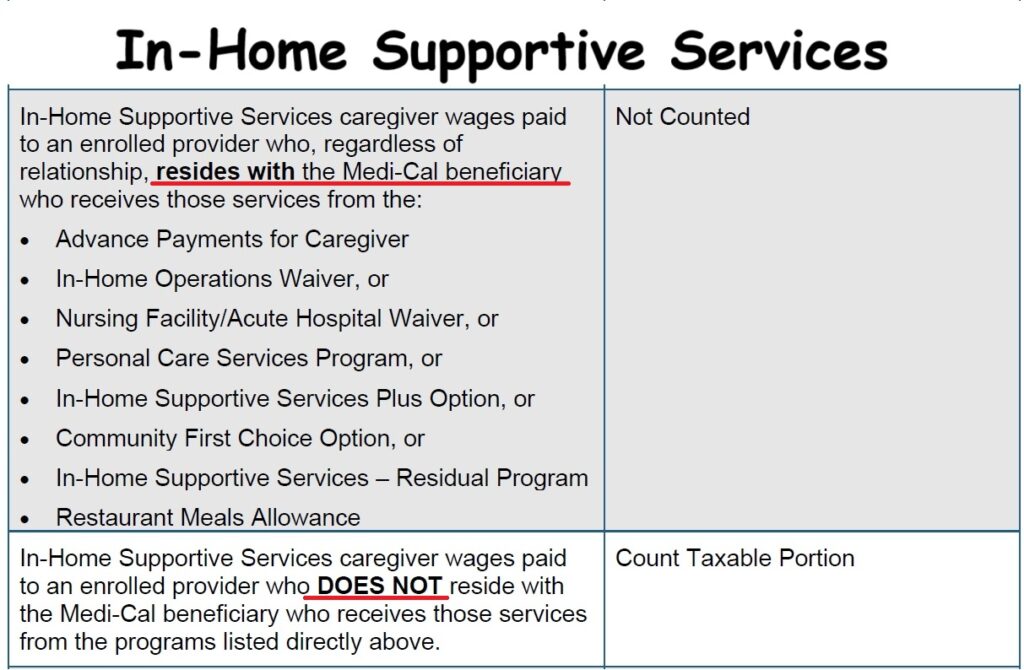

When the In-Home Supportive Services wages are for a person, you care for and do not live with, they are considered income.

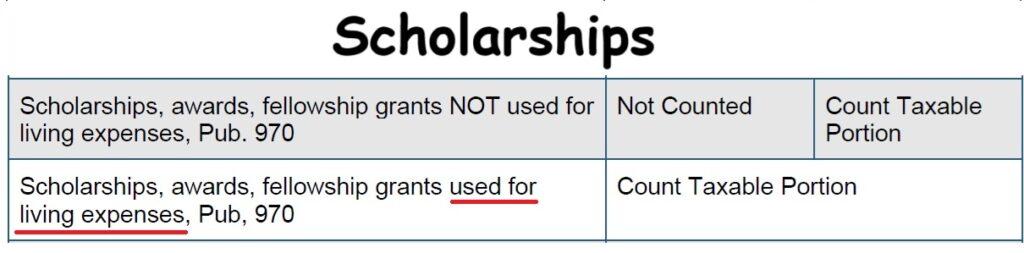

Scholarships where part of the money is for living expenses, that portion not attributed to tuition, is counted as income. Review publication 970 and the college to determine the taxability of the income for the student and primary tax filer.

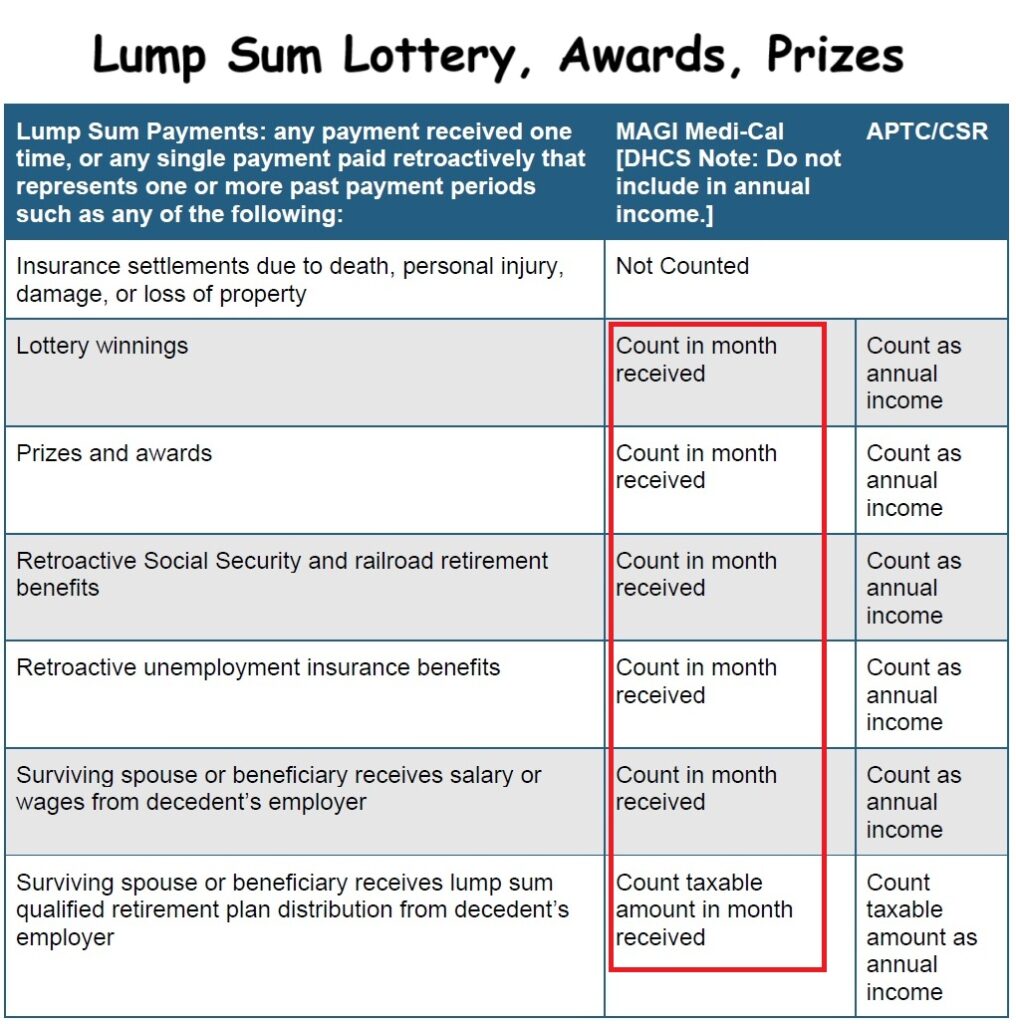

One-time lump sum payments from lottery winnings or retroactive Social Security deposits need to be included in the annual income. The one-time payment should be entered so that it does not rollover to the next year.

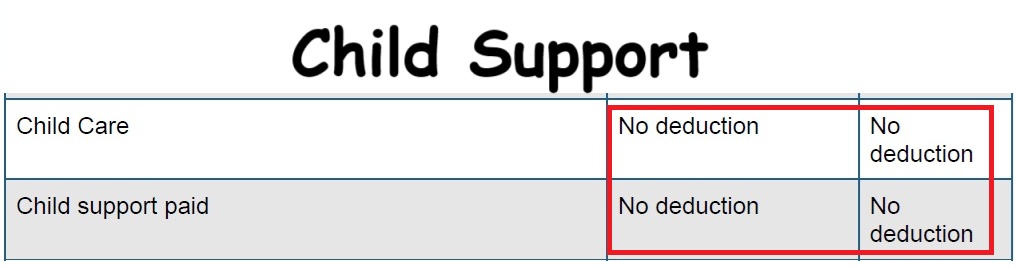

Child support is neither an income nor a deduction.

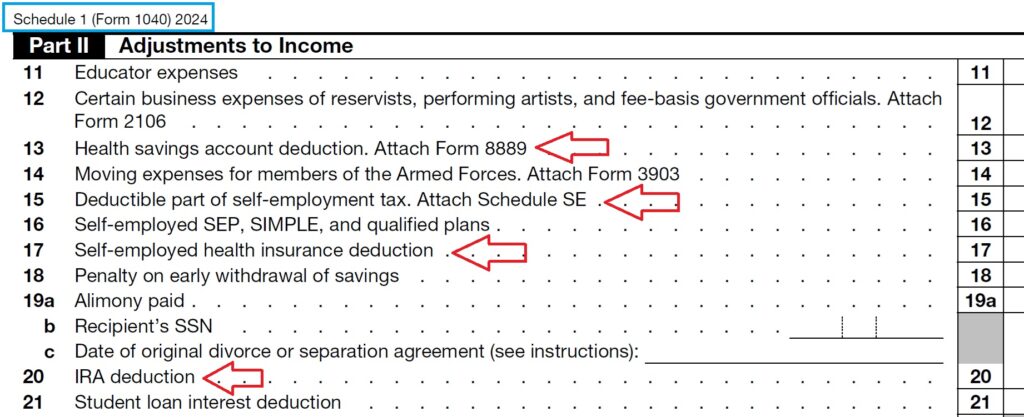

Reductions to the MAGI

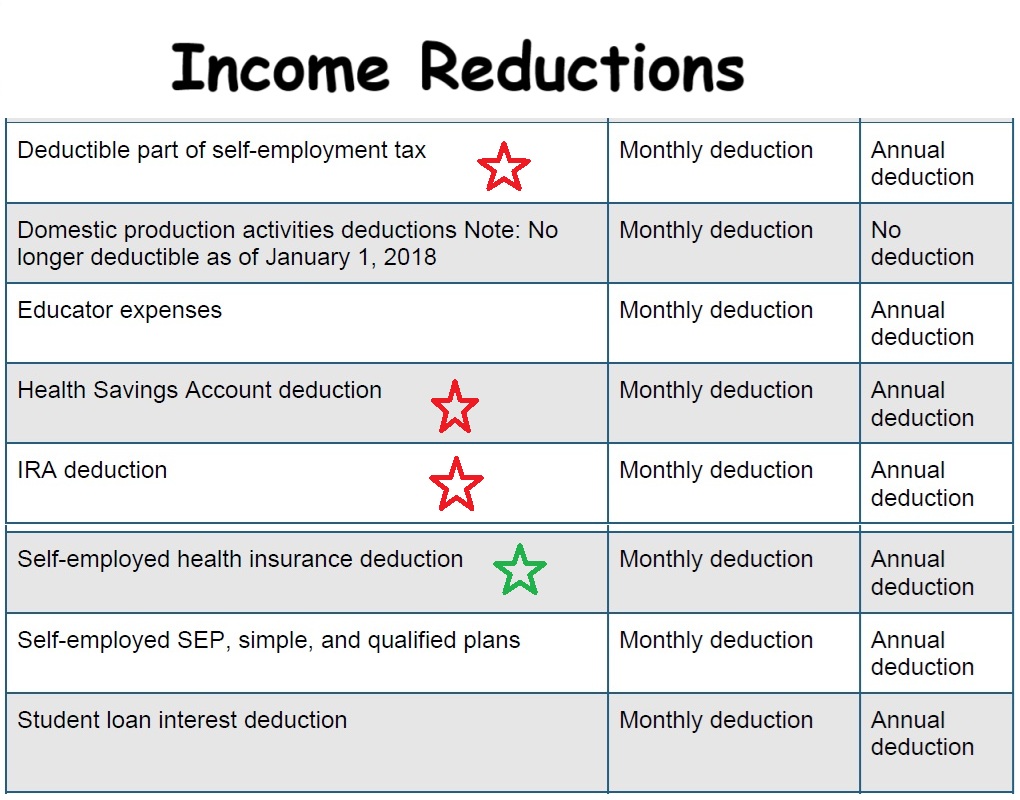

Some expenditures will lower the Modified Adjusted Gross Income because they lower the adjusted gross income. Specifically, contributions to your Health Savings Account, deductible part of self-employment tax, self-employed health insurance deduction, and IRA contributions.

The deduction for self-employed health insurance is complicated. Be cautious when reducing your income with this estimate. It will change based on your final Premium Tax Credit subsidy that you won’t know the exact amount until you begin to calculate your federal taxes for the year.

YouTube Video of Covered California Review